Quick Look at Velodrome V2 Further Enhancing Asset Efficiency, Strengthening OP Super Chain Vision

Velodrome V2 enhances asset efficiency and strengthens OP Super Chain vision.Author: Velodrome

Translation: Deep Tide TechFlow

TLDR

- Velodrome has launched its V2 version, aiming to consolidate its position as the most capital-efficient liquidity hub in DeFi and laying the foundation for Concentrated Liquidity Automated Market Maker (clAMM) and Automatic Voting Management (Relay).

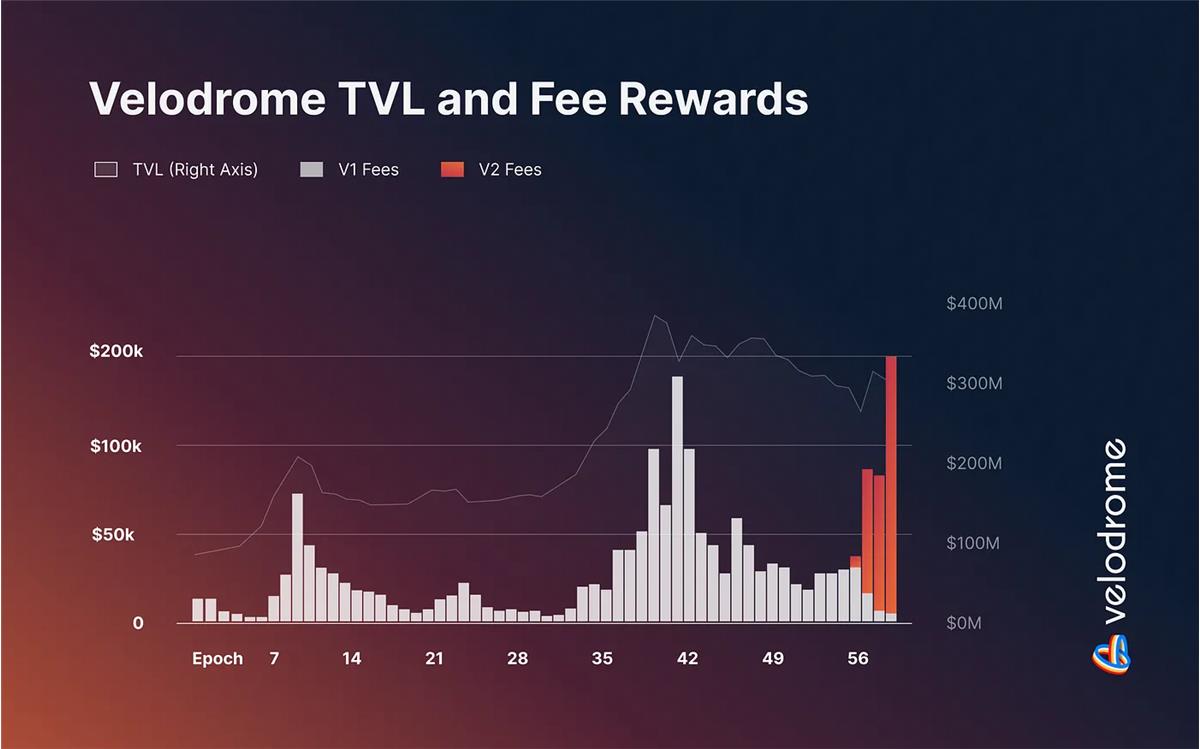

- Velodrome V2 has already set new records, generating more weekly fees in its third cycle than ever before, with speeds almost 6 times faster than V1.

- The implementation of clAMM by Velodrome will improve trade execution and reduce slippage, bringing many benefits such as increased fee rewards for veVELO voters, low-cost liquidity for partner protocols, and diversity of LP pools.

- Velodrome’s governance system empowers veVELO voters with control over the supply. Relay will further improve the user experience and system efficiency of voters through automatic voting, strengthening the governance foundation.

- Velodrome is committed to enhancing the Optimism ecosystem and Superchain vision by building a leading, efficient, and user-centric platform on Layer 2 Ethereum.

- LianGuai Observation | Opepen’s Rekindling A Community’s Co-creation and Win-win

- LianGuai Daily | RISC Zero raises $40 million; Manta Network developer p0x labs raises $25 million.

- Elon Musk establishes x.AI, aiming to snipe OpenAI or tell a new story of capital?

Introduction

The launch of V2 marks the beginning of an accelerated growth period for Velodrome. As a full-stack protocol redesign, V2 establishes the foundation for powerful features including customizable fees, Concentrated Liquidity Automated Market Maker (clAMM), and Automatic Voting Management (Relay). These enhanced functionalities will solidify Velodrome’s position as the most capital-efficient liquidity hub in DeFi, support an increasing number of tokens and protocols, and drive the expansion of Optimism Superchain. With the significant increase in rewards for veVELO voters and a seamless user experience on Nightride UI, we can already see the impact of V2.

Powering Digital Products

Despite recent challenges in the crypto industry, the potential for digital goods and decentralized applications remains immense. The DeFi space is evolving with a growing service ecosystem, low-cost and fast transactions on Layer 2 networks, and increasingly intuitive user interfaces. As the online economy expands, the use cases for cryptocurrencies and decentralized transparent financial services will multiply.

Velodrome aims to simplify the process of attracting liquidity for a growing variety of digital goods, providing a user-friendly interface and flexible incentive mechanisms that allow the team to maintain control over incentives.

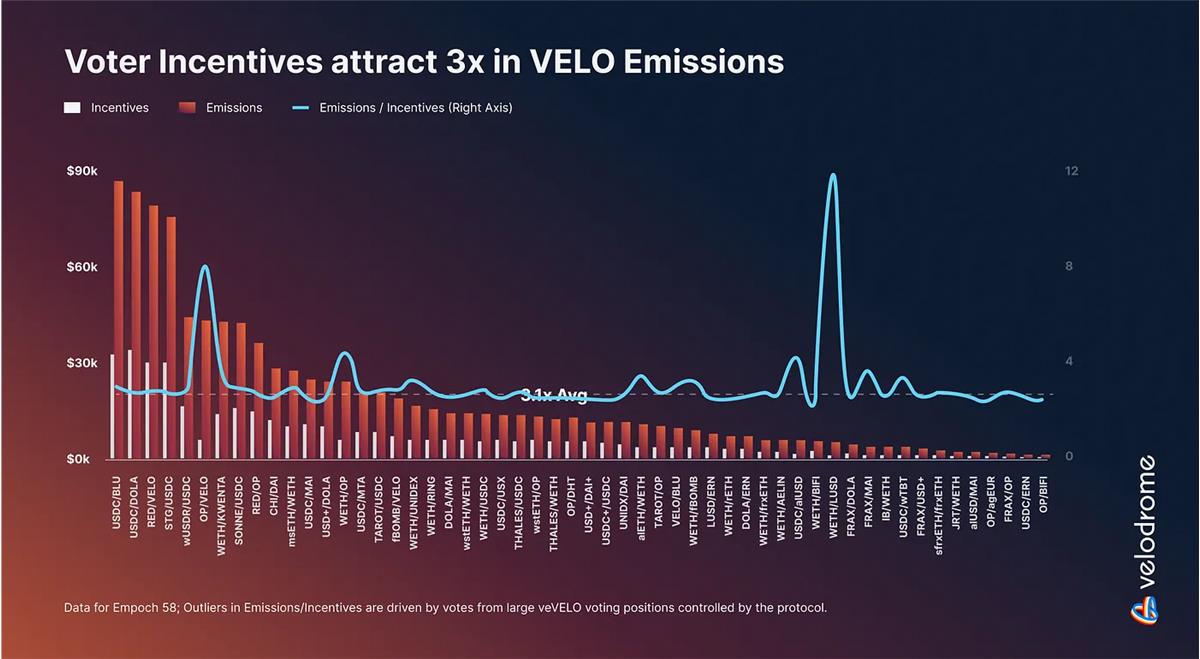

Velodrome distributes VELO to liquidity pools based on veVELO votes received in each cycle. Projects can attract votes for their pools by depositing incentives in any token form. Partner protocols can tap into the growing Velodrome community, and their token holders can find stable and user-friendly opportunities to provide liquidity.

The emission of V2 accounts for approximately 1.5% of the total supply. Compared to V1, this means a 20% increase over 4 years, aiming to drive a new wave of growth before the release of clAMM and entry into Superchain.

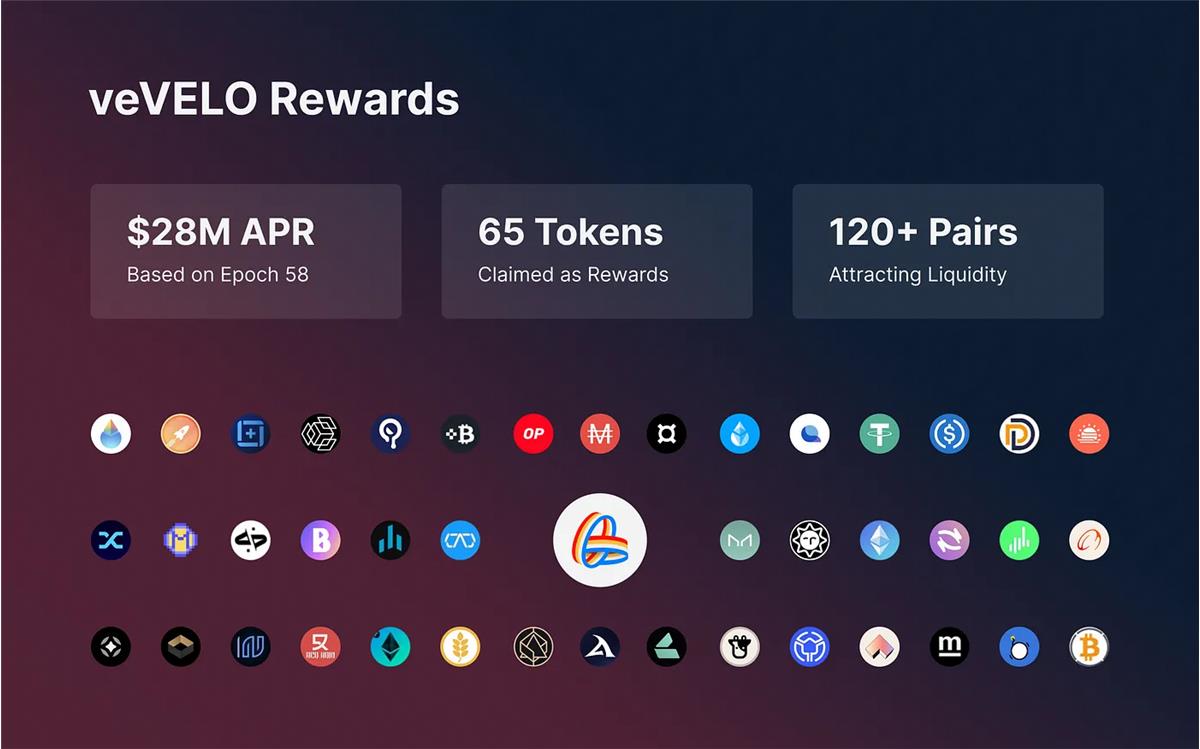

This scalability allows Velodrome to provide services for an increasing number of projects. Liquidity staking protocols, stablecoins, lending, yield aggregators, games, and even other decentralized exchanges are utilizing this flywheel to establish liquidity for over 120 different trading pairs, accumulating rewards for veVELO voters.

Scaling through capital efficiency

The implementation of Concentrated Liquidity Automated Market Maker (clAMM) will be another major leap for the Velodrome economic engine. By focusing the distribution of VELO emissions on liquidity provider (LP) positions within the active price range of trading pairs, clAMM significantly improves trade execution, enabling Velodrome to capture more trading volume with the same Total Value Locked (TVL), and effectively providing a powerful precision tool for guiding liquidity. This improved capital efficiency will benefit all aspects of the flywheel.

Partnership agreement

- Enhanced liquidity and reduced slippage: Velodrome will concentrate more emissions within tighter price ranges, incentivizing liquidity providers (LPs) to maintain active positions, thereby supporting trade execution. This will enable the protocol to offer low slippage trades and provide incentives for more liquidity pools.

- Self-sustaining liquidity pools: Lower slippage will attract more trading volume and fees. Fee-generating liquidity pools can sustain themselves, reducing the need for additional incentives from partnership agreements. This not only improves the efficiency of liquidity pools but also lowers the costs of partnership agreements, enhancing the overall sustainability of their operation.

Liquidity providers

- Continuous rewards: A time-based mining approach will provide liquidity providers with more stable rewards. Unlike other clAMM implementations where liquidity providers rely on market conditions to drive fee generation, Velodrome will allow liquidity providers to continuously receive rewards for the liquidity they provide within the specified range.

- Flexible reward accumulation: In the case of market fluctuations, liquidity providers can choose to unstake and accumulate the transaction fees captured by their liquidity. This approach ensures that liquidity pools maintain liquidity during volatility and compensates liquidity providers for higher risks. Fees accumulate with each transaction, allowing liquidity providers to maximize short-term returns. A higher activity baseline will appropriately reward veVELO voters and liquidity providers.

veVELO Voters

- Increase Fee Rewards: The clAMM liquidity pool will significantly increase trading volume by improving transaction execution. Combined with dynamic fees that can be adjusted based on market conditions, clAMM will greatly increase rewards for veVELO voters, incentivizing them to vote for the most productive liquidity pools.

- Growing Rewards Flow: The protocol’s increasing utility will attract more projects, bringing higher incentives to voters. More projects using Velodrome will diversify voter rewards and enhance the attractiveness of locking veVELO tokens.

Consolidating the Foundation

Velodrome’s veVELO governance system may be the most innovative and comprehensive system in DeFi. With over 14,000 participants, veVELO voters control 100% of the protocol’s supply and receive 100% of the fees and voting incentives, establishing a fully aligned incentive mechanism.

With V2, Velodrome will enhance user experience, strengthen governance processes, and give veVELO voters greater control over protocol mechanisms through Relay. Relay is an automated veVELO manager that allows voters to delegate their NFTs for optimal voting. Users can choose to automatically allocate voting power or maintain active voting power in specific liquidity pools while accumulating rewards.

Velodrome is also actively involved in Optimism’s governance and is building together with the Optimism Foundation. Currently, Velodrome proposes the development of govNFTs, a new token standard that can conveniently manage issued OP tokens. Future projects can use govNFTs to distribute issued OP grants, ensuring consistent incentive mechanisms for recipients and the entire ecosystem. Furthermore, similar to veVELO, govNFTs can eventually enable new governance features, such as increasing voting rights for OP holders.

Velodrome V2 is another example of the protocol’s resilience and long-term commitment to building an efficient, user-centric platform. Velodrome aims to attract projects to L2 and become the ultimate marketplace for liquidity on Superchain.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Observation | L2 Networks Go Live in Large Numbers, Ethereum’s Scaling Battle Begins in the Second Half of the Year

- Opepen Threadition has been online for 2 days and has received over 37,000 mintings. Why is Jack Butcher always able to create phenomenal NFTs?

- How to track smart money in cryptocurrencies? The first step to tracking crypto trends

- Injective, the pioneer of native order book chain, is a DeFi public chain based on COSMOS.

- 3-Minute Introduction to UniswapX How Powerful is the Next-Generation DEX Liquidity Aggregator?

- LianGuai Daily | Lens Protocol releases its V2 version; Binance has integrated BTC Lightning Network

- In-depth analysis of dYdX, the leader in on-chain derivatives How big is the imagination space of DYDX from DEX to Layer1?