How to track smart money in cryptocurrencies? The first step to tracking crypto trends

How to track smart money in cryptocurrencies The first step to tracking trends in crypto.Smart Money has always been a focus in the cryptocurrency market, and strategies that track smart money can indeed provide substantial returns for ordinary cryptocurrency investors. In fact, the percentage of investors using smart money-based cryptocurrency trading indicators, strategies, and tools is gradually increasing. Next, veDAO will lead everyone to understand smart money in the cryptocurrency market and how to track it.

1. What is Smart Money?

Smart money refers to professional investment institutions or individual investors in the cryptocurrency market who have outstanding investment research capabilities and information advantages. They have rich trading experience and excellent historical performance. Generally, they have relatively large funds, mature investment concepts, and a more comprehensive understanding of the cryptocurrency market than ordinary investors. The dynamics of smart money have special significance for ordinary cryptocurrency investors.

2. Why track smart money?

The high volatility of cryptocurrency assets, the severe information asymmetry in the market, and the increasing Matthew effect in the cryptocurrency market make it more difficult for ordinary investors to obtain market alpha, while a small number of smart money investors are making a lot of money. This is because smart money can access information and resources that ordinary traders cannot easily obtain, giving them an advantage in the cryptocurrency market. For ordinary cryptocurrency investors, tracking smart money in the cryptocurrency market can help identify market trends earlier, discover more and better investment opportunities in a timely manner, and achieve the same returns as smart money or reduce the gap in returns compared to smart money.

- Injective, the pioneer of native order book chain, is a DeFi public chain based on COSMOS.

- 3-Minute Introduction to UniswapX How Powerful is the Next-Generation DEX Liquidity Aggregator?

- LianGuai Daily | Lens Protocol releases its V2 version; Binance has integrated BTC Lightning Network

3. How to track smart money?

In the cryptocurrency market, due to the public and transparent nature of blockchain, users can view every transaction conducted on the blockchain. Through data processing and filtering, it is theoretically and practically possible to identify the transactions conducted by smart money.

To track smart money, investors first need to discover and find smart money. This requires investors to use blockchain explorers or smart money-related third-party tools to filter and find smart money that suits their goals and needs. The filtering of smart money is mainly based on its past on-chain interactions, transactions, and other on-chain information. It involves selecting based on transaction or interaction types, quantifying historical performance evaluation indicators, capital flows, and interaction protocols. Once smart money is found, the next step is to track it. Investors can choose to fully replicate and track smart money. For ordinary cryptocurrency market investors, tracking smart money means relying on their transactions or fully replicating their investment portfolios, thereby directly benefiting from their insights and skills, and achieving greater efficiency and more effective access to market alpha in trading.

However, it should be noted that not all smart money is as smart as it seems. Blindly copying all their trades without in-depth research is usually unwise, as these traders often enter the market at lower prices, while later traders are in different market conditions. At the same time, some smart money has multiple accounts, and the behavior of a single account does not necessarily represent the true behavior of smart money. It is currently difficult to determine how many accounts a smart money has. A better approach is to use tracking smart money strategies as an important reference dimension, combined with other indicators and analysis to make investment decisions. Currently, there are many dedicated platforms on the cryptocurrency market to track smart money. Here, veDAO selects 5 simple but powerful options for everyone.

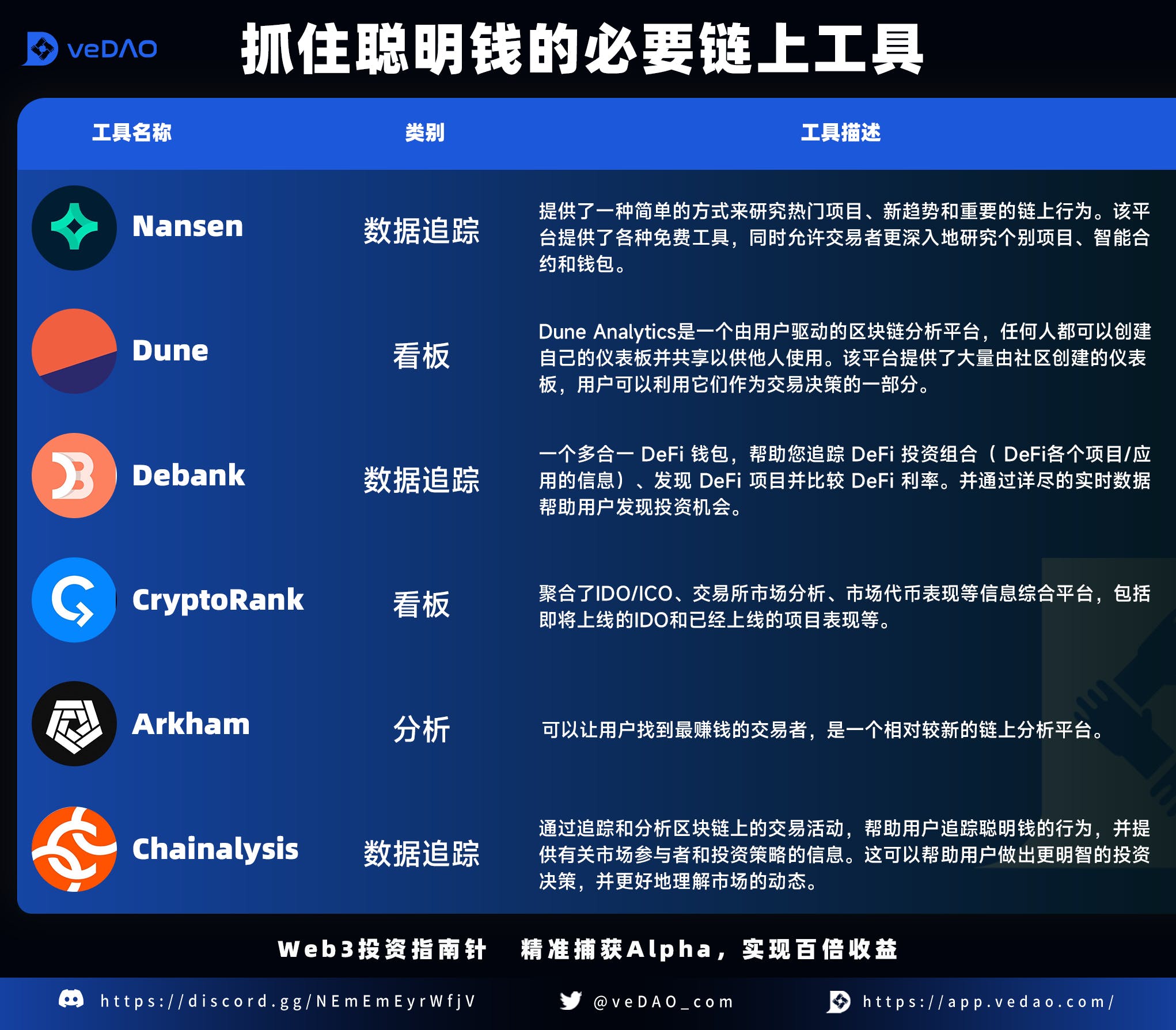

3.1 Nansen

As one of the most well-known blockchain analysis platforms for tracking smart money, Nansen provides a simple way to study popular projects, new trends, and important on-chain behaviors. The platform offers various free tools, while allowing traders to conduct more in-depth research on individual projects, smart contracts, and wallets. Its most relevant feature is called “Smart Money,” as the name suggests, it allows you to track the on-chain behavior of a large number of tagged wallets.

The Nansen Smart Money Tracker provides three main pieces of information about the on-chain activities of smart money (or addresses):

-

DEX Trading: Tracks the trading behavior of smart money in top DEX markets

-

Transfers and Interactions: Tracks all recent transfers by smart money and the contract protocols they interact with

-

Token Holdings: Explores the token holdings of smart money and their profit rankings

Importantly, Nansen’s Smart Money Tracker allows users to filter smart money addresses, including specific types such as funds, smart DEX traders, airdrop experts, smart NFT traders, IDO experts, staking experts, etc. This can help users refine their search, including customizing the types of transactions they are interested in.

Nansen’s Smart Money Tracker is currently only available to paid users and is relatively expensive. However, Nansen does offer a 7-day free trial for $9, which can be used to evaluate its value to users.

3.2 Dune+Debank

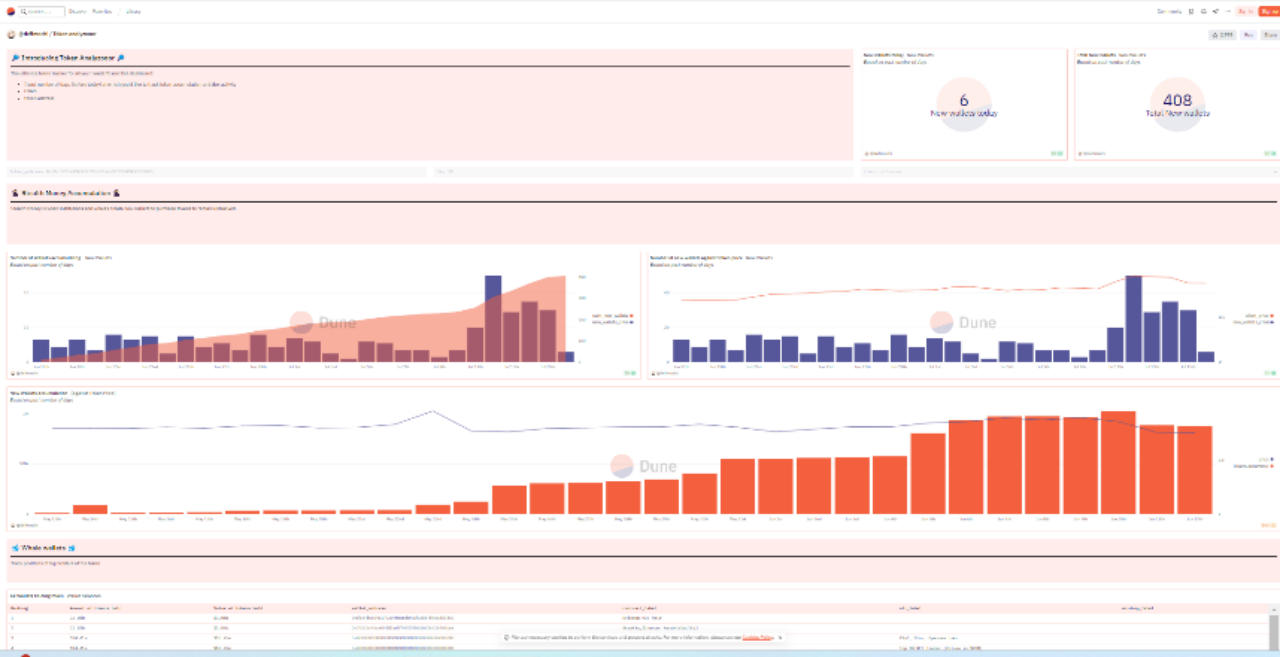

Dune Analytics is a user-driven blockchain analytics platform where anyone can create their own dashboards and share them for others to use. The platform provides a large number of community-created dashboards that users can leverage as part of their trading decisions. Through in-depth research, veDAO has found two of the best dashboards that can help users identify and track smart money.

A. Token God Mode Dashboard

This was created by a user named defimochi. This tool allows users to find a large amount of data on specific tokens of interest, helping users find smart money that may trade those tokens.

Link: https://dune.com/defimochi/token-god-mode

By entering a token address, selecting a tracking time range (e.g., the past 30 days), and choosing the relevant blockchain, the dashboard will present a list of the top 100 transactions with the highest estimated profits (along with other data). Users can then browse this list and manually filter out MEV bots to find the true smart money traders, i.e., those who achieve the highest trading profits.

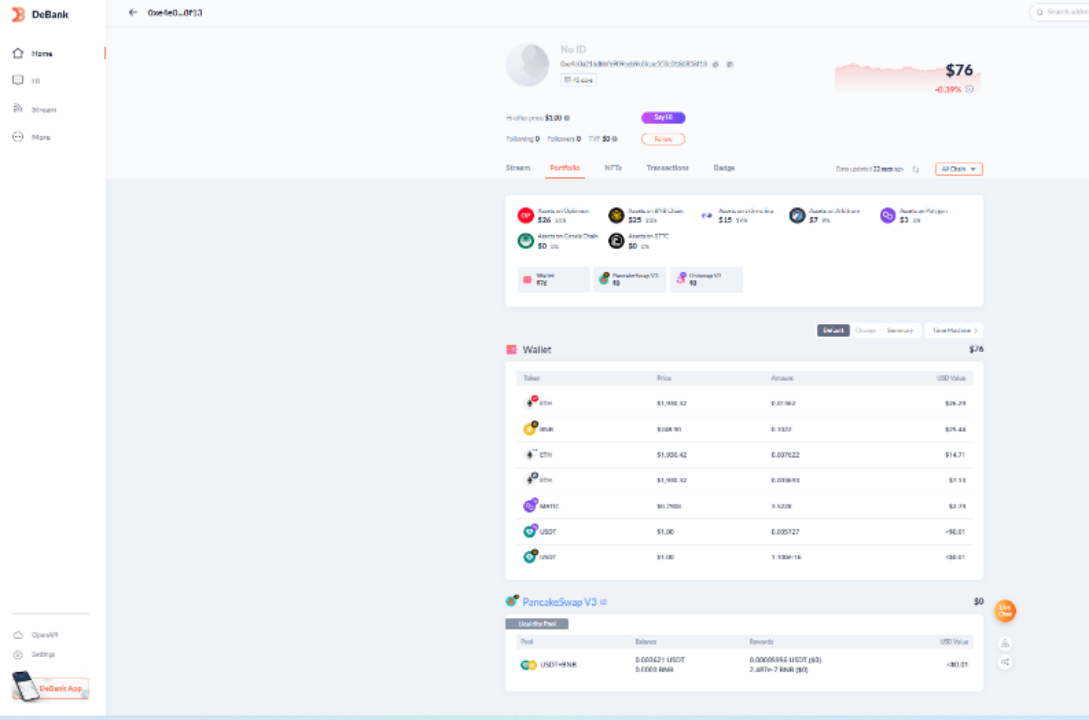

Next, users can copy and paste their wallet address into DeBank, where they can learn about their current token holdings and their recent transactions. With this information, users can gain some insights into their trading and investment strategies.

Link: https://debank.com/

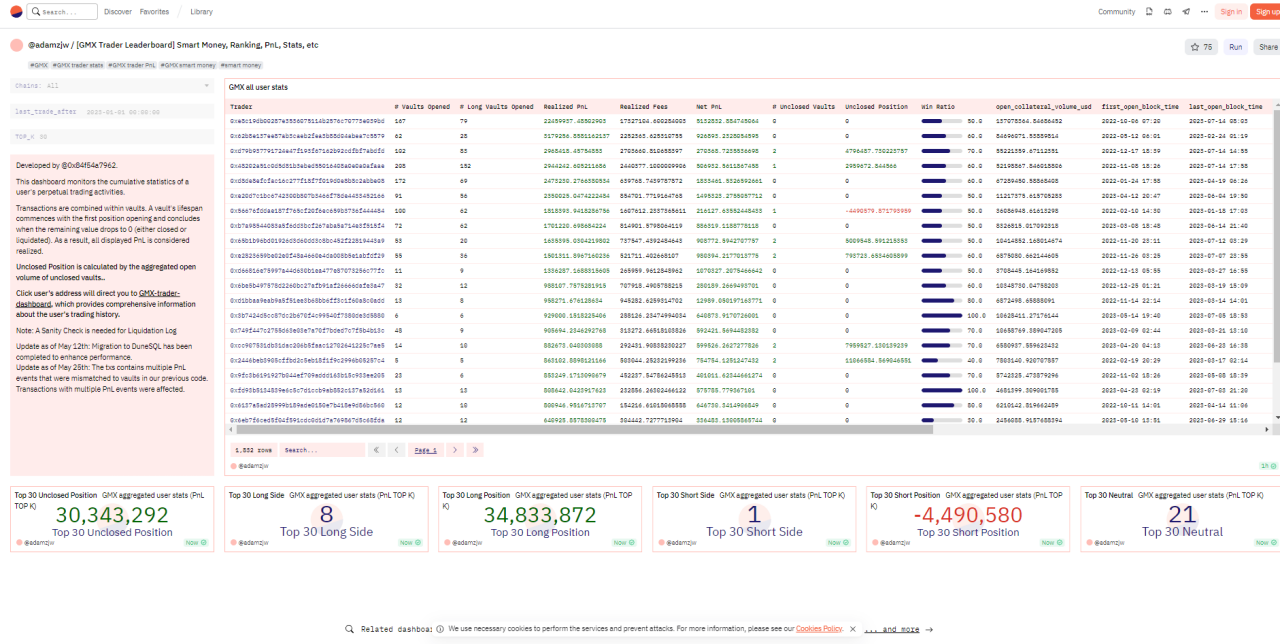

B. GMX Trader Leaderboard Dashboard

This dashboard was created by a user named adamzjw to identify smart money traders based on profitability or profit-loss ratios. Users can then input their addresses into DeBank or other portfolio tracking tools for further analysis of their on-chain behavior.

Link: https://dune.com/adamzjw/gmx-trader-leaderboard

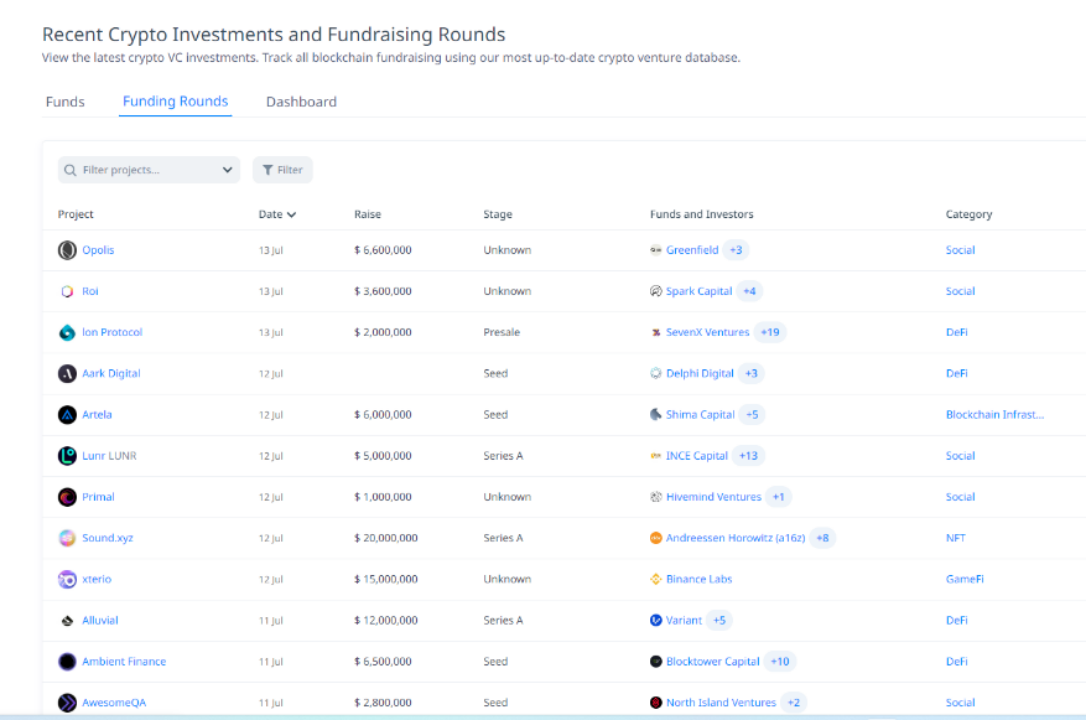

3.3 CryptoRank

CryptoRank can be used to detect recent fund trends. Although this platform does not provide real-time on-chain analysis like the above tools, CryptoRank offers a wealth of data that can be used to explore new market trends and opportunities. The platform provides various tools and trackers to help users gain in-depth market understanding and insights into current funding and investment situations.

For example, the Crypto Funds and Investors feature can be used to gain insights into the investment strategies of well-known funds and angel investors. This tool allows you to browse through a large number of venture capital funds, angel investors, and independent traders’ portfolios to understand their current performance. Users can also see a list of recent projects and recent funding rounds, displaying newly funded projects (and established ones) and detailed information about the entities involved.

This can help users understand the market trends perceived by smart money, enabling them to make wiser investment decisions.

For a more general overview of smart money in the crypto space, CryptoRank also offers various charts highlighting important data, such as monthly fund changes, popular investment categories, and the most active funds.

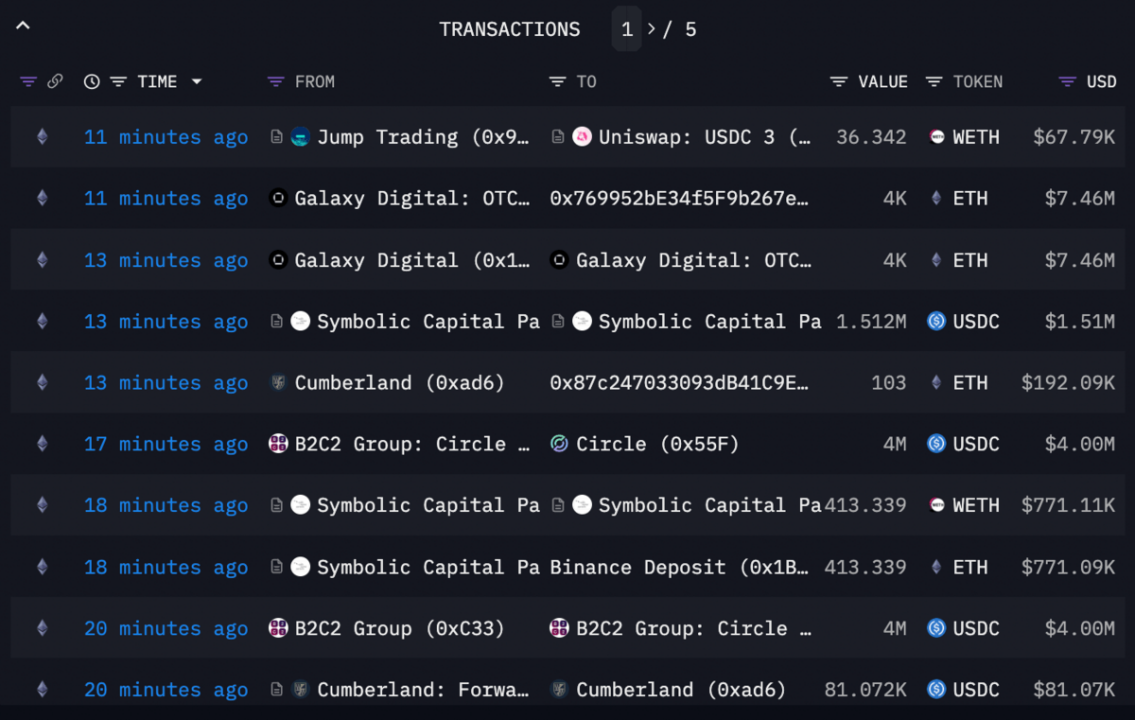

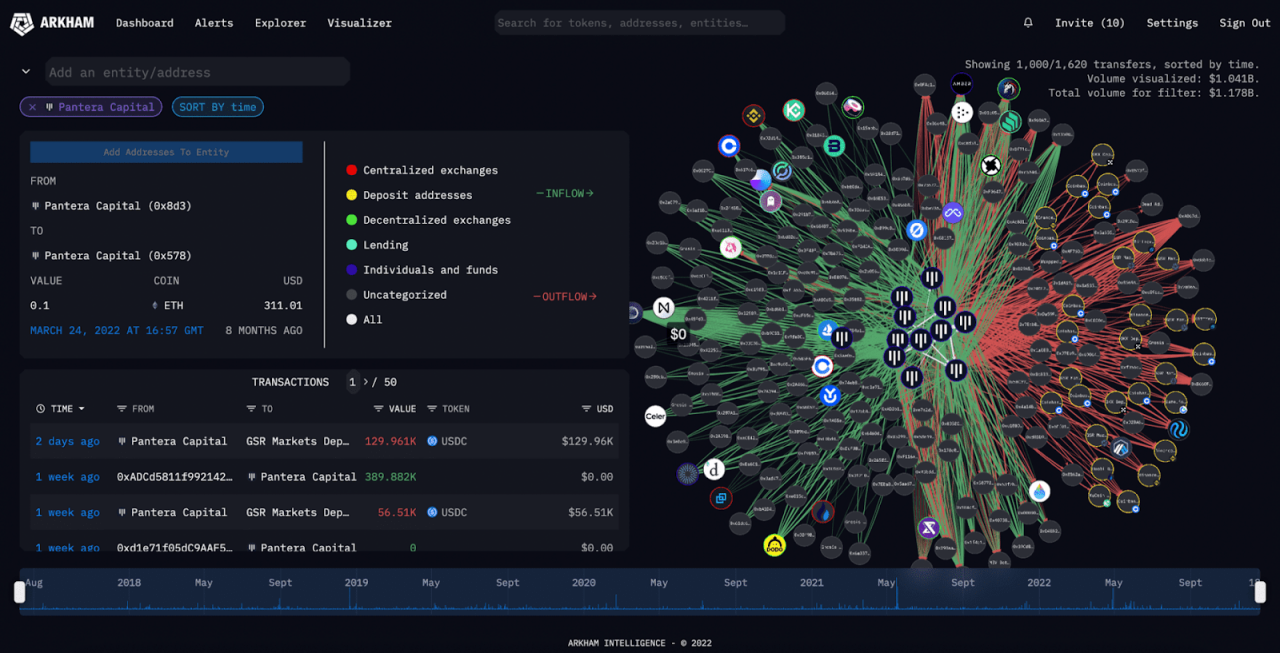

3.4, Arkham

Arkham allows users to find the most profitable traders and is a relatively new on-chain analysis platform. The platform does not automatically provide smart money wallet addresses and users need to search for them themselves. The platform provides rich information that users can use to find smart money through some investigation. Users can easily find a list of active smart money traders by using their transaction filters and then further filter out the leading traders.

For example, by filtering the results to only include trades within the last hour, with a minimum value of $50,000, and only trades conducted by funds, users can see a list of recent large trades made by smart money.

Then, users can browse through this list to find new or established crypto assets that are popular among smart money traders, or identify wallets that are particularly active and may require further investigation. Once a potential smart money is identified, users can simply click on its tag or wallet address to access a wealth of additional data, including its recent profit/loss chart.

By browsing through several smart money and comparing their recent profitability, users are able to find a suitable smart money wallet address to track. From here, users can view their current on-chain holdings, examine their investment portfolios, or scan their recent transactions to analyze their trading strategies.

Arkham project official website: https://www.arkhamintelligence.com/

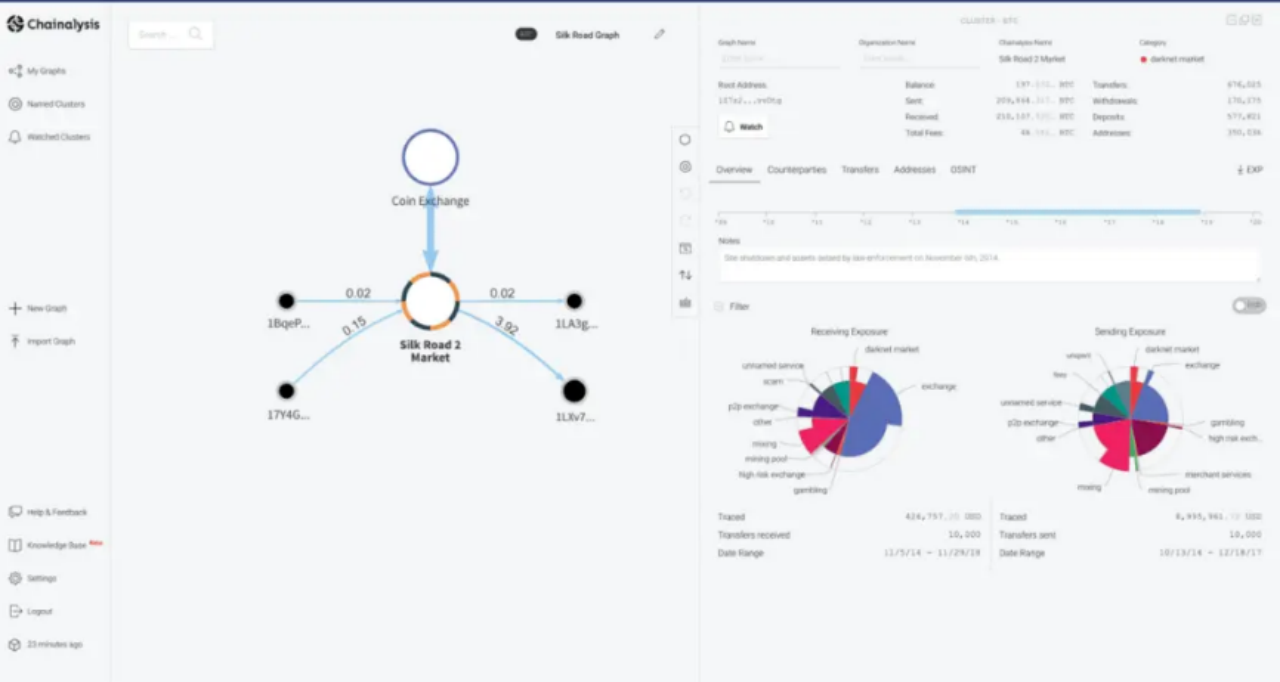

3.5, Chainalysis

Chainalysis helps users track the behavior of smart money by tracking and analyzing transaction activity on the blockchain, and provides information about market participants and investment strategies. This helps users make wiser investment decisions and better understand market dynamics.

By using its proprietary analysis tools and techniques, Chainalysis can track and analyze transaction activity on the blockchain. It can identify trading patterns and behavior of smart money, as well as the relationship between smart money and specific projects or entities.

Chainalysis’ platform helps users understand the investment strategies and behavior of smart money, as well as their influence in the market. Users can gain insights into market trends and investment opportunities by analyzing smart money transactions and holdings.

By tracking the flow of smart money, Chainalysis can provide detailed information about market participants, including investors, funds, and traders. This information can help users understand market dynamics and make wiser investment decisions.

Chainalysis platform address: https://www.chainalysis.com/chainalysis-business-data/

In addition to the above 5 tools, veDAO Research Institute has also compiled several other commonly used tools to help everyone find smart money more easily.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- In-depth analysis of dYdX, the leader in on-chain derivatives How big is the imagination space of DYDX from DEX to Layer1?

- Q2 2023 Investment and Financing Report Total investment amount decreases quarter-on-quarter, with the United States taking the lead.

- DigiFT Research Report: Two Paths for MakerDAO to Implement RWA – Offline Trust and On-Chain RWA

- Q2 2023 Polkadot Research Report: Revenue Decline by 32% Quarter-on-Quarter

- Binance Research Report: 88% of institutional-grade users are optimistic about the long-term development of cryptocurrency assets.

- Consensys: Global Cryptocurrency and Web3 Survey

- LD Weekly Report: ETH Staking Rate Rises to 19.43%, Layer2 TVL Total Locked Amount Reaches $9.68 Billion USD