Analysis of “Azuki” in Bear Market: Development Plan and Status

"Azuki" Analysis in Bear Market: Development Plan and Status

Introduction

What kind of magic can a red bean possess?

Azuki is a series of 10,000 non-fungible tokens (NFTs) inspired by animation. Since its launch by Chiru Labs in 2022, it has become a strong force in the Web3 field. Azuki’s launch witnessed the series selling out in a matter of minutes and accumulating over $29 million in funds. The project owes its current status to its diverse and loyal community. In addition to the stunning data, the uniqueness of Azuki actually lies in the team’s ambitious goal of creating a gamified metaverse. Their goal is to create a space called Hilumia that provides immersive interactive experiences for holders.

This report provides a comprehensive analysis of Azuki and Beanz’s performance in the NFT market, focusing on their community strength, lending dynamics, and strategic partnerships that drive their resilience and growth. We will explore their trading activity, holder patterns, loan volume, and cross-platform appeal from a data perspective, demonstrating how these two projects have carved out a position in the market amid volatility.

- Who are the internal “leakers” behind Binance’s multiple regulatory accusations?

- Gary Gensler’s Crypto Game: Stealing the Spotlight from Congress to Illuminate the SEC’s Path

- Understanding the Distributed AI Computing Network Gensyn

Latest News

IPX x Chiru Labs: A Revolutionary Web3 Expansion

Source: Tweet@Azuki

Chiru Labs, the creative force behind Azuki, has announced a significant partnership with the well-known global IP platform IPX. IPX is known for its successful collaborations with well-known brands such as BTS, Netflix, and Starbucks. This alliance marks a significant breakthrough for LINE FRIENDS in the Web domain (LINE FRIENDS is a series of popular and globally recognized sticker characters born from the LINE messaging application).

This partnership signifies a groundbreaking combination of Web3 and existing IP, covering co-creation of content, retail distribution in LINE FRIENDS stores, and immersive offline activities. Given that BEANZ and LINE FRIENDS have already set the pace, this collaboration is likely to expand to other IPs managed by Web3 partners designated by IPX.

This collaboration is significant as BEANZ’s IP will be presented to millions of LINE FRIENDS consumers. The successful expansion of the IP not only means that Chiru Labs and IPX have brought together similar user groups, but also expanded their user base in a way that few NFT projects can achieve. The recognition of influential brands like BTS further drives this collaboration.

Follow The Rabbit: Hype, Mystery, and Details

source:Tweet@Azuki

Azuki is back and bringing an exciting event “Follow The Rabbit” to Hakkasan nightclub in Las Vegas on June 23rd, 2023. Their previous “Check Your Wallets” and NYC NFT events have been widely acclaimed. They have promised to provide an immersive experience for attendees at this year’s event during the Year of the Rabbit.

The registration channel was already opened in mid-April, prioritizing Azuki and BEANZ token holders. However, due to overwhelming demand, Azuki has reopened the registration window and will officially close on May 28, 2023. The tickets are free, and non-holders need to pay a refundable deposit of $100, with registration processed through the tokenproof application. Attendees must be 21 years of age or older.

Given Azuki’s previous impact in the NFT world, this event is particularly significant. Since January 2022, Azuki has caused a storm in the bull market, with holders rushing to buy. Later, they announced a surprise airdrop of two NFTs for every Azuki held at a Los Angeles party in March. This further boosted the project’s popularity. Despite ongoing controversies, Azuki continues to find ways to grow and maintain a foothold in the NFT space.

“Follow The Rabbit” event may become a platform for Azuki’s future plans to be exposed. As speculation grows, some Azuki whales have started trading rare Azuki NFTs at floor prices. This strategy suggests that there may be future airdrops or token distributions. As Azuki prepares for this event, the attention from the outside world is only increasing, bringing a sense of suspense and excitement to the NFT community. Zagabond is the mysterious founder of Azuki, and he is adept at making the community feel involved without revealing too much information, further fueling people’s curiosity.

This event incorporates the mystery and hype elements represented by Azuki, making it one of the most anticipated events in the NFT world. While it remains to be seen whether this event will actually launch a new series of NFTs, expectations are high.

Azuki enhances interactivity with the comic book token attribute of Spirit DAO

Source: Tweet@Azuki

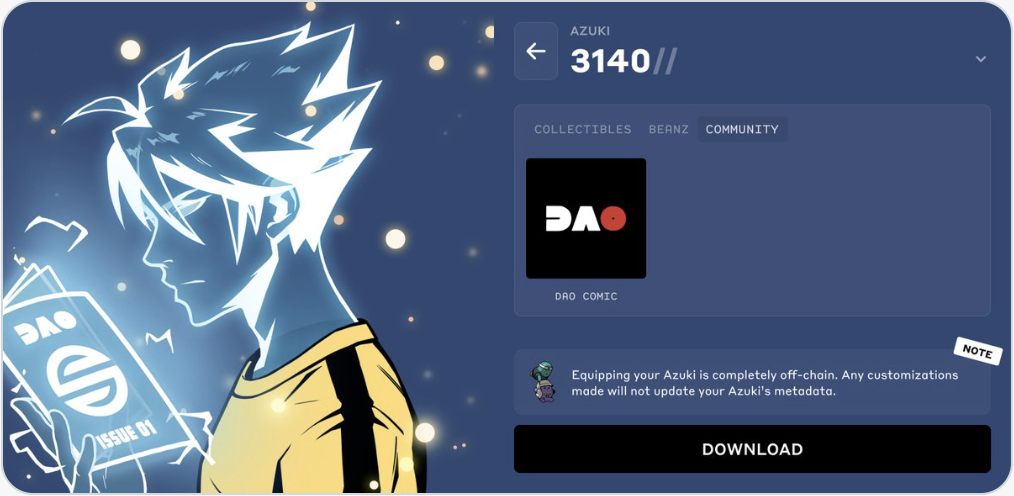

In this exciting development for the project, a private group of Azuki NFT collectors called Spirit DAO has been granted the coveted comic book token attribute by Azuki. Spirit DAO members can load this attribute to enhance their Azuki experience and differentiate themselves from ordinary members in the Azuki community.

This move demonstrates the synergy between Azuki and Spirit DAO and underscores Azuki’s commitment to cultivating creativity, collectibility, and immersive engagement. Spirit DAO, consisting of dedicated Azuki collectors, aims to solidify Azuki’s reputation in the emerging metaverse and is a powerful force. The comic book token attribute precisely strengthens this vision while also enhancing the interests of Spirit DAO token holders.

The comic book token attribute granted by Azuki to Spirit DAO can be obtained through Azuki collector profiles. This further emphasizes Azuki’s determination to dynamic community engagement. This new feature ensures that the personalization of Azuki tokens can be a creative off-chain experience without affecting the on-chain attributes of the tokens.

Essentially, Azuki’s collaboration with Spirit DAO through the comic book token attribute is an important step in enhancing user interaction and collector participation within the Azuki community. This development is sure to catalyze Azuki’s goal of establishing a prominent brand image in the metaverse.

Data Analysis

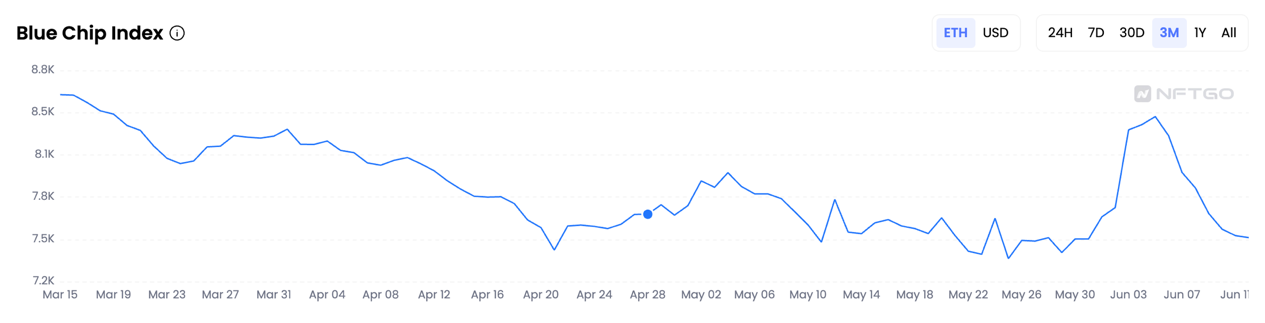

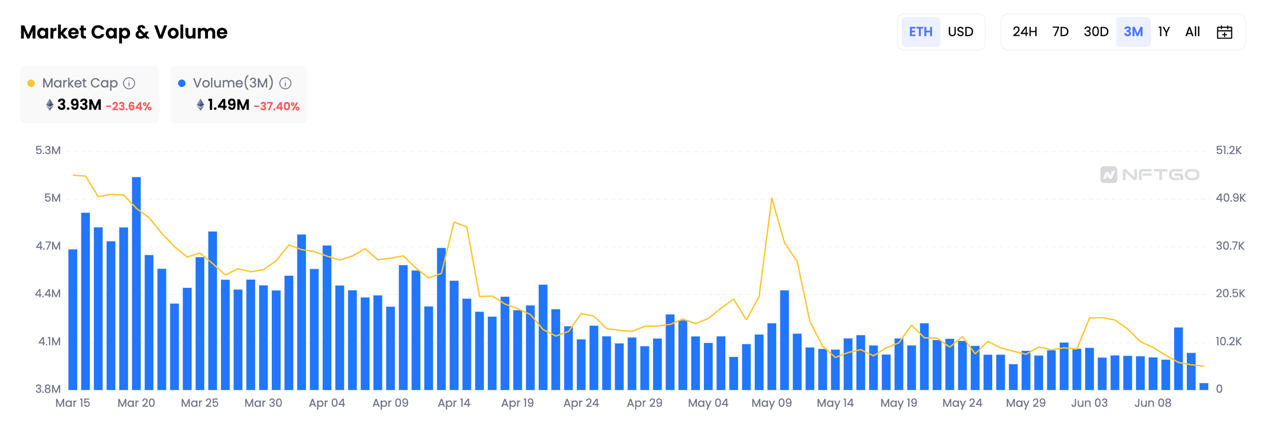

A review of the NFT market’s performance over the past three months reveals a declining trend. The market value fell steeply by 23.64%, from 5.1 million ETH to 3.9 million ETH. Although the blue-chip index experienced a brief rebound between May 31 and June 5, it also followed the downward trend overall, dropping from 85,000 ETH to 75,000 ETH, a decrease of 12.22%.

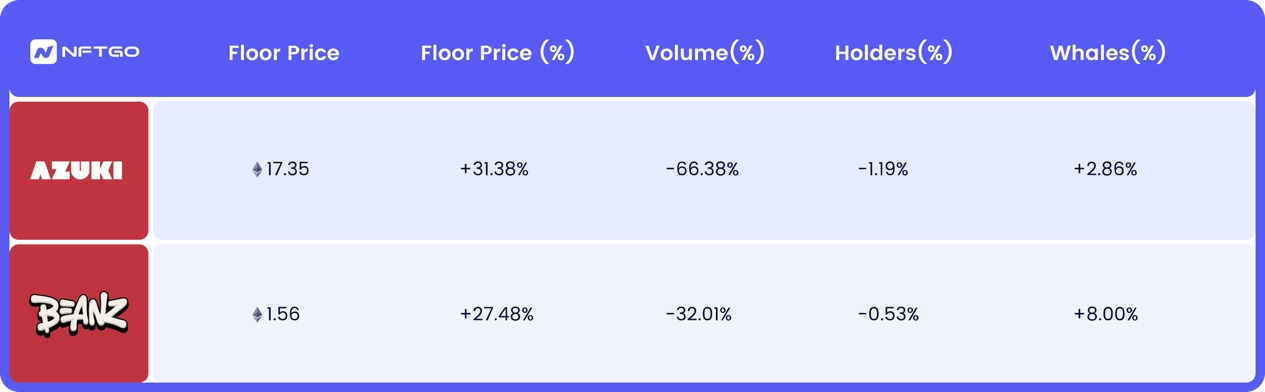

However, Azuki and Beanz are bucking the market trend and rising as strong projects thanks to their strong community support and product appeal.

Azuki

Despite the bearish trend, Azuki still performs impressively. This project’s strong resilience is due to a series of strategic measures, including frequent events, dynamic cooperation with IPX, and a strong community. Although the number of holders has decreased slightly, its market value continues to soar, and whale investors have also increased. These phenomena also reflect the power of followers. Compared to sales, the project has many transfers, and the high-value transfers have skyrocketed. This is a representation of the diamond hand mode, representing that the project is considered to have long-term value. Essentially, Azuki’s counter-trend rise not only reflects its strong market position, but also its vibrant community and strategic cooperation, which will continue to drive its development.

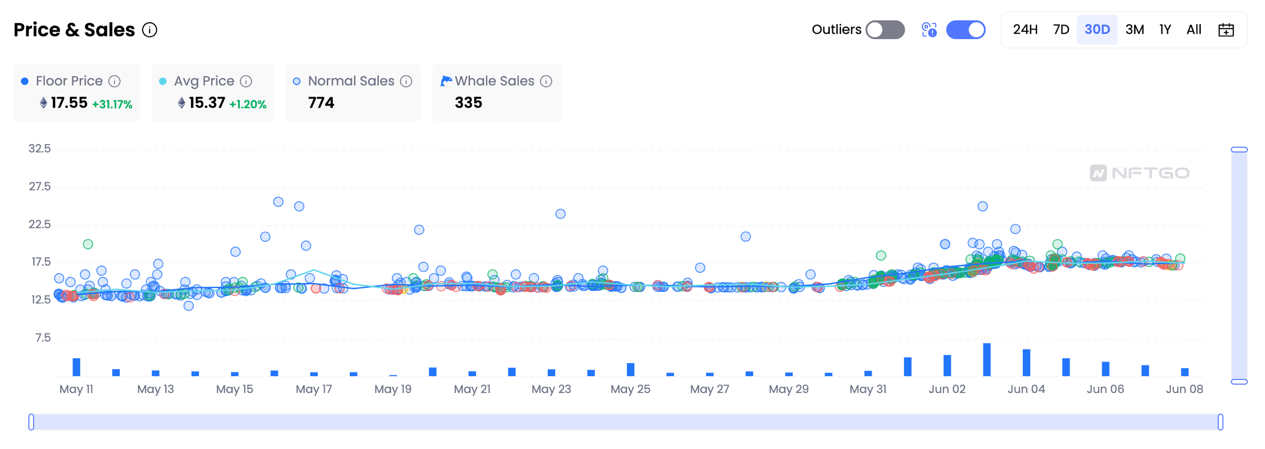

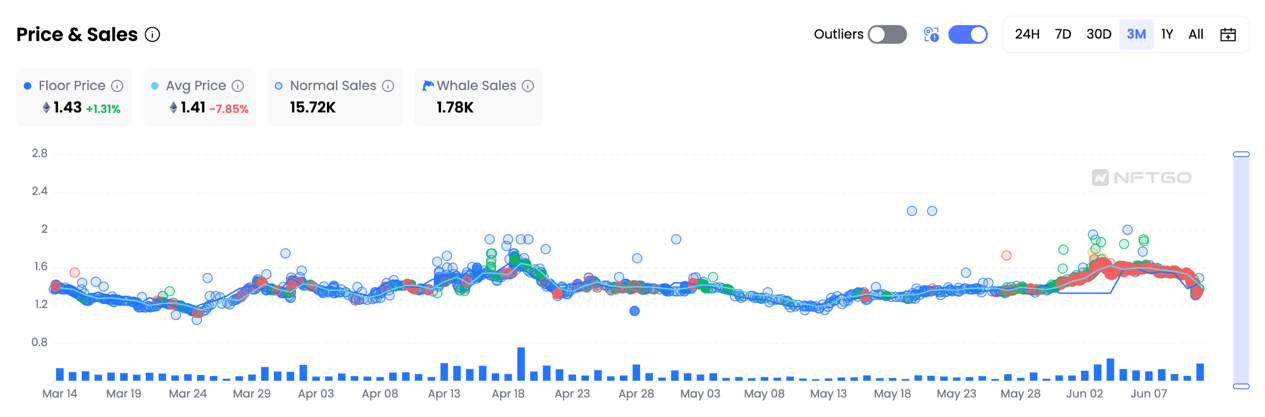

Price and Sales: Balance participation to promote stable growth of the project

Azuki’s recent market performance is stable and continuously growing, especially with last month’s floor price rising from 13.34 ETH to 17.54 ETH, a growth of 31.38%. In addition, the average price has reached a new high for the year, marking an important milestone for Azuki. There was a slight fluctuation on May 17th, but the overall trend remains positive. The average price has risen 28.6%, from 13.6 ETH to 17.49 ETH. The number of transactions initiated by bulk trading in the market is also a key indicator of the Azuki market dynamics.

Interestingly, the number of whale buyers and sellers has remained fairly balanced, indicating stable market conditions and no obvious manipulation pressure. In addition, the fact that both buyers and sellers are whales is extremely rare, proving that the Azuki market is not only dominated by heavyweight investors, but also has collectors from all walks of life actively participating. This positive market performance is due to Azuki’s consistent brand growth strategy and community planning. All these factors combined not only effectively sustain the interest of existing collectors, but also attract new participants to join the Azuki NFT market.

Market Cap and Trading Volume: Azuki’s Market Cap Breaks Out with Active Marketing as Trading Activity Stagnates

For the past three months, the market cap of Azuki has been growing in oscillations. Most notably, from May 29 to June 1, the release of extra tickets for the highly anticipated “Follow the Rabbit” Las Vegas event seemed to have a positive impact on investor sentiment, causing the market cap to reach a historical high of 177.77K ETH. Even after a slight dip, the current market cap is still at 175.55K ETH, reflecting an overall increase of 21.66%.

However, it is worth noting that despite the significant increase in market cap, the total sales volume for the past month is relatively lower than the previous months. This may indicate that while investors are optimistic about the value of Azuki, trading activity has somewhat plateaued. This could also be related to the Las Vegas event – even with high expectations, investors still want to see results before further trading.

In summary, the market cap and sales volume trends suggest that Azuki’s strategic partnerships and activity-driven marketing are positively influencing investor sentiment and promoting the overall market strength of the project. This reinforces the brand’s prominent position and further growth potential in the NFT space.

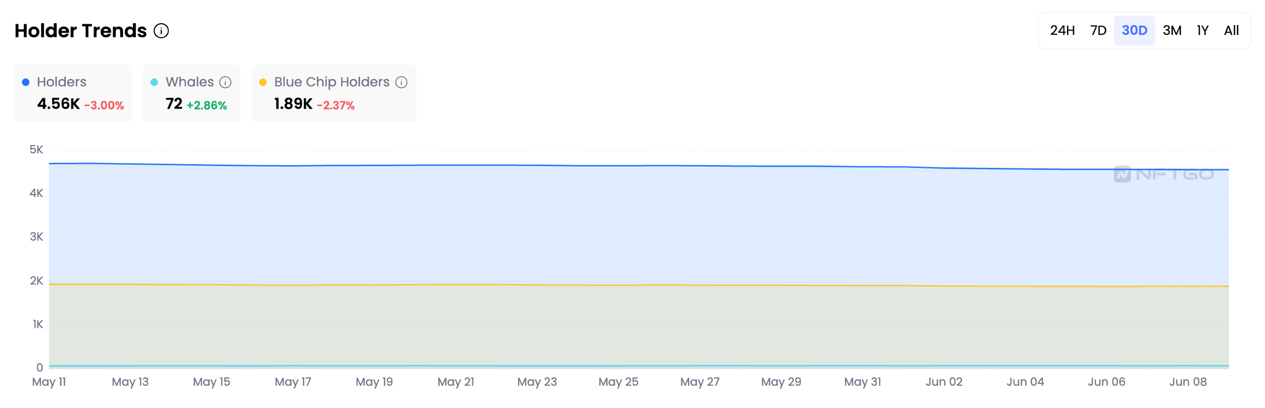

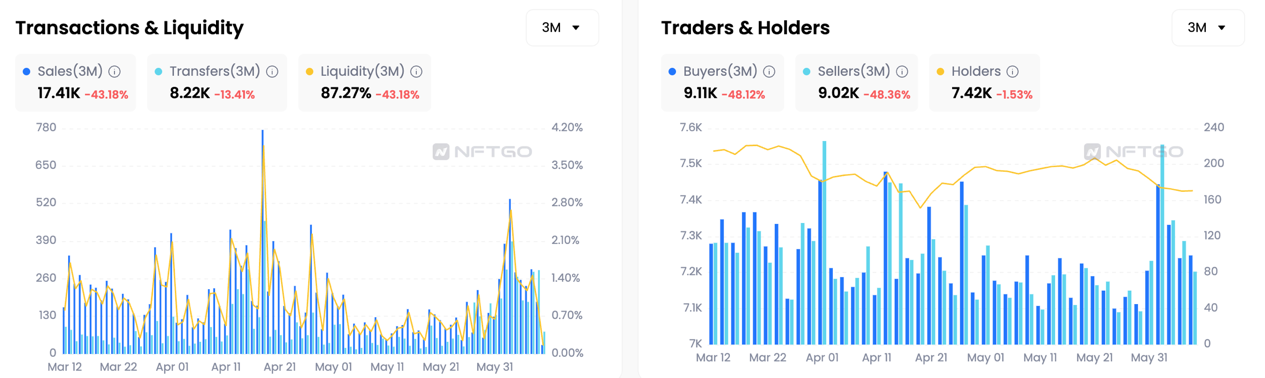

Trading, Liquidity, and Holders: Loyal Community and Whale Confidence are Sources of Azuki’s Market Resilience

In the past month, Azuki’s ecosystem has presented an interesting trend – although liquidity has decreased compared to the previous three months, the number of transfers has always exceeded the number of sales. This not only demonstrates the strong sense of unity within the community, but also indicates the diamond-hand mentality of Azuki holders. They hold their assets long-term and expect long-term value. This mentality may have been influenced by the “Follow the Rabbit” event.

At the same time, the number of holders decreased slightly by 1.97%, while the market cap increased significantly by 21.66%. This counterintuitive phenomenon suggests that although the number of participants has slightly decreased, the remaining holders have increased their bets, driving the increase in market cap. This is consistent with the observed 2.86% increase in the number of whales.

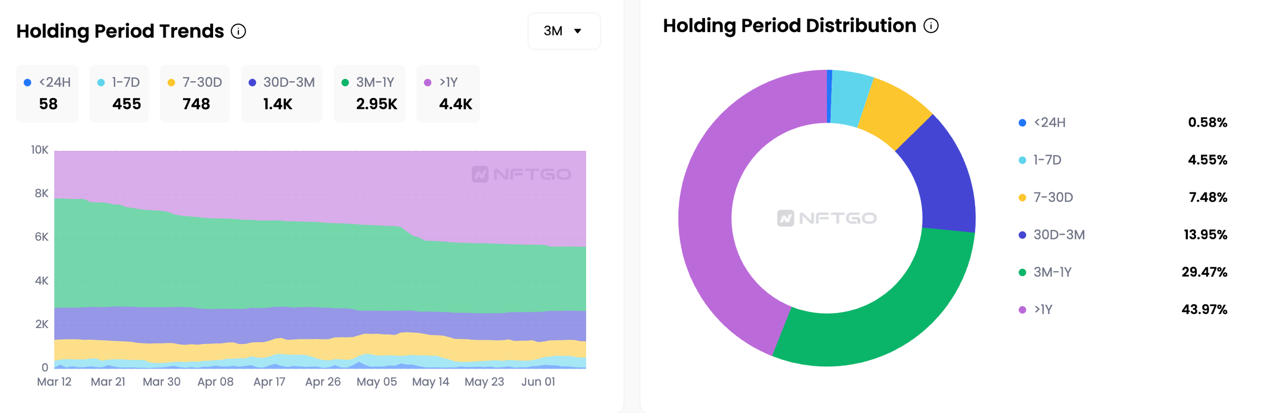

In the past three months, the number of people holding Azuki for more than a year has steadily increased, while the number of people holding for three months to a year has decreased accordingly. From a data perspective, the number of NFTs held for more than a year has seen a staggering increase of 100.36% – from 2.1K to 4.4K NFTs. Meanwhile, the number of NFTs held for 3 months to a year has dropped sharply by 41.37%, from 5K to 2.9K.

This almost equal transfer from a shorter holding period to a longer holding period reveals an interesting trend: many holders who held for 3 months to a year did not choose to sell, but decided to continue holding, thereby entering the range of holding for more than a year. This indicates that people have strong confidence in Azuki’s long-term value and growth potential, and also reaffirms that Azuki’s community is not just investing for short-term gains. They seem to have a long-term view of development and have deep trust in Azuki’s roadmap and the project team’s strategic decisions.

Essentially, Azuki’s ecosystem is a loyal and optimistic community. Despite the fluctuations in the market, they still firmly believe in the potential and strategy of Azuki, and are full of expectations for the bright prospects of the project.

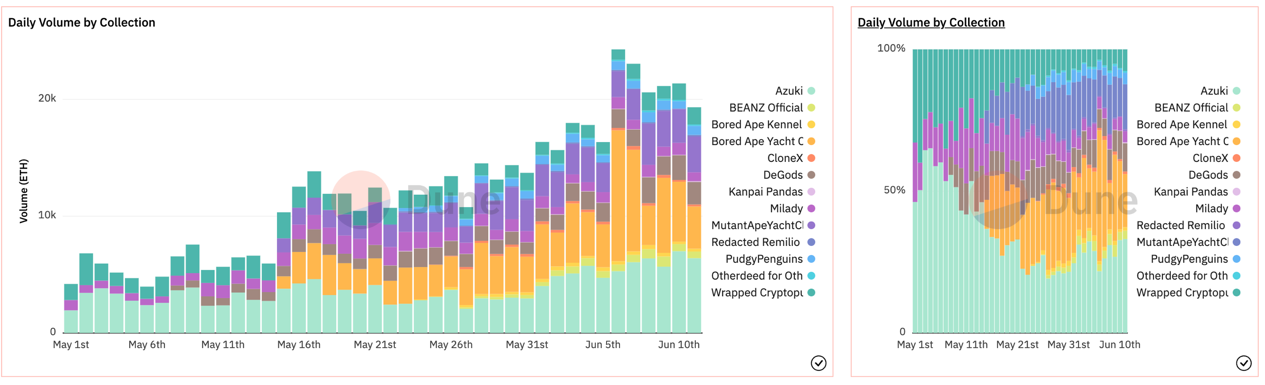

Trading Platform: Blur Becomes the Main Trading Platform for Azuki NFTs

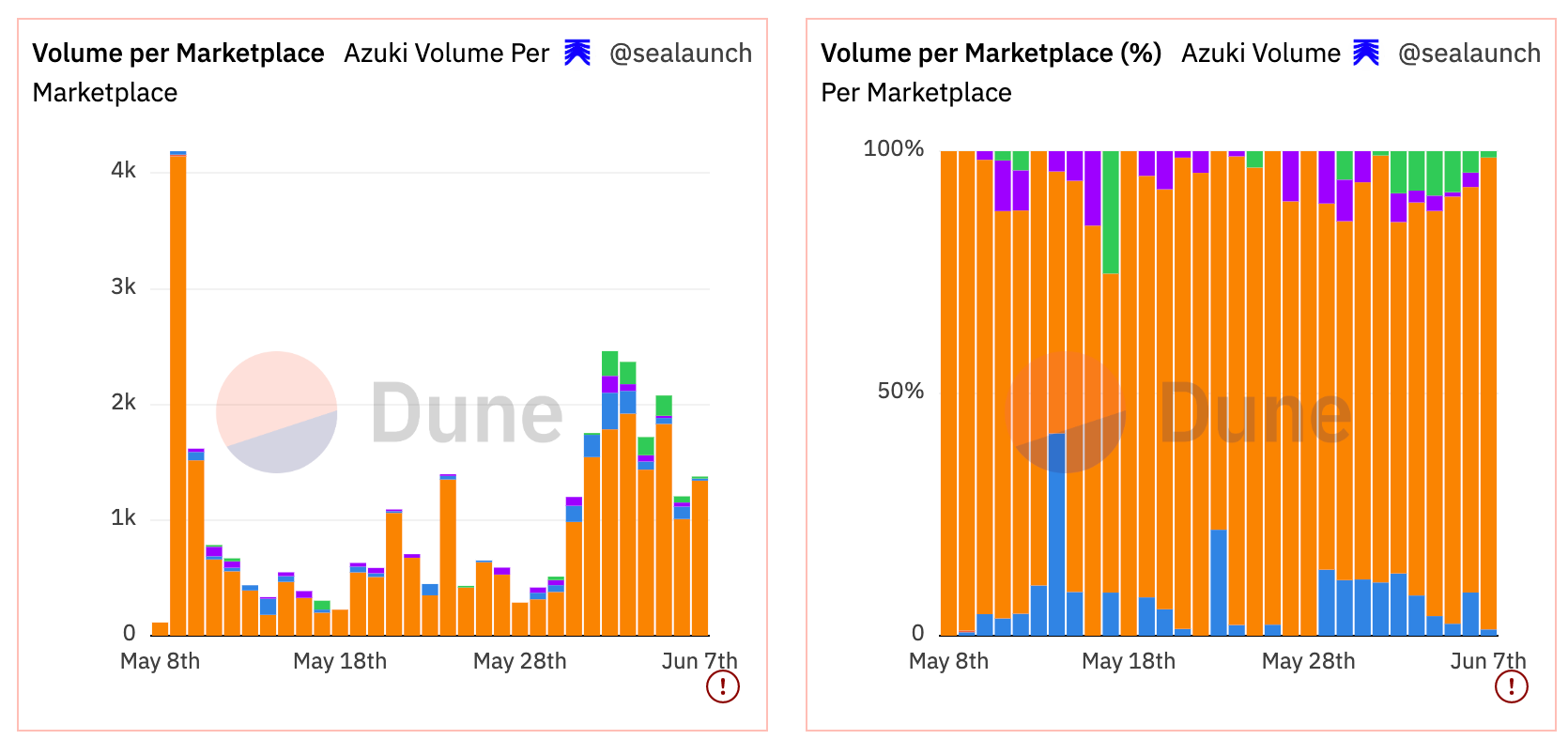

According to data from Dune Dashboard @sealaunch, it is obvious that the Blur trading platform has become the main market for Azuki transactions. There are several reasons for this:

First, the Blend (Blur Lending) function of Blur allows traders to maximize the liquidity of their NFTs. Given the high price of Azuki NFTs, this feature provides a powerful advantage for new collectors who recognize the huge potential of the Azuki project. Blend allows buyers to pledge their tokens, creating a more flexible trading environment.

Secondly, the fact that Blend does not charge a copyright fee is also attractive to traders. In contrast, Blur charges a 0.5% copyright fee for each transaction. Taking these factors into account, Blend is more cost-effective.

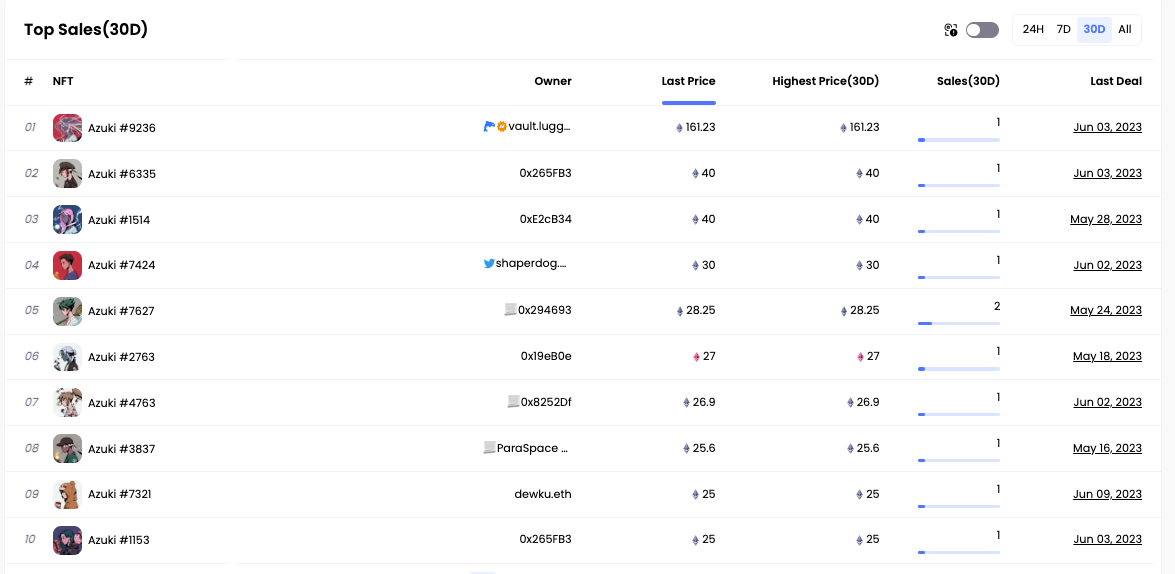

Furthermore, Blur is seen as a high-value trading platform, a view that is actually supported by the platform’s strong sales data. Azuki #9236 is an example of this, as the NFT sold for as much as 161.2345 ETH on Blur. This successful sale broke records and further solidified Blur’s reputation. New collectors flocked to the platform, raising Azuki’s overall position in the NFT market.

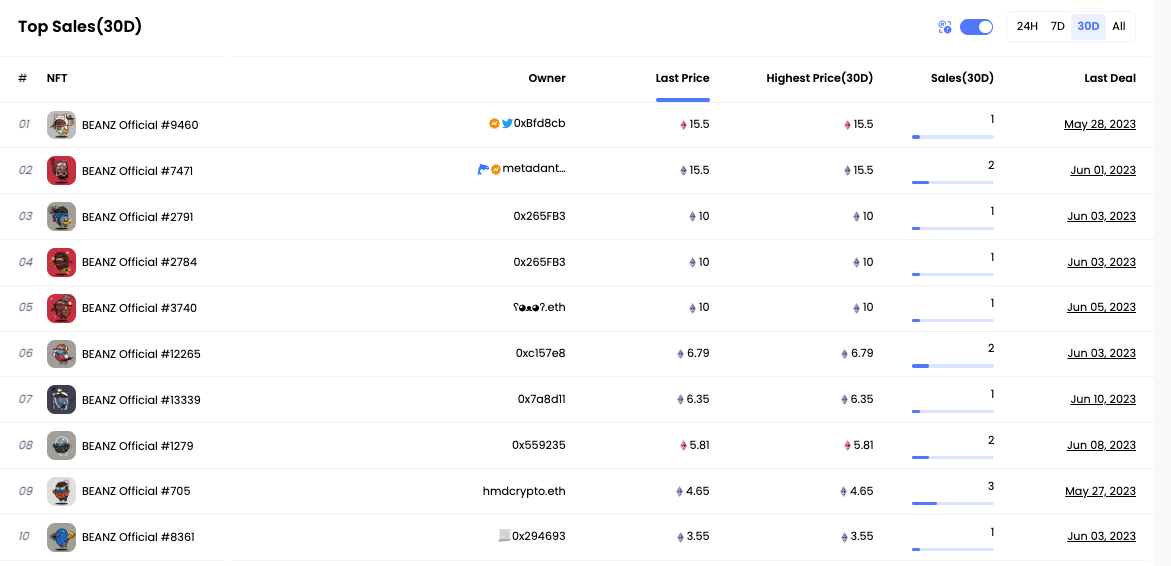

Sales ranking

BEANZ

Lowering the barrier to entry and improving Azuki universe’s market performance

In Azuki’s world, BEANZ is a competent partner, and it is a more cost-effective alternative. The number of BEANZ NFT collectors has increased significantly, mainly because they are much cheaper than Azuki, greatly lowering the barrier to entry into the Azuki universe. The strategic partnership with LINE FRIENDS has spawned BEANZ IP and characters such as “Jay” and “Jelly,” expanding BEANZ’s population coverage. This cooperation has allowed millions of new consumers to get in touch with BEANZ, driving a significant increase in the user base and opening up new sources of revenue through commodity and activity cooperation.

Once the partnership was announced, trading volume immediately increased from 143.32 ETH to 679.29 ETH, a 373.97% surge. Another notable period of trading volume growth occurred on April 18 when the official announcement was made that the “Follow the Rabbit” event for Azuki registration could be accessed through wallets holding Azuki or BEANZ tokens. Participants naturally opted for the more affordable BEANZ, resulting in trading volume skyrocketing from 256.58 ETH to an astonishing 1289.19 ETH, a growth of 402.45%. This trend pushed its trading volume and market value to a three-month high.

Interestingly, after the first whale trade on May 27, there was a brief period of whale buying, followed by a large number of whale sales. As a result, after a period of low liquidity in early May, BEANZ’s liquidity began to oscillate at a higher level. Despite a relative decrease in holders, the market value remained at its highest level in nearly three months.

Sales Ranking

Azuki and BEANZ’s Lending Journey

From Azuki’s lending volume on the Blur platform, it can be seen that in the past month, Azuki’s lending volume has been near the peak of the market and has even shown a fluctuating increase. Since May, Azuki’s lending volume has witnessed a significant surge from 3437 ETH to 6408 ETH, a strong growth of 86.44%. This trend indicates that the demand for Azuki NFTs in the market is constantly upgrading, consolidating its position as a strong competitor in the NFT ecosystem.

In early May, Azuki’s daily lending volume on Blur performed well, accounting for over 50% of the total lending volume. Although it has slightly declined since then, it has remained in the top three in the market and its trading volume share has stabilized at 20 to 30%. This consistency not only gives Azuki holders enough confidence but also enhances the attractiveness of the Azuki and BEANZ project to potential collectors, while also increasing their market visibility. This trend shows the strength of Azuki and BEANZ in adversity and also makes the outside world aware of their potential for continued growth.

Azuki Trading Signals

Probability of Rise and Fall (NFA)

RSI Strategy: A trading signal designed based on the relative strength characteristics of RSI buy and sell signals. Signals below the volatility range indicate buying, while signals above the volatility range indicate selling. The greater the deviation, the stronger the signal.

Azuki Pricing and Listing

Finding potential NFTs is where opportunities lie.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Office of the New York Attorney General Provides Tether-Related Documents in Response to CoinDesk

- How should investors hedge their risks during the “storm” of encryption?

- Uniswap v4: What’s Next for the Top DEX?

- Evening Reading | USDT Faces Serious Selling Pressure: Are Market Makers Exiting?

- Is USDT facing severe selling pressure due to market makers exiting?

- How can the development path centered around application chains avoid the pitfalls of Polkadot and Cosmos?

- How can we participate in interactions now that the re-collateralization agreement EigenLayer has officially launched on the mainnet?