Is Bitcoin still overvalued after the crash?

Source: LongHash

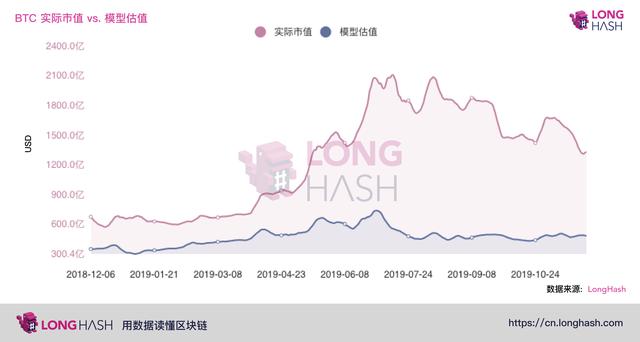

Recently, the price of Bitcoin has fallen sharply, once falling to around $ 6,500, a new low in the second half of 2019. However, at the same time, we see that LongHash's mainstream currency valuation model still shows that Bitcoin is in a relatively high valuation range.

LongHash uses the current mainstream Metcalfe's law to value crypto assets. Metcalfe's Law is a law on the value of the network and the development of network technology. It was proposed by George Gilder in 1993, but was named after the surname of Robert Metcalfe, the pioneer of computer networks and the founder of 3Com. In recognition of his contribution to Ethernet. The law states that the value of a network is proportional to the square of the number of users connected to it. Metcalfe's Law was originally used to evaluate the value of communication networks, but with the growth of social media and large-scale data sets in recent years, this law has also been confirmed in social networks. The most important of these is an independent study of the value of Facebook and Tencent, China's largest social networking company. Scholars have found that over the past 10 years, the value of these companies and the growth of their user base have not grown linearly, but met Metcalfe's Law.

Crypto assets are networks that connect users in a digital space. Users can interact by exchanging information and participating in transactions. Since these networks are digital, always online, and published on the blockchain, network usage data is easier to obtain than other types of networks (phone, fax, instant messaging, and social media). Therefore, according to Metcalfe's law, we use the unique address of daily active users to build a valuation model of crypto assets such as Bitcoin.

- Former US CFTC Chairman: Blockchain will completely change the market, Western countries also need to consider developing their own digital currencies

- Behind 378 pieces of business and industry change information: How does the blockchain company on the air outlet change?

- Analysis | The remainder is king: who can survive the spring?

The figure above uses Metcalfe's Law to value Bitcoin and Ether respectively. We found that the predicted value of ETH is in line with the actual market value, while the valuation of BTC is far from the market value. The possible reason is that Bitcoin generates a block approximately every 10 minutes, and the number of transactions per second (TPS) is maintained between 3-7, which causes a large number of unconfirmed transactions to accumulate, and also limits the growth of the number of active addresses. Therefore, the valuation of Bitcoin through the Metcalfe model is low. On the other hand, Bitcoin is regarded as digital gold, and it has a similar gold standard role in crypto assets. All crypto assets are linked to Bitcoin, which makes Bitcoin have a higher investment premium. These factors are not considered in the Metcalfe model.

Therefore, in the valuation of crypto assets, the Metcalfe model is more suitable for the valuation of crypto assets with high TPS or high scalability. In the valuation of Bitcoin, its performance may not be perfect, but it still has a certain reference value. According to the model's prediction, although Bitcoin is currently in a relatively high valuation range, it is far from reaching the bubble risk, and we can remain cautiously optimistic about the market outlook.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Global Blockchain Private Equity Financing Overwhelming Winter, November Dec. 66.4% MoM

- ECB executives: "We cannot sacrifice security" when talking about Libra

- Securities Daily: Digital assets will generate super enterprises

- Why do blockchain companies like to go to Hainan?

- How far is the fiat digital currency from us

- Bakkt launches bitcoin options contract next week, CME announces launch of options product plan

- Babbitt site 丨 Chinese and American listed companies discuss the blockchain, when will the industry usher in a novelty?