Interpretation of investment trends from top 5 VC firms in the years after 2023

Analysis of investment trends by top 5 VC firms after 2023.Author: DefiNapkin, Crypto KOL

Translation: Felix, BlockingNews

Following “smart money” is a good way to discover opportunities, and early discovery of opportunities can bring great investment returns. Here are the investment trends of 5 top crypto venture capital firms in 2023.

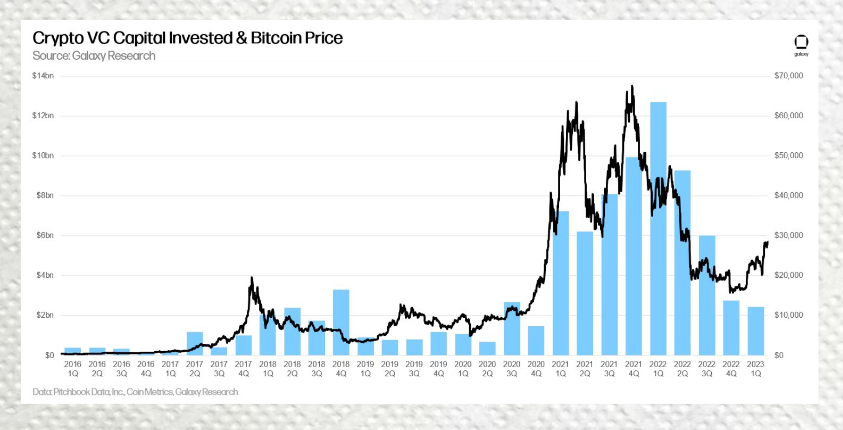

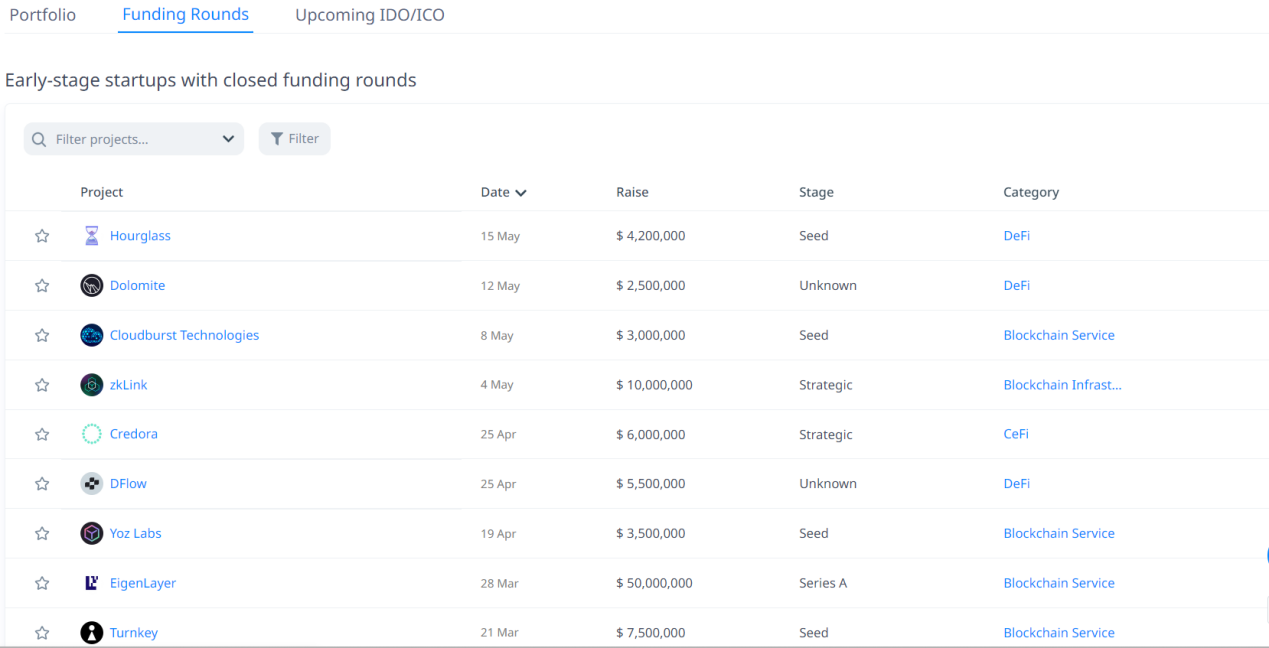

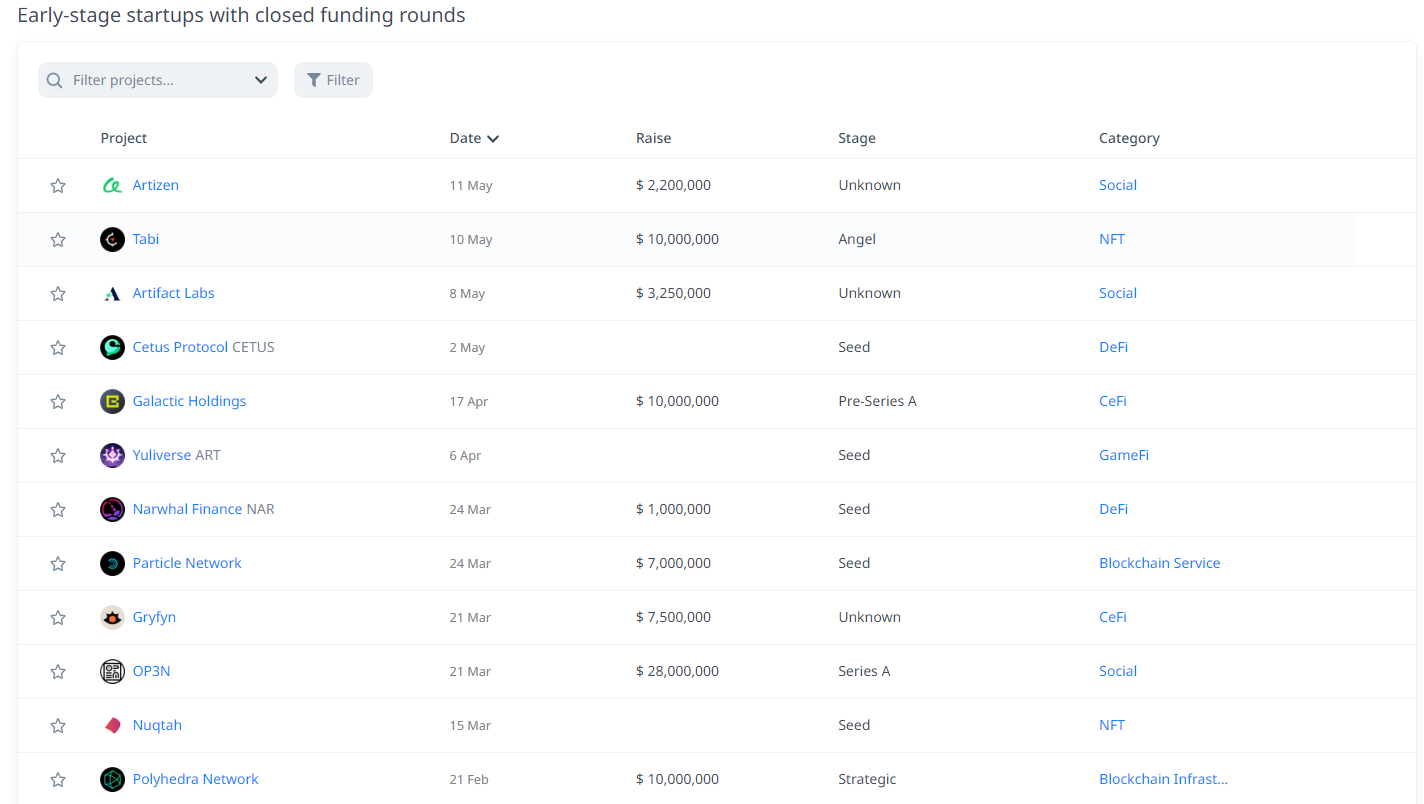

As shown in the figure below, except for the surprising month of March, the entire first quarter of 2023 was stagnant.

- Key factors for the future large-scale adoption of DID and specific investment directions

- Is the father of ChatGPT’s ambition to solve AI threats with cryptocurrency by airdropping to one billion people grand or is he just trying to make a quick buck?

- Sui Explorer Browser User Manual: Quickly Understand the Development of the Network

The reason is that crypto venture capital financing is often related to prices, and the following chart is a good example. If you look closely, you will find that financing often lags behind price increases. Therefore, the author believes that financing in the second quarter may increase.

In the fourth quarter of 2022, the market has reached the bottom of the price. The price of Bitcoin did not rise until the first quarter of 2023. Logically, crypto venture capital will also recover in the second quarter of 2023.

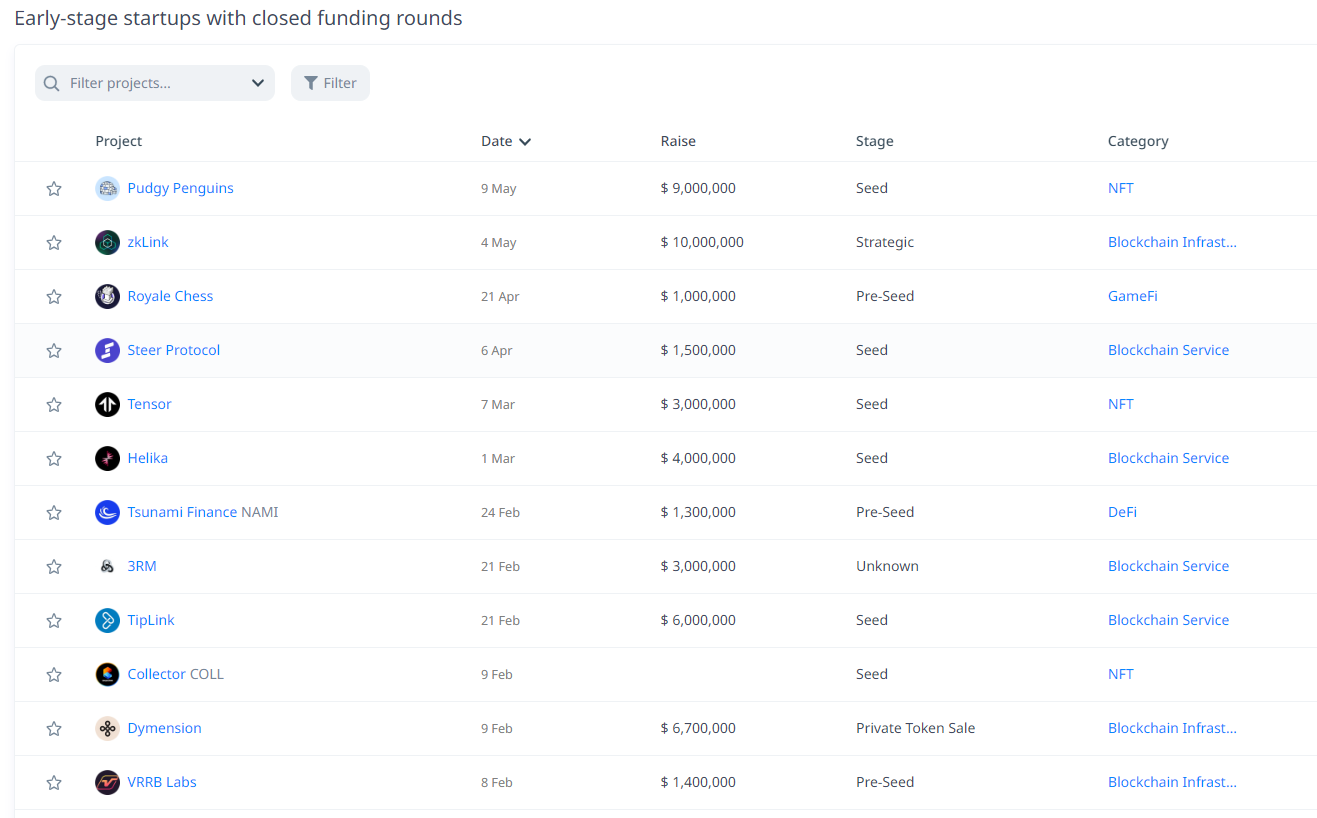

Although capital investment is trending downward, the number of financing activities in the first quarter of 2023 has increased, with 439 financing activities, while the fourth quarter of 2022 had 366 financing activities. The main reason is the promotion of pre-seed round financing activities, while the number of pre-seed round financing activities in the fourth quarter of 2022 slowed down, with only 42.

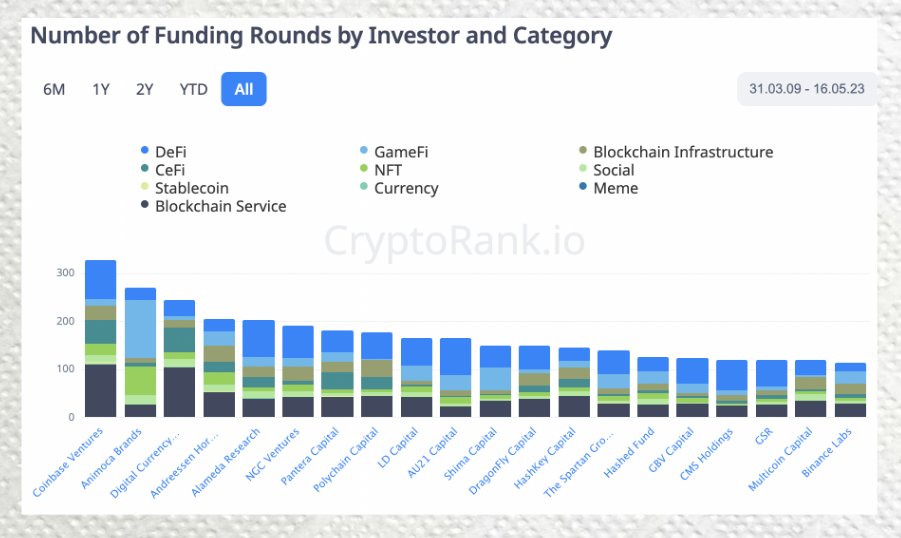

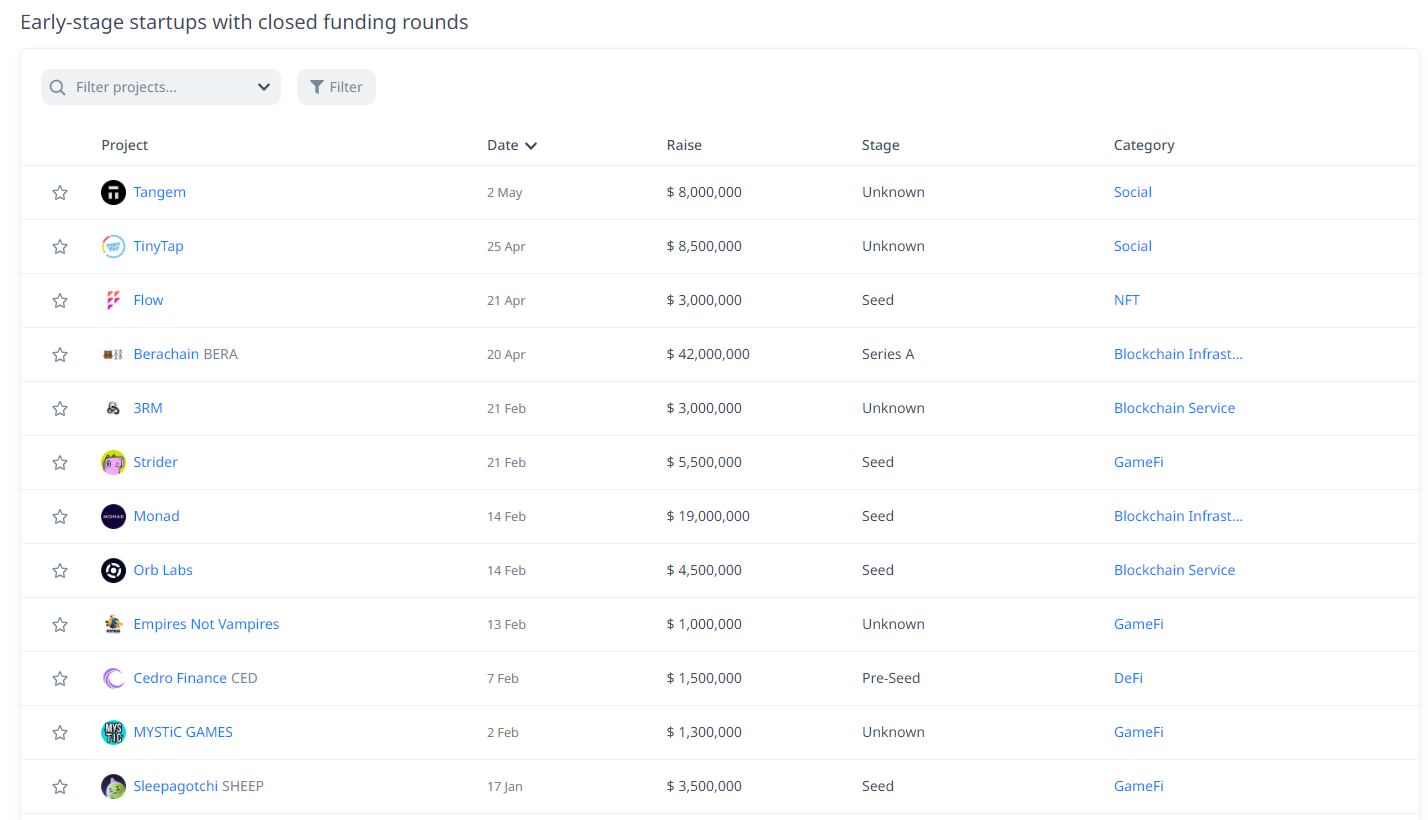

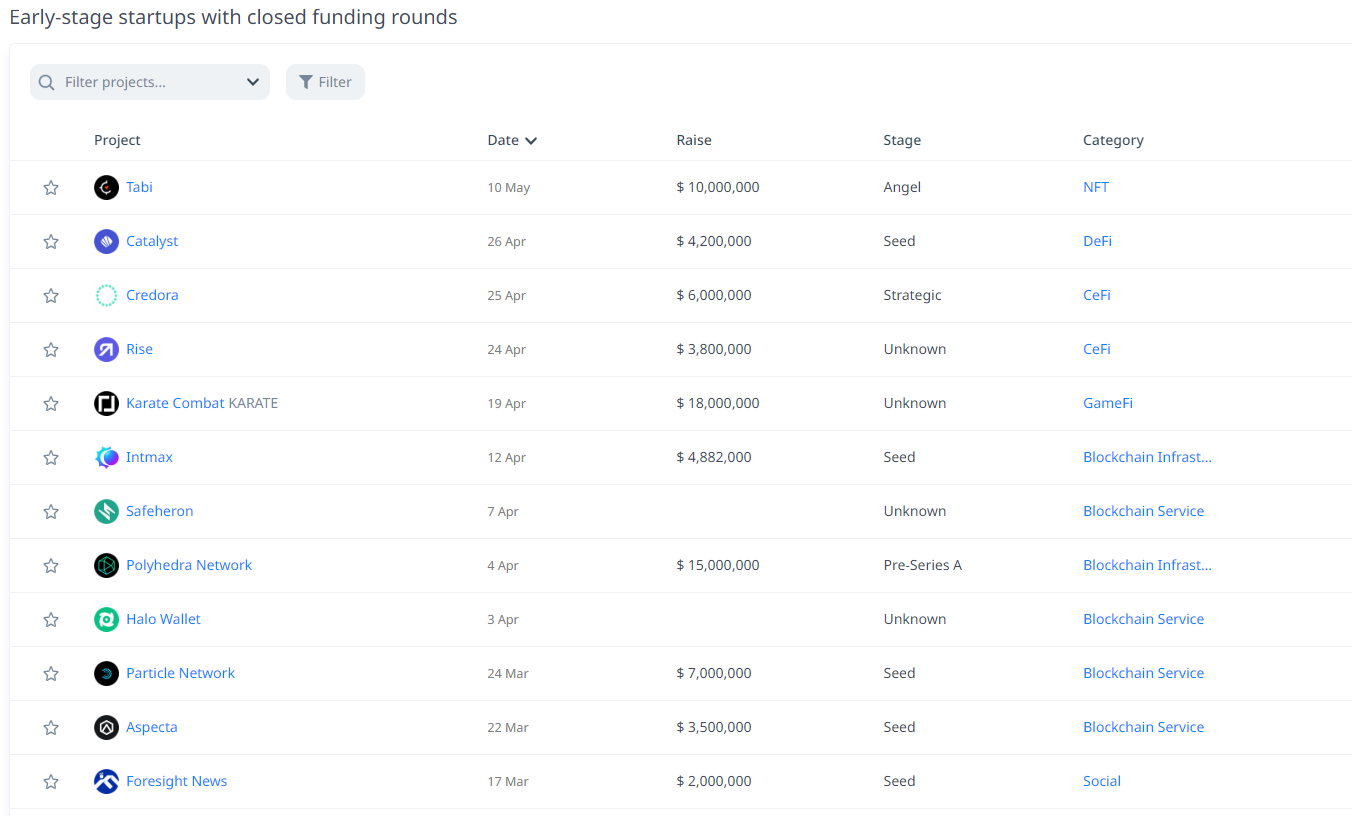

Now let’s look at the financing numbers by investment institutions and categories. Overall, in the VC investment category, DeFi is in the lead, followed by GameFi, and then infrastructure.

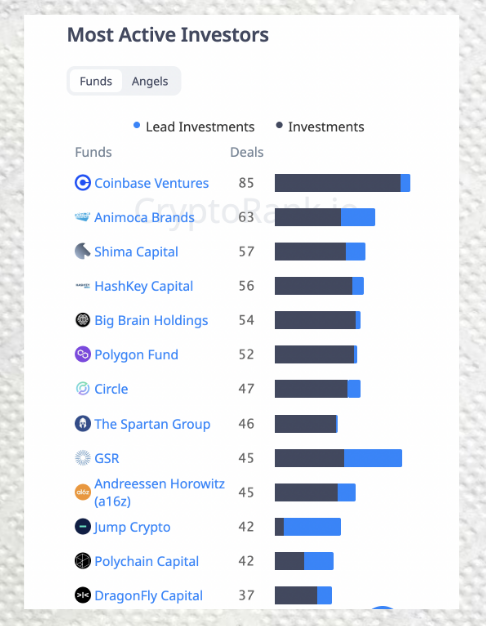

The five top VCs are:

- Coinbase Ventures

- Animoca Brands

- Shima Capital

- HashKey Capital

- Big Brain Holdings

Coinbase Ventures

Currently, the focus of investment is on infrastructure, followed by DeFi.

Animoca Brands

Currently, the focus of investment is on GameFi, followed by NFT.

Shima Capital

Currently, the focus of investment is on GameFi, followed by DeFi.

HashKey Capital

Currently, the focus of investment is on infrastructure, followed by DeFi.

Big Brain Holdings

Currently, the focus of investment is on DeFi, followed by infrastructure.

New Trends and Segments

Top VCs are laying out their blockchain infrastructure, DeFi, and GameFi. NFTs account for the largest share in the later financing rounds. STaaS service providers (Staking as a Service, referring to all service providers that provide users with generalized staking services) account for the largest share in pre-seed financing rounds.

Top VCs are laying out blockchain infrastructure services, DeFi, and GameFi in preparation for future large-scale adoption.

- Blockchain services are important infrastructure for DeFi. Typically, they have the highest income, and dApps also depend on infrastructure.

- DeFi is an innovative place where many new products and possibilities emerge.

- GameFi is a huge market that is coming soon and has not yet been developed.

Although the number of investments has decreased compared to two years ago, the venture capital scale and quantity are several times higher than four years ago when viewed from a longer time dimension.

It can be assumed that this depends on the trend of the Bitcoin price/cryptocurrency market performance. The author’s view is that it will increase (bullish), which is also in line with the upcoming regulatory clarity.

Related reading: Q1 Cryptocurrency Investment and Financing Report: Market Overview, Trends, and Investment Firm Performance

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Sustainable Path of Integrating Environment and Finance: Can ReFi Reshape Web3?

- What is the purpose of the world coin that features iris authentication, global airdrops, and the creator of ChatGPT?

- Can the combination of decentralized derivative exchanges and account abstraction open up the next incremental entry point?

- US House Stablecoin Hearing: State and Federal Regulatory Authority Dispute Focus of Both Parties

- Conversation with Sui Developer Relations Manager: How to start developing on Sui from scratch?

- Analysis of Dune: A powerful and practical free on-chain analysis tool

- Will modularization become the ultimate solution for cross-chain?