AI FOMO sweeps the world profits surge 8 times, NVIDIA emerges as the biggest winner.

AI FOMO boosts profits 8 times, NVIDIA emerges as top winner.

Source: Geek Park

Author: Jingyu

In the bleak environment of the US stock market, all investors are looking forward to a “hero stepping on the colorful auspicious clouds” to save the world.

- Experience the Tu Dog hype type SocialFi platform friend.tech it may be boring and even ridiculous at times, but it has unlimited potential.

- What is the security foundation of the post-POS era? A quick look at the newly proposed theory in the Ethereum community, Proof of Validator

- An Overview of Scroll’s Early Ecosystem What Opportunities Exist for Leading Players in zkEVM?

This hero’s name is Nvidia.

In the early morning of August 24th Beijing time, Nvidia released its second-quarter financial report. According to the report, as of July 30th, Nvidia’s second-quarter revenue reached a staggering $13.51 billion, an 88% year-on-year increase; net profit skyrocketed to $6.19 billion, an increase of over 800% compared to the same period last year’s $656 million!

After the announcement of the financial report, Nvidia’s stock rose 6% after hours, reaching $471.16 per share.

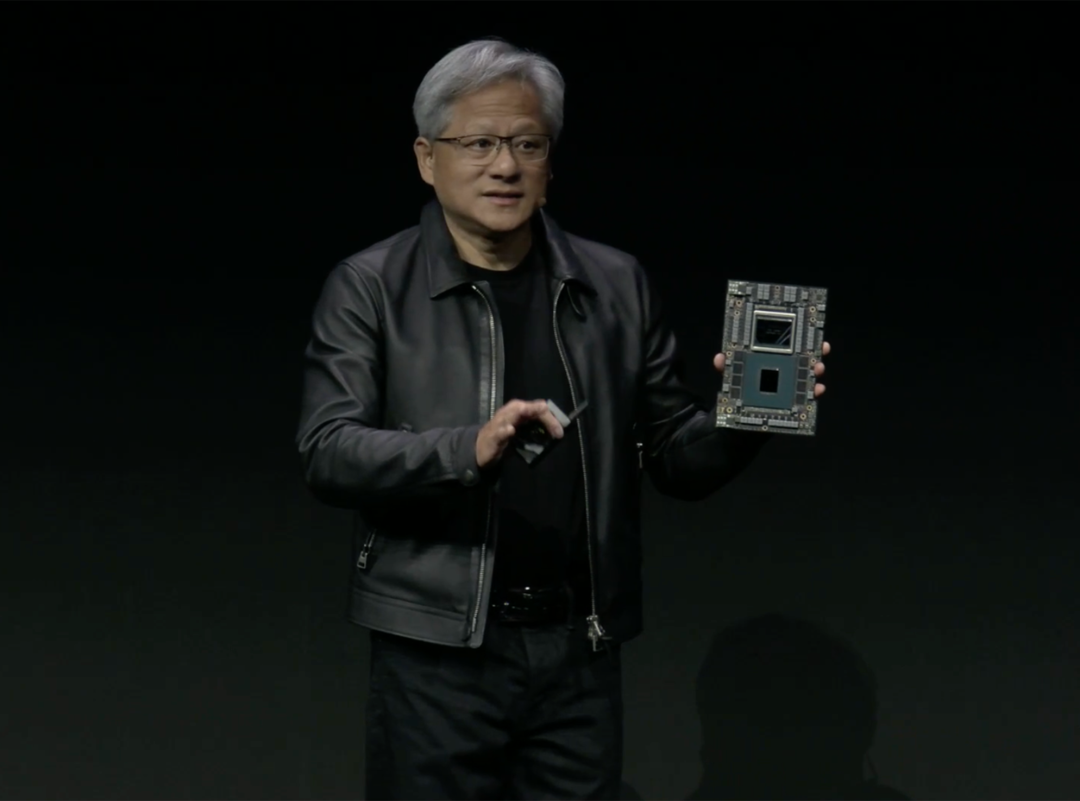

“The value of the trillion-dollar data center is accelerating its transformation into accelerated computing and generative artificial intelligence.” Nvidia co-founder and CEO Jensen Huang confidently said in a conference call.

01. Soaring Revenue and Profit, Rise of Data Center Business

Everyone predicted that Nvidia would make a big profit from this wave of AI, but no one expected this AI infrastructure company to make such a dramatic profit.

Financial institutions once predicted Nvidia’s second-quarter revenue to be $11.22 billion, but the actual figure of $13.51 billion beautifully slapped the analysts’ faces.

Thanks to the increasingly hot wave of AI, Nvidia’s processors A100 and H100, which are specialized for AI computing power, have been selling like crazy, leading to an 88% increase in revenue compared to the same period last year when AI had not yet “resurrected”.

If the soaring revenue has exceeded expectations, Nvidia’s net profit in the second quarter directly exploded. Last year, the company’s net profit was only $656 million, but in the second quarter of this year, this number directly rose to $6.19 billion, an increase of more than 8 times.

Image of the AI supercomputer entity composed of GH200|Nvidia

Nvidia CEO Jensen Huang said in a conference call with analysts: “There are already data centers worth about $10 trillion installed worldwide, including cloud and enterprise data centers.” “The trillion-dollar data centers are transforming into accelerated computing and generative artificial intelligence.”

As the “bishop of leather jackets” said, Nvidia’s revenue pillar is its data center business, which includes AI chips. Google, Amazon, and Meta are competing for Nvidia’s latest chips, and the company’s data center business currently has revenue of $10.32 billion, a year-on-year increase of 171%, far exceeding the expected $8.03 billion.

At the same time, the profit of the data center business is also quite substantial, with a gross profit margin of an astonishing 71.2%.

Facing Nvidia’s amazing financial performance, analysts praised its performance as the “1995 moment” of the last century’s Internet boom.

02. “AI Fear” – The Catalyst for Nvidia’s Rise to the Top

What supports Nvidia’s explosive performance is not only its continuous technological investment but also fear – companies and organizations around the world are afraid of missing out on this wave of AI frenzy, known as “AI FOMO”.

According to IDC data, AI spending is expected to grow by an average of 27% per year from 2022 to 2026. And one of the major beneficiaries of these additional expenditures is AI infrastructure companies like Nvidia.

At the SIGGRAPH2023 conference on August 9th, Huang Renxun unveiled the NVIDIA GH200, which can be used to build the GH200 Grace Hopper superchip platform. According to Huang’s statement, a computing center composed of 2500 GH200 chips, at the same cost of 100 million US dollars, can achieve 20 times higher energy efficiency in AI computing compared to traditional CPU computing centers.

In addition to the previous H100 and A100 chips, Nvidia has provided a rich “arsenal” for this wave of generative AI. Of course, it is also known that each chip is not cheap.

What’s even more frightening is that having money doesn’t necessarily guarantee you can get them.

Nvidia launches OVX server products with L40S GPUs | Nvidia

Previously, there was news that Saudi Arabian tycoons planned to purchase at least 3000 Nvidia H100 chips in the name of universities to build their own large language models. And the selling price of each H100 chip is no less than $40,000.

In China, from Baidu to ByteDance to Alibaba, all are increasing investments in the field of large models, and chips as the foundation of computing power cannot be ignored. There are rumors that Chinese internet giants may have placed a $5 billion order with Nvidia for chip purchases.

According to industry insiders, in the entire year of 2023, Nvidia plans to ship over 550,000 H100 chips worldwide!

This may be why Nvidia expects its third-quarter revenue to reach $16 billion, continuing to defy professional financial analysts.

One thing is certain, as long as the AI “arms race” doesn’t cool down, Nvidia’s financial reports will continue to be “impressive” and its stock price will continue to rise against the market trend.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The wave of Layer1&Layer2 has arrived, taking stock of the token bridging steps and potential opportunities of various new chains.

- How much selling pressure remains after the hacker account has liquidated 300,000 BNB?

- a16z Partner 4 Theories Driving the Creator Economy

- Taking speculation to the extreme? While everyone is obsessed with ‘personal stocks,’ friend.tech options contracts quietly go live.

- Enhancing user experience, reducing interaction steps, how can ‘intent-based transactions’ support the next wave of Web3 narrative?

- Wreck League Research Report Bored Apes Teams Up with Animoca to Create a 3A-Level PVP Fighting Blockchain Game

- Analyzing Friend.Tech from First Principles