Shenzhen Stock Exchange releases blockchain index, expanding capital entry

Source: Keith Communication

Summary

The Shenzhen Stock Exchange has launched the Blockchain 50 Index, and the focus of the capital market has continued to increase. The market will expect more new indexes and fund products to be launched, broadening the path for capital entry. On December 24, the official website of the Shenzhen Stock Exchange announced that it would release the Shenzhen Stock Exchange 50 Index on December 24, 2019. The announcement shows that the Shenzhen Stock Exchange 50 Index is based on companies listed in the Shenzhen Stock Exchange, whose business areas involve the upstream and downstream of the blockchain industry as a sample space. The 50 stocks constitute sample stocks. The index is weighted by free float market value, and the sample stocks are regularly adjusted on the next trading day of the second Friday in June and December each year. Ping An Bank, Midea Group, Suning Tesco, Annie Shares, SF Holdings, Sifang Jingchuang, BGI, etc. have all been selected as the 50 blockchain samples.

- Crypto psychological warfare: How does market sentiment influence Bitcoin?

- Number of exchange liquidity: the strength of the three major domestic exchanges close to Binance's abnormal trading volume

- Viewpoint: 2020 is the year of the blockchain transition. The prospects of supply chain finance and digital asset governance are promising.

With the successive launch of Bitcoin futures by the Chicago Board of Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) in December 2017, the capital market's focus on blockchain-related assets has continued to increase; on September 23 this year, intercontinental trading The Bakkt platform under the ICE launched the world's first Bitcoin futures settled in kind, followed by the US Securities and Exchange Commission's (SEC) 's increased attention to Bitcoin ETFs and Ethereum (ETH) futures, and the market has set considerable expectations. . This time the Shenzhen Stock Exchange released the Blockchain 50 Index, which provides a platform and tools for the capital market to participate in supporting the development of the blockchain industry. In order to help the development of the emerging technology industry, the Shenzhen Stock Exchange has released the Shenzhen Stock Information Technology Index (399620) and the Shenzhen Stock Telecom Index (399621). It can be expected that more blockchain-related sector index products and even ETFs are expected to accelerate their landing. Provide platforms and tools for capital entry.

Capital and supervision work together to help the development of the blockchain industry, and the application of the industry is expected to accelerate. This year, in addition to frequent regulatory actions and continuing to promote the healthy development of the blockchain industry, the capital market's support for blockchain has also continued to increase. At present, the channels and tools for capital investment to participate in the development of the blockchain industry are still very limited. It can be expected that with the release of more blockchain-related sector indexes and related ETF fund products, the blockchain industry will leverage the power of capital , Rapid development, and constantly promote the application landing. It is recommended to actively pay attention to the application of the three major scenarios of finance, people's livelihood and government affairs, as well as the application direction of the combination of blockchain and AIoT to solve the pain points of the scenario.

Blockchain has broad application space in the three major scenarios of finance, people's livelihood and government affairs. For example, in the financial scenario, it is difficult to solve the problems of SME loan financing, bank risk control, and department supervision. In the people's livelihood scenario, it provides smarter, more convenient, and better public services for the people. Level of precision; guarantee the orderly and efficient flow of production factors in the blockchain; in the government affairs scene, realize the common maintenance and use of government affairs data across departments and regions, and bring a better government service experience for the people. With the rapid popularization of the alliance chain, the blockchain will play an important role in three major scenarios, serving the real economy and promoting the progress of blockchain technology research and development.

Recommended mainline: For the subject, we continue to recommend the following three mainline blockchain service targets:

1. Financial services. (1) Supply chain finance: easy to see shares, Sifang Jingchuang, Hailian Jinhui; (2) financial security, blockchain asset hardware storage: Westone, Geer Software, Feitian integrity;

2. Livelihood services. (1) Electronic Invoice and Payment: Donggang Co., Ltd., Guangdian Express; (2) Electronic Authentication: Digital Authentication; (3) Copyright Service: Annie Shares.

3. Government affairs scene: High-light software, Huayu software.

Risk Warning : Uncertainty in regulatory policies, and the development of blockchain infrastructure is not up to expectations.

The Shenzhen Stock Exchange launched the Blockchain 50 Index, and the focus of the capital market has continued to increase. The market will look forward to more new indexes and fund products to broaden the path for capital entry. On December 24, the official website of the Shenzhen Stock Exchange announced that it would release the Shenzhen Stock Exchange 50 Index on December 24, 2019. The announcement shows that the Shenzhen Stock Exchange 50 Index is based on companies listed in the Shenzhen Stock Exchange, whose business areas involve the upstream and downstream of the blockchain industry as a sample space. The 50 stocks constitute sample stocks. The index is weighted by free float market value, and the sample stocks are regularly adjusted on the next trading day of the second Friday in June and December each year. Ping An Bank, Midea Group, Suning Tesco, Annie Shares, SF Holdings, Sifang Jingchuang, BGI, etc. have all been selected as the 50 blockchain samples.

With the successive launch of Bitcoin futures by the Chicago Board of Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) in December 2017, the capital market's focus on blockchain-related assets has continued to increase; on September 23 this year, intercontinental trading The Bakkt platform under the ICE launched the world's first Bitcoin futures settled in kind, followed by the US Securities and Exchange Commission's (SEC) 's increased attention to Bitcoin ETFs and Ethereum (ETH) futures, and the market has set considerable expectations. . This time the Shenzhen Stock Exchange released the Blockchain 50 Index, which provides a platform and tools for the capital market to participate in supporting the development of the blockchain industry. In order to help the development of the emerging technology industry, the Shenzhen Stock Exchange has released the Shenzhen Stock Information Technology Index (399620) and the Shenzhen Stock Telecom Index (399621). It can be expected that more blockchain-related sector index products and even ETFs are expected to accelerate their landing. Facilitate capital entry.

Capital helps the development of the blockchain industry, and the application of the industry is expected to accelerate. This year, in addition to frequent regulatory actions and continuing to promote the healthy development of the blockchain industry, the capital market's support for blockchain has also continued to increase. At present, the channels and tools for capital investment to participate in the development of the blockchain industry are still very limited. It can be expected that with the release of more blockchain-related sector indexes and related ETF fund products, the blockchain industry will leverage the power of capital , Rapid development, and constantly promote the application landing. It is recommended to actively pay attention to the application of the three major scenarios of finance, people's livelihood and government affairs, as well as the application direction of the combination of blockchain and AIoT to solve the pain points of the scenario.

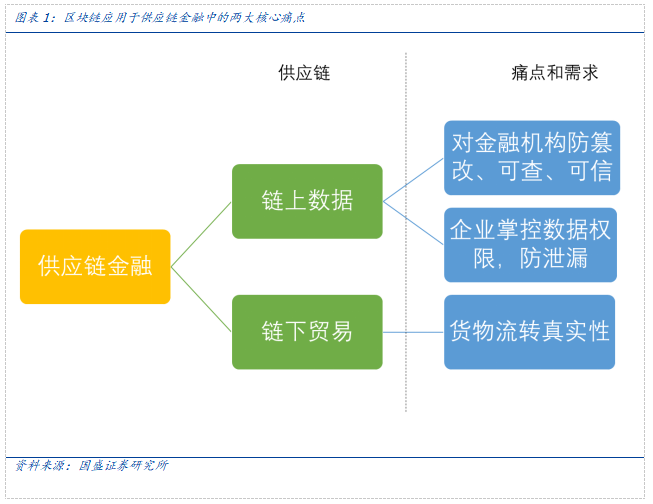

Blockchain has broad application space in the three major scenarios of finance, people's livelihood and government affairs. For example, in the financial scenario, it is difficult to solve the problems of SME loan financing, bank risk control, and department supervision. In the people's livelihood scenario, it provides people with smarter, more convenient and better public services; and it improves the intelligentization of city management. Level of precision; guarantee the orderly and efficient flow of production factors in the blockchain; in the government affairs scene, realize the common maintenance and use of government affairs data across departments and regions, and bring a better government service experience for the people. With the rapid popularization of the alliance chain, the blockchain will play an important role in three major scenarios, serving the real economy and promoting the progress of blockchain technology research and development. However, blockchain can't solve all the problems. It also needs to combine AIoT and other technologies to solve the pain points and landing problems in practical scenarios. For example, in the supply chain financial scenario, the blockchain is used as the foundation platform and the Internet of Things and AIoT technologies are used to solve the entire trade The credible process and the binding of online data and offline physical trade is the general direction of the industry's development. With the combination of blockchain and new technologies such as AIoT and 5G, more new business models and scenario applications will be spawned.

In terms of subject matter, we recommend the following three mainline blockchain service companies.

1. Financial services. (1) Supply chain finance: Easy to see, Hailian Jinhui; (2) Fintech: Quartet; (3) Financial security, Blockchain asset hardware storage: Guardian, Feitian.

2. Livelihood services . (1) Electronic Invoice and Payment: Donggang Co., Ltd., Guangdian Express; (2) Electronic Authentication: Digital Authentication; (3) Copyright Service: Annie Shares.

3. Government affairs scene: High-light software, Huayu software.

In addition, with regard to the regulatory requirements for the virtual asset trading platform released in Hong Kong, it is recommended to pay attention to the Hong Kong stock Huobi Technology Holdings (HK 1611).

The development of blockchain infrastructure failed to meet expectations. Blockchain is the core technology for solving supply chain finance and digital identity. At present, the blockchain infrastructure cannot support high-performance network deployment. The degree of decentralization and security will have a certain restriction on high performance. Risk of development not meeting expectations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum's implementation of the hard fork on January 1 will accelerate the block time, and ETH inflation may rise by more than 20%

- Long Baitao | Digital Asset Research Institute Digital Currency Weekly (2019/12/22)

- Shenzhen Stock Exchange official blockchain index released, six rules for stock selection, constituent stocks rose an average of over 50% during the year

- Without losing control and ownership, can you get rewards through data sharing in the blockchain?

- Multiple Youtube encrypted bloggers deleted a large number of videos without any notice

- Analysis: Why pay attention to the challenge of stable currency to sovereign currency?

- What kind of development will the crypto world usher in in 2020? Talk about three low-key product trends