Head DEX protocol iZUMi Finance on ZkSync: based on UniSwap V3 improvement, creating a new DL-AMM mechanism

iZUMi Finance on ZkSync is introducing a new DL-AMM mechanism based on UniSwap V3 improvements for Head DEX protocol.Author: Biteye Core Contributor JoJonas

Editor: Biteye Core Contributor Crush

More than a year and a half after the release of Uniswap V3, its concept of “aggregated liquidity” has become commonplace among users.

Currently, the analysis data provided by Uniswap’s official website shows that V3’s TVL is about three times that of V2, and its daily trading volume is more than 10 times that of V2.

- Weekly Preview | ACDE Conference may determine the scope of Cancun upgrade; Tokens of projects such as Avalanche and RON will be partially unlocked

- Quickly learn about 18 new projects in recent times: DeFi, games, and tools

- Recap of ETHGlobal Lisbon Hackathon: Quick Look at 5 Promising New Projects

Concentrated liquidity allows users to actively choose the price range at which they provide liquidity, significantly improving the LP capital efficiency of V3. However, it has not changed the constant product formula that defines LP, that is, impermanent loss still exists and is relatively amplified as capital efficiency improves;

User transactions still have slippage and are vulnerable to sandwich attacks. From a user’s perspective, limit orders are a more familiar and advantageous way of trading, but V3 does not yet provide them.

Uniswap V3 actually already has the concept of price ranges, and the liquidity of each range is defined based on the upper and lower limits of the range, as shown below:

Since LPs cannot track market price changes in real-time, once the price exceeds the selected range, LPs will become single-currency liquidity, which means a loss relative to the current market price.

In tracking market prices, institutions and professional investors obviously have an advantage; a recent data analysis shows that investors providing liquidity to Uniswap V3 are overall in a loss state, and the transaction fee has not exceeded the impermanent loss.

https://twitter.com/thiccythot_/status/1589022227437039616

Do AMMs really have to stick to the xy=k formula to the end? Recently, the author noticed a new AMM design concept, which is shared here.

01, iZUMi’s DL-AMM model

The DL-AMM model comes from the iZiswap in the iZUMi product matrix. The design concept was first proposed in a paper published by two co-founders of iZUMi in November 2021.

https://assets.izumi.finance/paper/dswap.pdf

This paper proposes an innovative algorithm for Uniswap V3’s shortcomings and has the following features:

1. Discretized Concentrated Liquidity (DL-AMM)

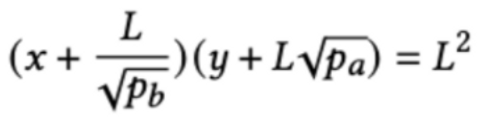

DL-AMM does not use a constant product formula. Instead, liquidity is placed at discrete price points, each of which follows a constant sum formula (x + y = L). Countless discrete price points are connected to form a complete AMM price curve similar to Uniswap’s. At the same time, when placing interval liquidity, DL-AMM uses a new “liquidity” quantification definition (L = x*√p + y/√p) to transform Uniswap V3’s integral sum into a geometric sum, which can be efficiently completed in constant time.

2. Grouped Limited Liquidity

In DL-AMM, liquidity will be divided into two categories: LP liquidity, and limit order liquidity. The former is the same as V3, while the latter is one-way. Once the target price is exceeded, the token will not be exchanged and will be retained until the user “claims” it. If the liquidity within a group has not fully exceeded the target price, “claims” follow a first-come-first-served principle. Traditional trading matching engines need to poll all orders at a price point. With innovative algorithm design, DL-AMM can complete matching in constant time for the first time, and ensure time correctness, fairness, and complete non-custodial security of funds.

Compared with Uniswap V3, DL-AMM proposed by iZUMi avoids transaction slippage at each price point by applying a constant sum formula at different discrete price points, and achieves on-chain order book functionality by combining discrete price points (and liquidity depth based on this). Later comers such as TraderJoe’s liquidity bin are based on DL-AMM’s design.

DL-AMM model introduction, source: https://izumi.finance/paper/dswap.pdf

The figure shows the constant sum formula used by DL-AMM, where different discrete price points correspond to different (p, L). The LP curve (yellow line) and Uniswap’s blue line (constant product formula, xy=k) have different final effects, as shown in the left figure.

It can be seen that if the price interval is dense enough, the yellow line can approach the blue line infinitely, and there is no difference between the two in actual trading experience and operational experience.

The right figure shows DL-AMM’s support for limit orders. Limit orders will be provided as a special LP (single currency), together with ordinary LPs to provide liquidity, which brings limit order function to iZiswap, which Uniswap cannot achieve.

DL-AMM has expanded the potential of Uniswap V3’s limit order function and provided a complete on-chain order book function through several clever improvements. And based on the on-chain order book of iZiswap DL-AMM, it can perfectly avoid the technical difficulties encountered by traditional thinking, providing a new development direction for it.

iZiswap was launched on May 20, 2021, and has undergone continuous iterations. The total value locked (TVL) of the entire chain is currently about 94.7 million US dollars.

iZiSwap Pro launched by iZUMi has an on-chain order book function for point-to-point pool matching (AMM mode); at the same time, zero-slippage and anti-MEV decentralized limit orders are also refreshing.

We’re proud to present the revolutionary #iZiSwapPro, a fully on-chain order book exchange embedded with AMM. COMING 🔜

✅New UI

✅Limit Order

✅Trade with NO SLIPPAGE

✅100% Decentralized & Transparent, Funds are #SAFULearn more https://t.co/hb4st098y8#DEXRevolution pic.twitter.com/vAJNVSmL7P

— iZUMi Finance | Token2049 🇸🇬 (@izumi_Finance) December 15, 2022

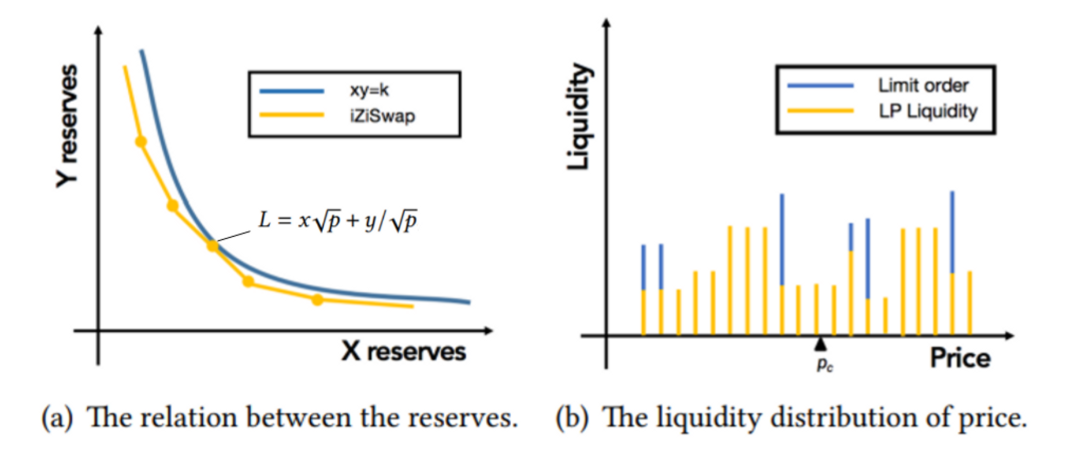

iZiswap has successively launched on multiple chains such as BNB chain/Arbitrum. Since its launch on ZkSync on April 21, it has become the DEX with the largest TVL on ZkSync in just three weeks.

Data on iZiSwap on ZkSync

Currently, Ref Finance on Near and Arctic on Aurora both adopt iZiswap’s original DL-AMM solution. The former is the largest DEX in the Near ecosystem, with a peak TVL of 270 million US dollars.

02, Trader Joe’s Liquidity Book

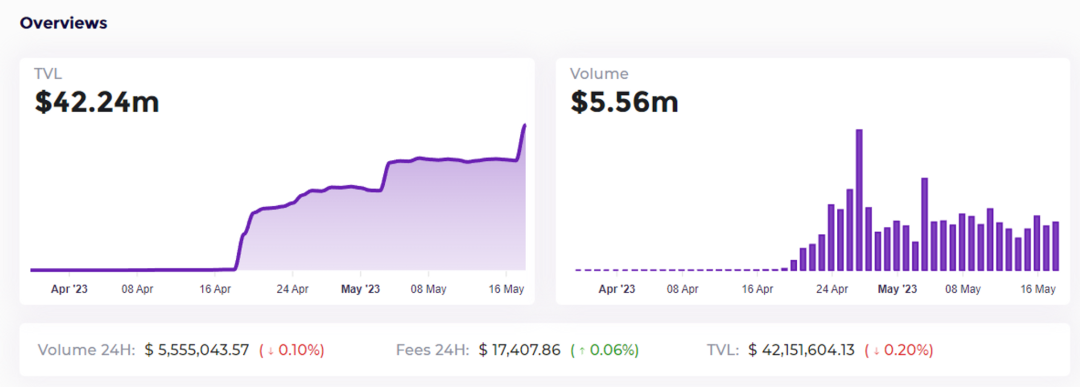

Traderjoe adopts the DL-AMM approach, and sets multiple discrete price bins (Liquidity Bin) for LP, and the LP in each price bin is also defined by the constant sum formula (as shown on the left in the figure below).

The liquidity in each price bin is provided by multiple users. Taking c as the proportion of token Y in the price bin, it is easy to see that only the current market price is in the price bin c between (0,1).

For the price bin with a price higher than the market price, its liquidity is composed of token Y (c=0); for the price bin with a price lower than the market price, its liquidity is composed of token X (c=1).

So far, the design of Liquidity Bin is basically the same as that of DL-AMM, which can also achieve lower slippage.

On its official website, it also provides users with some liquidity addition strategies based on this, allowing users to freely match liquidity bins to achieve their own strategy combinations.

https://help.traderjoexyz.com/en/trader-joe/liquidity-book/liquidity-strategies

For example, the “Bid-Ask” strategy in the following figure:

To further reduce impermanent loss, Liquidity Bin has designed a trading fee mechanism that is associated with price volatility.

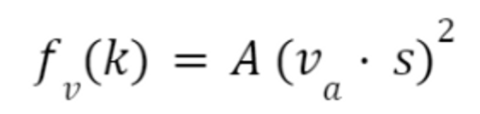

In addition to the basic fee component that is the same as traditional mechanisms, the trading fee includes a variable fee component (as shown in the formula below).

This fee component has a quadratic relationship with the volatility accumulator (v_a) (s is the price bin length). The v_a is used to measure the degree of price volatility. If the price fluctuates too rapidly in a short period of time, the variable fee will increase correspondingly to reduce impermanent loss through stable fluctuations, and attract liquidity when volatility is too low.

The Liquidity Book can be seen as a combination of iZUMi’s DL-AMM ideas and dynamic fees. Its core still lies in replacing the constant sum formula of discrete price points with the constant product formula of the entire system, but it currently does not support the Limit Order function.

Since the advent of Uniswap, xy=k seems to have been the “bible” of the AMM field because of its simplicity and effectiveness.

Due to the shortcomings of the xy=k formula, many teams have begun to explore new possibilities. The DL-AMM model proposed by iZUMi is one of the practical and elegant solutions.

It can not only support the trading depth and experience of the original xy=k model, but also reduce slippage and MEV, and bring new functions such as on-chain order books.

It is believed that there will be more innovations based on DL-AMM to add richer liquidity adding strategies to the chain, and the emergence of new applications (such as user-friendly on-chain order books) will lay the technical foundation.

Will DL-AMM be the future? Let’s wait and see.

Reference

[1] https://Uniswap.org/whiteBlockingper-V3.pdf

[2] https://docs.izumi.finance/

[3] https://assets.izumi.finance/paper/dswap.pdf

[4] https://defillama.com/protocol/ref-finance

[5] https://help.traderjoexyz.com/en/trader-joe/liquidity-book

[6] https://github.com/traderjoe-xyz/LB-WhiteBlockingper/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Token issuance of Sui’s ecological project faced setbacks including token unlocking delay and team unlocking, resulting in a difficult start.

- Listing 10 low-market cap LSD-fi projects:

- The absurdity in the Meme season: me, Ben.eth, sending money

- NFT as a wallet: What innovations will the new standard ERC-6551 bring to NFTs?

- Where’s the next opportunity? A review of the potential projects that will issue tokens on the Sui blockchain.

- Overview of Bitcoin DeFi ecosystem projects

- Project Research | Aptos In-Depth Study Report on MOVE’s New Public Chain