Overview of the seven major L2 networks: What are their respective advantages and potentials?

Overview of 7 L2 networks: their advantages and potentials.Ethereum Layer-2 (L2) scaling solutions are flourishing and will be the biggest highlight of the next bull market. So, how do you find your 100x in this race? To answer this question, we’ll take a deep dive into the 7 L2 projects with the greatest future potential.

This article is based on the views of crypto researchers MooMs and 0xFinish in a Twitter thread.

1. Optimism

In October 2022, Optimism launched OP Stack, an open-source development stack that supports the OP mainnet. It introduces the concept of a superchain, a set of L2 blockchains (OP chains) built on top of the OP Stack.

- Inventory of 9 Chain Data Tools Outside of Arkham That Have Not Yet Been Released

- Evening Reading | RWA Track: Progress of Top 10 Projects

- List of 15 projects worth keeping an eye on: Thena, Stargate, Pendle…

The stack is made up of various code libraries that can be used to create highly customizable L2 blockchains. Essentially, its purpose is to simplify the creation of L2 blockchains.

The Bedrock upgrade on June 6, 2023, is the first official version of the OP Stack and brings several key improvements:

• Lower fees

• 70% reduction in deposit times

• Improved modularity of proofs

• Improved node performance

Following the Bedrock upgrade, Optimism’s next step is to upgrade to a superchain. Optimism’s L2 Rollup chain is the first member of the superchain. Coinbase’s upcoming Base chain for the mainnet will be the second member.

Worldcoin, which raised $240 million, is also building on OP Stack. Binance’s BNB Chain has also launched a testnet for its EVM-compatible OP chain opBNB based on OP Stack.

The ultimate goal is for the various L2 networks built using OP Stack to form a “superchain” – with all L2s sharing sorting, proof, and cross-chain infrastructure, enabling seamless communication between networks.

Optimism is currently the third largest L2 calculated by TVL, but with its OP Stack vision and partnerships, it has the potential to become a leader in L2 in the coming years.

Many people are bullish on Arbitrum but overlook Optimism. Coinbase and Binance have brought huge user bases to Optimism, and I believe this is just the beginning.

2. Arbitrum

Arbitrum is an Optimistic Rollup and currently the largest and most dominant L2 network by TVL. It launched its mainnet in August 2021.

Arbitrum’s ecosystem currently includes:

• Arbitrum One: the core Rollup of the entire Arbitrum ecosystem

• Arbitrum Nova: a Rollup for projects with expected high transaction volumes

• Arbitrum Nitro: an open-source stack supporting Arbitrum L2

Here we will focus on Arbitrum Nova, which has 90% lower gas fees than Arbitrum One. Although Arbitrum Nova has lower security, it is very suitable for games, social, and other high-bandwidth applications. Opensea and TreasureDAO recently launched their market on Arbitrum Nova.

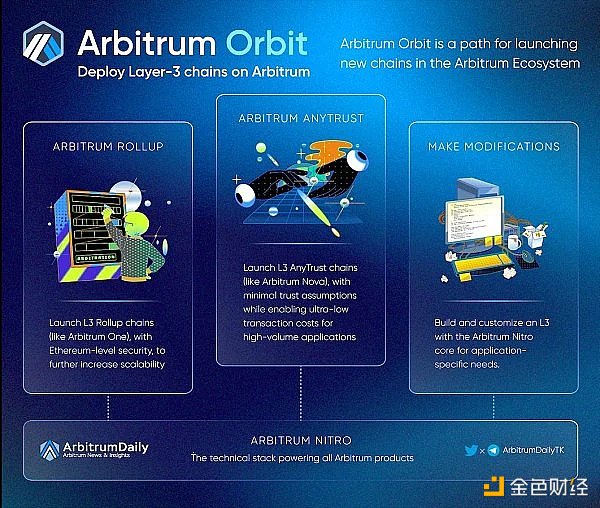

What is Arbitrum’s vision? Like Optimism, Arbitrum launched an open-source framework for everyone to use in March 2023 called “Arbitrum Orbit”, which allows any developer to create and deploy L3 without permission or formal approval.

The easiest way to understand L3 is to view them as L2 of Arbitrum One, which is already an Ethereum L2. They greatly improve the scalability of Arbitrum One, making it the ideal solution for high-throughput applications.

The difference between OP Stack and Arbitrum Orbit is that L3 will be built on top of Arbitrum One, while OP chains will be independent networks that share security with each other.

L3 may be a good narrative in the future. However, I think OP Stack has more room for growth as it targets a wider range of users through institutional entities.

Arbitrum vs Optimism

The main technical difference between the two chains is that Optimism uses single-round fraud proof, while Arbitrum uses multi-round fraud proof.

This means that Optimism’s approach is faster but may be more expensive since it is executed on L1 due to higher gas fees. Arbitrum takes longer to deliver but is more cost-effective.

Additionally, Optimism uses the EVM, while Arbitrum has its own Arbitrum Virtual Machine (AVM). This means that Optimism’s programming language is limited to Solidity. Arbitrum supports all EVM programming languages.

3. Polygon

Polygon is a blockchain dedicated to enhancing Ethereum’s scalability by using different solutions to achieve this goal. Their flagship product is the Polygon PoS sidechain, which currently processes 2-3 million transactions from 300,000-400,000 addresses per day.

Polygon also ventures into dApp chain narratives and has released their own solution called Supernets, which enables developers to build customizable dApp chains.

Additionally, Polygon’s zkEVM (its EVM ZK-rollup solution) went live on the mainnet at the end of March, with around 20,000-50,000 transactions per day since then.

Polygon’s recent 2.0 upgrade aims to unify these platforms to create a seamless user experience.

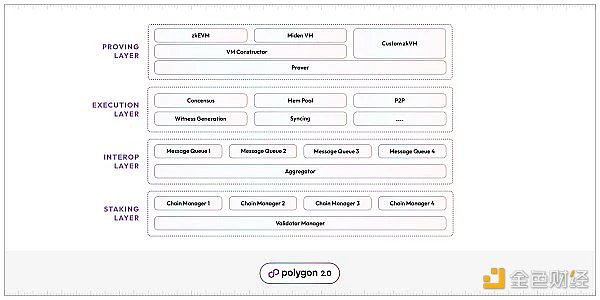

The concept of Polygon 2.0 is an ecosystem consisting of various L2 chains supported by ZK technology, utilizing a unique cross-chain coordination protocol to achieve seamless interoperability between Polygon zkEVM, Polygon PoS, and Supernets.

Polygon 2.0 consists of four protocol layers, each of which supports a critical process within the ecosystem:

• Staking layer: provides users with a re-staking function using Polygon’s native token, MATIC

• Interoperability layer: facilitates cross-chain messaging within the ecosystem

• Execution layer: enables any Polygon chain to generate batches of ordered transactions, or blocks

• Proof layer: proves all transactions on each Polygon chain

I believe that Polygon is the main competitor to Optimism for large-scale adoption. They have already partnered with many large Web 2 companies, attracting millions of users.

4. Base

“Base is a secure, low-cost, developer-friendly Ethereum L2 designed to bring the next billion users to Web3.”

Base is built on OP Stack by Coinbase and is planned to gradually decentralize over the next few years.

As a cryptocurrency exchange, Coinbase has an easy “cryptocurrency fiat currency” gateway, so Coinbase’s 110 million users and $80 billion in assets can easily adopt Base.

Base’s testnet was released on February 23, and is expected to launch its mainnet this year.

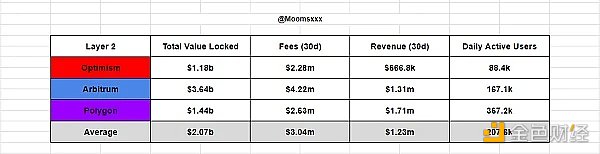

Even in a bear market, Coinbase has 8.3 million monthly trading users (according to December 2022 data), while in terms of its competitors, Polygon, Optisium, and Arbitrum have an average fee of 3.04 million, average revenue of 1.23 million USD, and an average of 200,000 daily active users.

This means that Coinbase only needs to convert 2.50% of its 8.3 million bear market users to Base users to reach the average daily active user count of these three competitors. Therefore, Base may become one of the main L2s in the DeFi (trading) field.

5. Mantle

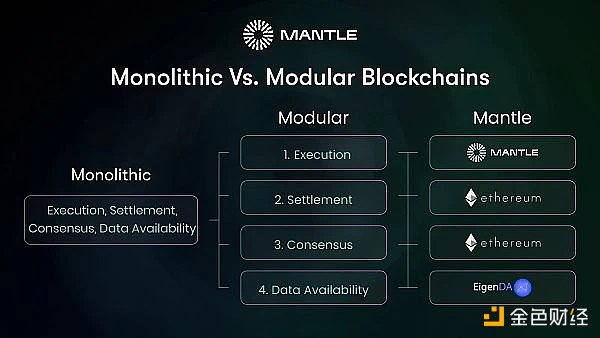

Mantle is a novel modular L2 network designed to take Ethereum’s scalability to a new level while maintaining a high level of decentralization and strong security.

Mantle is launching in 2023, and it separates the three key layers of the blockchain (consensus, execution, and data availability) to allow for independent optimization:

• Consensus layer: works similarly to how L1 chains work, primarily focused on sorting transactions and blocks.

• Execution layer: isolated from the other two layers, dedicated to executing transactions and smart contracts.

• Data availability layer: based on innovative DAS technology, ensures that data is always available and not hidden, improving network security.

Mantle’s modular design could change the game in the L2 race. By separating the three key layers to allow for independent optimization, it can make the network more flexible and scalable without affecting security or decentralization.

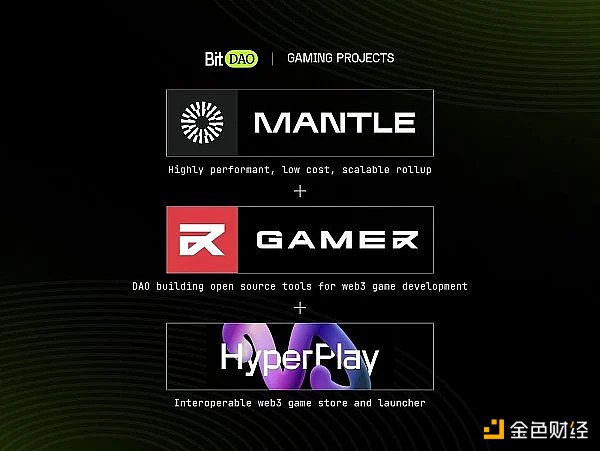

Mantle has also gained attention for its partnership with the decentralized autonomous organization BitDAO. This strategic partnership could bring significant value to the Mantle network and solidify its position in the blockchain ecosystem.

One unique aspect of Mantle is its focus on enhancing user experience, particularly for chain games or GameFi. With Mantle’s high scalability, lower transaction costs, and faster transaction speeds, it could completely change the GameFi landscape.

Despite being a newcomer in the L2 space, Mantle has shown great promise. Its innovative technology, focus on user experience, and commitment to decentralization make it a strong competitor in the increasingly fierce L2 race.

6. opBNB

In June 2023, Binance announced the launch of the opBNB testnet. Based on the OP Stack, opBNB is very focused on maintaining compatibility with the Binance Smart Chain (BSC), which provides significant advantages for BSC developers and users.

Similar to Base, opBNB will leverage Binance Exchange’s massive user base to provide seamless and cost-effective L2 solutions for millions of users who already use Binance. This suggests that opBNB has tremendous growth potential in the DeFi ecosystem.

It is worth noting that the success of opBNB will be closely related to the native token BNB of the entire Binance ecosystem. If opBNB gets attention, it may have a positive impact on the value of BNB, triggering a chain reaction on the entire Binance ecosystem.

According to the roadmap, opBNB will launch its mainnet in 2023. The launch of the opBNB mainnet is worth paying attention to because it will showcase Binance’s L2 solution’s performance in high-frequency trading, gaming, and social networks.

7. zkSync

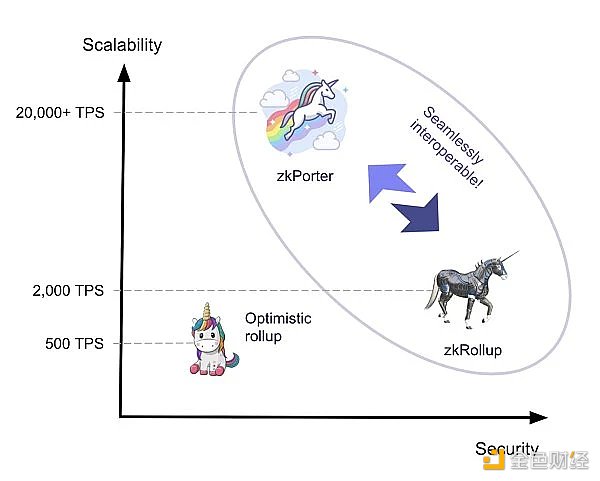

zkSync is an L2 scaling solution developed by Matter Labs. It uses zkRollup technology and aims to provide Ethereum-level security. It is one of the key projects driving the L2 revolution.

zkSync uses zero-knowledge proof technology to bundle multiple transactions into one proof. By moving most of the computation off-chain and ensuring high-level security through the Ethereum mainnet, it improves scalability.

One notable advantage of zkSync is that it allows users to pay gas fees with the tokens they want to transfer, rather than having to use ETH. This greatly improves the user experience and brings Ethereum closer to mainstream adoption.

Matter Labs is also committed to making zkSync upgradable without a hard fork. This modular design ensures it can be integrated into future Ethereum improvements and scaled alongside the growing Ethereum ecosystem.

By using a PoS consensus mechanism for block validation, zkSync remains decentralized and aligned with Ethereum’s core values.

The main goal of zkSync is to be fully permissionless, allowing any project to build and deploy smart contracts on its network. This will further help with Ethereum’s scalability and support for diverse dApps.

zkSync’s vision is not just as a scaling solution; it is a stepping stone towards a more scalable, secure, and user-friendly Ethereum network. With zkSync, the possibilities for Ethereum to radically transform various industries are limitless.

Following projects like zkSync is crucial for understanding the future of Ethereum and DeFi. As Ethereum continues to evolve, zkSync will undoubtedly play a crucial role in its growth and adoption.

zkSync is not just a competitor to L2 projects; it sets the standard for L2 security, scalability, and efficiency. As the Ethereum ecosystem continues to develop, zkSync is worth long-term attention.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of RWA Tracks: Progress of Top 10 Headline Projects and 20 Early Stage Projects

- What projects has dao5, founded by a former Polychain partner, invested in, as part of their plan to co-build a venture capital DAO with the founder?

- 4 Potential Decentralized Physical Infrastructure Network (DePin) Projects: Hivemapper, Render, Helium, and IoTeX

- A Quick Look at Q2 Cryptocurrency Venture Capital Overview, What Projects is Bankless Paying Attention to?

- Has on-chain intelligence become a “human flesh search”? Binance’s new IEO project Arkham receives negative feedback.

- Understanding Binance’s Launchpool Project Arkham and What is Intel-to-Earn?

- Share potential investment opportunities and niche projects worth paying attention to: Flashstake, Protectorate Protocol, aori…