LianGuai Observation | L2 Networks Go Live in Large Numbers, Ethereum’s Scaling Battle Begins in the Second Half of the Year

L2 Networks Go Live, Ethereum's Scaling Battle Begins in H2Author: LianGuai, Climber

The call for a bull market in cryptocurrency is growing, with Optimism and Arbitrum dominating the top 6 positions in the public chain TVL rankings and attracting significant investment. Ethereum’s Cancun upgrade is poised for launch in the second half of 2023. For other L2 networks, time and opportunities are running out.

Recently, several prominent L2 networks have announced the deployment of their mainnets. As of July, the mainnets that have been launched include Starknet v0.12.0, Linea launched by Consensys, Base launched by Coinbase, and Mantle Network. Scroll and Shibarium, launched by Shiba Inu, are scheduled to go live in August or later.

In just two weeks, such news has been frequent, indicating that the previously tested L2 networks are unable to resist the temptation and are eager to start their land-grabbing mode. With the narrative of the Cancun upgrade and the halving of BTC, the second half of the year is a good time for capital and project parties to venture into the cryptocurrency market, even if it is not calm and stable.

- Opepen Threadition has been online for 2 days and has received over 37,000 mintings. Why is Jack Butcher always able to create phenomenal NFTs?

- How to track smart money in cryptocurrencies? The first step to tracking crypto trends

- Injective, the pioneer of native order book chain, is a DeFi public chain based on COSMOS.

This article will attempt to analyze the underlying reasons, data comparisons, and potential explosive possibilities of the four highly anticipated L2 networks that have recently launched their mainnets.

Launch Process and Content

Starknet v0.12

Starknet is a general-purpose Zk Rollups L2 network built using the STARK proof system, with the Cairo programming language used for its infrastructure and contract development. It has been live on the mainnet since November 29, 2021.

On July 5th of this year, Starknet launched Starknet alpha v0.12 on the Goerli testnet, and six days later, the community approved the proposal to launch this version on the mainnet with a support rate of 97.91%.

On July 12th, Starknet v0.12.0 was officially deployed on the mainnet. This version focuses on improving network throughput to enhance scalability and transaction latency. The v0.12.0 version brings significant improvements to the sequencer, including sequencer performance, cancellation of the Pending status, and block hash system calls.

Specifically, the new version uses Rust blockifier and LambdaClass’s Cairo VM to speed up the transaction processing time of the sequencer and supports Cairo compiler v2.0.0. It changes the PENDING status to ACCEPTED_ON_L2 (once a transaction is in this state, it means it will be included in a block) and adds experimental system calls.

Linea

Linea is a zkRollup supported by Consensys zkEVM. It has performed well in the testnet phase, with over 5.5 million unique wallets submitting over 46 million transactions, making it one of the largest and fastest-growing projects on Goerli.

On the same day as Starknet v0.12, Linea launched on the Ethereum mainnet, with external access to be available during the Paris EthCC conference. Linea uses Ethereum as its native currency and rewards participants who took part in the Voyage event, with each user eligible to mint a commemorative “Contribution Proof” NFT based on their ranking.

For the Linea mainnet alpha launch, this version provides faster throughput and reduces transaction fees by 15 times compared to Ethereum Layer 1 (L1). In addition, this version also supports deeper integration with MetaMask, which plans to offer its popular Bridge, Swap, and Buy features to Linea users in the Portfolio.

Base

Base is an L2 network created by the cryptocurrency giant Coinbase, with a market value of $20 billion. It mainly utilizes the OP Stack technology to develop Optimistic Rollup on the Ethereum network.

On July 13th, the Base mainnet went live, but at this stage, it is only open to developers. Developers are allowed to deploy applications on Base, and some tools for developers have also been launched on its mainnet. The network node providers mainly include Blockdaemon, QuickNode, Blast, Safe Wallet, blockchain explorers Etherscan and Blockscout, as well as data indexers The Graph and Covalent.

Prior to this, Base officially announced the completion of internal and external audits. Of the five mainnet launch standards previously listed, four have been completed, with only the stability of the verification test network remaining.

To highlight the security of the Base network, its official statement pointed out that the protocol security team, in collaboration with OP Labs, spent more than 6 months enhancing the security of Base and Optimism. This includes auditing all Optimism pre-deployments and contracts on L1 and L2 to identify vulnerabilities and risks in the technology stack, as well as using fuzz testing methods for key components such as L2 bridges and sequencers.

In addition, Base also stated that it hired more than 100 security researchers through the Code4rena public smart contract audit competition to find and report any bugs in OP Stack, but no major vulnerabilities were found.

Scroll

Scroll is an EVM-compatible zkRollup designed for use on the Ethereum network. It is currently undergoing further testing and optimization on the Goerli testnet and has not yet gone live on the Ethereum mainnet. However, there have been reports in June and July that Scroll is expected to go live around August.

As a project in the ZK family of L2 solutions, Scroll has raised a total of $80 million with a valuation of $1.8 billion, and was once considered to be the biggest dark horse in the ZK family.

In late February of this year, Scroll launched an Alpha testnet open to all users and stated that it would improve the performance of zkEVM in the coming months.

In May, Scroll co-founder Ye Zhang stated that Scroll would launch its mainnet as soon as possible. The team has sent relevant materials to auditing companies, and the next step will be to implement decentralized verifiers and ultimately design a decentralized sequencer. The Scroll testnet has over 4 million unique wallet addresses participating daily, processing over 500,000 transactions, and over 100 projects have submitted information to the official team.

On July 12th, researcher pseudo, who focuses on Scroll, posted an article stating, “Scroll is about to launch its mainnet. Everything should be ready to use. You just need to change your RPC.” This shows that Scroll does not want to remain silent in the face of signals from other competitors about going live on the mainnet.

At the same time, to better prepare for the mainnet launch, on July 14th, Scroll announced the launch of the “Contribute to Scroll” program, encouraging open collaboration and allowing anyone to contribute to Scroll in newly introduced open-source repositories.

Data Achievements and Performance

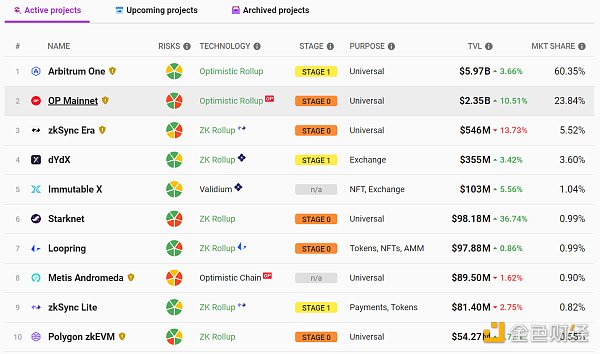

As a result of the effect of major celebrities’ L2 mainnet launches, according to L2BEAT data, Ethereum’s L2 network TVL has returned to over $10 billion for the first time in nearly 3 months and has been maintaining this level.

Among the top ten market share rankings, Optimism and Arbitrum in the Op Rollups category account for 84.19% of the market share, while Zk Rollups are relatively insignificant in comparison.

Among the top ten market share rankings, Optimism and Arbitrum in the Op Rollups category account for 84.19% of the market share, while Zk Rollups are relatively insignificant in comparison.

Currently, Starknet has a TVL of $101 million, accounting for less than 1% of the market share, ranking 6th. StarkWare previously revealed that after the launch of Starknet v0.12.0 mainnet, the network’s performance remained at a level of 37 TPS, with a peak TPS close to 100.

According to Crunchbase data, StarkNet has raised a total of $282.5 million in seven rounds of financing. However, it is unclear whether the additional $9.5 million from Alameda Research, which went bankrupt in November 2022, has been received. In addition, in October last year, 105 ecological projects were already deployed on StarkNet.

Since Linea has not been opened to the public yet, its current TVL is only $267,000, ranking 21st on the L2 list.

In terms of financing, Linea has received support from multiple institutions, including its parent company ConsenSys, and has raised a total of $725 million. According to LianGuai’s statistics, there are currently 57 projects in the Linea ecosystem.

Base has the same situation as Linea, with a current TVL of $634,000.

From a hardcore data perspective, Coinbase alone has over 110 million verified users and custodies assets worth over $80 billion, so Base does not need to worry about on-chain revenue. Data analyst LianGuainda Jackson’s investigation shows that out of the 57 Base launch partners, 26 (45%) are invested by Coinbase Ventures, indicating the closeness of its alliance.

Scroll has not yet deployed its mainnet, so on-chain data is yet to be demonstrated. However, its previous financing of up to $80 million and a valuation of $1.8 billion are enough to compete with other competitors in terms of capital.

As for other data, as mentioned above, Scroll has over 4 million unique wallet addresses and processes over 500,000 transactions per day. More than 100 projects have submitted their information through this website.

Therefore, whether this dark horse can successfully emerge remains to be seen.

The essence of clustering: user competition

Currently, the mainstream view in the crypto market is that the Ethereum Cancun upgrade, which is most likely to take place in the second half of this year, will drive the L2 sector.

Firstly, the halving of BTC is already a major narrative that benefits the crypto market. Secondly, Ethereum Cancun is an additional upgrade to the ETH blockchain after Shanghai, with EIP-4844 and possible EIP-6969. By then, the speed of L2 could increase by 10 times, 100 times, or even more, and costs would be lower.

The transaction costs for users on L2 Rollups may decrease by tens of times after the full implementation of EIP-4844. However, there are already two Op Rollups competitors, OP and Arb, among the top ten public chain TVL rankings. Once the Zk Rollups network is fully launched, the future L2 market will have more room for imagination.

Furthermore, it is precisely because of the first-mover advantage of Arb and Op that they have already established absolute dominance in the L2 market. The narrative around Zk Rollup has mostly taken shape, and there is no need to spend time polishing the technology. Projects like Linea and Base, which have recently gained popularity, are actually built on the technological achievements of other leading Rollup projects.

Web3 veteran geek @Faust expressed to LianGuai, “For these new L2 projects that have recently launched their mainnets, there is no need for long-term technical iterations. Because they have already launched their mainnets with little pressure in terms of technology, especially projects like StarkNet and Scroll that have accumulated at least two years of technology. So in the future, the most important thing is who can quickly attract users.”

Currently, no general zk Rollups have been launched. The future competition in L2 is likely to no longer focus on technical superiority, but on who can acquire more user groups. Coin issuance is the best way to attract users, but to issue coins, there must be a mainnet. Therefore, the earlier the mainnet is launched and coins are issued, the more market share the project can occupy.

Another KOL in the cryptocurrency circle also thinks so. He believes that in the future, the core competition among Zk Rollups may not be technology, but marketing and community culture, or the relationship with developers and the attractiveness to users.

@Faust also believes that the market generally believes that the bear market is ending and the market is starting to rebound. These large projects are trying to seize the opportunity, which is why they are rushing to launch their mainnets in the second half of this year.

Therefore, after these star L2 networks go live in the second half of this year, as long as the bull market rebounds, it will be a good opportunity for them to quickly grow by issuing coins.

Conclusion

Based on the L2 networks that have already announced the launch of their mainnets, the second half of this year is likely to be the stage for Zk Rollups. Under the stimulation of token airdrops like Optimism and Arbitrum in the first half of this year, the Layer2 track has become a mainstream narrative field that users are eagerly anticipating. It is also highly probable that L2 projects like ZkSync, StarkNet, and Base will issue coins in the second half of this year.

However, it should be noted that although these Layer2 projects have experienced explosive growth in user numbers after the launch of their testnets or mainnets, if they rely solely on token airdrops to attract users and cultivate usage habits, then once the incentives are no longer there, user attrition is only a matter of time.

Therefore, how to steadily increase their TVL while maintaining attractiveness to users is the true test for these Layer2 projects and other projects.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 3-Minute Introduction to UniswapX How Powerful is the Next-Generation DEX Liquidity Aggregator?

- LianGuai Daily | Lens Protocol releases its V2 version; Binance has integrated BTC Lightning Network

- In-depth analysis of dYdX, the leader in on-chain derivatives How big is the imagination space of DYDX from DEX to Layer1?

- Q2 2023 Investment and Financing Report Total investment amount decreases quarter-on-quarter, with the United States taking the lead.

- DigiFT Research Report: Two Paths for MakerDAO to Implement RWA – Offline Trust and On-Chain RWA

- Q2 2023 Polkadot Research Report: Revenue Decline by 32% Quarter-on-Quarter

- Binance Research Report: 88% of institutional-grade users are optimistic about the long-term development of cryptocurrency assets.