Huobi Research Institute’s latest research report | A comprehensive analysis of the current situation, risks, and future development of the cryptocurrency financial product market.

Huobi Research Institute's latest report analyzes the current status, risks, and future development of the cryptocurrency financial product market.According to Datos.com, the global cryptocurrency wealth management market had reached $292 billion as early as 2021, with a year-on-year growth of over 600%. It is expected to exceed $5 billion by the end of this year (2023).

With more and more traditional financial institutions entering the cryptocurrency custody business, the cryptocurrency wealth management market is experiencing rapid growth. As a more stable investment option in the high-risk market, it is becoming increasingly popular among investors.

So, how do you choose a cryptocurrency wealth management product?

Should you choose a centralized CeFi product or a decentralized DeFi product?

- Reflection on the fundamental reasons for the current stagnation of the NFT market

- Opinion Supporting the US dollar with Bitcoin would restrict the Federal Reserve’s ability to respond to economic crises.

- Token Economics 101 How to Create and Accumulate Real Value?

It depends on the investor’s understanding of cryptocurrency wealth management. If you have never chosen a cryptocurrency wealth management product before, or if you have only blindly chosen based on the APY, this article will provide comprehensive introductory information to help you make more rational and wise choices.

This research report is produced by the Huobi Research Institute and covers the definition, types, market status, and development trends of cryptocurrency wealth management products. It provides a detailed explanation of cryptocurrency wealth management products, including DeFi cryptocurrency wealth management products and CeFi cryptocurrency wealth management products. It also analyzes the four common types of risks and the legal and regulatory environment. It provides valuable insights and cryptocurrency asset strategy recommendations for investors, market participants, policy makers, and regulators.

I. Definition and Types of Cryptocurrency Wealth Management Products

Cryptocurrency wealth management products can be seen as an innovative financial service using blockchain technology. These wealth management products provide investors with opportunities to store and increase the value of their digital assets. Essentially, cryptocurrency wealth management products can be divided into two categories, just like traditional wealth management products: fixed-term and current. Fixed-term products require investors to lock their funds for a specified period of time to obtain a predetermined return, while current products allow investors to deposit and withdraw their funds at any time, but the return rate may vary. Both types of products provide effective supplements to traditional bank savings accounts and open up new income opportunities for investors.

II. Current Status and Development Trends of Cryptocurrency Wealth Management Market

2.1 Size and Growth of Cryptocurrency Wealth Management Market

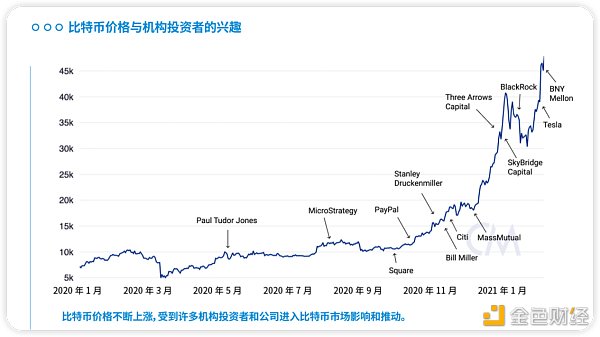

According to Datos.com, the global cryptocurrency wealth management market had reached $292 billion as early as 2021, with a year-on-year growth of over 600%. It is expected to exceed $5 billion by the end of this year (2023), indicating the continuous growth of investors’ interest and confidence in digital assets. Cryptocurrency wealth management involves digital currencies and their derivatives. Bitcoin is widely regarded as an investment target, and the new wave of its trading has also spawned more wealth management tools.

The most popular forms at present mainly include direct investment in Bitcoin, investment in new types of digital currencies such as NFTs, and various lending services. Holding Bitcoin directly has always been a popular investment method. In addition, as new tokens are constantly being issued, investors are interested in other digital assets. Many custodian institutions absorb assets for trust business expansion and also provide lending services for other digital tokens such as Bitcoin, lending out digital tokens to earn interest.

The rapid growth of the cryptocurrency wealth management market is due to the high risk and high return that digital currency can provide, and users prefer decentralized and transparent currency attributes. According to predictions, since the occurrence of world extreme events (changes in the local geopolitical situation under the impact of trade competition, Russia-Ukraine conflict), the entire cryptocurrency wealth management market is expected to continue to expand rapidly as more investors recognize the value of cryptocurrencies.

Source: Coin Metrics

2.2 Main Investors and Their Behaviors in Cryptocurrency Wealth Management Products

The main investors are mostly young and wealthy technology enthusiasts. This group of people is curious and confident about digital assets and pursues high returns on investment. They mostly learn about and participate in investments through online social networks and forums. This group is mainly concentrated in the age group of 30 to 45.

In addition, high-end individuals have also become investors. The high returns offered by cryptocurrency wealth management products attract them to participate. These investors often have higher investment capabilities and willingness to take risks.

The common characteristics of cryptocurrency wealth management investors are: high risk tolerance, high recognition of digital currencies, and willingness to participate in emerging markets. They mostly pay attention to the latest news and data of popular tokens and make investment decisions quickly. However, they also need to pay special attention to high-risk factors such as large fluctuations in cryptocurrency prices.

Their investment behavior tends to be short-term and medium-term, and long-term holdings are not common. They mainly focus on potential returns rather than long-term asset appreciation.

3. Cryptocurrency Wealth Management Products: Explanation and Risk Analysis

3.1 Introduction to Cryptocurrency Wealth Management Products

Specifically, cryptocurrency wealth management products refer to financial activities conducted using cryptocurrencies, and these products have significant differences in their forms and investment returns. They are mainly divided into two categories: decentralized finance (DeFi) wealth management products and centralized finance (CeFi) wealth management products. These two categories of products have their own characteristics, as well as different risks and returns. When investing, users need to have a clear understanding of them, understand their operating principles and possible risks, and make wise investment decisions.

Before delving into these two categories of products, it is important to note that cryptocurrency wealth management products are different from traditional financial products. They are not based on government currencies but on cryptocurrencies. This means that they are not subject to the constraints of the traditional financial system, but they also bring new challenges and risks, such as market volatility and technological risks.

In the following chapters, we will provide a detailed introduction to DeFi and CeFi cryptocurrency wealth management products, hoping to help readers better understand these two types of products and make more informed investment choices.

3.1.1 DEFI Cryptocurrency Financial Products

3.4.1.1 Curve

Curve is one of the earliest automated market makers (AMMs), initially focused on stablecoin trading (the V2 version expanded to include non-stablecoin trading) and providing large-scale, low-slippage stablecoin transactions through innovative algorithms.

The main stablecoin pool on Ethereum for Curve is the 3pool, which facilitates transactions between DAI, USDC, and USDT stablecoins, with a maximum yield of 2.44%.

3.4.1.2 Aave

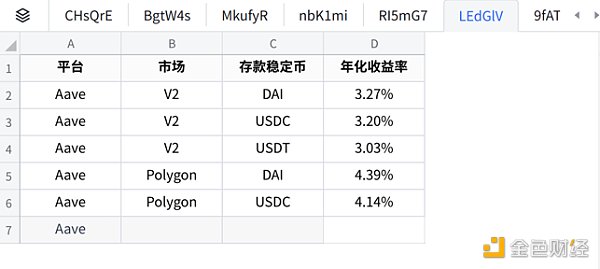

Aave is one of the leading DeFi lending platforms. Aave offers five markets including V1, V2, AMM, Polygon, and Avalanche, with the highest annual yield found in the USDT lending pool on the AMM market at 7.66%.

3.4.1.3 Compound

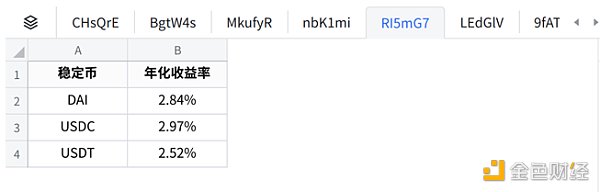

Compound is also one of the leading DeFi lending platforms, currently deployed on the Ethereum network and supporting lending operations for DAI, USDC, and USDT stablecoins. According to the latest data, the Total Value Locked (TVL) on Compound is $13.2 billion. On Compound, the annual yields for DAI, USDC, and USDT deposits are 2.84%, 2.97%, and 2.52% respectively, with the highest yield found in USDC at 2.97%.

3.4.1.4 Yearn

Yearn is a DeFi yield aggregator with a total value locked of $4.23 billion. Yearn automatically allocates users’ funds to other protocols to maximize yield. Yearn currently supports Ethereum and Fantom, and offers two types of yield products: Vaults and Iron Bank. Vaults are yield aggregation products, while Iron Bank is a collateralized lending product. The highest annual yield is found in the DAI Vaults on Fantom, with a rate of 24.96%.

Among them, the highest yield for the Ethereum-Vaults USDT product is 7.68%, followed by a yield of 5.76% for USDC.

3.1.2 CeFi Cryptocurrency Financial Products

3.4.2.1 CeFi Stablecoin Financial Products

Although decentralized finance (DeFi) is developing rapidly, centralized finance (CeFi) still plays an important role in the cryptocurrency financial sector. In the field of stablecoin financial products, CeFi mainly focuses on major exchanges. With their large user base and abundant capital reserves, exchanges have unique advantages in their financial services.

The stablecoin financial products offered by exchanges are more like traditional bank financial products, combined with the characteristics of blockchain technology to introduce a series of new products. These include: current account financial products, fixed-term financial products, investment plans, high-interest current accounts, dual-currency investments, node staking, ETH2.0, etc. Below, we will introduce the stablecoin financial products offered by four exchanges: Huobi, Binance, OKEx, and Gate.io.

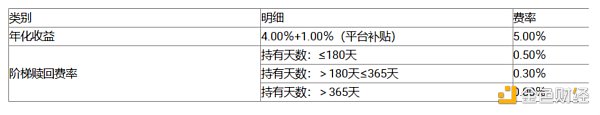

Huobi’s stablecoin wealth management products are typically high-interest demand products, which support withdrawals at any time and have relatively stable returns and high asset security. Currently supported currencies include USDT, DOT, FIL, TUSD, USDC, ETH (other currencies will be gradually supported). The annualized returns and redemption fees for USDT can be referred to as follows:

Target users of Huobi’s high-interest demand products:

1. High-net-worth individual investors: If you have a higher wealth accumulation and are seeking investment opportunities with high returns, this product is suitable for you as a long-term stable asset allocation, which requires you to bear the cost of short-term redemption fees.

2. Professional investors: If you are an institutional investor, fund manager, or other professional investor. With market insights and investment experience, you can select high-quality wealth management products. This product is also suitable for stable and high-return investments.

3. Long-term investors: If you have a sum of money that can be invested for a long time, such as retirement reserves, children’s education funds, etc., and are willing to invest the funds for a long time in wealth management products, this product is also suitable for you. It can help you withstand short-term market fluctuations and lock in stable returns.

3.4.2.2 CeFiNon-stablecoin wealth management

The above statement is about the content of stablecoin wealth management products by major exchanges. Next, we will introduce some wealth management products in the non-stablecoin area. Here, we mainly use Huobi as an example.

1. “Dollar-cost averaging” product

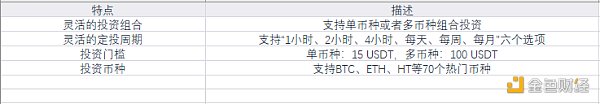

The “Dollar-cost averaging” is a product designed for long-term investors, especially suitable for investors with limited time, lack of investment experience, but seeking long-term growth and risk diversification. This plan allows investors to regularly invest funds, enabling them to average down investment costs, reduce the impact of market fluctuations, and achieve the effect of accumulating small amounts over time and enjoying compound interest.

This plan is particularly suitable for investors who make good use of the average cost method, busy working professionals, long-term investors, and small investors.

2. Spot balance automatic wealth management

Spot balance automatic wealth management is a convenient wealth management method. It can be started with one click to help investors easily invest in all currencies that support demand-based wealth management. Through this method, investors can achieve automatic compound investment of assets while enjoying flexible subscription and redemption.

3.2 Main types of risks for cryptocurrency wealth management products

Although cryptocurrency wealth management products bring potential high returns to investors, like any investment, they also have certain risks. Based on the characteristics of cryptocurrency, the associated risks may be higher. These risks mainly include the following aspects:

3.2.1 Market Risk

The cryptocurrency market is highly volatile. Price fluctuations can be very dramatic and are often due to various factors of uncertainty, including technological changes, policy or regulatory changes, and changes in market participant sentiment. For example, the release of new technology or policy that may be beneficial to a certain cryptocurrency could cause its price to rise. Conversely, unfavorable news or events could cause prices to fall. In some cases, these fluctuations can be very dramatic, with prices experiencing significant increases or decreases in the short term.

3.2.2 Liquidity Risk

Liquidity risk refers to the ability of investors to buy or sell assets quickly at a reasonable price when needed. For cryptocurrencies with low liquidity, if there are not enough buyers in the market, investors may need to sell their cryptocurrencies at a price below the market price, resulting in losses. Similarly, if there are not enough sellers in the market, investors may need to buy cryptocurrencies at a price higher than the market price. Additionally, cryptocurrencies with low liquidity may be more susceptible to price fluctuations caused by large transactions.

3.2.3 Technical Risk

The infrastructure of cryptocurrencies, including blockchain and smart contracts, relies on complex technology. This technology may have undiscovered vulnerabilities that can be exploited for attacks, resulting in loss of investor assets. Furthermore, due to the anonymity and irreversibility of cryptocurrencies, technical failures or operational errors can lead to investors being unable to recover their assets.

3.2.4 Regulatory Risk

The attitudes and policies of countries around the world towards cryptocurrencies vary. Some countries or regions may have a welcoming attitude towards cryptocurrencies and have policies that encourage their development. However, there are also countries or regions that may have cautious or even negative attitudes towards cryptocurrencies and have implemented strict regulatory policies. Changes in these policies can directly impact the value and availability of cryptocurrencies.

IV. Legal and Regulatory Environment of Cryptocurrency Wealth Management Products

4.1 An Overview of the Legal and Regulatory Environment of Cryptocurrency Wealth Management Products Worldwide

The legal and regulatory environment for cryptocurrency wealth management products is extremely diverse worldwide. For example, the U.S. Securities and Exchange Commission (SEC) has established regulations for cryptocurrencies, considering certain cryptocurrencies as securities, which means that related cryptocurrency wealth management products need to comply with securities regulations. In Europe, anti-money laundering (AML) and know-your-customer (KYC) regulations have been implemented for cryptocurrency exchanges. However, countries like China and India have adopted strict control policies on cryptocurrencies, including banning cryptocurrency trading and mining activities.

4.2 Impact of Regulatory Attitudes and Policies in Different Countries

The regulatory attitudes and policies of different countries have a significant impact on the market development of cryptocurrency financial products. For example, countries like Switzerland and Singapore, which have an open attitude towards cryptocurrencies, have a thriving cryptocurrency market and have attracted a large number of cryptocurrency companies and investors. On the contrary, countries like China and India, which have strict policies on cryptocurrencies, have limited development in their domestic cryptocurrency markets.

4.3 Impact of Regulatory Environment on Market Development

A clear and stable regulatory environment can help improve market transparency, protect investor interests, and attract more investment. However, excessive or unclear regulation may have a negative impact on the market. For example, in 2017, the Chinese government banned initial coin offerings (ICOs) of cryptocurrencies, which led to many cryptocurrency projects and investors leaving China. On the other hand, the regulatory actions by the U.S. SEC on cryptocurrencies, while putting pressure on certain cryptocurrency companies, also help maintain market order and protect investor interests.

5. Future Development and Strategic Recommendations for Cryptocurrency Financial Products

5.1 Development Potential and Challenges of Cryptocurrency Financial Products

5.1.1 Huge Future Development Potential for Cryptocurrency Financial Products

Cryptocurrency financial products have tremendous development potential in the future. With the advancement of technology, cryptocurrencies are gradually being accepted by the public and applied in various scenarios, including cross-border remittances, insurance, supply chain finance, etc. As a type of financial service, financial products contribute to the development of cryptocurrencies and meet users’ investment and financial management needs.

According to a report by Markets and Markets, the global crypto asset management market is expected to have a compound annual growth rate (CAGR) of 21.5% between 2021 and 2026. Research And Markets is even more optimistic, predicting a CAGR of 82.4% for the global blockchain market between 2021 and 2028, with the market size reaching $39.46 billion by 2028.

Increasing Demand for Cryptocurrency Financial Management in Family Offices

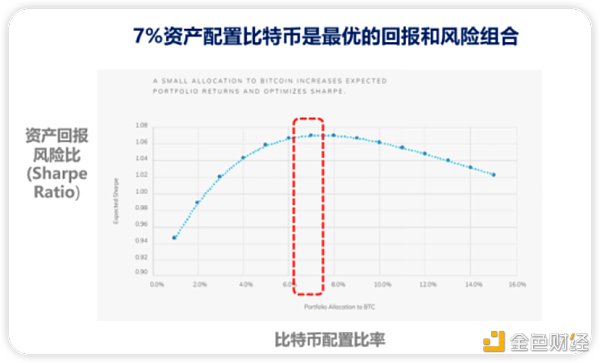

For long-term funds such as high net worth clients, family offices, and university endowments, proper allocation of cryptocurrency assets such as Bitcoin can effectively hedge against inflation, increase asset returns, and reduce overall asset volatility. A research report by Galaxy Digital in November 2020 shows that allocating 7% of total assets to Bitcoin maximizes asset returns and risk ratio, i.e., the Sharpe ratio. A research report by Coinshares in November 2021 points out that currently only about 1% of assets managed by institutions are allocated to cryptocurrencies. Considering the trillions of dollars in assets managed by institutions, increasing the allocation from the current 1% to 7% would bring a trillion-dollar market to the cryptocurrency asset management market.

However, after the sharp drop in Bitcoin in May, confidence in the future growth of cryptocurrency asset management has been shaken. The main reason for the bear market in cryptocurrency assets is the global economy and macro environment, with the direct trigger being the global decline in asset prices caused by the Fed’s interest rate hikes and balance sheet reduction. Since May and June 2022, with the death spiral of LUNA, the collapse of FTX, and other factors, the entire cryptocurrency market has entered a rapid decline, with a slight recovery around June 2023 (at the time of writing this article).

Although we are currently emerging from the bear market, the popularity of wealth management in the market has not yet reached its peak. However, in the long run, cryptocurrency assets represented by Bitcoin are still in a stage of rapid development.

5.1.2 Challenges of Cryptocurrency Wealth Management

1. Valuation Challenges and Volatility of Cryptocurrency Assets

Valuing cryptocurrency assets faces significant challenges, as there is no universally recognized valuation system, resulting in frequent market speculation and price volatility. This not only increases the difficulty for fund managers in investment decisions and risk control, but also leads to cautious attitudes from regulatory agencies and institutional investors towards cryptocurrency assets. These factors collectively hinder the long-term development of the cryptocurrency wealth management industry.

2. Fragmentation of Global Regulatory Frameworks

Although some countries have issued fund management licenses for cryptocurrency asset management or incorporated them into existing fund management systems, global regulation remains fragmented. This does not align with the cross-border flow and globalization characteristics of cryptocurrency assets. Cryptocurrency asset management companies face high compliance costs when dealing with the impacts from different countries, regulatory systems, and policies. Especially after the collapse of the Terra/UST stablecoin, regulatory agencies have increased their focus on stablecoins. Due to the lack of mature stablecoin regulatory systems globally, the cryptocurrency asset management industry faces significant risks arising from stablecoin regulatory uncertainties.

3. Imperfections in Cryptocurrency Asset Management Systems

Compared to traditional fund management systems, cryptocurrency asset management systems are still in a rapid development stage. Traditional system service providers have not yet extensively entered this field, and the unique nature of cryptocurrency assets makes the construction of asset management systems difficult and costly.

Some well-established cryptocurrency asset management companies, such as BBshares, Amber Group, or asset management companies under exchanges, have to invest significant resources to develop their own dedicated cryptocurrency asset management systems. These systems need to provide comprehensive services, including front-end trading, mid-end fund management and risk management, back-end reporting and reconciliation, API key cryptocurrency multi-signature management, etc. Independently developing and maintaining an entirely new cryptocurrency asset management system is a heavy burden for fund companies, hindering the industry’s rapid development towards greater specialization.

4. Safety and Network Attack Risks

The decentralized and online nature of cryptocurrencies makes them vulnerable to network attacks and security vulnerabilities. Hackers may use technical means to steal encrypted assets, causing significant losses to investors and management companies. Therefore, cryptocurrency financial companies need to invest a large amount of resources to ensure security protection, improve system security, and mitigate potential security risks.

5. Lack of Market Transparency

Compared to traditional financial markets, the cryptocurrency market has lower transparency. Exchanges and project parties may engage in insider trading, market manipulation, and other behaviors, which pose additional risks to cryptocurrency finance. In addition, the anonymity of cryptocurrencies may lead to some investors exploiting market loopholes for illegal activities, which has a negative impact on the entire industry.

6. Liquidity Issues between Fiat and Cryptocurrencies

Although the liquidity of the cryptocurrency market is gradually increasing, there are still difficulties in exchanging cryptocurrencies for fiat currencies in many cases. Exchanges and financial institutions may restrict exchange limits or charge high fees, which impose additional burdens and risks on cryptocurrency finance.

7. Education and Trust Issues for Retail Investors

Many retail investors lack understanding of cryptocurrencies and related financial products, which may lead to misunderstandings and panic about cryptocurrency finance. Therefore, cryptocurrency financial companies need to increase their efforts in education and promotion to help investors understand the risks and returns of cryptocurrencies and build trust.

In conclusion, the challenges faced by the cryptocurrency finance industry include valuation systems, regulatory systems, asset management systems, security, market transparency, technological development, liquidity issues, and education and trust issues for retail investors. To address these challenges, the industry needs to work together to promote the prosperous development of the cryptocurrency finance market.

5.2 Strategic Recommendations for Investors

For investors, the cryptocurrency market is a new type of market where risk management has not yet been established, the classification of financial products and regulations in various regions are also not yet perfect. It is recommended that investors pay attention to the following points:

1. Manage risks well: Due to the high volatility of cryptocurrencies, investors should clearly understand their risk tolerance and allocate investment funds accordingly.

2. Understand investment products: Investors should have a deep understanding of the products they invest in, including the operation mode and source of returns.

3. Pay attention to regulatory trends: Investors should closely monitor the regulatory trends of cryptocurrencies worldwide in order to adjust their investment strategies in a timely manner.

5.3 Recommendations for Policy Makers and Regulatory Agencies

Here are some recommendations for policy makers and regulatory agencies:

1. Establish clear regulatory policies: Policy makers and regulatory agencies should establish clear regulatory policies for cryptocurrency financial products to provide clear rules for the market.

2. Strengthen investor education: Policy makers and regulatory agencies should strengthen investor education on financial knowledge and risk awareness through various means.

3. Establish reasonable risk prevention and control mechanisms: Regulatory agencies should establish reasonable risk prevention and control mechanisms, such as formulating anti-money laundering and counter-terrorism financing rules, to enhance cryptocurrency transactions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- JPMorgan Chase and the Clash of Bitcoin Adaptability is the Core of Financial Evolution

- Data Consensus Rebuilding the Trust System and Returning Digital Oil to Individuals

- Interpreting the RWA track of on-chain real estate Can it revolutionize the traditional trading and leasing market?

- Interview with Uniswap Founder Handing Over Routing Issues to the Market through UniswapX

- Can blockchain revolutionize the traditional real estate transaction and leasing market?

- Tokyo vs Kyoto Japan’s Cryptocurrency Twin Cities

- Reading the Bitcoin ETF 5 futures ETFs with total assets of nearly $1.3 billion. How much does the news of the Bitcoin application affect?