How to prepare for a bear market in encryption? A summary of 20 “potential stocks” worth paying attention to.

Preparing for a bear market in cryptocurrency? Here are 20 stocks to watch.Author: slappjakke.eth, Crypto KOL

Compiled by: Felix, BlockingNews

The market is in a downturn, copy trading (CT) is no longer effective, and it’s time to start slowly accumulating high-quality projects. This article is a list of the top 20 projects worth watching, compiled by Crypto KOL slappjakke.eth.

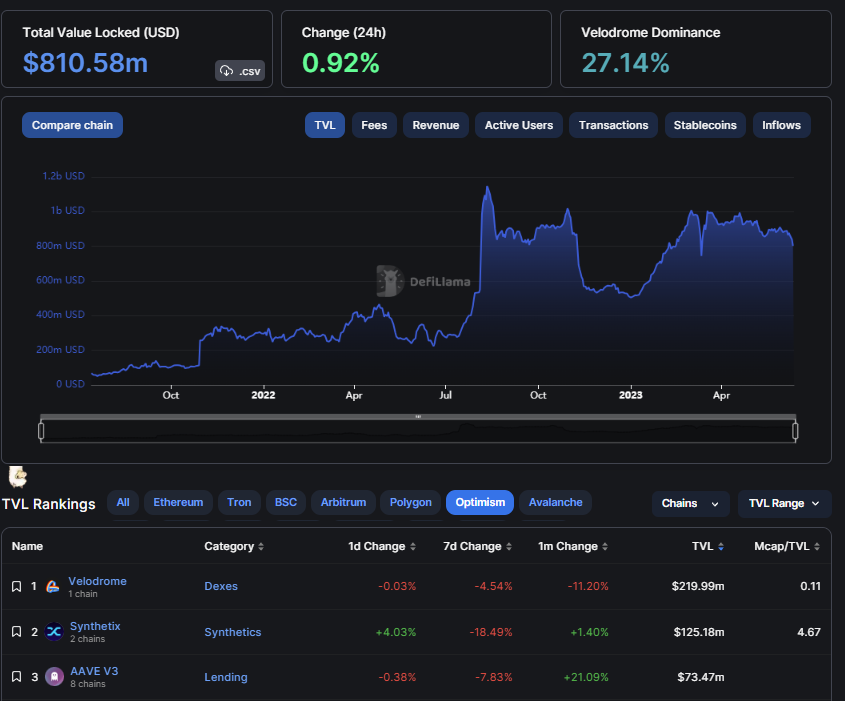

VELO

Velodrome is the first successful ve(3,3) DEX and the only one dominating TVL on a single chain. It is the primary liquidity center on Optimism. The fee switch to V2 is about to be activated, and centralized liquidity will be achieved. In the future, the token AERO will be airdropped to veVELO lockers on Base.

- Analysis of LSDfi Leader Lybra Finance: Project Characteristics and Potential Risks

- Analysis of Binance’s Launchpool Project Maverick: How does MAV AMM improve capital efficiency?

- Listing 7 zkSync ecosystem projects worth paying attention to: Sat.is, SyncSwap, Velocore…

Related reading: Velodrome: Building a Liquidity Flywheel on Optimism Using the ve(3,3) Mechanism

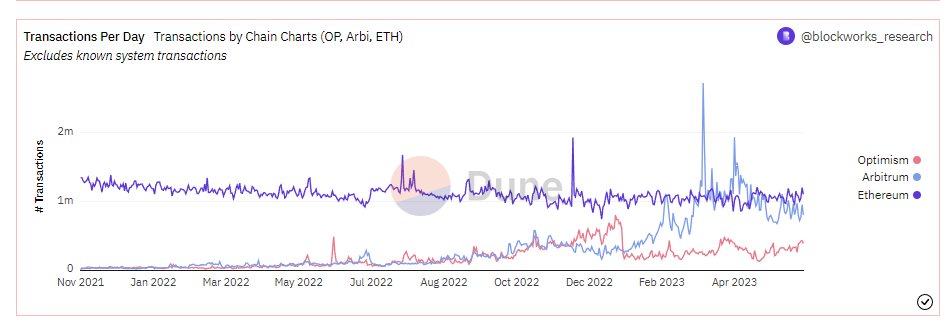

ARB

Arbitrum is a leader in Layer2 and has built an impressive ecosystem. Arbitrum has strong user stickiness, and innovative projects are more willing to launch on Arbitrum than Etherscan.

Related reading: In-depth analysis of Arbitrum: Ethereum’s backyard, a thriving ecosystem

STG

Stargate Finance, the flagship project based on LayerZero technology, is a cross-chain bridge and DEX that connects all chains. As more and more chains are adopted, Stargate will be in a leading position, and the narrative of the entire chain will become more and more grand.

Related reading: BlockingNews hands-on experience: What are the advantages of the cross-chain bridge Stargate based on LayerZero?

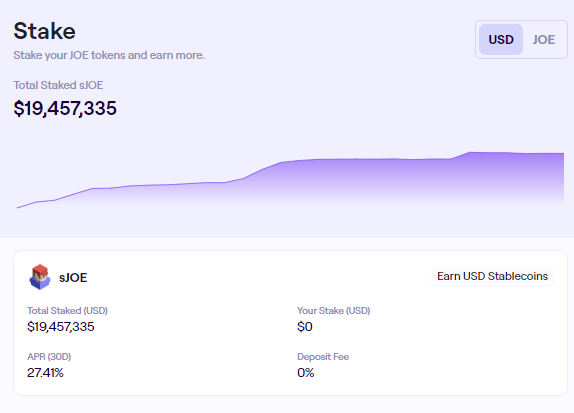

JOE

Trader Joe’s Liquidity Book is an innovative centralized liquidity DEX that recently released Auto Pools (automatic rebalancing and fee compounding). Joe has the advantages of high fees for LP, profit sharing for stakers (APR is 27%), low emissions, and more.

Related reading: Analysis of Trader Joe’s latecomer status: Besides switching to Arbitrum, what innovations does the protocol itself have?

FXS

Frax Finance has been continuously building and delivering during the bear market, quietly capturing a large share of the LSD market with its innovative frxETH product. Currently, its products include:

- frxETH (liquidity staking product)

- FraxFerry (cross-chain bridge)

- FraxLend (lending platform)

Upcoming:

- frxETH v2

- Frax v3

Related reading: From 0 to $1.3 Billion in 100 Days: Why Frax Finance’s “High-Interest Absorption” Model Works?

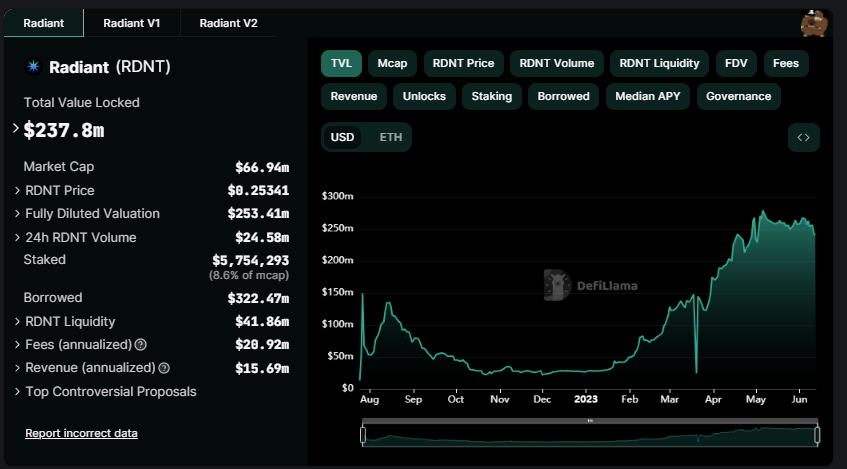

RDNT

RDNT Capital is a full-chain lending protocol based on LayerZero technology and has been deployed on Arbitrum and Binance Smart Chain, with more chains coming soon. With innovative token economics, RDNT achieved dynamic liquidity and TVL growth during the bear market.

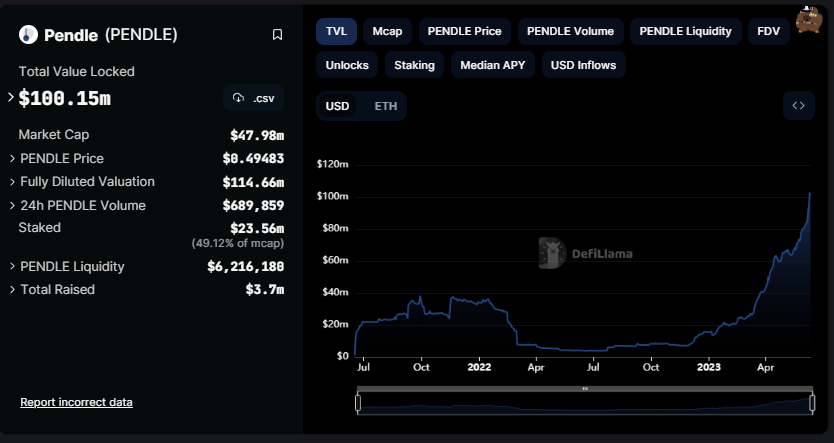

PENDLE

By splitting the principal token PT and the yield token YT, Pendle makes interest rate swaps more diverse, and this innovative protocol has swept LSD market share. Even during the bear market, Pendle’s TVL continued to rise, and it occupied a higher market share in competition with Equilibria.

Related reading: Is the Crypto Interest Rate Market Coming Back? In-depth Analysis of LSD Interest Rate Market Service Provider Pendle

GMX

GMX is a derivative DEX protocol, with trading volume and fee revenue constantly rising, and has started a true revenue narrative with their GLP token, featuring innovative and first-class token economics.

Although GMX’s fee revenue has recently declined and token prices have been impacted, its V2 version that supports synthetic assets is coming soon.

Related reading: Comparison between dYdX and GMX: Who Will Lead the Next Bull Market Derivatives DEX Narrative?

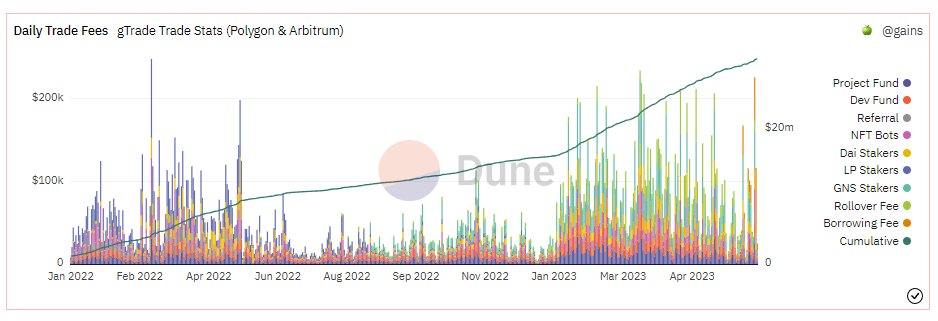

GNS

Gains Network is a decentralized derivatives trading platform that offers up to 100x leverage, forex, and other trades. After launching on Arbitrum, Gains Network’s fee revenue has increased significantly.

Related reading: A Comprehensive Guide to Gains Network: Entering the Dark Forest of Decentralized Leveraged Trading

LYRA

Lyra Finance is an on-chain options trading protocol based on AMM, where users can buy/sell call or put options for ETH, BTC, ARB, and OP. Hedging LP Vaults ensures safer LPs and lower tail risks.

After being deployed on Arbitrum, lyra Finance dominates on-chain options trading volume.

THE

Thena is the leader of ve(3,3) on BNBchain, with centralized liquidity implemented first, and perpetual trading with ALPHA will be implemented soon. All fees go to veTHE lockers.

Thena team delivers products quickly and has a dense roadmap with many upcoming products.

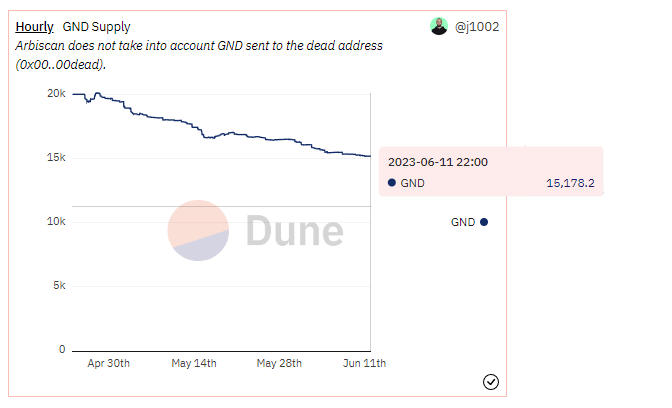

GND

GND Protocol is creating a revenue stablecoin gmUSD with high deflation and a uniswap v3 CL farm.

As a result of buybacks, OTC buybacks, and xGND lockups, GND supply is decreasing, dropping 25% in two months.

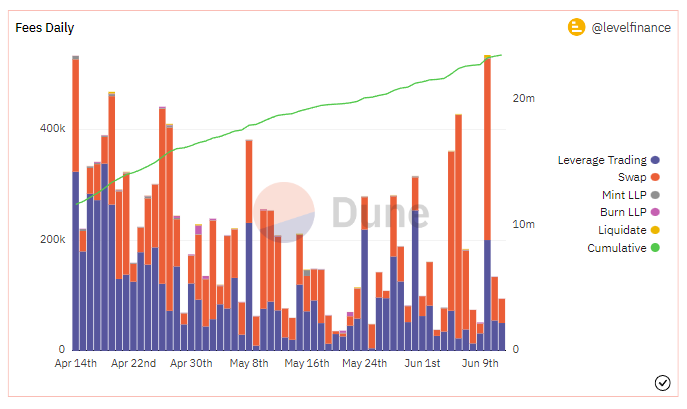

LVL

Level Finance is a perp dex that uses an innovative risk management system. It has recently been charging huge fees (note that some say all fees are for farming incentives), and this product is planned to be deployed on Arbitrum soon.

rDPX

dopex_io is a decentralized options protocol that includes two tokens $DPX and $rDPX.

rDPX V2 is currently under development, which will introduce the synthesis of hook assets $dpxETH by burning $rDPX (to create deflationary pressure). Dopex_io is a Gigabrain team (people who have a deep understanding of the cryptocurrency industry), has sufficient DAO funding, and possesses excellent Meme genes.

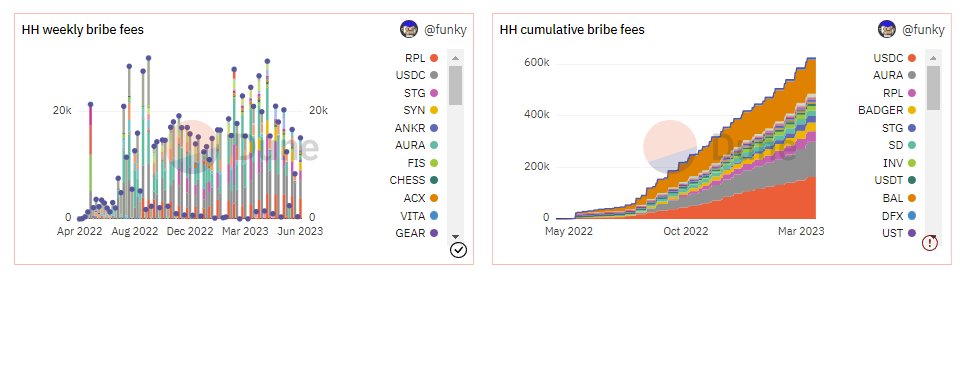

BTRFLY

RedactedCartel, a liquidity bribery market operator, is building products on the Curve, Convex, Frax, Balancer, and Aura ecosystems. It is a powerful builder with a large DAO funding pool and is building high-quality products.

Products include:

- Hidden Hand (Bribery Market)

- Pirex (Automatic Mixing)

Coming soon:

- Dinero (Stablecoin)

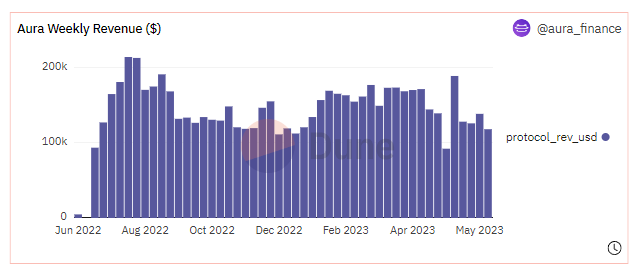

AURA

Aura Finance is a yield aggregator, meta-governance platform, and bribery market of the Balancer ecosystem, controlling 31% of veBAL and will be released on Arbitrum soon.

Related reading: Aura Finance: Balancer Ecosystem Yield Aggregator and Meta-Governance Platform

STX

Stacks is creating an L2 smart contract layer for Bitcoin. Stacks is to Bitcoin what Arbitrum and Optimism are to Ethereum.

Stacks has introduced a new consensus mechanism: Proof of Transfer (PoX) consensus mechanism. However, the confirmation time of the current version of Stacks is very slow, but the Nakamoto Release plan will fix this problem.

Related reading: How far can the top Layer2 Stacks of Bitcoin go? Analysis of Stacks technical features and ecology

BIT (MNT)

Mantle is launching modular Layer2 rollups on Ethereum, with support from a $3 billion Mantle DAO and a range of grants and incentives to attract builders and users.

Related reading: Mantle in detail: the largest decentralized DAO organization, the conversion and upgrade road of BitDAO

The last two projects carry high risks. Please be mindful of your own risk management.

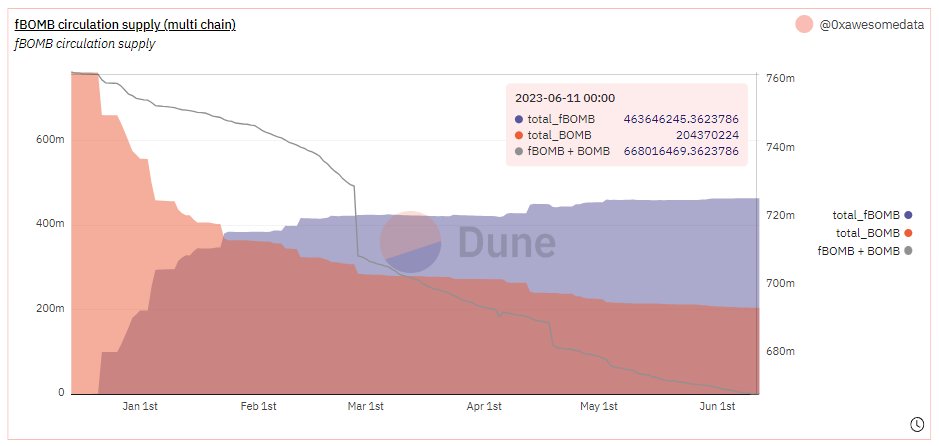

fBomb

fBomb Opera is a deflationary farm token with over 20 farms and flywheels on different ve(3,3)s, DAO bribes, and accumulation of veNFTs. fBomb Opera always maintains 100% APR and performs well in the market.

At the same time, fBomb Opera has a stable burn rate, burning over 10% of the supply in the past 6 months.

UNIBOT

Team Unibot has created a Telegram bot that allows users to paste contract addresses for trading in TG chats.

However, to ensure safety, please use a new wallet. So far, Team Unibot’s trading volume has exceeded $10 million.

- Sniper Bot

- Copying Whale Trades

In addition, Team Unibot’s migration and pledge, as well as fee sharing, will be launched soon.

Please note that although slappjakke.eth has made the above recommendations, some of these projects may not survive in a bear market. Especially now, as we are in a period of high investment risk and a bear market, prices may continue to fall. DYOR.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Will Recursive Markings Trigger the Next Wave of BTC Ecology?

- a16z will open an office in London and plans to launch a blockchain accelerator project.

- Preview of a New Project | Rodeo, a Leveraged DeFi Mining Project: Could it Become the Leveraged Center of the Arbitrum Ecosystem?

- Quick Look at Token Unlocking Status of Mainstream Projects in June

- Inventory of Catalysts Coming to the Cryptocurrency Industry: GMX V2, Camelot Upgrade, Lybra Finance V2…

- Introducing Ark: a privacy-focused alternative Bitcoin scaling solution

- a16z: A detailed explanation of the working principle of Cicada, a ZK-based on-chain voting project