Coinbase Early Product Manager: Learn Crypto Corporate Governance from ZCash, Tezos, Melon

Original title: Crypto Corporate Governance

Written by: Linda Xie, co-founder of blockchain investment agency Scalar Capital, early product manager at Coinbase

Compilation: Perry Wang

Source: Chain News

- Is Bitcoin still overvalued after the crash?

- Former US CFTC Chairman: Blockchain will completely change the market, Western countries also need to consider developing their own digital currencies

- Behind 378 pieces of business and industry change information: How does the blockchain company on the air outlet change?

Disappointed with the information on the corporate structure of the cryptocurrency industry on the market, I decided to analyze some of the high-profile projects myself to see how they transitioned from companies to foundations. The governance mechanisms they established in this process set a precedent for subsequent followers. As an outsider (I'm not a journalist), I rely on news stories, blog posts, Twitter topics, and conversations with individuals to help me bring these charts together.

I have also marked the parts of each chart where governance issues are still pending or the results are poor, such as:

- Which business model is suitable for a decentralized ecosystem? Should the founding team make money from the initial state (the projects created themselves) or from businesses that depend on others in the ecosystem?

- How to establish an independent foundation? Who is eligible for the Foundation Board?

- How to prevent the foundation from going to the enterprise (through permission) to play a left-handed right-hand capital game while ensuring that the foundation protects the best interests of the project?

- Should governance be parameterized at the smart contract or legal entity level? Is there another way to set the initial state?

- The last question is probably the most important one: who decides who will make the decision? Who can solve these problems, together or one by one for each project?

In each chart, the boxes represent entities and the arrows represent cash flows. Sources are standardized under each chart:

ZCash

- Zooko Wilcox, A Personal Letter About The Possibility of a New Zcash Dev Fund

- Matt Luongo, Decentralizing the Dev Fee

- A conversation with James Prestwich

Zcash is one of the most well-known projects in the field, and has been transparent to the community in terms of governance. In short, the Zcash agreement originally had a Founders' Reward (FR) to support the development of the agreement, but the founder award may run out in 2020-21. FR funded the corresponding development company, the Electronic Coin Company (ECC), which supports its own operations by selling a portion of future founder rewards to investors to earn cash. These investors then use a portion of The human-rewarded cash flow established the Zcash Foundation and the Zcash Dev Fund.

Regarding the issue of reward shares for the founders of ECC and ZCash development funds, some renegotiations have been conducted, and once the founder rewards have expired, renegotiations are needed.

For Zcash's governance mechanism, the core question now is: once the founder reward expires, how will ECC get funding support? How does the Zcash Development Fund receive funding support?

Tezos

- Gideon Lewis-Kraus, Inside the Crypto World's Biggest Scandal

- Stephen O'Neal, The History of Tezos: The Infamous ICO Trying to Rebound Amidst Lawsuits and Disputes

- Paul Vigna, A $ 232 Million Cryptocurrency Fight Comes to a Close

- Thijs Maas, The Curious Tale of Tezos —from a $ 232 MILLION ICO to 4 class action lawsuits.

Tezos has completed the most high-profile ICO in the crypto industry, and articles claiming that Tezos raised $ 232 million are widely circulating. Tezos' ICO is paid in Bitcoin BTC and ETH. These funds in BTC and ETH are locked in the Tezos Foundation until the Foundation Board agrees to use a portion of the funds from the founder couple Arthur Breitman and Kathleen Breitman. Buy DLS, a dynamic ledger solution. This move was postponed as the price of BTC and ETH against fiat currency fluctuated.Another reason may also be that the board of directors of the Tezos Foundation is too independent.

The question is: how could Tezos and the creators of its source code establish an independent foundation without having funds under the full control of an independent council?

Melon

- Mona El Isa, Melon Council unveiled at M-1

- Fabian Gompf, Melon Council: everything (new) you need to know

- Jenna Zenk, Introduction to the Melon Governance System

- Conversations with Jenna Zenk

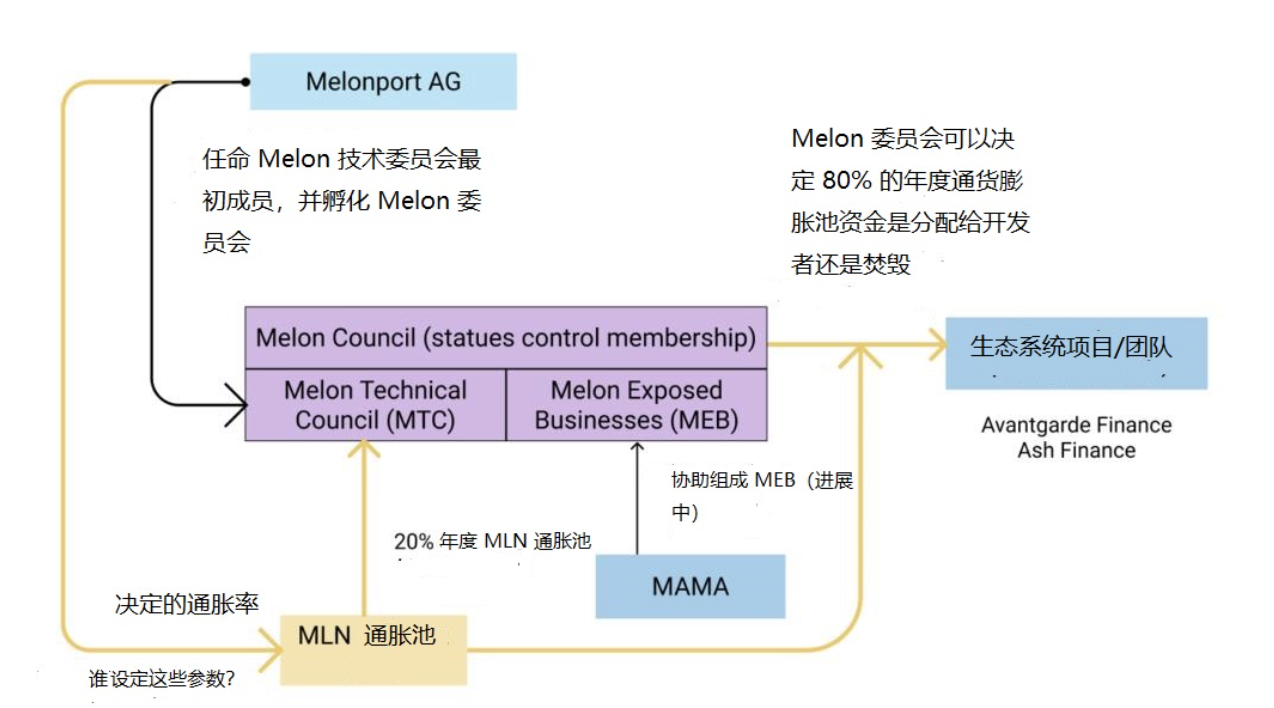

Melon has transparent but complex governance mechanisms. After designing the underlying technology of the Melon project, Melonport AG transferred control of the project to the Melon Committee, which has the ability to issue grant funds for projects built on Melon.

These subsidies come from no more than 80% of the MLN's annual inflation pool, and the remaining 20% is compensated to an organization under the Melon Committee, the Melon Technical Committee (MTC). The MEB has not yet been established, and it seems more like the "upper house" in the two chambers of parliament, which can determine membership access rather than subsidizing the allocation of funds.

Melonport AG has now disintegrated and no longer manages Melon. It transferred responsibility to the Melon Committee, appointed the original members of the Melon Technical Committee, let the Melon Committee establish its own governing charter, and discussed membership access.

This architecture forms an interesting back-reference with the Tezos pattern. It appears that Melonport AG has transferred the governance of the Melon project to an independent agency and has not turned the latter into a puppet of unfriendly entities.

The question of this governance model is: according to this structure, what initial state should the initiating project set, and what conditions should subsequent foundations set?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis | The remainder is king: who can survive the spring?

- Global Blockchain Private Equity Financing Overwhelming Winter, November Dec. 66.4% MoM

- ECB executives: "We cannot sacrifice security" when talking about Libra

- Securities Daily: Digital assets will generate super enterprises

- Why do blockchain companies like to go to Hainan?

- How far is the fiat digital currency from us

- Bakkt launches bitcoin options contract next week, CME announces launch of options product plan