Regulatory Pressure Slows Down Capital Inflow, Ethereum’s Collateralization Rate Approaching a Key Milestone

Regulatory pressure slows capital inflow, Ethereum's collateralization rate nears milestone.Author: Krisztian Sandor, CoinDesk; Translation: Song Xue, Blocking

Ethereum’s (ETH) staking is approaching a key milestone, with 20% of all tokens locked in staking contracts, but inflows have slowed as investors become cautious about regulatory risks after the initial hype.

Investors have deposited 23.9 million ETH into Ethereum’s staking network, including tokens that have been submitted and are waiting in the queue. Hildobby’s Dune Analytics dashboard shows that the total staked amount accounts for about one-fifth of the token’s 120 million supply.

Ethereum’s upgrade in Shanghai, which began in April, allows withdrawals from its proof-of-stake network, creating new demand for the second-largest cryptocurrency. Staking allows cryptocurrency owners to lock up tokens and participate as validators in securing the network in exchange for rewards, making it a popular investment for long-term investors including institutional investors.

- AlloyX: A liquidity collateral protocol based on RWA assets

- NFT lending protocol Gondi, developed by Florida Street, has completed a $5.3 million seed round of financing, led by Hack.vc and Foundation Capital.

- Injective, the pioneer of native chain order book.

Since the upgrade, as investors have rushed in, deposits have far outpaced withdrawals by 4.5 million, valued at $8.4 billion at current prices, extending the wait time for establishing new validators to about a month and a half.

However, compared to the initial surge, the inflow rate last month has slowed down.

Tom Wan, a research analyst at 21Shares, a digital asset investment product company, said in a report: “The slowdown may be due to regulatory scrutiny of centralized exchanges.”

Wan pointed out that early June was a “critical turning point” for inflows, when the US Securities and Exchange Commission (SEC) sued cryptocurrency exchanges Binance and Coinbase. The regulator claimed that the two platforms were the largest ETH staking service platforms, offering unregistered securities through their staking services.

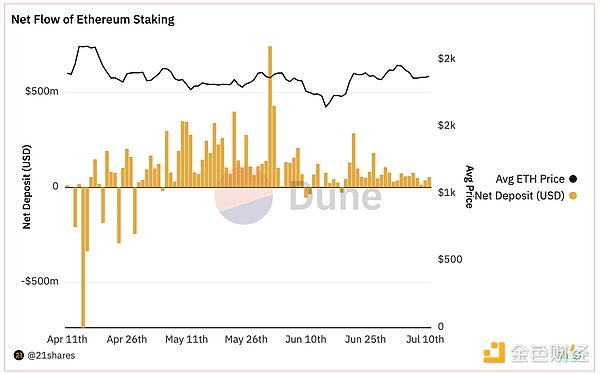

21Shares’ Dune Analytics dashboard shows that after the lawsuit, the net inflow of ETH staking dropped significantly for a period of time and appeared negative on some days for the first time since early May. Since then, the flow has returned to positive, but remains below May levels.

(Net ETH Staking Flow from 4.11-7.10; Source: Dune Analytics/21Shares)

(Net ETH Staking Flow from 4.11-7.10; Source: Dune Analytics/21Shares)

Validator queue pressure eased

Slowing demand has helped ease pressure on the validator queue to activate new validators on the network. The waiting time for deploying new validators has been reduced from nearly 46 days in early June to 36 days.

Ethereum blockchain manager Irina Timchenko of staking service Everstake tweeted that raising the bar for new validators entering the network each day also helps to solve Ethereum congestion problems, reducing the queue time by five days.

John “Omakase” Lo, a partner at investment company Recharge Capital, pointed out that the still long wait time is unfavorable for investors and will “definitely” reduce the flow of staking.

He explained that tokens transferred to staking only receive rewards if they are stuck in the queue, reducing the effective annualized rate of return.

However, Katie Talati, head of research at digital asset investment firm Arca, said that the possibility of the validator queue affecting inflows is small.

“Investors are more concerned about the queue for canceling stakes or how long it takes to withdraw funds from ETH staking.”

Decentralized staking assets are on the rise

The risks of centralized staking services may prompt investors to turn to decentralized solutions.

Talati said, “We see significant growth in staking assets on decentralized staking protocols such as Rocketpool and Lido.”

Over the past month, these two decentralized liquid staking protocols have grown by 5.4% and 6.3% respectively, surpassing Coinbase and Binance.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bored Ape suffers from losses and is forced to sell, aristocratic holders become big losers

- Cross-chain vs Multi-chain

- Arkham Product Performance, Financing Status, and Investor Expectations

- Will NOVA be the next Pepe? Analysis from the perspective of trading techniques.

- Analyzing the new token governance system: Utilizing Balancer weighted pools to achieve deep liquidity and reduce impermanent loss.

- How can Opside collaborate to build the ZK ecosystem as the era of multiple Rollups approaches?

- YugaLabs CEO: Our biggest risk is deviating from our mission, not regulation