Monthly Report | Cryptocurrency Financing in November: STO and IEO with stagnation of ICO

Text: Interchain Pulse · King Go

Source: Interchain Pulse

In November, the financing amount of IEO and STO was zero again. This is the fourth time that the STO's financing amount in the year is zero, and it is the second time that the IEO's financing amount is zero.

Interchain Pulse According to statistics from Coinschedule, the total amount of cryptocurrency financing in November was 46 million US dollars, a slight increase from the previous quarter and an increase of 7.2%. Among them, ICO still accounts for the entire proportion of the financing amount for the month.

- From technology open source to industry connection, Babbitt Academy and Weizhong Bank hold blockchain open course

- Coinbase Early Product Manager: Learn Crypto Corporate Governance from ZCash, Tezos, Melon

- Is Bitcoin still overvalued after the crash?

(Drawing: Interlink Pulse Academy)

STO and IEO on the verge of death

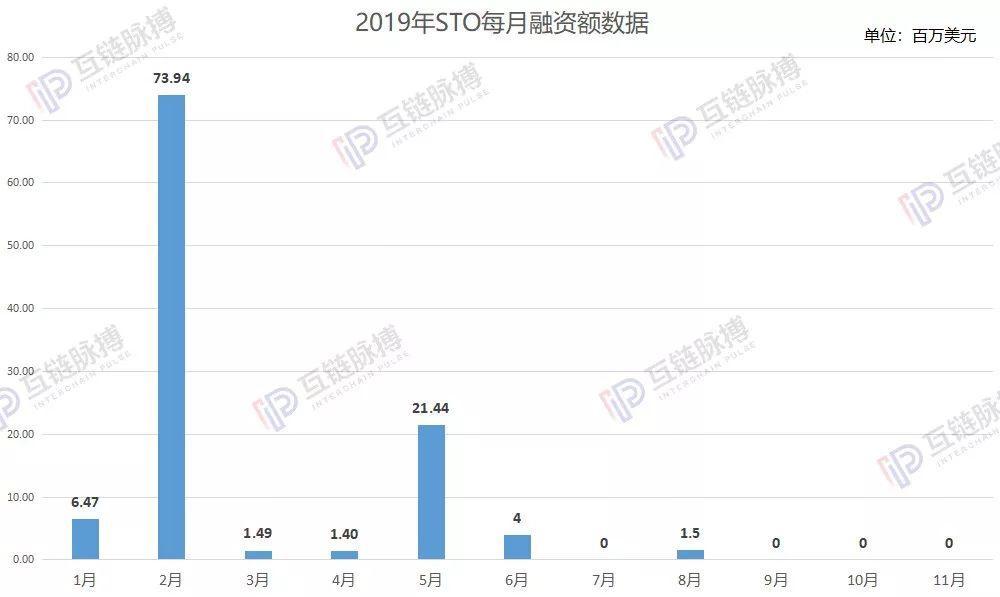

Observing the data this year, after July, September, and October, the amount of STO financing in November was zero for the fourth time in the year. And further combing STO's financing data this year, as of now, its annual total value is 110 million US dollars, and the monthly average value is 11 million US dollars.

This also means that from the second half of the year, STO financing has been completely lower than the average level, and continues to decline until there is no financing amount data for three consecutive months.

(Drawing: Interlink Pulse Academy)

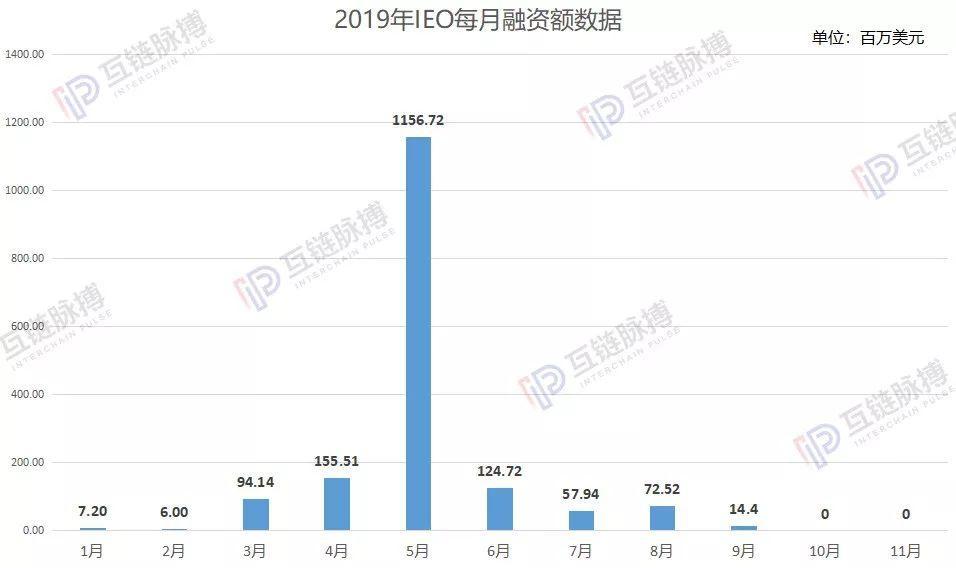

On the other side, the amount of IEO financing has also been zero for the second time this year. As of now, the total financing amount of IEO in 2019 has reached 1.689 billion US dollars, of which the Bitfinex exchange platform token LEO financing amount is 1 billion US dollars. Excluding LEO, IEO's average monthly funding is $ 62 million.

Among them, March to August basically remained at the average level, and began to fall sharply in September. The financing amount of IEO decreased by 80.14% from the previous month. In October, it was the first time that the data returned to 0, and November was flat.

(Drawing: Interlink Pulse Academy)

Interlink pulse analysis analyzes the reasons for the recent IEO data decline. On the one hand, it is its own chaos, which makes users enthusiastically retreat. In the early days, the IEO exploded under the auspices of large exchanges, and some third-rate exchanges abused the IEO model. Most projects opened high and low, skyrocketed, and even returned to zero.

In addition, the 31 districts also counted 51 IEO projects in four mainstream trading platforms, OKEx, Binance, Huobi, and Gate. The IEOs of the four major platforms have experienced soaring prices, and most IEO projects have difficulty maintaining the currency price. Those least popular IEO projects have already buckled down, and most have seen declines of up to 80% -90%.

For IEO, users are mostly speculative. When the attraction of the project weakens, the enthusiasm of the user will recede, and the market enthusiasm will naturally be unsustainable.

On the other hand, regulatory policies are also the key factors that lead to lower financing.

When counting cryptocurrency financing data for October, Interchain Pulse pointed out that US regulations have strengthened and the US Securities and Exchange Commission has stepped up the corresponding crackdown. In November, China further strengthened its supervision of ICOs and virtual currency exchanges. IEOs that issue projects for financing on exchanges are naturally more vulnerable.

Interchain Pulse had previously observed Inwara's 2019 half-year data. The largest number of blockchain financing projects was in the United States, accounting for 11.23%; meanwhile, the number of blockchain financing projects in China ranked fourth. Therefore, the crackdown of China and the United States will have a greater impact on the cryptocurrency financing market.

ICO is also showing signs of decline

In addition to paying attention to ICO data, as of now, its total financing amount has reached 1.52 billion US dollars, and the average monthly financing amount is 138 million US dollars. Although the amount of financing in November has picked up, compared with the average, the data in the past two months is still low.

(Drawing: Interlink Pulse Academy)

In addition, Interlink Pulse observed that only three projects were recorded on the Coinschedule platform this month, compared with nine, four, nine, and five projects included in the previous four months, and the number of ICO financing projects also decreased.

The three areas covered in November were shopping, medical and job search.

(Tabulation: Interlink Pulse Academy)

According to the online public information query, the SocialGood platform is the world's largest shopping network using blockchain. When shopping on partner sites such as Amazon and Apple, you can use SocialGood Tokens (SG) to get up to 20% free cash back.

The MEDK project is based on blockchain technology and plans to grow cannabis and extract vegetable oil for medical purposes. The blockchain can ensure the security and transparency of all processes in the production line; Life Task is a competency-driven job search platform that is based on the blockchain to ensure the privacy of data and the implementation of smart contracts.

This article is the original [Interlink Pulse], please indicate the source when reproduced!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Former US CFTC Chairman: Blockchain will completely change the market, Western countries also need to consider developing their own digital currencies

- Behind 378 pieces of business and industry change information: How does the blockchain company on the air outlet change?

- Analysis | The remainder is king: who can survive the spring?

- Global Blockchain Private Equity Financing Overwhelming Winter, November Dec. 66.4% MoM

- ECB executives: "We cannot sacrifice security" when talking about Libra

- Securities Daily: Digital assets will generate super enterprises

- Why do blockchain companies like to go to Hainan?