Breaking down the past three Bitcoin cycles: Who will drive the next cycle?

Analyzing the past three Bitcoin cycles: Predicting the next one.“`html

Author: Michael Nadeau

Compiled by: Luffy, Foresight News

The next Bitcoin block reward halving is expected to occur around April 8, 2024. Historically, the halving has triggered three remarkably similar cycles. In this article, we’ll break down the past three Bitcoin cycles and predict the next one.

- Breaking down the past three Bitcoin cycles: what will drive the next cycle?

- Analysis: Why did the cryptocurrency market fall today?

- Arthur Hayes: Bitcoin Will Become the Currency of Artificial Intelligence

The topics we explore include:

- What drives Bitcoin cycles?

- Operational and network KPIs for the first 3 cycles

- Price trends for the first 3 cycles

- Predictions for the next cycle

What Drives Bitcoin Cycles

Every 210,000 blocks, the Bitcoin block reward is halved. Measured in time, this occurs roughly every 4 years. It marks a change in Bitcoin’s monetary policy, reducing the block reward (network inflation) paid to miners by 50%.

Next April, the Bitcoin block reward will decrease from 6.25 BTC per block to 3.125 BTC.

With the reduced new issuance, it’s reasonable to conclude that the reduced new supply is a catalyst for each bull market.

The theory goes like this:

After the halving, miners sell fewer Bitcoin into the market. This takes a large chunk of selling pressure out of the market. Prices are at the margin, and new buyers push the price up. Then, financial media starts talking about Bitcoin, people start searching for it on Google, Bitcoin goes viral, new buyers flood in, on-chain activity picks up, venture capital firms pour money into new businesses that support the ecosystem. More businesses = more marketing = more users, which stimulates more buyers and more on-chain activity, and more media coverage.

Voila, new all-time highs are made.

That’s a nice story, let’s see if the data backs it up.

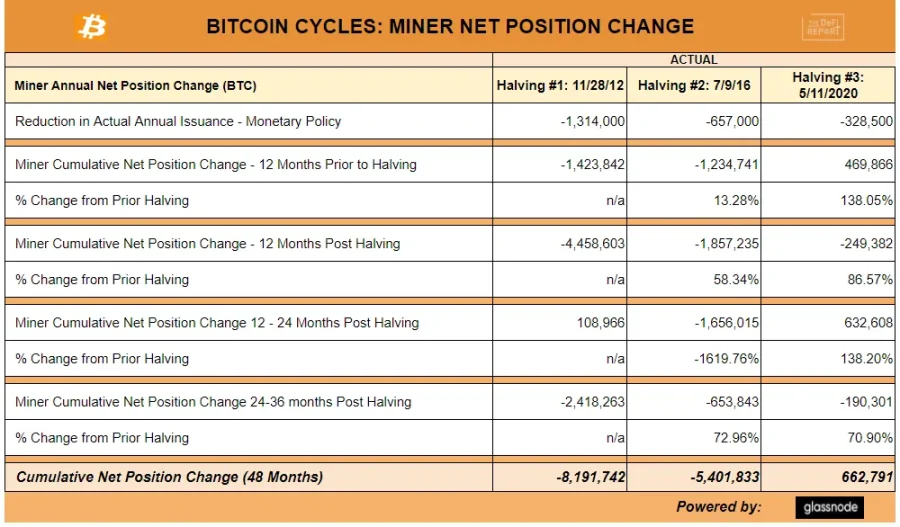

Net position change = The net change of Bitcoin held by wallet addresses tagged by Glassnode as belonging to miners.

“`

In the United States, inflation has ended and the Fed has paused rate hikes. Asset prices have risen since the beginning of the year and may continue to do so for some time.

But there are also some clouds on the horizon, and monetary policy may undergo a shift.

Specifically, $7 trillion of US government debt will mature next year. This debt needs to be refinanced/reissued to support fiscal spending. According to updated data from the Congressional Budget Office in May 2023, the US deficit is expected to be $1.5 trillion this year.

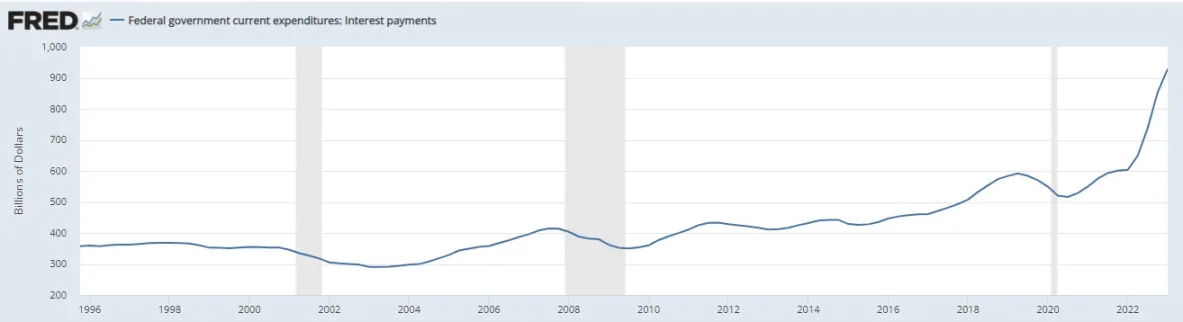

Meanwhile, debt interest payments have become the second largest expenditure for the US government, nearly $1 trillion annually.

Data source: Fed FRED database

In October, 43 million Americans will resume student loan repayments, with an average rate of $503 per month. According to a survey, 37% of borrowers say they need to cut back on other expenses. 34% say they can’t afford the cost at all.

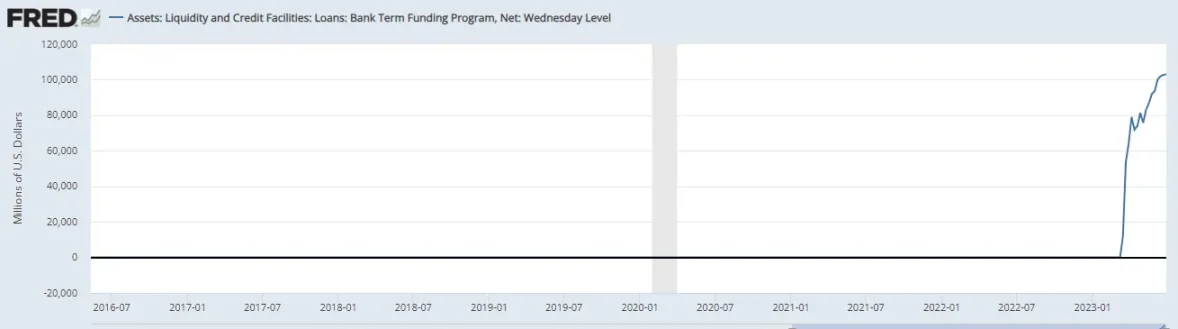

In addition, banks are still requesting to join the Fed’s regular bank financing plan:

Data source: Fed FRED database

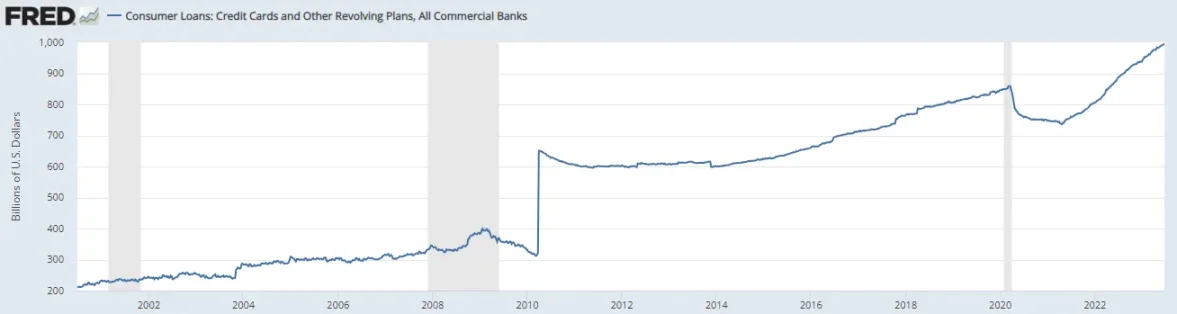

Consumer credit card loans hit a record high of over $1 trillion:

Data source: Fed FRED database

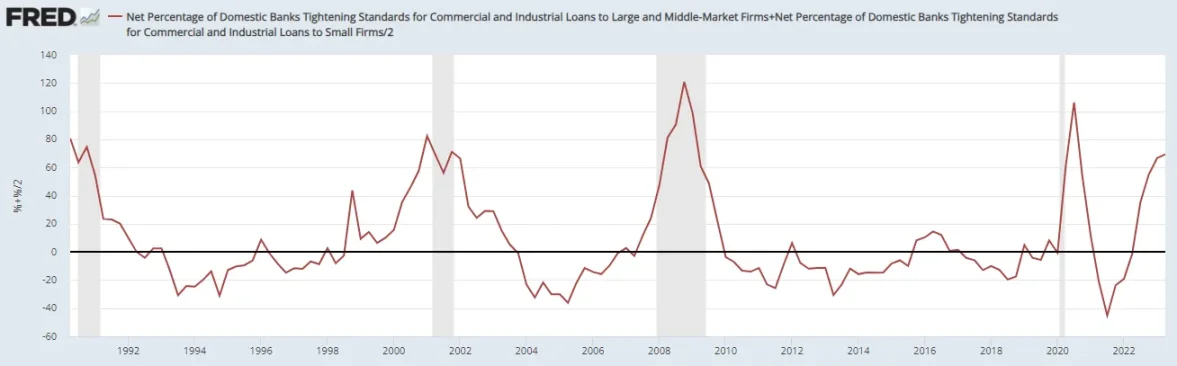

Bank loan standards also indicate an economic downturn is looming:

Data source: Fed FRED database

Finally, the commercial real estate industry has over $1.5 trillion in debt that needs to be refinanced in the coming years. This is because interest rates are at their highest levels since 2006. Of course, due to remote work, occupancy rates and valuations of office space have declined. To make matters worse, a group of analysts at Citigroup found that more than 70% of commercial real estate office building loans are held by regional banks.

5 key points:

The best time to buy Bitcoin is when everyone thinks it’s dead. We have two chances in 2022. We remind our readers in December that Bitcoin is bottoming out. Secondly, what is the second best time to buy Bitcoin? Historically, it happened during any downturn before the halving. Of course, timing the market is difficult. Dollar-cost averaging works well for assets like Bitcoin that are in the early stages of global adoption. Even those who bought at the top of past cycles have performed well in the long run. Bitcoin is currently down 55% from its all-time high, but its 10-year, 7-year, 5-year, and 3-year compound annual growth rates are 84%, 73%, 36%, and 49%, respectively. The key is to have long-term conviction. Know exactly what you’re buying and ignore the noise.

Forecast: Based on the first three cycles, we predict that returns will continue to decline. The target price for Bitcoin in this cycle is $158,000.

A higher-level framework: We predict that the peak market capitalization of Bitcoin in the next cycle will reach $31.5 trillion (compared to $12 trillion in the previous cycle). This will make Bitcoin’s market capitalization 25% of gold’s. Long-time readers know that we ultimately believe Bitcoin will reach and surpass the gold market ($12.6 trillion market cap currently).

Overall, we believe that the total market value of cryptocurrencies in the next cycle may soar to $8-10 trillion (compared to $3 trillion in the previous cycle). Ethereum, competitive L1s, and important infrastructure areas may present interesting opportunities.

Cycle low after the cycle: We expect Bitcoin’s volatility to continue in the coming years. That being said, we expect volatility to decrease over time. The growth of the market size, the entry of more mature investors into the field, mature market structures and products, new regulations, and less “Wild West” leverage will all contribute to this outcome. Note that Bitcoin is like a commodity—in a bull market, its price far exceeds its production cost, and then it falls to (sometimes below) its production cost in a bear market.

About the previous cycle: We believe that the cycle did not reach its full potential due to the mining ban in China. If you remember, Bitcoin had just hit an all-time high, Tesla had just purchased Bitcoin for its balance sheet, and Michael Saylor had purchased billions of dollars of Bitcoin through Microstrategy and a media tour. We believe that Bitcoin could have broken through $100,000 if not for the mining ban in China. Due to the concentration of miners in mainland China (abundant cheap hydroelectric power), the ban eventually led to forced sell-offs and surrenders by miners.

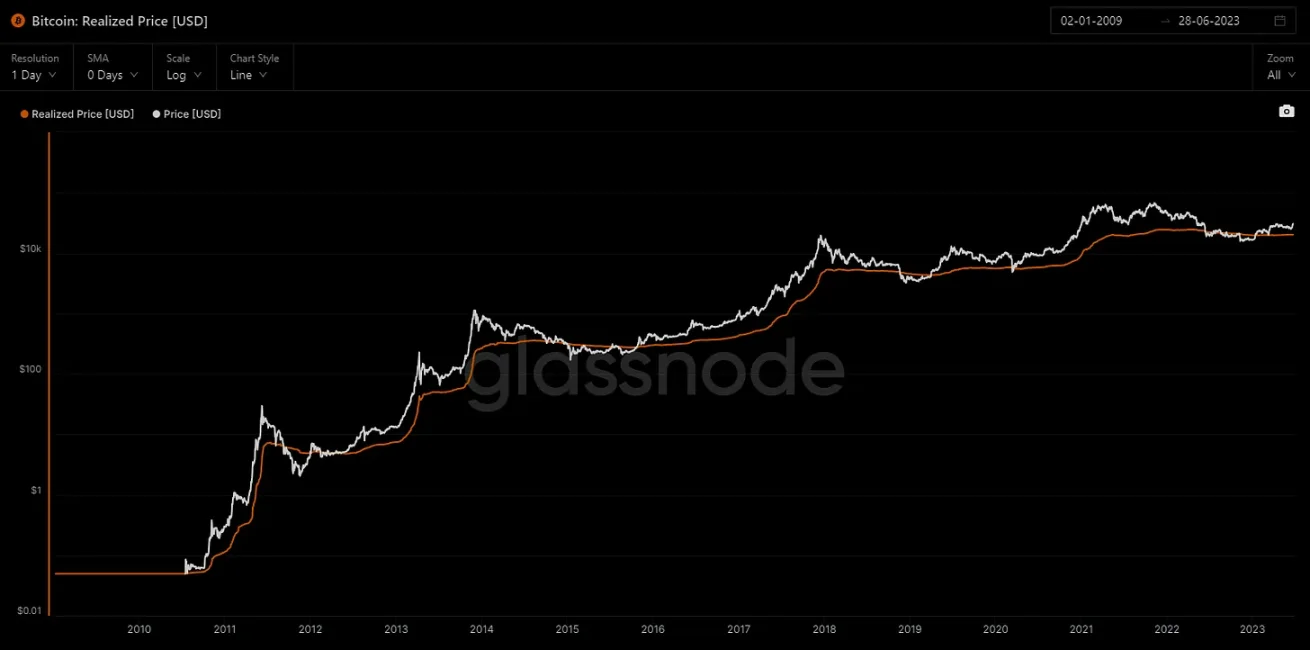

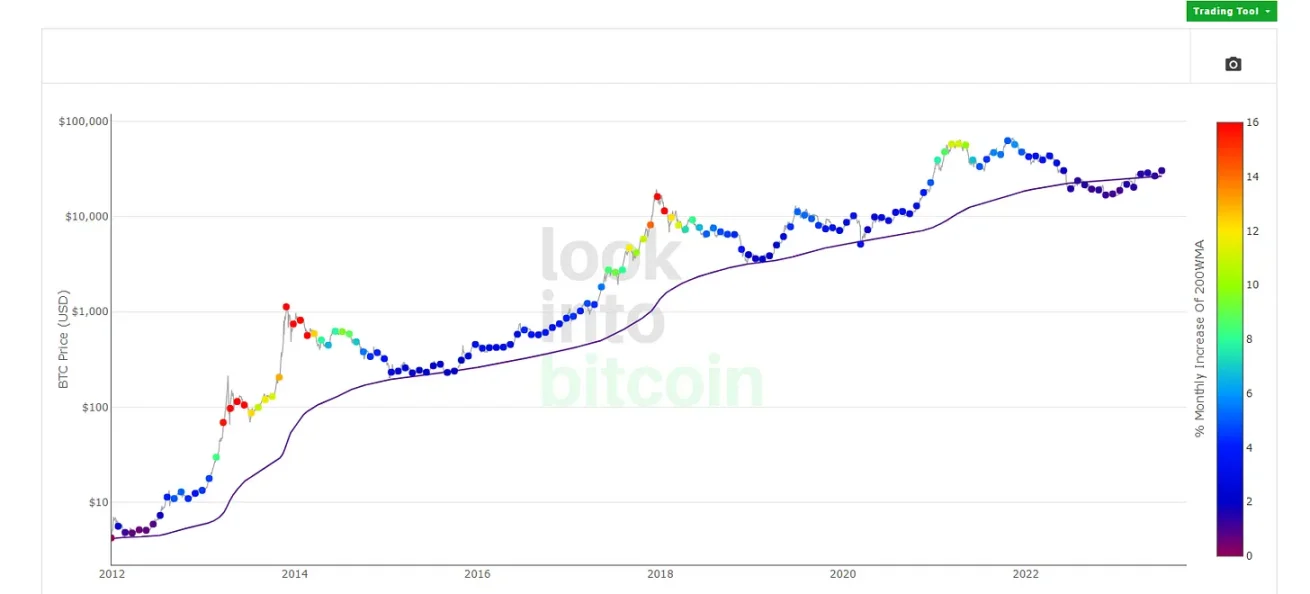

### Mid-Cycle KPINarrow the scope and understand where we are today relative to past cycles.Market Value to Realized Value:_Source: Glassnode_This metric measures the ratio of market price to the average price of each circulating Bitcoin. We exited the green zone at the beginning of 2023, which is a good entry point historically. That being said, we are still at a relatively low level.Realized Value:_Source: Glassnode_Realized value represents the average price, or the purchase price, of each Bitcoin in circulation. The current price is $20,323.34.200 Week Moving Average Heatmap:_Source: Look into Bitcoin_In 2022, Bitcoin broke below the 200-week moving average for the first time in its history and stayed below it for roughly 9 months. Since then, Bitcoin has recovered and the 200 WMA is currently at $26,665.### ConclusionThe adoption cycle of Bitcoin is mainly driven by the “narrative” of global liquidity, network growth, and the halving supply shock. These three elements seem to combine well together.Most importantly, the Bitcoin spot ETF with approval in the coming months bearing the name BlackRock.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Arthur Hayes: Why Bitcoin Will Become the Preferred Currency of Artificial Intelligence?

- Has Inverse Finance successfully transitioned from CDP lending products to fixed-rate lending markets?

- “Fortune” interview with Sister Wood: Will ARK win the first Bitcoin spot ETF?

- Lightning Labs launches AI Bitcoin tool that enables sending Bitcoin on the Lightning Network

- What is Bitcoin Recursive Mnemonic?

- How is the market searching for logic in the old-school DeFi as COMP and MKR continue to rise in recent days?

- In the first half of the year, it lagged behind BTC. What kind of “danger” and “opportunity” will ETH face in the second half of the year?