Injective, the pioneer of native chain order book.

Injective: pioneer of native chain order book.Author: Yilan, LD Capital

Public Chain Order Book Track Pattern

When it comes to DEX, most people immediately think of AMM, which is a very useful and key DeFi primitive mechanism. Although onchain LOB (on-chain order book) is criticized for its lack of LP ecology and regulatory arbitrage behavior of centralized exchanges on the chain compared to AMM, onchain LOB also plays an important role in the entire DEX track, especially for professional traders and institutions. It is an important sub-track of the DEX track.

Overall, order book exchanges can be understood in four types. The first one has excellent trading speed and throughput and other high performance, but is highly centralized CEX, which is the trading choice of most people in the market, such as Binance/OKX. The second one is the Ethereum L1 on-chain order book, such as Gridex, which achieves high decentralization. However, because the transaction is executed directly on the chain, the performance is limited and users need to pay high gas fees. The third one is the high-performance off-chain order book based on Rollup, which matches off-chain to reduce gas fees and batch processing settlement on-chain to ensure security, such as dYdX v3, Vertex, Zigzag, etc. ETH L2 Base recently called on onchain order book DEX to become part of its ecological fund and deployed in its ecology. The development of each L2 will provide a good development soil for onchain order book. The fourth type is high-performance DeFi native chain/customized chain that meets the high-performance needs of orders, such as Injective and Sei, which have not yet launched their mainnet, dYdX V4, etc.

In the fourth type of DeFi order book native chain, in addition to typical projects including Injective, dYdX V4 being tested, SEI, there are also Osmosis, Kujira, and Crescent, etc. Currently, DYdX and Injective are the ones that have grown to scale, benefiting from the Ignite consensus framework (formerly Tendermint, a proprietary Byzantine fault-tolerant BFT PoS infrastructure), IBC, and customizable SDK’s special construction. Almost all order book native chains are built on the Cosmos ecosystem, but Injective is the pioneer to build an on-chain order book on Cosmos.

- Bored Ape suffers from losses and is forced to sell, aristocratic holders become big losers

- Cross-chain vs Multi-chain

- Arkham Product Performance, Financing Status, and Investor Expectations

This article mainly introduces Injective in the DeFi order book native chain, focusing on the core advantages and moats of the public chain order book DEX and the competitive situation, and whether Injective’s fundamentals have an advantage.

Injective is an L1 blockchain optimized for DeFi and interoperability. In fact, prior to announcing its integration with Cosmos, Injective was also seen as an Ethereum L2/sidechain, but with a consensus layer and sovereignty on Cosmos, Injective became a plug-and-play financial infrastructure that covers high-performance on-chain decentralized exchange infrastructure, decentralized bridging, oracles, and composable smart contract layers with CosmWasm. Other protocols in the ecosystem can use Injective’s on-chain order book to launch liquidity and matching services, adding a layer of composability.

Injective leverages the high finality and low transaction costs of Cosmos Tendermint/Ignite, SDK and IBC technology components to support its order book functionality and further enhance capital efficiency and liquidity segmentation while maintaining interoperability with Ethereum. Using an FBA (Frequent Batch Auction) order matching engine, in which each order is aggregated at the end of a block and all market orders are executed at the same price, Injective prevents front-running with its OME (Order Matching Engine) and offers decentralized finance infrastructure that is more decentralized, faster, more final and MEV-resistant than traditional financial order books and other AMMs.

Injective Construction

Injective Chain is the core component of Injective, and the Injective Chain constructed using the Cosmos Tendermint/Ignite standard inherits decentralization, security and high performance.

The above figure shows the entire Injective Stack composition

Service Domain

The service layer acts as a bridge between exchange DApps (such as Helix) and the underlying blockchain layer. It consists of multiple APIs, including exchange APIs, coordinator APIs, derivative APIs, and The Graph API. These APIs play a critical role in ensuring seamless communication between different components in the Injective ecosystem, helping users to trade and access various DeFi services. The APIs within the service layer enable Helix to interact with Tendermint/Ignite-based Cosmos chains and Ethereum blockchains. This modular API design approach provides greater flexibility and scalability, ensuring that Injective can continue to grow and evolve to meet the changing needs of the DeFi space.

Cosmos Layer

The Cosmos layer is the foundation of the Injective chain, built on Tendermint/Ignite, and is responsible for executing various types of transactions and derivative orders. This layer includes Injective API and Injective EVM remote procedure call (RPC), which implements the connection to the Injective chain and Injective Explorer. EVM (Ethereum Virtual Machine) is a decentralized, Turing-complete virtual machine used to execute smart contracts on the Ethereum blockchain. Injective Explorer is a tool for tracking all transactions that occur on the Injective chain, providing valuable insights into platform activity and performance for users. Tendermint’s instant finality property makes it an ideal choice to support the Injective chain because it enables fast transaction execution and settlement. The Cosmos layer also provides a range of security and performance advantages, including the Tendermint/Ignite consensus mechanism, horizontal scalability, and powerful application frameworks for building custom blockchain applications.

The Importance of Consensus Mechanisms

Choosing Tendermint/Ignite as the consensus mechanism for the Injective Chain is due to its ability to provide near-instant finality, high fault-tolerance, and support for horizontal scalability. In the context of a trading platform, near-instant finality is especially important as it ensures that transactions can be executed quickly and efficiently without the risk of rollback or double-spending, allowing Injective to maintain a high level of performance even as trading activity on the platform increases. Tendermint’s PoS consensus algorithm also provides high fault-tolerance, ensuring that the Injective Chain can continue to function correctly in the presence of malicious or faulty nodes.

The specific implementation involves the Tendermint/Ignite protocol using multiple rounds to propagate blocks to network validators via proposal messages. For a block to be propagated, it must be voted for by multiple block proposers and signed by the corresponding validator’s private key. Validators communicate via peer-to-peer (P2P) gossip protocol on Tendermint/Ignite, and for a block to be considered valid, it must be accepted by two-thirds or more of the validators, also known as the Byzantine-fault-tolerant (BFT) Proof-of-Stake (PoS) consensus mechanism.

Ethereum Domain

The bridge layer is crucial for cross-chain interoperability and communication between Injective and the Ethereum network. It consists of the Injective Bridge smart contract, which itself relies on Wormhole, Peggy, IBC, and Axelar. The bridge layer interacts with the Injective Chain, the Ethereum network, and other supported blockchains. The Injective Bridge achieves bi-directional transfer of ERC-20 tokens and assets between the Injective and Ethereum blockchains through Peggy. The cross-chain interoperability achieved by Wormhole, Axelar, and IBC is crucial for decentralized blockchain infrastructure as it allows different networks to seamlessly share data and assets. Through the Injective Bridge, the ability to leverage the capabilities of the Ethereum network and its DApps ecosystem allows Injective and the entire Cosmos ecosystem to inherit some of the significant liquidity on Ethereum.

Project Background

Injective is incubated by Binance and is one of the eight projects in the first phase of the Binance Labs incubation, with support from numerous investment institutions. The recent SEC crackdown on Binance has had limited impact on the decentralized exchange Injective.

Eric Chen, Co-Founder and CEO of Injective Protocol, graduated from the Computer Science College of New York University, and the core team has a good professional background, with work experience in internationally renowned companies such as Open Zeppelin, Amazon, hedge funds, etc. Core team members graduated from renowned institutions such as Stanford University.

Value Capture

1) Protocol Fee Value Capture

After 40% of trading fees are allocated to exchanges and DApps, Injective uses the remaining 60% to repurchase INJ. The protocol conducts an auction once a week, in which participants bid for the fees of that week using INJ. The winning bidder receives a basket of tokens and profits from arbitrage opportunities, while the protocol uses the proceeds to buy and burn INJ to maintain the deflationary nature of the INJ token.

2) Tendermint-based Proof of Stake (PoS) Security

INJ token is used to secure the Injective blockchain using a proof of stake mechanism. Both validator nodes and delegators can participate in staking.

3) Developer Incentives

40% of fees generated by dApps built on Injective are directly used to incentivize new developers to build applications on Injective, creating a growing developer community.

4) Protocol Governance

INJ token is responsible for governing every component of Injective, including chain upgrades.

Token Allocation

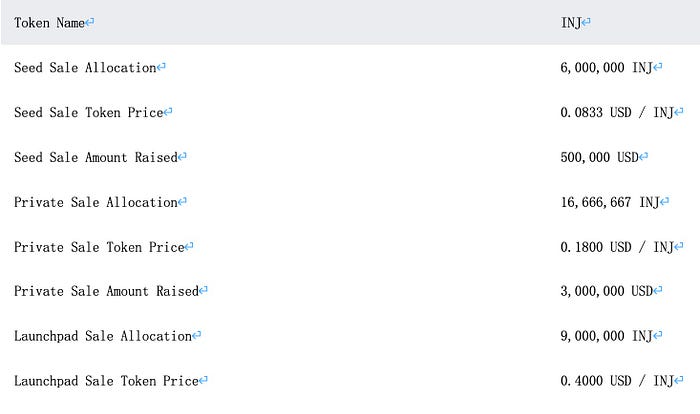

Token Sales Data

Source: Binance Research

Ecosystem Projects

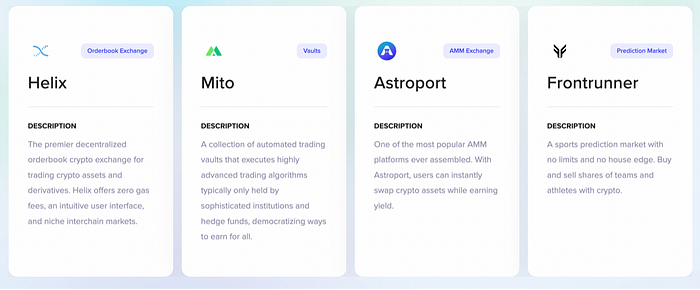

There are currently 24 Dapps that have been launched on the Injective mainnet, most of which are DeFi-related, as well as applications for communication infrastructure, information protocols, NFTs, and other related applications built on Injective.

Source: https://www.rootdata.com/EcosystemMap/list/247?n=Injective

Major Dapps on Injective

Source: Injective Official

Competition Landscape

SEI is a protocol that can be compared with Injective from the consensus mechanism foundation, OME type (FBA), FDV and other aspects. SEI has some detailed differences with Injective in the OME mechanism, which will be introduced in detail below.

DYDX is about to migrate from Ethereum to Cosmos and launch the dYdX chain (dYdX V4). Currently, V4 is in the test network, and the launch of dYdX V4 mainnet may squeeze Injective’s market share to a certain extent, depending on the transaction incentives and institutional preferences of the two parties. From the perspective of token release stage, 90% of Injective tokens have been released, and dydx, including the unreleased SEI, may have an advantage in token incentive space.

In terms of valuation, SEI completed a valuation of 800 million U.S. dollars and raised 30 million U.S. dollars in the last round, with participation from Jump Capital, Distributed Global, and others. Injective is currently valued at less than 800 million, while dYdX is valued at 1.9 billion. Injective’s valuation still has room for growth relative to its competitors, but the key business data of transaction volume is obviously not as good as other competitors (Helix 24hrs trading volume 22mln, dydx 600mln), and the gap in trading volume with dydx is very large, which is related to the fact that Injective’s trading pairs are mainly Cosmos ecosystem assets.

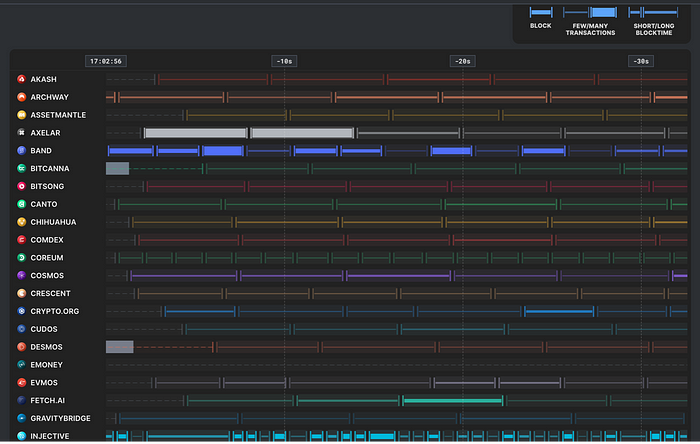

Compared with other blockchains on the Cosmos network, Injective is currently the fastest, with an average block time of about 1 second. The chart shows that Injective’s block production speed is significantly higher than other chains.

OME Comparison

The above picture is a comparison of the order matching mechanisms of SEI, Injective, dYdX V4, Serum, and Uni V3 by @3V Labs.

The order book resists MEV, and there is a demand for handling large-scale institutional order flow. Currently, most public chain-type order book DEX’s MEV defense mechanism minimizes adverse MEV through frequent batch auctions (FBA). In addition to FBA, Off-Chain low-latency OME is the order matching mode of dYdX V4.

For Injective, FBA matching mechanism is an important upgrade, which adopts frequent batch auction model. The result achieved is to maintain fast transaction time, approach market price through higher liquidity, and narrow the price difference.

So what is FBA? Understanding FBA requires an understanding of the concept of continuous double auction CDA. FBA actually solves the problem of CDA capital inefficiency.

CDA Continuous Double Auction Problems

Both cryptographic derivatives and centralized exchanges in traditional financial markets use a continuous double auction (CDA) model. In this model, orders are processed as soon as they arrive at the exchange. This can be achieved by either executing the order immediately on the opposing order on the order book or holding it on the order book until a matching order is found.

The way in which continuous double auctions process orders encourages speed, and high volatility markets create huge arbitrage opportunities. The role of market makers (MMs) is to follow the market price of the asset and provide depth by placing orders on both sides of the order book. As prices change, MMs must cancel and create orders accordingly.

However, between price updates from external signals, high-frequency traders (HFTs) have the opportunity to execute outdated MM orders before the MM cancels the order. As a result, HFTs are able to obtain arbitrage profits. The profit from this outdated order grab game is large and sustained, so HFTs invest in advanced technologies such as microwave towers and FPGAs for nanosecond-level (billionth of a second) speed competition, putting MMs at an insurmountable disadvantage.

Due to these obvious problems, MMs are often forced to increase investment in competitive technology solutions, which is often indirectly paid for by traders through higher transaction fees. In addition, MMs tend to become more risk-averse by providing a lot of depth near the market price. This not only harms retail traders who want to execute orders at fair prices but also causes high volatility within the spread and destroys market stability on a small time scale. Therefore, retail traders are often forced to establish positions at less than ideal prices.

The matching engine of continuous double auctions requires high-throughput processing at unpredictable times, and most other times the demand is small. Even if built by centralized institutions, exchanges based on continuous double auctions rarely meet the market demand for 100% normal operating time. Within the scope of the blockchain network, the situation is further deteriorating. Therefore, compared to the most modular centralized exchanges today, decentralized exchanges are much less flexible in solving the same challenges.

In continuous double auction (CDA) design for decentralized exchanges, minor tweaks have been shown to be unsatisfactory and ultimately result in economic losses for retail traders. For example, prioritizing orders based on payment of higher gas fees instead of submission time, ignoring other orders with reasonable gas fees.

Any user who trades more aggressively on a specific AMM exchange protocol has experienced the pain of paying high gas fees to robots that profit on the margin of trader slippage tolerance. AMMs aim to eliminate the need for institutional MMs, and the capital inefficiency costs associated with CDA are directly passed on to retail traders.

Now let’s take a look at the advantages of FBA and Injective FBA

Injective’s frequent batch auction (FBA) has been widely proposed as a clear solution to the capital inefficiency problem associated with CDA. One advantage of FBA is to improve market fairness and liquidity by eliminating pre-trade.

Injective FBA is defined by three characteristics:

1) Discrete time; accept orders in a discrete time interval called the auction interval. At the end of each auction interval, fill the cross orders in the following priority order:

First fill the market order, then fill the unfilled limit order from the previous auction interval, and finally fill the limit order from the latest auction interval. If the quantities of the buyer and seller are different, the smaller quantity side is completely filled, and the order of the larger quantity side is filled proportionally (filling the uniform part).

2) Uniform clearing price; fill the limit order with the uniform clearing price of the highest cross order quantity. If the quantities of the buyer and seller are the same, the middle price is used as the clearing price.

3) Closed bidding; orders are not posted on the order book until the end of the auction interval and execution batch auction. This eliminates the possibility of pre-trade and negative spreads.

The longer auction interval relative to market making incentives in frequent batch auctions provides market makers with enough time to cancel outdated orders before HFTs can execute. This eliminates the risk that market makers must deal with pre-trade issues, so they do not need to invest their capital in advanced technology.

Market makers are encouraged to provide deeper liquidity and tighter spreads near the market price, which is not only better for retail traders who try to fill orders at or near the fair price, but also reduces volatility associated with potential price crashes.

Frequent batch auctions aggregate orders into a group for state changes or order book containment. Blockchains queue and write transactions in batches to continuously generated blocks. The optimal batch interval for FBA is still debated, but has been reported in academic papers to be between 0.2 and 0.9 seconds, which corresponds to the auction interval of Injective, which executes batch auctions at the end of each block.

SEI, as a protocol using FBA for order matching on Cosmos, has some differences at the detail level compared to Injective FBA, such as 1) SEI implements block parallel processing and no longer processes transactions in order. Multiple transactions involving different markets can be processed simultaneously, thereby improving performance. According to recent load tests, it can be seen that the block time is reduced by 75-90% compared to processing in order, and the delay of parallel processing is 40-120 milliseconds, while the delay of processing in order is 200-1370 milliseconds;

2) SEI’s price oracle is responsible for streaming price data from off-chain to the blockchain and is built into the chain. This means that all validators need to submit their prices (exchange rates) when submitting blocks. A block will only be created when all validators reach a consensus on a common price. If validators miss certain voting windows or provide prices that deviate too much from the median, they will be penalized;

3) Trading order bundling, market makers can cancel and create orders involving multiple markets in one transaction (i.e. merging orders for all BTC perpetual contracts into one smart contract call for a specific market).

Injective is built on the PoS consensus based on Tendermint/Ignite’s BFT foundation, with immediate finality features that match the FBA execution at the end of each interval. As FBA has no concept of time priority within the auction interval, it is a market design that perfectly matches the blockchain operating on the same basis. This is because Tendermint/Ignite is a consensus engine based on BFT (Byzantine Fault Tolerance) consensus algorithm. It uses a pre-selected set of validator nodes to reach consensus and votes and confirms the order of transactions through consensus rounds. Tendermint/Ignite is designed for high security and determinism and is suitable for applications that require strong consistency and finality, which is perfectly matched with Injective’s infrastructure.

By replacing continuous two-way auctions (CDA) with frequent batch auctions (FBA), Injective adopts a market design that is technically powerful and can compete with centralized exchanges. Injective is able to eliminate pre-trading that harms the interests of traders, helping market makers provide deeper liquidity and tighter spreads. The implementation of frequent batch auctions prepares Injective for competing with institutional-grade centralized exchanges in trading volume.

Summary

Injective has the advantages of best transaction speed, instant finality, almost zero gas fees, and anti-MEV, which are derived from 1) fast block confirmation speed (but relatively high centralization degree) based on Tendermint BFT consensus mechanism and with timely finality; 2) all fees related to interaction with the chain are paid by the DApp of the exchange, which broadcasts the signature message of the transaction to the Injective Chain node instead of the trader himself, which means that the trader does not need to pay any gas fees; 3) using frequent batch auctions (FBA) as the order settlement mechanism. Orders submitted to the mempool are executed at the end of each block (about 1 second block time) and will not be published on the order book until the auction process is completed, which effectively prevents MEV bots from front-running trades.

The built-in settings of the Injective on-chain order book are more friendly to ordinary users, especially institutional strategy orders, than AMM (Univ4 may achieve stop orders to some extent). AMM has a large TVL, and LP has become an organic part of the entire market. For LOB, it is naturally lacking the step of on-chain staking assets, and the attraction of MM needs to be supplemented externally, making it difficult to form an LP ecology similar to AMM and capture the value chain derived from the LP ecology. Of course, AMM-like products can also be built on Injective, but currently, the main trading volume of Injective still occurs on the order book front-end Helix.

Before Rollup greatly improves the performance of LOB dex, building a native chain on Cosmos is still the best solution for high-performance LOB. The launch of dYdX v4 mainnet may squeeze Injective’s market share, depending on the transaction incentive measures and institutional preferences of the two. LOB dex on Rollup will also form certain competition, but due to the definition of dapp as a non-public chain and the lack of sovereignty, the valuation system and the order book of the native chain are completely different. LOB DEX and AMM both use decentralized methods, and at this stage, it is not necessary to define what the endgame is. This market always needs diversified solutions.

Injective uses LOB as the core trading model, which has the “MEV protection” feature. By building on Tendermint, it provides a highly decentralized, high-performance, and reliable environment that can be used for cross-chain derivatives, forex (FX), synthetic assets, and futures trading, providing a safe and efficient platform for institutional order flow and market makers for trading applications, and eliminating the risk of market manipulation and exploitation by high-frequency traders. The implementation of frequent batch auctions has prepared Injective for competing with institutional centralized exchanges in trading volume, making Injective a naturally decentralized trading platform favored by institutions. But this also means that Injective’s price is closely related to institutional funding. In the next cycle, based on the high-performance chain trading engine, one-click chain issuance and other engineering implementations will further promote professional market makers to establish liquidity in the DEX field, and together with AMM, help transfer pricing power from CEX to DEX.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Will NOVA be the next Pepe? Analysis from the perspective of trading techniques.

- Analyzing the new token governance system: Utilizing Balancer weighted pools to achieve deep liquidity and reduce impermanent loss.

- How can Opside collaborate to build the ZK ecosystem as the era of multiple Rollups approaches?

- YugaLabs CEO: Our biggest risk is deviating from our mission, not regulation

- With the advent of the Rollup era, how can Opside collaborate to build the ZK ecosystem?

- Crash and Reshape: Drawing Lessons from the History of the Gaming Industry to Look Ahead at the Future of NFTs

- Pendle v2 Overview: Driving Pendle to Become a Key Part of DeFi Infrastructure