Articles about Search Results DeFi - Section 8

- You may be interested

- Born for blockchain games, ERC-1155 bec...

- The lightning network was bombarded, an...

- BTC block reward is about to be halved,...

- QKL123 blockchain list | The overall ma...

- ETH 2.0: A vision for the world's ...

- The most profitable cryptocurrency fiel...

- Analysis: What are the common character...

- MWC19 Notes: Back to 5G, telecom operat...

- Unveiling the Rise of Lido: How it Cons...

- Zhu Jiaming: Don't ignore the capi...

- Dialogue Vitalik: Most people are stuck...

- Beware of Yale and Harvard Endowment Fu...

- ChainLink, the oracle connecting the tw...

- Research: Bitcoin has added more than 1...

- Why aren’t people talking about b...

MKR Drives DeFi Recovery Are RWA and Endgame Sustainable Narratives?

Recently, RWA leaders and DeFi blue-chip project MakerDao have been quite popular. Mint Ventures researcher Alex Xu attempts to analyze the internal and external…

IOSG Ventures In-depth Exploration of New DeFi Unleashing the Potential of Data

DeFi, IOSG Ventures In-depth exploration of the potential of New DeFi to unleash data. LianGuai's thoughts on the future development of DeFi.

Injective, the pioneer of native order book chain, is a DeFi public chain based on COSMOS.

When it comes to DEX, most people immediately think of AMM, which is very useful and is the key original mechanism of DeFi. Although…

Ripple has not won, but it has definitely not lost the next step in the lawsuit

A federal district judge in the SEC vs Ripple lawsuit issued a partial summary judgment favorable to Ripple...

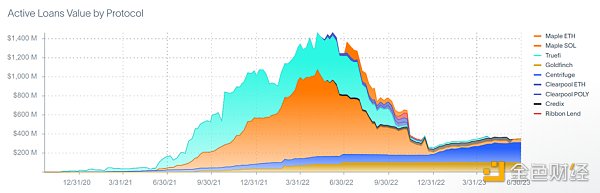

Is RWA the next growth engine for DeFi?

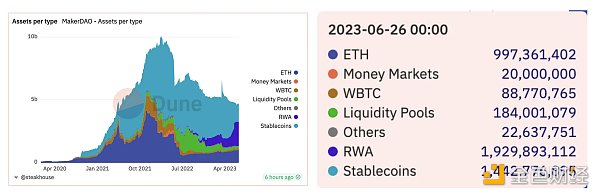

Among MakerDAO's assets, RWA has surpassed stablecoins to become the largest asset class.

In-depth analysis of MakerDAO’s RWA layout: How does the DeFi protocol integrate real-world assets?

MakerDAO is one of the largest DeFi projects in terms of volume and is currently the best example of combining Tradfi and DeFi.

In-depth analysis of MakerDAO RWA layout, how DeFi protocols integrate real world assets

Cryptocurrency researcher RyanCiz.eth explains the reasons why MakerDAO adopts real-world assets, and how DeFi protocols and DAOs use real-world assets to achieve stability, higher…

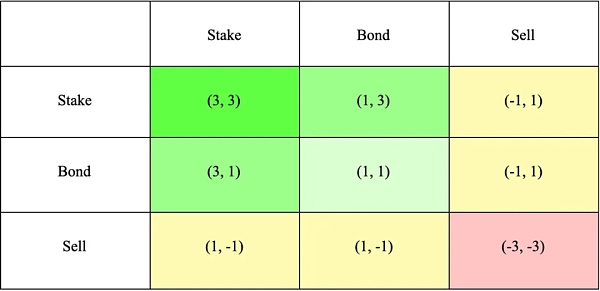

DeFi Economic Model Explained: Four Incentive Models from Value Flow Perspective

Designing a token economic model is essentially designing an "incentive-compatible" game mechanism.

Pendle v2 Overview: Driving Pendle to Become a Key Part of DeFi Infrastructure

Pendle facilitates a new yield exchange market by splitting the income asset (i.e. stETH) into principal tokens (PT) and yield tokens (YT). Ken Chia,…

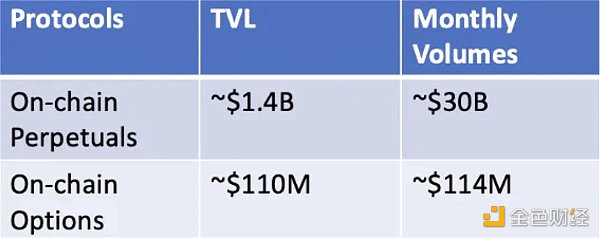

Comprehensive interpretation of DeFi options: market overview, product model and potential protocols

Higher capital efficiency translates into better futures pricing, lower slippage, and higher leverage opportunities, catering to the risk appetite of cryptocurrency traders.

Find the right Blockchain Investment for you

Web 3.0 is coming, whether buy Coins, NFTs or just Coding, everyone can participate.