AlloyX: A liquidity collateral protocol based on RWA assets

AlloyX: A collateral protocol for liquidity using RWA assets.Real-world assets (RWA) in credit agreements provide AlloyX with an immediate opportunity. RWA are tangible assets that exist in the real world and are brought onto the chain through tokenization, such as loans, receivables, invoices, and real estate. Since 2020, tokenized RWA loans have been growing as a category of crypto assets, with a deposit size exceeding $1 billion by mid-2022. However, with a huge length of only one asset type in RWA, this asset class is not only fragmented but also very diverse in the various parameters that investors need to consider.

The underlying tangible assets (i.e. borrowers) in the asset pool of credit agreements represent many regions, industries, business types, and maturity cycles. For example, the Goldfinch Senior Pool represents on-chain loans from countries in Africa, Latin America, and Southeast Asia, covering fintech debt, consumer loans, and small business loans. When investors allocate funds to a credit agreement, they not only consider the broad risk categories in the asset pool but also the DeFi and blockchain-related risks, such as blockchain downtime risk, smart contract risk, governance risk, and protocol risk.

In addition, due to the long-term nature of its asset holdings, RWA often has difficulty managing liquidity demands for withdrawals. Loans in credit agreements have maturities of several years, which means long lock-up periods for capital invested in RWA. During this lock-up period, users cannot withdraw their USDC or use it as collateral. If the credit agreement still wishes to support withdrawals, it can leave a portion of the total lock-up value to handle redemptions, but this can significantly reduce the performance return of the asset pool due to idle cash.

Creation Purpose

The AlloyX project team experienced early on the challenges that liquidity providers face when lending real-world assets on-chain, even if real-world companies have sound financial and operational conditions. As operators and investors, they discovered inefficiencies that presented an opportunity to create a platform that could abstract complexity, allowing anyone to easily invest in real-world assets and earn returns.

- NFT lending protocol Gondi, developed by Florida Street, has completed a $5.3 million seed round of financing, led by Hack.vc and Foundation Capital.

- Injective, the pioneer of native chain order book.

- Bored Ape suffers from losses and is forced to sell, aristocratic holders become big losers

Product

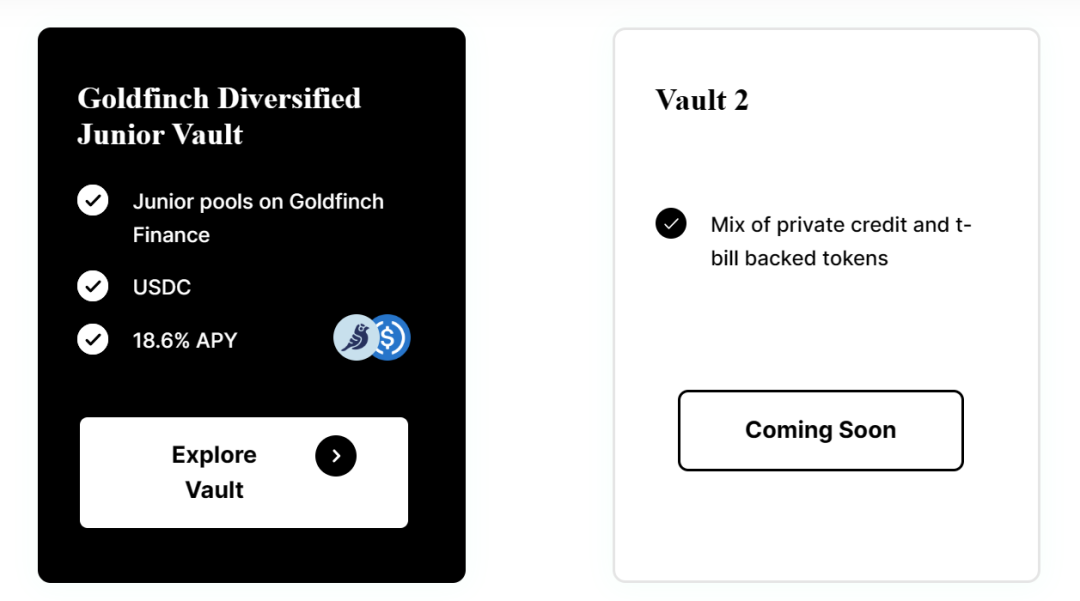

Users can select the “themed vault” they wish to invest in by depositing USDC into the vault and receiving the vault token. When users wish to withdraw, they can exchange the vault token for USDC.

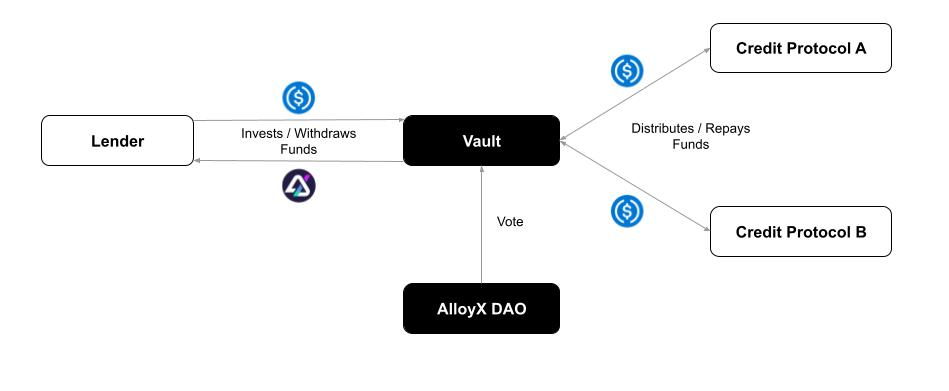

RWA Vault Works

AlloyX’s vault combines Credix Finance’s over-collateralized tokenized loans (digitally tokenized assets supported by real-world assets such as loans or debt instruments) with tokenized US Treasuries smart contracts to provide DeFi investors with opportunities for real-world assets liquidity. AlloyX’s vault follows a simple and powerful principle: the lender provides funds to the vault in the form of USDC, which aggregates the deposited tokenized assets and allocates and operates them according to the vault’s preset parameters. By depositing USDC, users receive the vault token based on the floating exchange rate and earn income. What sets AlloyX apart is its automatic allocation across multiple credit protocols, where USDC is deployed according to the vault’s allocation rules.

Users can also create their own vaults to invest in whitelist assets in AlloyX’s partner credit protocols with approval from the AlloyX DAO. Once funds are deposited into the vault, allocated funds will be directed towards partners.

The repayment of the underlying borrower flows back to the vault on the AlloyX platform. Investors can redeem their repayment shares in the form of vault tokens or convert them to USDC depending on their liquidity needs.

Every entity that invests and redeems on the AlloyX platform is required to complete customer due diligence (KYC) with compliance partner Blockingrallel Markets, saving them time and resources from having to go through multiple KYC processes individually for each protocol.

At the same time, AlloyX has created a seamless and efficient ecosystem that allows users to customize strategies in the tokenized credit market, earn funding revenue, and benefit from automatic reinvestment of repayments.

-

Borrow: Users can lend their capital to a vault to earn income. Deposit USDC and receive vault tokens based on the floating exchange rate. Repayments will automatically reinvest or convert to USDC to meet redemption demand.

-

Manage: Users can choose to create their own vaults containing target assets and trading desks obtained from partner credit protocols.

Overcoming the Challenges of Tokenized Credit

AlloyX is developed by a team with deep expertise in fintech lending, credit underwriting, investing, and blockchain technology. The core founding team experienced firsthand the limitations of investing in tokenized credit.

Unlike some crypto loans, most credit protocols require investors to lock up their funds for a set period of time, meaning they can’t be used as collateral or accessed until maturity. As RWA loans grow, lenders will want easy liquidity and the ability to diversify their investment positions. To date, crypto investors haven’t had the option to easily craft bespoke strategies in RWAs. Investing in different credit protocols requires going through multiple KYC onboarding processes, which takes a significant amount of time, effort, and resources. All of these issues are obstacles to RWA growth.

As of now, the total amount of active RWA loans has reached $530 million and continues to grow in the crypto bear market. Analysts from Coinbase and Coinmetrics both anticipate significant growth in tokenization of RWA, a trend driven by increasing institutional adoption and demand for transparency and compelling use cases for crypto.

Advantages of AlloyX

-

Flexibility and Composability: Users have control over their investment strategy by customizing based on their liquidity needs, target returns, and risk tolerance. Easily mix real-world correlated assets, including US Treasuries, to maximize investment potential.

-

Enhanced Liquidity: Users can withdraw portions of their funds before loan maturity and have the right to access liquidity when needed.

-

Diversification: Establish a diversified investment strategy by pooling funds from various credit and US Treasury protocols. By spreading investments across multiple pools and assets, users can potentially reduce risk and maximize returns.

-

Simplified Onboarding: Save time, effort, and money with a simplified onboarding process. Access multiple credit protocols with just one KYC process, eliminating the hassle of duplicate procedures.

-

Automated Reinvestment and Reduced Cash Drag: AlloyX simplifies the investment process by automatically reinvesting funds at each payment cycle. This keeps users’ capital working for returns, minimizing idle cash and maximizing potential earnings.

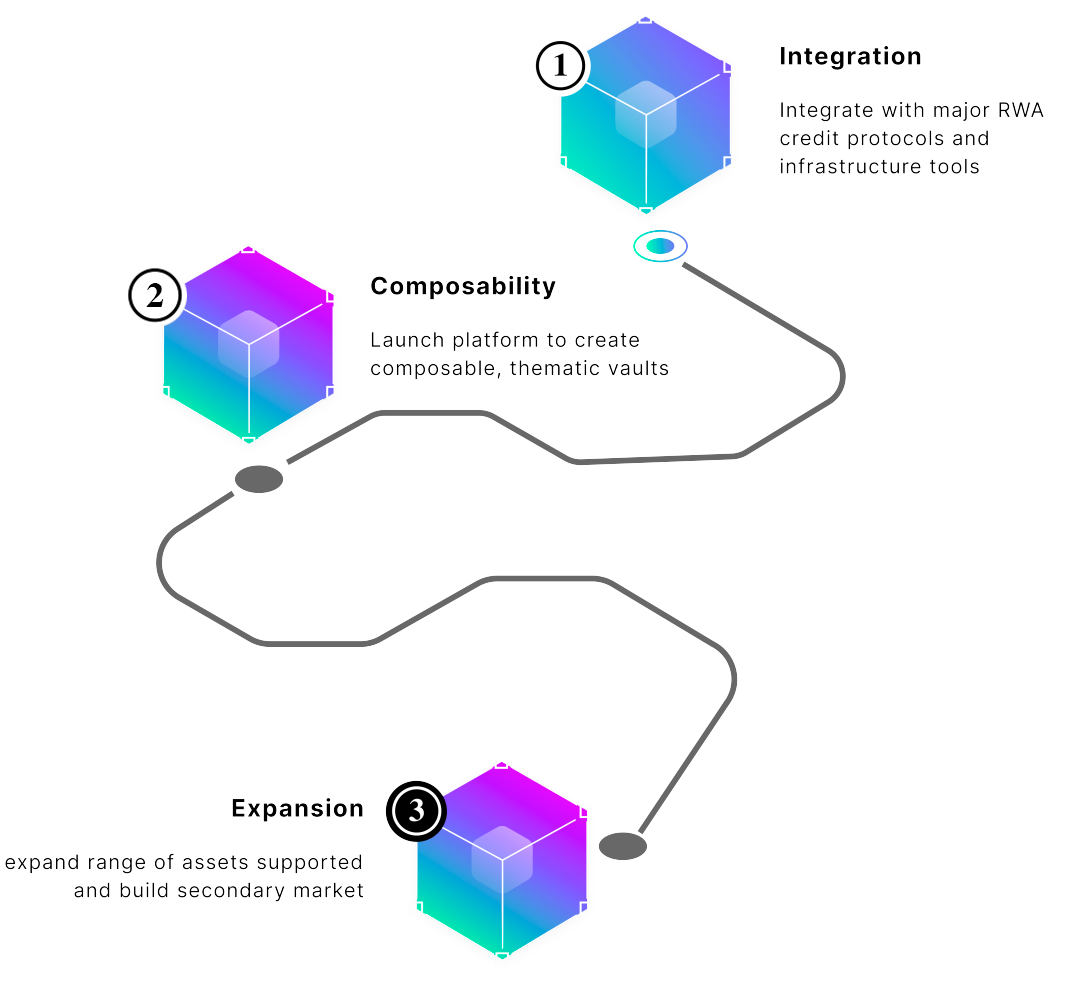

Roadmap

Through seed round financing, the team has integrated with nine credit agreements. The Golden Room, which is mixed with Credix Finance and US Treasuries, will go live in the beginning of Q3 2023 and will be available for non-US users. The product roadmap will continue to focus on integrating with other DeFi protocols and establishing a DAO organization. Since its inception, AlloyX’s total locked value (TVL) has reached $5 million and has achieved an average yield of over 18%.

Summary

In late June, AlloyX announced that it had raised $2 million in pre-seed funding, led by Hack VC, with participation from Circle Ventures, Digital Money Group, Stratos, Lecca Ventures, MH Ventures, Very Early Ventures, Archblock, dao5, and Credix Finance.

AlloyX hopes to build a diverse credit investment portfolio supported by real-world enterprises on the blockchain. AlloyX enables protocols, DAOs, and institutional investors to easily and conveniently build diversified RWA investment strategies, and AlloyX provides a flexible and efficient platform for borrowers to manage all RWA investments based on their own income, risk, and liquidity preferences. AlloyX believes that by leveraging encryption and blockchain technology, it can contribute to a more efficient, transparent, accessible, and fair ecosystem for RWA DeFi.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Cross-chain vs Multi-chain

- Arkham Product Performance, Financing Status, and Investor Expectations

- Will NOVA be the next Pepe? Analysis from the perspective of trading techniques.

- Analyzing the new token governance system: Utilizing Balancer weighted pools to achieve deep liquidity and reduce impermanent loss.

- How can Opside collaborate to build the ZK ecosystem as the era of multiple Rollups approaches?

- YugaLabs CEO: Our biggest risk is deviating from our mission, not regulation

- With the advent of the Rollup era, how can Opside collaborate to build the ZK ecosystem?