Enhancing user experience, reducing interaction steps, how can ‘intent-based transactions’ support the next wave of Web3 narrative?

How can 'intent-based transactions' support the next wave of Web3 narrative?Original title: Powerful Intents: LianGuairt 1

Original author: Mike Calvanese and the team at Brink

Original translation: Luccy, Joyce, BlockBeats

This is part 1 of a 3-part series on Intents written by Mike Calvanese and the Brink team.

- Wreck League Research Report Bored Apes Teams Up with Animoca to Create a 3A-Level PVP Fighting Blockchain Game

- Analyzing Friend.Tech from First Principles

- Attracting 100,000 users in a month and ranking third in terms of protocol income, how much longer can the decentralized social application Friend.tech stay popular?

Intents are spreading rapidly, and they are one of the many user experience improvements achieved through account abstraction. They are also a hot topic discussed by Vitalik in his speech at EthCC. Intents allow users to define the on-chain outcomes they expect and outsource the technical work to third-party solvers that interact directly with networks and protocols. In the end, the abstraction layer will make Web3 applications look like regular applications. It reduces the existing learning curve and will attract millions of new users.

The shift towards the Intents paradigm means that future users will no longer need to worry about things like submitting transactions, paying gas fees in ETH, mitigating MEV on AMMs by setting slippage limits, or bridging assets between networks.

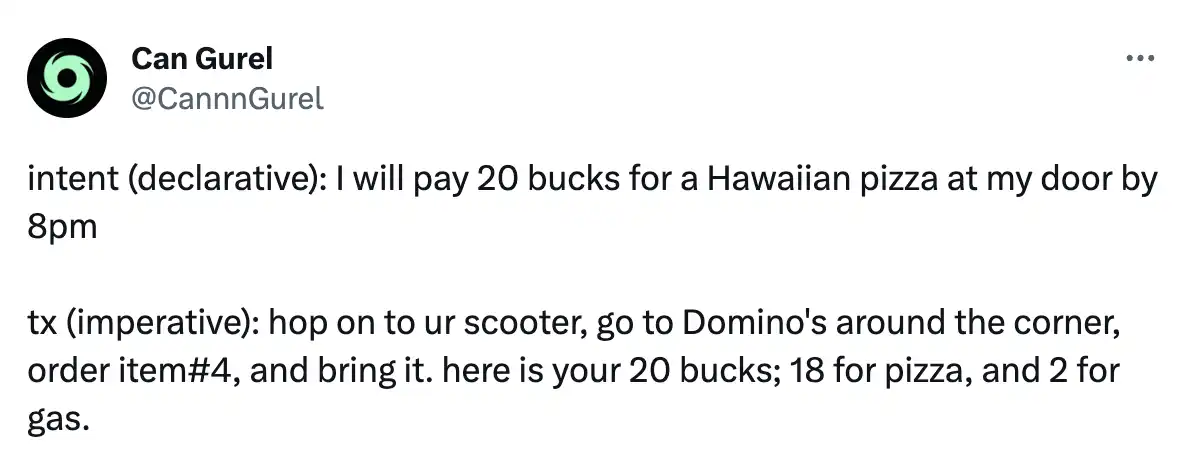

A simple way to understand Intents is to see them as declarative expressions of what users want to happen, rather than imperative steps on how to achieve something.

https://twitter.com/CannnGurel/status/1663292583550803969

Current Intents

Intents are not a new concept.

Prior to the emergence of Uniswap and AMMs, Ethereum projects like EtherDelta and 0x provided order books based on Intents. NFT markets have been using signed Intents for years to place and quote NFTs, and updated systems like CoW Swap and UniswapX now offer more advanced Intents-based infrastructure for ERC20 limit orders.

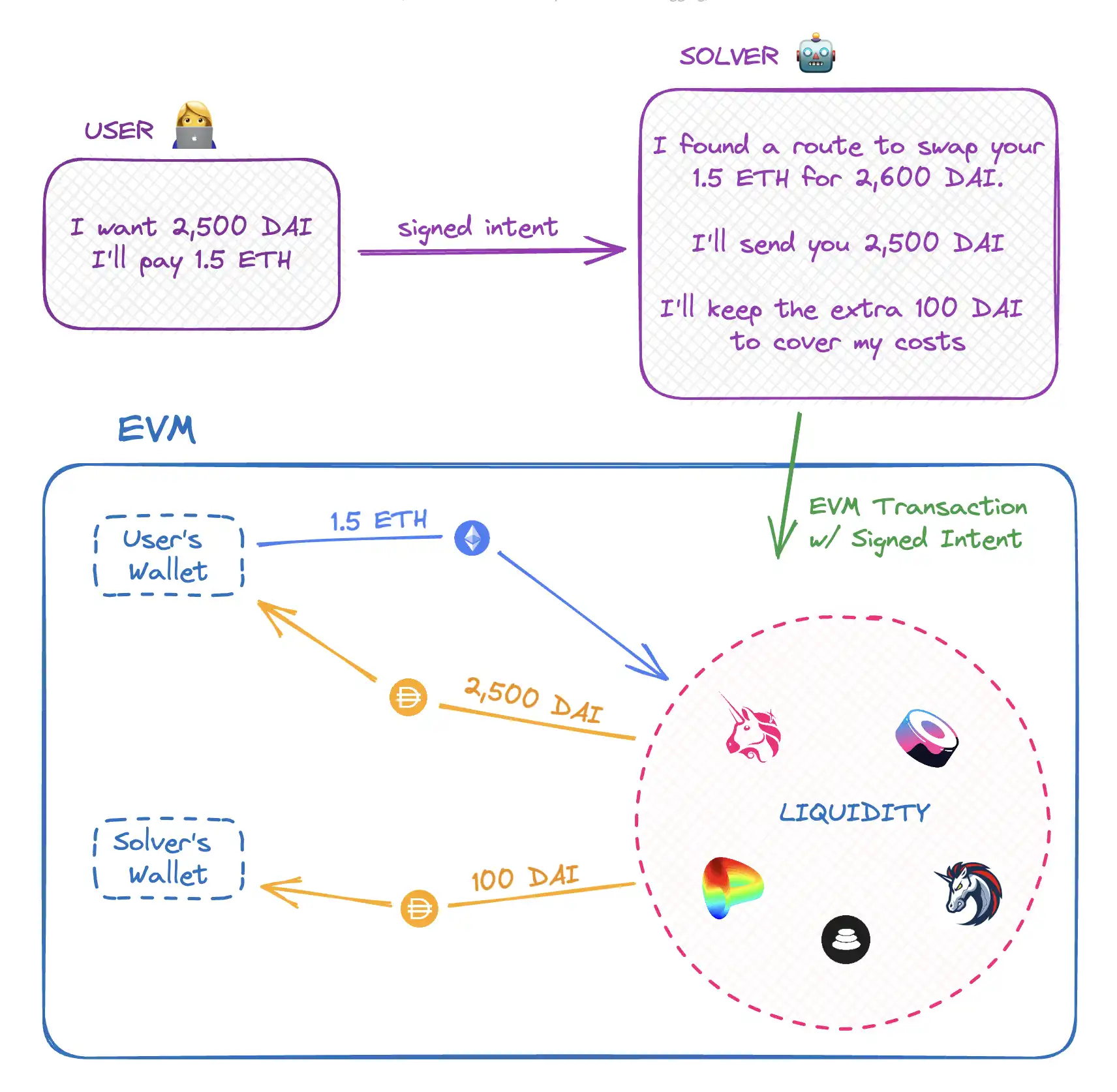

Looking at the current landscape, the word “Intents” seems synonymous with “limit orders” because the only Intents widely supported in Web3 today are “I want X, and I’m willing to pay Y”. The architecture of limit order Intents is often simple and focused on one goal: exchanging at a more favorable price than the current market quote. Users sign their limit order Intents, and solvers search for paths to “fill” the signed Intents using AMMs, other liquidity sources, or in some cases, other Intents. Solvers have an incentive to find paths because they can keep the remaining portion as additional revenue once the user’s Intents are satisfied.

Limit order Intents architecture

Many systems have already been established to support scenarios where limit order Intents are used, but as more advanced Intents tools are developed, we will see more generic architectures that enable more powerful use cases.

Some examples of general Intents systems include Anoma and Flashbots SUAVE, which are currently under active development. They will provide the Gossip layer of Intents, where users broadcast signed Intents to Gossip nodes. These chains will be specific to Intents, facilitating the connection between users signing Intents on different networks and solvers executing them.

Another example is Brink, a solution for creating composable Intents. Brink allows users and developers to build, sign, and settle Intents based on conditional states across multiple EVM-compatible networks.

The Future of Intents

Let’s explore several ways in which Web3 Intents can go beyond simple limit orders and introduce some new concepts:

Conditional Intents: allowing the execution of an action when one or more conditions are met

Sequential Intents: expressing the desire to take repeated actions

Multi-step Intents: opening one or more new Intents when resolving an Intent

Intents Graph: a path formed by a set of related Intents

Conditional Intents

Current Web3 applications have only one type of conditional Intents: limit orders. In the future, we will have Intents composed of any number of conditions from any state, resulting in various operations.

If you are a Web3 user, you have made many conditional decisions in the past that can be expressed as Intents, signed, and delegated to third-party solvers, such as:

Price Threshold: “If the price of A/B is lower than X, swap B for A”. In traditional finance (trad-fi), this is called a “stop-loss”.

Governance Decision: “If a governance proposal that I don’t support passes, sell token A”.

Wallet Balance: “If my hot wallet ETH is insufficient, transfer more ETH from my cold wallet to my hot wallet”.

Elapsed Time/Number of Blocks: “If more than X blocks have been mined, transfer ETH to the recipient”.

All of these can be signed as a single Intent. Solvers will monitor these Intents and take action on behalf of the user when the conditions are met. Users sign these conditions, and as part of their Intents, they force solvers to check the on-chain state to prove the condition.

Intents can be expressed with any number of conditions, for example:

I want to buy 2 ETH with DAI when the following three conditions are met: 1) ETH price is below $1,750; 2) the average DAI yield for lending ETH is high; 3) a whale wallet I’m following has purchased at least 10 ETH in the last 24 hours.

When a complex state condition is met with any number of conditions, users will be able to express Intents to buy, sell, stake, transfer, or bridge assets, all with just a single signed Intent.

Sequential Intents

Intents will provide a protocol-agnostic way to execute sequential actions. While today’s Intents typically involve a single signature corresponding to a single operation (limit order), we will soon see the emergence of sequential Intents.

Users take continuous actions today by depositing funds into protocols or exchanges. Here are some examples:

Cost averaging: “Buy ETH with DAI at market price once a month.” Users typically use CEX platforms like Coinbase to accomplish this task.

Yield compounding (also known as re-staking): “Withdraw rewards from A, swap them for B, and then re-stake.” This is a cumbersome process involving multiple transactions and interactions with multiple DeFi protocols.

Hot wallet replenishment: “I have a cold wallet with 50 ETH. Whenever my hot wallet ETH balance falls below X, transfer Y ETH from my cold wallet to my hot wallet.” This requires multiple independent transactions.

Payment streaming: “Transfer X USDC to the receiving address every two weeks.” Streaming payment applications support this but require users to deposit assets into smart contracts.

Market-making: LP positions based on AMMs essentially follow the same pattern as two opposite swaps, which continue in an infinite loop: “When the price of A/B exceeds X, swap A for B; when the price of A/B is below X, swap B for A.”

From these examples, it can be seen that today’s continuous actions require users to deposit into specific protocols and submit many transactions. Through Intents, users can express their desired continuous actions with a single signature.

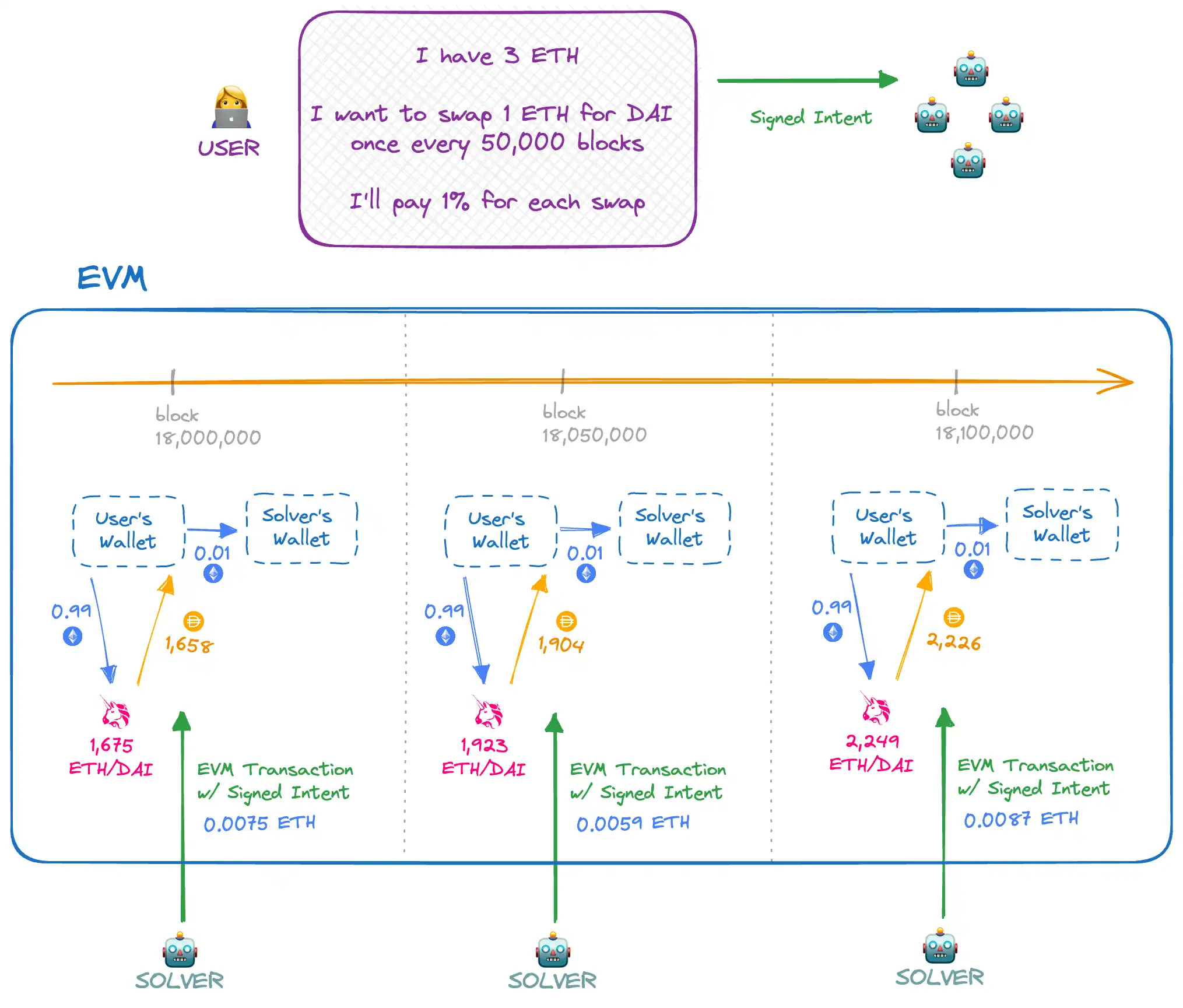

Cost averaging is a perfect example. Users intending to average costs (repeatedly buying or selling over time) can express it as a signature that allows exchanging 1 ETH for DAI at a price provided by an ETH/DAI TWAP oracle that is difficult to manipulate, every 50,000 blocks (approximately once a week on the Ethereum mainnet), with a fee of 1% (0.01 ETH). The solver will monitor this Intents and check:

1. Does the user’s account have 1 ETH available for exchange?

2. Has it been 50,000 blocks since the last exchange?

3. Is 1% (0.01 ETH) enough to cover the gas cost of the swap?

4. After the solver pays the gas for the swap, is there enough ETH left to cover the solver’s operational costs, which may include the risk of losing out on PGA (Priority Gas Auction) or any other fees? Is the potential profit worth it for the solver?

If all of these pass, the solver will send a transaction to fulfill the user’s ETH→DAI exchange Intents. As long as the user’s account has enough ETH, the solver can monitor the “cost averaging” Intents with a single signature and generate a continuous flow of transactions. Users can obtain what they want without directly interacting with the EVM network or specific protocols.

Cost-averaging Intents architecture

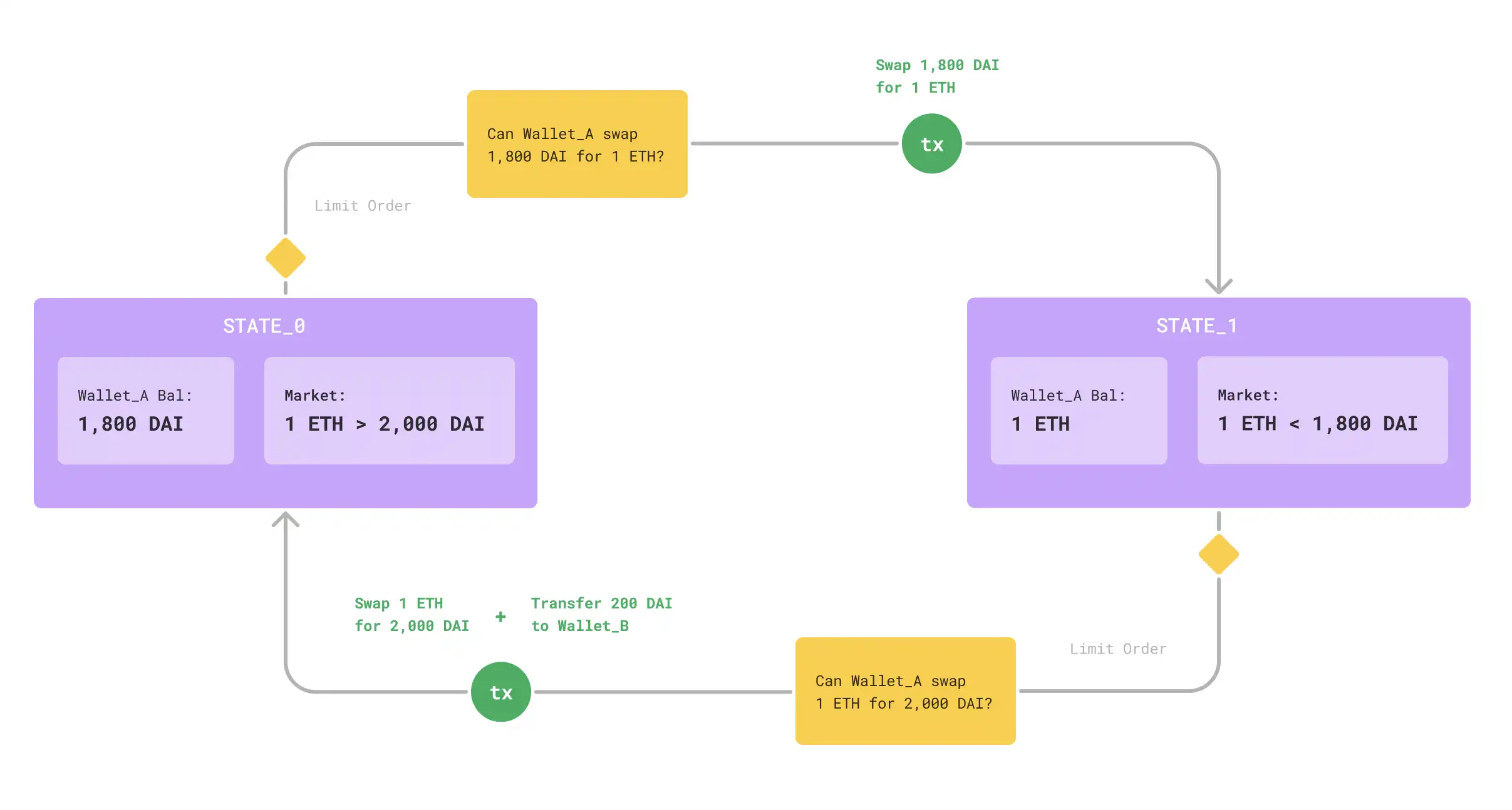

Using Intents for market making is another example of a continuous and potentially infinite operation that can be delegated to solvers. A user who wants to market make ETH/DAI may create an Intents that allows for the exchange of DAI→ETH at a price of 1,800 ETH/DAI or lower, and the exchange of ETH→DAI at a price of 2,000 ETH/DAI or higher. Through this Intents, the user attempts to lock in a profit of 200 DAI per trade when the market fluctuates between the price points of 1,800 and 2,000 ETH/DAI.

Market Making Intents

Think of it as two mutually exclusive limit orders, where one opens up when the other is executed, and vice versa. Users can sign a single exchange intent at each price point. As long as the market continues to fluctuate at these price points, theoretically, solvers can execute countless orders without any action required from the user.

Multi-Step Intents

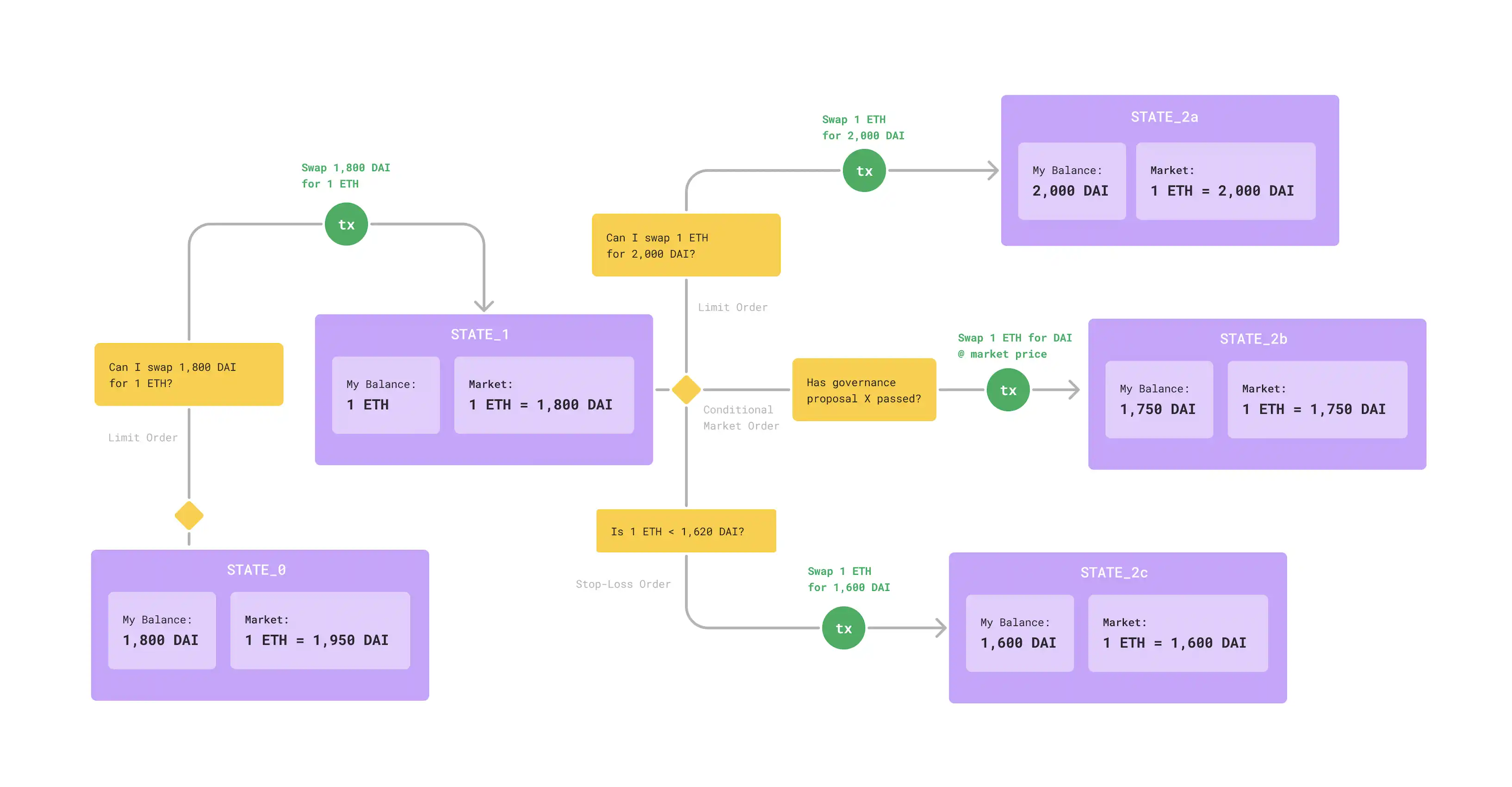

Intents can be composed of multiple steps. You can think of these intents as a state machine, where each trade transitions from the previous state to a new state, depending on the conditions defined by the previous state.

A simple example of a multi-step Intents is a classic traditional financial order arbitrage trade. These orders may vary in complexity, but simplified versions are common in traditional financial trading applications. With Web3 composability and multi-step Intents, we can perform very powerful order arbitrage trades.

A Web3 order arbitrage trade Intents can be expressed as: “I want 1 ETH and I am willing to pay 1,800 DAI for it. Once I have paid 1,800 DAI and acquired 1 ETH, I am willing to hold this 1 ETH until I can sell it at a price of 2,000 DAI. If the ETH/DAI price drops below 1,620 DAI, I want to sell this 1 ETH to minimize my losses, and in this case, I will accept 1,600 DAI and pay a 20 DAI fee to the solver. If I still hold this 1 ETH when [random governance proposal] passes, I want to sell this 1 ETH at the ETH/DAI price on the market and give the solver 10% of the proceeds.”

“Bracket Order” Intents

This is a relatively simple 3-step order with some condition triggers, but these types of orders can be much more complex.

Intents Chart

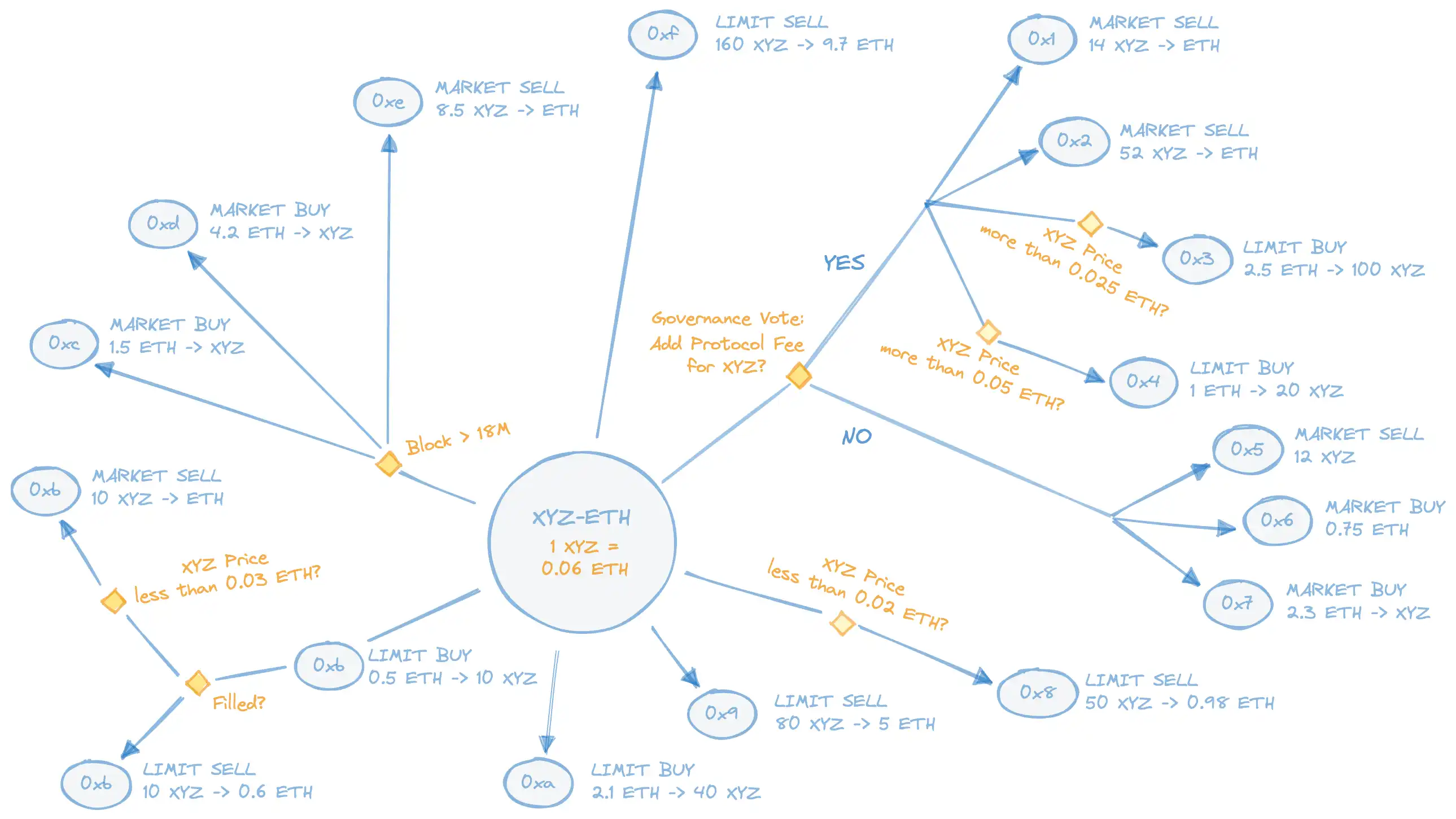

The relationship between different user Intents can form an Intents chart. These charts represent combinations of conditions and actions defined by users, resulting in exchanges, asset transfers, or other on-chain behaviors. All the previous Intents examples are essentially named arrangements of specific graphs.

Just as limit orders represent the current state of market liquidity, Intents graphs can represent not only the current state but also the liquidity under many different potential future states.

For example: Users trade XYZ and ETH in a fictional market. Intents are used to represent the buying and selling of XYZ under various conditions, such as the outcome of governance proposals, specific block mining, market price fluctuations, or whether other Intents have been fulfilled.

Intents graph for fictional XYZ-ETH market

This graph represents the liquidity that currently exists and the liquidity that could exist in future states. Intents graphs can span across markets or even across different chains.

Conclusion

With new developments happening every day, Intents is making progress.

References:

Decoding Intents: Revolutionizing the Web3 user experience and order flow in blockchain;

Architecture based on Intents and its risks;

SUAVE, Anoma, Shared Sequencer, and Super Builder.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- OPNX Development History Tokens soar by a hundredfold, becoming a leading bankruptcy concept?

- Weekly Announcement | OKX platform upgrades KYC process and recommends users to complete advanced authentication; Avalanche (AVAX) will unlock tokens worth approximately $100 million.

- LianGuai Daily | The SEC files a motion for intermediate appeal regarding the Ripple case; friend.tech completes seed round investment, with LianGuairadigm participating.

- Content Marketing Methodology A Required Course for Web3 Startups

- Regulatory crackdown, slowed growth, Binance suffers two major setbacks.

- DeBank plans to launch Layer2, and the wool party has already taken action?

- Mining myself, mining out a 50% annualized return? Interpreting the Ve (3.3) game hidden behind the emerging star RDNT in the borrowing and lending market