One year after Terra’s Black Swan event: Market is on the mend, but still struggles to shake off the gloom

One year after Terra's Black Swan event, the market is recovering but still faces challenges in dispelling the gloom.Author: ChainCatcher

On March 23, Do Kwon was arrested in Montenegro. Last May, Do Kwon was accused of attempting to flee South Korea before the Luna crash, but he denied it. He continued to deny it until the moment he was arrested in Montenegro with an Interpol red notice. He traveled all the way from Singapore to Serbia while still denying that he was “evading”.

Source: Associated Press

When Do Kwon was arrested, he appeared somewhat confused with his slightly plump face. During the investigation, he was accused of forging a passport and even rumors of “swallowing a hardware wallet”. The “suspect” in front of us and the young man who lacked awe and was extremely confident a year ago were completely different.

- Overview of DePIN Track: Is it Disruptive Innovation or a “Castle in the Air”?

- Bitcoin’s new generation of multi-signature scheme MuSig2: providing better security, efficiency, and privacy features

- Litecoin’s LTC20 protocol: the next speculative market with hundredfold or thousandfold growth?

At the end of 2021 and the beginning of 2022, Do Kwon expressed hope for the new year on social media. He wrote: “Web3 is the key to the encryption industry in 2022” “May the moon shine brighter this coming year”.

He and the fanatical Lunatics could not have imagined that this round of “new moon” would only shine for a little over a quarter before it began to dim. In a market where emotions are high, people tend to treat confident and ambitious young people differently, including SBF at that time. Bloomberg once described Do Kwon as establishing a “confident, aggressive and occasionally childish” image on social media.

In March 2022, Terra and UST algorithmic stablecoin were frequently questioned by the outside world. Subsequently, Do Kwon chose a very radical way to respond to the doubts-a bet with the encryption KOL Sensei Algod about whether the price of LUNA after a year can exceed the current price of 88 US dollars. The bet amount was one million U.S. dollars, and one day later, Do Kwon added the bet amount to ten million U.S. dollars. The bet between the two was supervised by the encryption KOL Cobie.

However, the lively bet seemed to have never happened. Cobie, the supervisor, remained silent on the matter that day, and the crypto podcast Uponly, which he hosted, also stopped after the sponsor FTX went bust, and thereafter rarely mentioned the connection with FTX.

Sensei Algod, who proposed the bet, quoted a tweet from a year ago, writing: “Although looking back, we could easily judge that Luna would collapse, looking at the comments under the tweet a year ago, you know how I was ridiculed at the time. It is a good lesson to be aware that the masses often make mistakes.” After all, people will eventually realize the “waxing and waning of the moon” after suffering losses.

In fact, there is no shortage of whistleblowers in the Terra thunderstorm and UST crash events. When Terra first appeared, analysts noticed the risk of this protocol triggering a “death spiral,” and with the Anchor protocol launching a 20% APY UST deposit plan, more people began to predict Terra’s collapse, and even someone warned that “Terra will destroy the entire crypto world”.

But few could resist the temptation of such high returns, and everyone smelled the danger of Ponzi schemes. But people subconsciously believed that they were the ones who could get out of Terra before it collapsed. After all, even professionals and authoritative veterans like Jump Crypto, Hashed, and Delphi didn’t escape this disaster.

As Algod mentioned earlier, it is easy to reflect afterwards. Those who lacked experience and had no stop-loss strategy probably went through the heavy blow a year ago in shock and numbness.

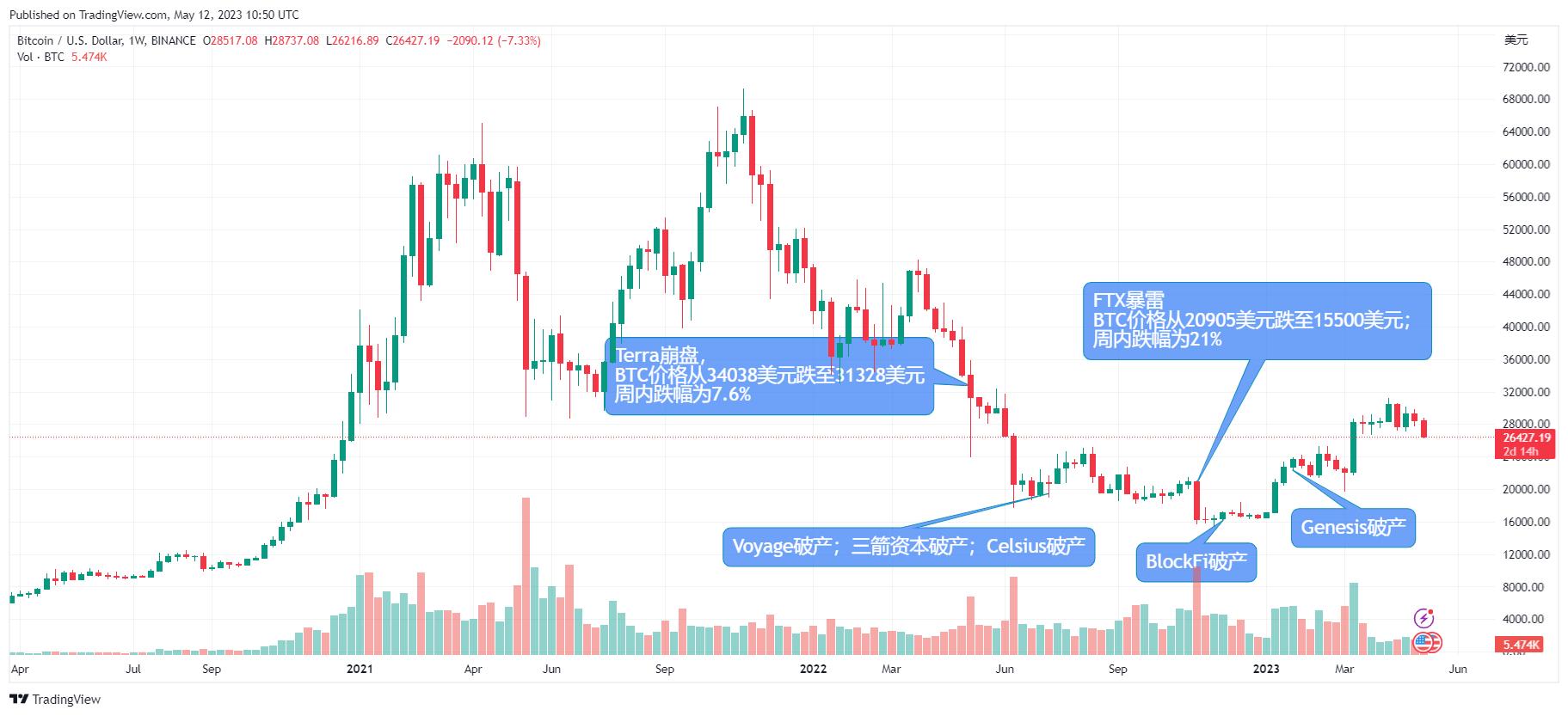

The Terra incident became the worst start of 2022, and then the fire ignited one heavyweight project after another along a seemingly pre-buried fuse. The price of Bitcoin fell from $34,038 all the way, and a year later it has not recovered. Although the market is steadily recovering, the price of Bitcoin also reached its highest point of $31,043 in early this year. But it is undeniable that the market is still shrouded in last year’s series of thunderstorms, and the risk of thunderstorms cannot be ruled out.

Do Kwon being arrested and the subsequent lengthy trial and sanctions did not put an end to the entire incident. But in this year, after the Terra incident, what did we lose and gain?

Apart from top crypto companies such as Three Arrows Capital, Voyage, Celsius, and FTX going bankrupt, hundreds of projects have also announced their deaths or disappeared in the rapidly cooling market; investors have begun to re-examine the evaluation criteria for crypto projects, and hot money from the traditional finance industry is also scarce in flowing towards crypto and Web3; under the multiple pressures of increasingly stringent regulatory policies led by the United States, banks severing crypto-related businesses, and market makers choosing to exit, crypto companies such as Coinbase, Kraken, and Tether have begun to seek global markets, and crypto companies and Web3 entrepreneurs are like migratory birds, constantly searching for the “crypto paradise” with the most suitable climate from the United States to Singapore, Dubai, and then to Hong Kong…

This article will make a quick review and (incomplete) sorting of the important events and effects after one year of the Terra incident.

I. Review of the series of events

1. Terra’s collapse

On May 8, 2022, Terra withdrew $150 million in UST liquidity from the existing UST-3Crv (UST/USDC/USDT/DAI) liquidity pool because it wanted to set up a new 4Crv Pool (UST/FRAX/USDC/USDT) on Curve. The UST price began to slip slightly out of anchor.

To hedge against risks, some institutions and users began to sell UST on a large scale. On the same day, 2 billion UST flowed out of the Anchor lending platform, increasing the pressure on UST price anchoring. Due to the sudden appearance of a large amount of UST on the market, the further decline of UST price was aggravated, and many people exchanged their UST for its underlying asset, LUNA, which also led to an increase in the supply of LUNA and a sharp drop in its price. The prices of LUNA and UST entered a death spiral, and their prices almost hit zero.

On May 11, Do Kwon announced that he could not save the market.

On May 13, many exchanges delisted Luna and suspended trading, and the Terra public chain stopped operating.

In less than a week, the Terra ecosystem with a market value of over $40 billion collapsed. The Luna/UST incident affected many crypto institutions and projects. The price of BTC fell from $34,038 to $31,328, a weekly decrease of 7.6%.

2. Three Arrows Capital Announces Bankruptcy

One of Terra’s largest investors, Three Arrows Capital, publicly announced that it was affected by the LUNA/UST crash and is deeply mired in a liquidity crisis due to the Terra collapse.

During the LUNA/UST crash, Three Arrows Capital invested another $200 million. According to clearing company Teneo, the risk exposure brought by the LUNA/UST crash to Three Arrows Capital is about $600 million.

In addition to direct financial losses, as the LUNA/UST crash affected the sentiment of the cryptocurrency market, the price of BTC also fell from $30,000 to $20,000, resulting in a large-scale credit contraction in the cryptocurrency market.

Three Arrows Capital happened to use a lot of leveraged funds, but because many of its assets (such as $1 billion worth of GBTC) lack liquidity and cannot be sold, it cannot add margin, leading to a crazy shrinkage of Three Arrows Capital’s assets. At the same time, it is unable to repay the funds borrowed from the lenders and is being demanded for compensation by the creditors.

3. Voyager Bankruptcy

The Three Arrows Capital explosion has triggered a chain reaction of more loan platforms going bankrupt. The loans that Three Arrows Capital has not yet repaid involve about $666 million (including 15,250 BTC, $350 million worth of USDC stablecoins, etc.).

On July 6, 2022, the cryptocurrency lending platform Voyager announced that it had applied for bankruptcy protection and suspended trading, deposits, withdrawals, and other services.

On July 11, 2023, Three Arrows Capital applied for bankruptcy protection to the New York court. According to Teneo’s clearing report, Three Arrows Capital owes about $3.5 billion to 27 cryptocurrency companies. These creditors have filed lawsuits against Three Arrows Capital.

The largest creditor is the cryptocurrency lending platform Genesis, a subsidiary of Digital Currency Group (DCG), which provided Three Arrows Capital with a loan of $2.3 billion. Part of this debt is borne by its parent company DCG, because Three Arrows Capital holds $1 billion worth of GBTC trust issued by DCG. Therefore, Genesis ultimately claimed $1.2 billion from Three Arrows Capital.

Secondly, the cryptocurrency lending platform BlockFi stated that Three Arrows Capital is one of its largest borrowers, and the collapse of the company resulted in a loss of about $80 million for the company.

4. Celsius Bankruptcy

On July 13, 2022, Celsius, a cryptocurrency lending platform for institutions, announced that it had filed for bankruptcy, owing a $75 million USDC loan to Three Arrows Capital.

In addition to the impact of Three Arrows Capital, Celsius was also affected by the collapse of LUNA/UST, as it was the largest holder of stETH (an Ethereum staking certificate on Lido), which was affected by the UST unpegging market sentiment, causing stETH to be unanchored from the price of ETH. As the value of stETH fell and liquidity problems on the platform intensified, users of the platform were severely squeezed and forced to sell stETH at a low price to meet the demand for asset redemptions. The platform ultimately declared bankruptcy due to severe insolvency.

5. FTX Bankruptcy

On November 11, 2022, more than 100 entities, including the cryptocurrency trading platform FTX and its affiliates, filed for bankruptcy protection in the United States.

The origin of FTX’s bankruptcy was a document disclosed by CoinDesk. On November 2, 2022, CoinDesk disclosed that Alameda Research may currently be insolvent.

On November 6, 2022, Zhao Changpeng publicly expressed concerns about FTX’s ability to pay, and Binance decided to liquidate all remaining FTT on its books. This triggered a wave of withdrawals by users of FTX and Alameda, with billions of dollars in assets flowing out of wallets associated with FTX and Alameda.

On the evening of November 8th, FTX suspended user withdrawals. FTX’s funding gap was as high as $8 billion.

On November 11, the cryptocurrency trading platform FTX filed for bankruptcy protection.

With the public release of FTX’s bankruptcy filing, it became apparent that FTX and Alameda had long been in crisis. Data shows that as early as May, Alameda had liquidity problems due to the collapse of Terra and the bankruptcy of Three Arrows Capital. At that time, in order to rescue Alameda from the Voyager and Three Arrows Capital bankruptcy storms, FTX allegedly used FTT tokens as collateral to lend to Alameda. This also became the biggest fuse for FTX’s subsequent liquidity shortage.

The BTC price fell from $20,905 to $15,500, a 21% decline for the week.

6. BlockFi Bankruptcy

On November 28, 2022, cryptocurrency loan provider BlockFi announced that it had applied to the court for bankruptcy protection.

In court documents, it stated that its creditors owed between $1 billion and $10 billion, with over 100,000 creditors. FTX ranks second with $275 million in debt.

7. Genesis Bankruptcy

On January 20, the cryptocurrency lending platform Genesis filed for bankruptcy protection.

After FTX went bust, Genesis’ derivative business had $175 million stuck in FTX. Prior to this, due to the collapse of Three Arrows Capital, Genesis suffered losses of up to $2.36 billion. The company stopped withdrawals and new loan disbursements from its loan subsidiary on November 16. The Bitcoin price remained around $21,000.

II. Chain Reaction: The Decline of Algorithmic Stablecoins and the Exploration of Stablecoin Regulation

After Terra and algorithmic stablecoin UST went bust, not only did it cause a series of related project crashes, but it also directly led to market attention to stablecoins.

First, after the collapse of Terra, people tried to protect their rights through legal channels, but found that they could not find corresponding regulatory laws. It was not until April 19, 2023 that the US House Financial Services Committee issued a 73-page “Stablecoin Bill Discussion Draft,” which explicitly mentioned the disposal methods for algorithmic stablecoins: they cannot guarantee a one-to-one asset reserve, nor can they hold stablecoins directly or indirectly linked to the US dollar, and must be banned.

Although this draft does not represent the final bill, stablecoins have already attracted high regulatory attention. Compared with discussions such as “whether cryptocurrencies are securities,” the regulatory demand for stablecoins is more urgent.

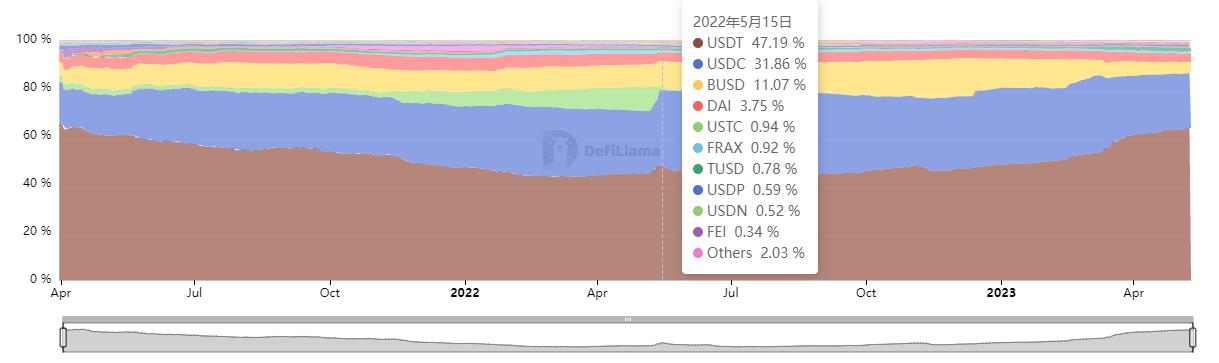

Second, algorithmic stablecoins quickly declined after the Terra incident. According to Defillma’s data, from May 8 to 15, 2022, USDC and USDT’s market share increased by about 3%, and the market share of algorithmic stablecoins was eroded.

USDN is an algorithmic stablecoin launched by the WAVES protocol, which uses a similar pegging mechanism to UST/LUNA. USDN almost began to break away from the anchor at the same time as UST. In early 2023, USDN will transition from a stablecoin to Waves ecosystem index tokens, no longer anchored 1:1 to the US dollar, basically giving up the algorithmic stablecoin race.

USN, launched by Near Protocol, began using USDT to mint USN after UST’s collapse. However, due to double-minting, there was a “US $40 million collateral gap,” and the project ultimately failed.

In addition, decentralized stablecoin projects were also affected. DAI, launched by the MakerDAO protocol, fell from over 8 billion to $4.8 billion in market value and has yet to recover; in February 2023, Frax announced a target collateral ratio (CR) of 100%, removing algorithmic support and turning FRAX into a fully collateralized stablecoin.

Although this year, some DeFi giants began developing stablecoin businesses, such as the CRV-issued over-collateralized stablecoin crvUSD and Aave’s upcoming over-collateralized stablecoin GHO. These stablecoins differ significantly from UST and use more conservative mechanisms.

3. Causes behind the Chain of Bankruptcies

1. Overly Centralized Ecosystems

Using Terra as an example, a 20% APY helped Terra quickly absorb tens of billions of dollars in market value and grow rapidly in the short term. Algorithmic stablecoin systems appear to be flexible but are incredibly fragile. Most importantly, the Terra ecosystem is too centralized and singular. According to April 2022 data, Terra has locked in over $30 billion in assets, with Anchor accounting for 51.15% or more than $15 billion. The Terra ecosystem essentially lacks DeFi protocols that can truly absorb UST, ensuring that a significant decline in UST’s application demand in Anchor will inevitably lead to a comprehensive collapse of UST and LUNA.

In addition, FTX’s collapse was due to the error of putting too many eggs in one basket, with most of FTX’s assets directly related to FTT.

2. Excessive Leverage

Unlimited nesting and excessive leverage were the direct causes of Three Arrows Capital’s bankruptcy: Three Arrows invested in a derivative with anchored value through leverage and pledged the derivative to obtain highly liquid collateral, which was then sold for arbitrage. However, when the derivative was untethered from its underlying asset, its price and liquidity plummeted, and Three Arrows was unable to sell the derivative in a timely manner to cope with the creditors’ run, ultimately resulting in bankruptcy.

Excessive leverage and leverage ratios have always been one of the biggest systemic risks in the cryptocurrency market. Although the interlocking pattern can generate positive feedback for the cryptocurrency industry in a stable market, it also leads to a snowball effect in a declining market.

3. Lack of Regulation and Lack of Transparency in CeFi

Since the birth of the cryptocurrency industry, it has lived under the shadow of unclear regulations. The cryptocurrency industry lacks effective supervision of institutional behavior. CeFi projects such as Three Arrows and FTX have over-centralized and unsupervised power, leading to the disorderly expansion of capital. Although exchanges such as Binance have disclosed reserves after a series of explosions, there is still a lack of endorsement and supervision from authoritative third-party institutions, and the commitment to a lack of punishment mechanism is not highly credible. The industry still needs to explore better on-chain custody methods and audit mechanisms.

4. The Cryptocurrency Industry’s “God-Making Movement” Is Still Going Strong

The reason why Do Kwon, Suzhu, SBF, and their projects can rise rapidly in a short period of time is due to collusion between the mass market, media, and capital.

5. Human Nature Remains the Same

Finally, there is an old saying that speculation is as ancient as mountains, and there is nothing new on Wall Street. Speculators use greed to build tall buildings, while short sellers use panic to make huge profits. History repeats itself not because of inherent social laws, but because of eternal human nature.

IV. Seriously Examine the “Elephant in the Room”

Coins have two sides. Although a series of explosion events such as Terra and FTX have dealt a heavy blow to the industry, they have also severely punctured the huge bubble created in the previous bull market, and the industry has begun to re-examine the “elephant in the room.” The industry’s value standards, security mechanisms, and supervision are all moving towards a new level.

In terms of industry value standards, the so-called “top” is demystified. Terra, FTX and others are all cryptocurrency giants with a market value of tens of billions of dollars, and they are backed by top investment institutions such as Temasek, Sequoia Capital, and Grayscale. But a collapse can also happen in an instant. This has made the industry realize that being big and not falling is not a law, and authority will also lose credibility. When hot money enters but the pace of value creation cannot keep up, the biggest landmine is often buried.

After the explosion events, the valuations or prices of most first- and second-tier projects gradually returned to a more healthy direction. Investment institutions such as Temasek have also started to review, research, and improve their investment processes. Some cryptocurrency users may no longer be easily deceived by financing backgrounds and dream-making stories.

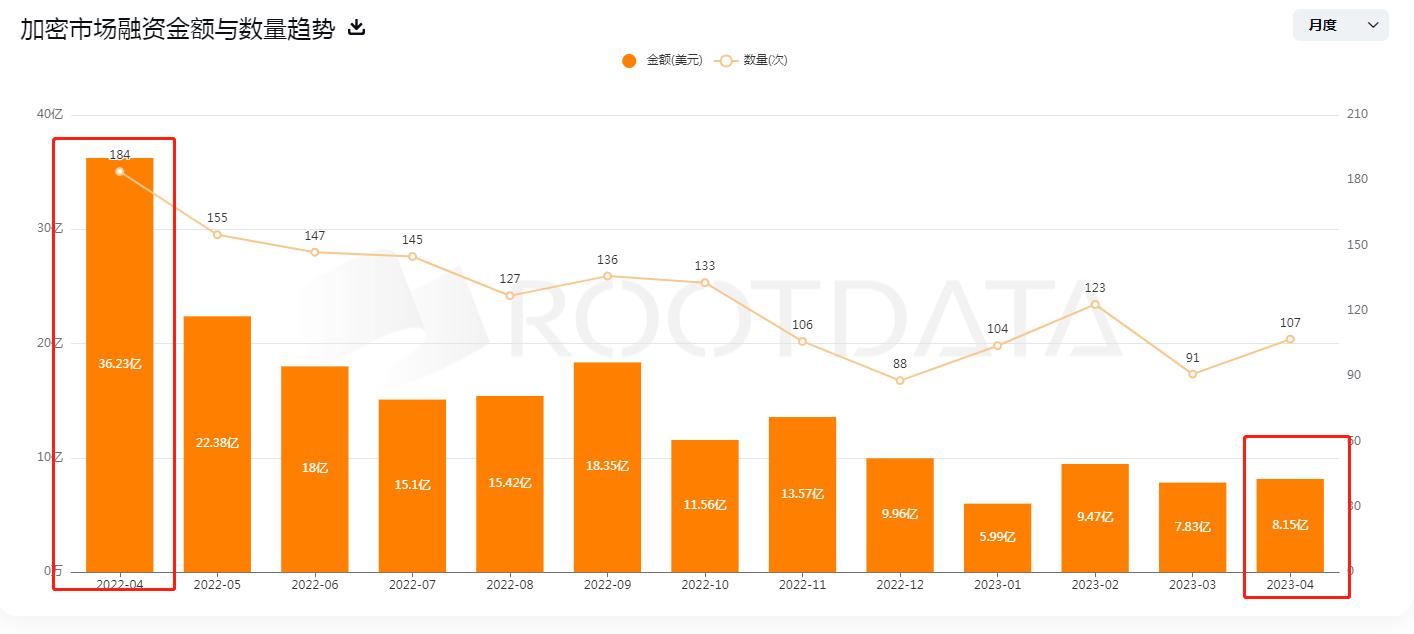

According to RootData, funding in the cryptocurrency field totaled $814 million in April 2023, down 77.6% from about $3.623 billion in April 2022. In addition, the number of funding deals fell from 186 to 106, a year-on-year decline of about 43.1%.

Meanwhile, transparency in the crypto industry is increasing. Following the FTX incident, top centralized exchanges such as Binance, Kraken, OKX, and Huobi have all disclosed their reserve proof and accepted industry supervision. Although they currently lack the endorsement of authoritative third-party audit organizations. After the FTX collapse, enterprises and individuals are investing more in financial management and

After FTX collapsed at the end of last year, the US SEC has strengthened its regulatory attitude towards the cryptocurrency industry and begun to scrutinize and prosecute some cryptocurrency projects that may be involved in securities law violations, including cryptocurrency giants such as Binance, Coinbase, and Kraken. Currently, due to the continuous pressure on the cryptocurrency industry by US authorities, some projects have chosen to “escape” from the US and expand their global business. Well-known cryptocurrency market makers such as Jane Street and Jump Trading also plan to withdraw from their cryptocurrency trading businesses in the US. Although the regulation of the cryptocurrency industry in the US is relatively strict, it is not completely exclusive and recognizes the innovative potential and social value of the cryptocurrency industry.

The South Korean authorities have launched an emergency investigation into the Terra case and the project’s founder, Do Kwon, and related persons who may have violated fraud, money laundering, or tax evasion laws. The South Korean Financial Services Commission (FSC) has also announced plans to strengthen its supervision of cryptocurrency exchanges and platforms, requiring them to register with the government and comply with anti-money laundering and consumer protection regulations. Even though the government is still dealing with the aftermath of “Terra,” South Korea is not as aggressive as the US government. Recently, the South Korean government has drafted some regulations, and the South Korean central bank also plans to introduce separate regulations for stablecoins to keep the cryptocurrency industry developing in South Korea.

As the regulatory development in various countries and regions is unbalanced, new regional trends in cryptocurrency innovation have emerged, and some views summarize this trend as “rising in the east and falling in the west.” Cryptocurrency companies and Web3 entrepreneurs are like migratory birds, constantly looking for the “cryptocurrency sanctuary” with the most suitable climate, from the United States to Singapore, Dubai, and Hong Kong.

The Singaporean government, with the slogan of “encouraging innovative development,” opened its arms to Web3 first. Singapore is one of the main centers of cryptocurrency innovation in Asia, with many cryptocurrency projects and companies, including Terraform Labs, and has issued multiple payment institution licenses. Singapore already has a comprehensive cryptocurrency regulatory framework called the Payment Services Act (PSA), which requires cryptocurrency service providers to obtain licenses and comply with anti-money laundering and anti-terrorist financing rules, and the government has also adopted a relatively friendly and flexible regulatory approach. A series of measures once again revitalized the Web3 industry in Singapore. Various Web3 conferences held in Singapore in the second half of 2022 successfully aroused the passion of Chinese Web3 entrepreneurs and further pushed “Eastern Web3 Power” and Chinese projects into the global cryptocurrency market.

As a leading international financial center, Hong Kong is following in the footsteps of Singapore but is striving to become the global center for Web3. In December of last year, Southern Eastern Asset Management launched the first virtual asset ETFs in Asia, including Bitcoin ETFs and Ethereum ETFs. Although many cryptocurrency projects gathered in Hong Kong in April this year, the requirements of the Hong Kong government for the cryptocurrency industry are actually stricter. The regulatory framework proposed by the Hong Kong Monetary Authority (HKMA) requires all institutions that provide cryptocurrency asset trading platform services to apply for a license and comply with regulations such as anti-money laundering and anti-terrorist financing. In addition, only professional investors who meet certain conditions can trade through these platforms, and retail investors are excluded. The HKMA said that this is to protect the interests of investors, prevent financial stability risks, and maintain Hong Kong’s reputation as an international financial center. Prior to this, the President of the Hong Kong Monetary Authority, Eddie Yue, stated that virtual assets will be developed in a sustainable manner and that there will be no “soft hand” in digital asset regulation. Overall, Hong Kong supports and accepts the development of the cryptocurrency industry in the Hong Kong region with a more cautious attitude.

In Dubai, the government still maintains a relatively open and supportive stance towards cryptocurrency innovation after the Terra incident. Several initiatives have been launched to promote the development of blockchain and crypto in the field, such as the Dubai Blockchain Strategy, the Dubai Future Foundation, and the Dubai International Financial Center (DIFC). Dubai also provides flexible regulatory frameworks for cryptocurrency companies, allowing them to operate under a sandbox system or obtain licenses from DIFC or Abu Dhabi Global Markets (ADGM). Currently, due to the subsequent collapse of FTX, Dubai is re-examining the risks of the cryptocurrency industry, while the Dubai Virtual Assets Regulatory Authority (VARA) has strengthened its review of projects applying for cryptocurrency licenses.

Other countries are also continuing to pay attention to the Terra incident and its impact on cryptocurrency regulation. For example, Japan has strengthened its supervision and management of cryptocurrency exchanges and platforms, requiring them to report suspicious transactions and strengthen network security measures. India has proposed a bill to ban all private cryptocurrencies (except those issued by the central bank). Recently, the EU passed a comprehensive cryptocurrency regulation called the “Markets in Crypto-Assets” (MiCA), which aims to make rules more consistent among member states and ensure consumer protection and financial stability.

In summary, the Terra event highlights the necessity for more effective and coordinated regulation of crypto assets, particularly algorithmic stablecoins, which poses significant challenges to consumer protection and financial stability. Different countries have different approaches and priorities in cryptocurrency regulation, and global dialogue and cooperation among regulatory agencies, policymakers, industry participants, and civil society are crucial to promoting innovation and trust in the crypto space.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blocking Daily Report | Bitcoin Mining Difficulty Increased by 3.22% to 49.55T; LayerZero Launches Bug Bounty Program of up to $15 Million

- DeFi on Bitcoin: Is BTCFi a breakthrough or a bubble?

- From the perspective of “de-dollarization” in Web3, speculate on the ultimate form of currency in the future

- Layout for many years but little known? Exploring the full picture and opportunities of the Japanese Web3 encryption market

- PA Daily | Tether will allocate 15% of its net profits to purchase Bitcoin; Ripple acquires crypto custody company Metaco for $250 million

- Jump Trading’s Crypto Waterloo: Forced to Exit US Crypto Trading Market, Facing Terra Class Action Lawsuit

- With a massive user base in the world of cryptocurrency, could MetaMask become the Google of Web3?