Financing Weekly Report | 24 public financing events; Bitcoin financial services provider River completes $35 million Series B financing, led by Kingsway Capital.

Financing Weekly Report | 24 public financing events, including River, a Bitcoin financial services provider that raised $35 million in a Series B financing round led by Kingsway Capital.Highlights of this issue

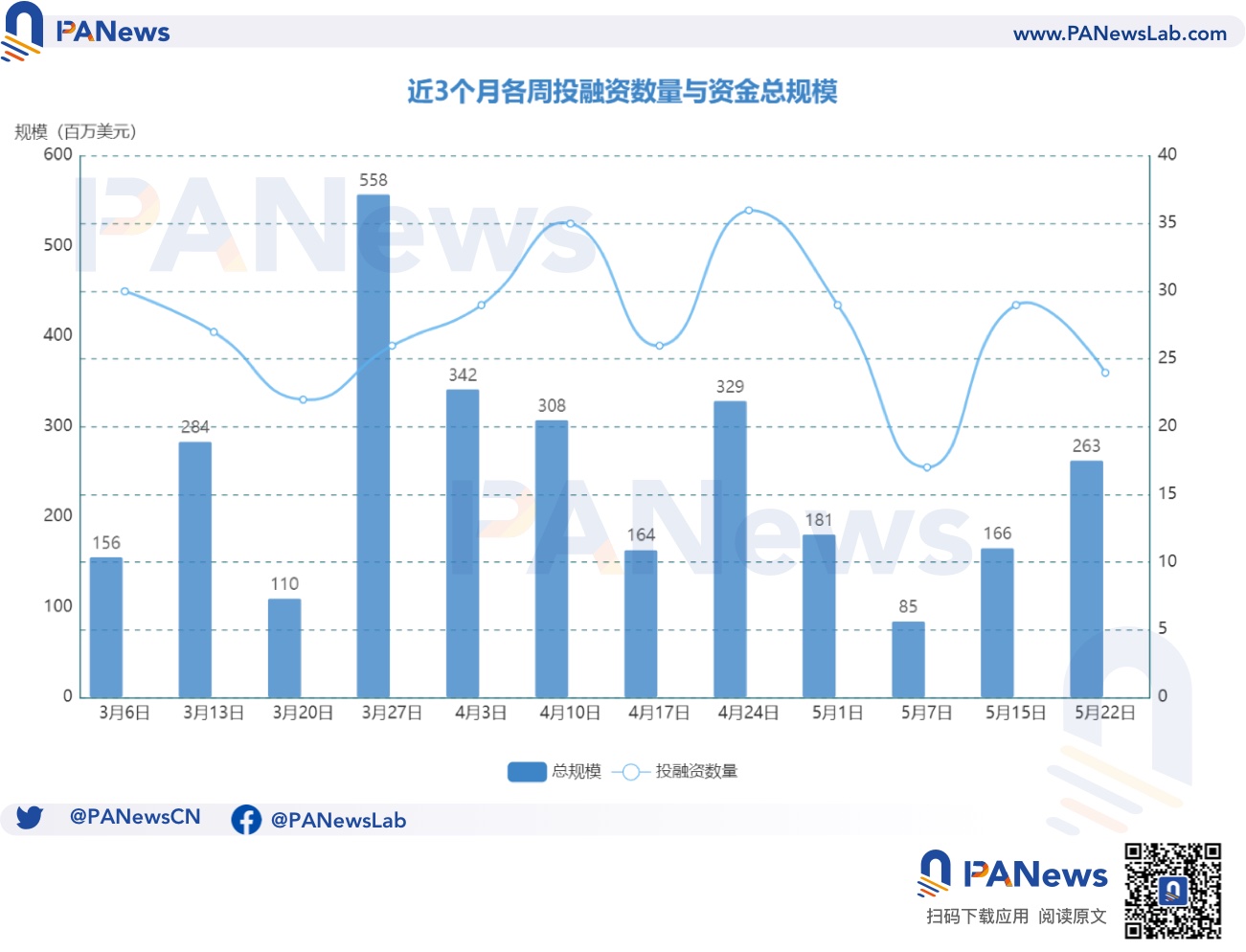

According to BlockingNews’ incomplete statistics, there were 24 blockchain investment and financing events worldwide last week (5.15-5.21), with a total fund size of approximately US$263 million. The overview is as follows:

- DeFi announced 4 investment and financing events, among which the liquidity collateralized derivative protocol Asymmetry Finance raised US$3 million from Ecco Capital, Republic Capital, GMJP, and Ankr;

- Chain Games announced 1 investment and financing event. Web3 game publishing platform World Play League (WPL) completed a pre-seed round of financing, with Genesis Vault Capital participating;

- NFT and Metaverse announced 3 financing events, among which the music NFT platform anotherblock completed a 4 million euro seed round of financing, led by Stride.VC;

- Infrastructure and Tools announced 8 financing events, among which the privacy-focused blockchain and artificial intelligence startup Auradine completed an A round of financing of US$81 million, led by Celesta Capital and Mayfield;

- Other Web3/crypto-related projects announced 6 financing events, among which bitcoin mining startup Cormint Data Systems completed an A round of financing of US$30 million;

- Centralized Finance announced 2 financing events, among which bitcoin voucher provider Azteco completed a 6 million US dollar seed round of financing, led by Jack Dorsey.

Let’s take a comprehensive look back at last week’s investment and financing events.

DeFi

Cryptocurrency startup Hourglass completes a US$4.2 million seed round of financing, led by Electric Capital

- Overview of BTC NFT Ecology: Development Status, Trading Market and Value Analysis

- One year after Terra’s Black Swan event: Market is on the mend, but still struggles to shake off the gloom

- Overview of DePIN Track: Is it Disruptive Innovation or a “Castle in the Air”?

Time-bound token (TBT) infrastructure company Hourglass completed a US$4.2 million seed round of financing, led by Electric Capital, with participation from Coinbase Ventures, Circle Ventures, and others. Hourglass aims to provide additional rewards to users who are willing to lock assets in smart contracts for a certain period of time. It released the first-ever market for time-bound tokens, which tokenize users’ collateral assets in decentralized finance (DeFi) protocols based on the locking time period.

Asymmetry Finance Completes $3 Million Financing for Liquidity Collateral Derivatives Agreement

Asymmetry Finance, a liquidity collateral derivatives agreement, has raised $3 million from Ecco Capital, Republic Capital, GMJP and Ankr. The project is led by co-founders Justin Garland and Hannah Hamilton. Asymmetry’s main product is safETH token, which represents a basket of liquidity collateral derivatives tokens, including Lido’s wstETH, Rocketpool’s rETH, Frax’s frxETH, Stakewise’s sETH2, and Ankr’s ankrETH.

Dolomite, an Arbitrum DeFi Protocol, Completes $2.5 Million Financing Led by NGC

Dolomite, an Arbitrum DeFi protocol, has announced the completion of a $2.5 million financing round, led by Draper Goren Holm (DGH) and NGC, with participation from Coinbase Ventures and others. Dolomite supports spot and margin trading, over-collateralized lending, and other features. Dolomite plans to integrate more assets to unlock more financial strategies and partnerships.

PoseiSwap Raises New Round of Financing with a Valuation of $25 Million, with Emurgo Ventures Participating

PoseiSwap, the first DEX on Nautilus Chain, has completed a new round of financing with a valuation of $25 million, with participation from Gate Labs, Emurgo Ventures, Republic, and Cipholio Ventures, among others, and the amount of financing has not been disclosed. Previously, PoseiSwap had raised $1.5 million in financing from Zebec Labs with a valuation of $10 million. PoseiSwap not only provides token trading, liquidity provision services, liquidity mining, and staking, but also supports related transaction services for NFT assets and has privacy compliance features.

Blockchain Gaming

World Play League Completes Pre-Seed Financing Round with Participation from Genesis Vault Capital

Web3 game publishing platform World Play League (WPL) has completed a pre-seed financing round with participation from Genesis Vault Capital, and the amount of financing has not been disclosed. WPL aims to create a community-owned Web3 game publishing platform that changes the way game players and game studios interact in the Web3 space, enhancing player engagement and ownership. It is currently in the exclusive alpha stage. WPL has also built an SDK to simplify the publishing process of Web3 games and accelerate player user acquisition.

NFTs & Metaverse

Metaverse Company Super League Raises $23.8 Million Through Convertible Preferred Stock Trading

Super League, a metaverse company, has completed a $23.8 million private placement of convertible preferred stock. SternAegis Ventures acted as the exclusive placement agent for the financing transaction, with participation from existing investors, new investors, and affiliates of the placement agent. Super League offers gaming and digital space experiences on metaverse platforms such as Roblox, Minecraft, and Fortnite, with innovative solutions that allow consumers to socialize, entertain, explore, collaborate, shop, learn, and create in the metaverse.

Music NFT platform anotherblock completes €4M seed round, led by Stride.VC

Stockholm-based music NFT platform anotherblock has completed a €4 million seed round, led by Stride.VC, with participation from Swedish film producer Axwell and Swedish house music mafia (Swedish House Mafia). The new funding will be used to further develop the company’s global presence. anotherblock aims to reshape the global music copyright market.

Italian art tech company Reasoned Art completes €1.4M seed round to launch Web3 digital art project Monuverse

Italian art tech startup Reasoned Art has completed a €1.4 million seed round, with investors including Korean investment fund Woori Technology Investment and LVenture Group. The funding will be used to focus on developing the Monuverse project, which aims to protect and enhance cultural heritage through the potential of digital art and Web3: 3D models of monuments reinterpreted by digital artists to create new works of art certified through NFTs.

Infrastructure & Tools

Auradine completes $81M Series A, led by Celesta Capital and Mayfield

Privacy-focused blockchain and AI startup Auradine has completed an $81 million Series A financing round, led by venture capital firms Celesta Capital and Mayfield. Other investors in the round include Cota Capital, DCVC, Stanford University, bitcoin mining company MARA, and others. Founded in 2022, Auradine is developing a wide range of hardware and software infrastructure, including energy-efficient silicon, zero-knowledge proofs (a blockchain-based privacy tool), and AI solutions for decentralized applications. Auradine is expected to launch its first product this summer and will focus on serving clients in industries such as finance and healthcare.

Bitcoin financial service provider River completes $35 million Series B funding, led by Kingsway Capital

Bitcoin technology and financial services company River raised $35 million in a Series B funding round led by investment firm Kingsway Capital, with participation from billionaire Peter Thiel. River raised $12 million in its previous Series A funding round in 2021. River provides a wide range of bitcoin-related services for individuals and businesses, including fee-free dollar-cost averaging, mining, brokerage with full-reserve custody, and wallet networks that support on-chain and Lightning Network transactions. In October of last year, the company launched River Lightning, an application programming interface (API) that makes it easier for companies to connect their applications to the Lightning Network.

Web3 developer platform Airstack raises over $7 million in funding led by Superscrypt

AI-supported Web3 developer platform Airstack has raised $7 million in funding, led by Superscrypt, with participation from Polygon, Hashed Emergent, NGC, and others. This is the latter half of the pre-seed funding round, with the first half completed in Q3 2023, with participation from Polygon and others. Airstack allows developers to access and utilize on-chain data with AI-supported natural language requests. Airstack has also announced an updated version of its Jam social application along with the funding announcement.

Israeli crypto startup CryptoHub raises $6 million in funding at a $30 million valuation, led by Tectona

Israeli crypto startup CryptoHub raised $6 million in funding at a $30 million valuation, with $3 million coming from lead investor Tectona. Founded in November 2021 by Eliran Ouzan and Shlomi Bazel, CryptoHub aims to be a provider of technology tools and solutions for the blockchain industry, and is set to launch its first project, “CoinScan,” a platform that displays real-time cryptocurrency transaction information and provides analysis and research resources.

Cloud cost optimization platform Antimetal raises $4.3 million in seed funding, led by Framework Ventures

Cloud cost optimization platform Antimetal has raised $4.3 million in seed funding, led by Framework Ventures, with participation from Chapter One, IDEO CoLab Ventures, Polygon Ventures, and others, as well as angel investors such as Louis Guthmann, ecosystem lead at Starkware, and Kelvin Fichter, software engineer at Optimism. Antimetal reportedly provides a solution that uses AI to automatically optimize costs, covering the entire process of infrastructure procurement, sales, and risk management. In private beta testing, the Antimetal platform helped more than 35 companies reduce cloud costs by up to 75%.

ZK startup Lagrange Labs completes $4m funding round led by 1kx

Zero-knowledge (ZK) startup Lagrange Labs has completed a $4m pre-seed funding round to develop its ZK system to enable secure interoperability across different blockchain networks. The funding was led by investment firm 1kx, with participation from Maven11, Lattice Fund, CMT Digital, and Daedalus Angels. Lagrange’s work can attract more users to DeFi by allowing developers to build dApps that can run across different blockchains while mitigating potential security threats.

Digital asset data provider PYOR completes $4m seed funding round

Digital asset data provider PYOR has announced the completion of a $4m seed funding round, led by Castle Island Ventures, with participation from Hash3, Antler, Future Perfect Venture, and Coinbase Ventures. PYOR, which was founded in August 2022, aims to provide key insights on digital assets through a tailored desktop analytics interface. The project is currently in beta, with its Terminal product, a plug-and-play data terminal enabling institutions to access basic blockchain data and write private query information through customised dashboards that suit their needs.

DID solution provider Lifeform completes IDG Capital-led $300m Series B funding round

Decentralised digital identity (DID) solution provider Lifeform has announced the completion of a $300m Series B funding round led by IDG Capital at a valuation of $3bn. So far, Lifeform has raised over $10m in seed, A, and B funding rounds.

Other

Bitcoin mining firm Cormint raises $30m in Series A funding round

Bitcoin mining startup Cormint Data Systems has completed a $30m Series A funding round to build a data centre at its Fort Stockton site in Texas with a computing power of 2.4 EH/s. The round was led by Cormint CEO Jamie McAvity and Nav Sooch, chairman of semiconductor firm Silicon Laboratories (SLAB). Former CTO of the chip company Alessandro Piovoccari also participated in the Series A funding round with existing investors. The new capital added 400 BTC ($10.8m), which was raised through promissory notes at the end of 2022.

Web3 startup Story Protocol completes $29.3m seed funding round led by A16z Crypto

Web3 startup Story Protocol has completed a $29.3 million seed round, led by a16z Crypto and featuring participation from Hashed, Samsung Next Fund, Two Small Ventures, DAO5, and others. According to filings with the Accounting and Corporate Regulatory Authority (ACRA), a16z invested $10 million in Story Protocol through its CNK seed fund. Story Protocol offers a way to create, manage, and license intellectual property on-chain, and has formed a remixable and composable story Lego ecosystem that empowers creators to produce stories with ownership and incentives.

Engage-to-Earn music platform Unitea raises $7 million in seed funding

Digital music platform Unitea has raised $7 million in seed funding, led by 1st Class Guernsey, Chaos Capital, TokenSociety, and Fuel Venture Capital. Unitea aims to incentivize fans to support their favorite artists through an Engage-to-Earn model, whereby fans can earn digital tokens called Karma by sharing music and creative content, which can be redeemed for exclusive rewards ranging from custom digital assets to concert tickets and meet-and-greets.

Decentralized AI integration platform AiONE raises $3 million in private funding

Decentralized AI integration platform AiONE has announced $3 million in private funding, with investors unnamed. AiONE helps businesses and projects integrate AI design into various development processes and is currently live on the Binance Smart Chain. AiONE previously raised $1 million in seed funding in April of this year.

Web3 entertainment company AnotherBall raises $2.2 million in angel funding

Web3 entertainment company AnotherBall has raised $2.2 million in angel funding, with participation from Polygon founder Jaynti Kanani, Sony Group CTO Hiroaki Kitano, Twitch co-founder Kevin Lin, and others. AnotherBall is building a new Web3 virtual influencer project called IZUMO, which aims to create a place for anime, manga, and gaming culture-loving streamers, illustrators, music and video producers to continuously create revenue according to their interests.

Decentralized education platform Founderz raises €1 million in funding, led by Oryon Universal and Sevenzonic

Decentralized education platform Founderz raised €1 million in funding, led by Oryon Universal and Sevenzonic. Founderz aims to provide manpower value to businesses focused on digital and innovative projects using decentralized educational methods and training topics. The company will add blockchain and Web3 online master’s courses. In addition, its partnership with Microsoft to create AI and innovation online master’s courses was made available to users in May.

Centralized Finance

Bitcoin voucher provider Azteco completes $6 million seed round, led by Jack Dorsey

Bitcoin voucher provider Azteco has completed a $6 million seed round, led by Jack Dorsey, with participation from Lightning Ventures, Hivemind Ventures, Ride Wave Ventures, Aleka Capital, Visary Capital, Gaingels, and others. Through Azteco, people can easily save, spend, and send small amounts of Bitcoin.

Fintech firm Jia raises $4.3 million in seed funding, led by TCG Crypto

Blockchain-based emerging market small business lending agency Jia has raised $4.3 million in seed funding led by early supporter TCG Crypto, as well as an additional $1 million in on-chain liquidity commitments, with participation from BlockTower, Hashed Emergent, Saison Capital, and Global Coin Research. Angel investors including Blockingcky McCormick also participated in the round. Jia was founded last year by several former Tala executives, Zach Marks, Cheng Cheng, Ivan Orone, and Yuting Wang.

Institutional Funds

Web3 venture capital firm Red Beard Ventures raises $25 million in funding, with participation from Animoca Brands and SuperRare

Web3 venture capital firm Red Beard Ventures has completed a $25 million funding round with investors including a16z’s Marc Andreessen and Chris Dixon, Web3 gaming giant Animoca Brands, and NFT platform SuperRare. The new round of funding aims to accelerate the adoption of Web3 technology and support the launch of a token economics accelerator project called Denarii Labs, which is a joint initiative with Horizen Labs Ventures. The program will focus on providing consulting services, weekly educational courses, mentoring, launch support, and more for those launching token projects. The accelerator is currently accepting its first batch of applications and is scheduled to begin in Q3 of this year, with each company receiving $100,000 to build its brand.

BTCEX launches $20 million Web3 Innovation Fund

Cryptocurrency exchange BTCEX has announced the launch of a $20 million startup fund for Web3 innovation. In addition to supporting the MOVE ecosystem project, the fund will also invest in other potential Web3 projects that can solve real-world problems (such as projects under the Aptos and Sui ecosystems). The BTCEX Innovation Fund will also provide key service support for collaborative projects, including listing, liquidity, LaunchBlockingd, and pledging.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin’s new generation of multi-signature scheme MuSig2: providing better security, efficiency, and privacy features

- Litecoin’s LTC20 protocol: the next speculative market with hundredfold or thousandfold growth?

- Blocking Daily Report | Bitcoin Mining Difficulty Increased by 3.22% to 49.55T; LayerZero Launches Bug Bounty Program of up to $15 Million

- DeFi on Bitcoin: Is BTCFi a breakthrough or a bubble?

- From the perspective of “de-dollarization” in Web3, speculate on the ultimate form of currency in the future

- Layout for many years but little known? Exploring the full picture and opportunities of the Japanese Web3 encryption market

- PA Daily | Tether will allocate 15% of its net profits to purchase Bitcoin; Ripple acquires crypto custody company Metaco for $250 million