Robinhood Bot Comprehensive and Fast New Trading Robot

Robinhood Bot Advanced and Efficient Trading RobotRecently, Telegram trading bots have become the hottest new topic, with various trading bots emerging one after another. Based on this, the new project we are introducing today is RobinHood Bot.

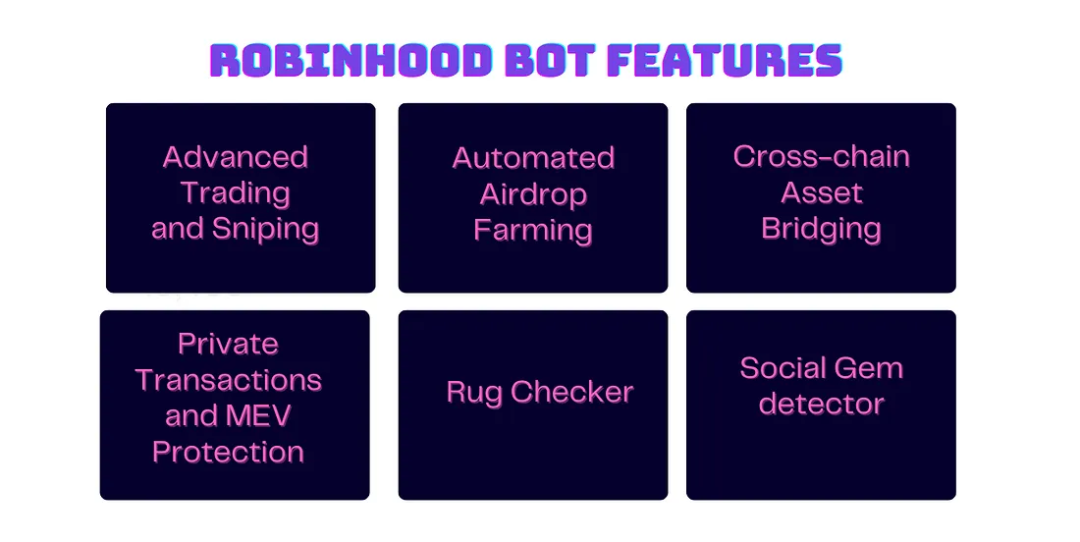

RobinHood Bot is a comprehensive and versatile cryptocurrency bot designed to provide a seamless trading experience and be a one-stop solution for all cryptocurrency trading needs. It combines the best features of various bots to provide unique and powerful tools for cryptocurrency enthusiasts. Whether users are experienced traders or beginners, RobinHood Bot offers tools to maximize trading potential. It supports advanced trading and sniping, automatic airdrop harvesting, cross-chain asset bridging, private trading, MEV protection, and other functions. RobinHood Bot aims to execute trades at lightning speed, making it a powerful tool for traders. RobinHood Bot can execute trades faster than traditional platforms, ensuring users don’t miss any opportunities.

Mechanism Analysis

RobinHood Bot employs various mechanisms to provide its services. For advanced trading and sniping, it uses advanced algorithms to execute trades at lightning speed and snatch up new tokens. This allows users to take advantage of price fluctuations and get new tokens ahead of others in the market.

- Bear market forces on-chain innovation. Are these newly popular projects worth paying attention to?

- ABCDE Why Should We Invest in GRVT (Gravity)

- Interpreting the Future Path and Star Projects of LayerZero’s Cross-chain Innovation

- Automatic Airdrop Mining

RobinHood Bot uses smart contracts that interact with different protocols on multiple EVM-compatible chains. This enables the bot to perform various automated tasks such as bridging, swapping, adding liquidity, staking tokens, and interacting with DeFi protocols, all without the need for manual intervention by users.

- Cross-chain Asset Bridging

RobinHood Bot uses interoperability protocols like Bungee and Layer0 to bridge assets between different networks. This enables users to quickly transfer their assets from one network to another, allowing them to take advantage of different opportunities on different EVM blockchains.

- Private Trading and MEV Protection

RobinHood Bot employs privacy protection techniques and MEV mitigation strategies. This enables users to execute trades with enhanced privacy and protect themselves from front-running trades and other MEV attacks.

Features

Advanced Trading and Sniping

-

Access to on-chain smart wallets (profit wallets).

-

The bot provides advanced trading features: including liquidity sniping; call channel sniping; direct contract pasting; support for instant contract and LP acquisition, as well as advanced trading terminal features; copy trading smart wallet; multi-wallet emulation; sentiment detector.

Automatic Airdrop Mining

-

Automated on-chain interactions for airdrop mining.

-

Operates on multiple EVM-compatible chains, such as ZkSync, LayerZero, Linea, Scroll, Base, Taiko, Polygon, zkEVM, etc.

-

Executes various automated tasks in different protocols, including bridging, swapping, adding liquidity, borrowing, lending, minting NFTs, etc.

-

Provides airdrop tracking and anti-Sybil detection features.

Cross-Chain Asset Bridging

-

Allows users to bridge their assets between different networks.

-

Simplifies fund management and transfers.

-

Supports over 10 EVM chains, including Ethereum, Arbitrum, Optimism, Zksync, Binance Smart Chain, Avalanche, Polygon, etc.

Private Transactions and MEV Protection

-

Supports private transactions to enhance transaction privacy.

-

Provides protection against Miner Extractable Value (MEV) attacks.

-

Protects transactions and intelligently addresses sandwich attacks to provide additional security.

Rug Checker

-

Features advanced checkers and anti-rug functions.

-

Ensures the security of users’ investments by examining various factors, including the credibility of the project team, deployer’s wallet, source of funds, code audits, verifications, liquidity lock, contract abandonment, token holders’ count, etc.

-

The algorithm actively scans for team-locked liquidity and/or abandoned contracts. Users can evaluate the team’s intentions and commitment to the project by receiving real-time alerts about the duration of the lock and information about the team’s intentions and commitments.

-

The robot assigns security points to each factor.

Social Gem Detector

-

Detects alerts during contract deployment.

-

If it exceeds the safety threshold, it tracks etherscan for large purchases.

-

The robot has a Gem Hunters database from social media websites that can detect projects early on.

-

If any of these accounts discuss a project on social media, the robot adds these tokens to the Social Gem Detector channel.

-

If more Gem Hunters discuss the project, the robot’s algorithm continues to add points to the token.

-

Users can manually initiate transactions or preset the robot to trade when it passes the rug check and the social gem score exceeds 50%.

-

Fully scans Twitter to provide data on token mentions and promotions.

Supported Chains

- Ethereum

- Arbitrum

- Base

- Optimism

- Zksync

Tokenomics

The $HOOD token is the native utility token of the RobinhoodBot ecosystem. It is an integral part of the platform and serves as the primary means of interaction between the community and the system itself.

|

Total Supply |

100 million |

|

ETH Price |

$1850 |

|

Initial Mcap |

$37,000 |

|

FDV |

$92,500 |

|

Circulating Supply |

40 million |

|

Vested Supply |

60 million |

|

Circulating Supply at TGE |

40% |

$HOOD Distribution

|

Percentage |

Amount |

Notes |

|

|

Initial Liquidity |

40% |

40 million |

No lock-up period |

|

DAO Treasury |

40% |

40 million |

Linear unlock within 24 months |

|

Foundation |

10% |

10 million |

2% unlocked at TGE, the rest linear unlock within one year |

|

Team |

10% |

10 million |

Vesting period of more than 12 months, with a 3-month cliff |

Fee Structure

RobinHood Bot does not charge any fees in the initial stage to attract new users. After the initial launch phase, the fee for Robinhood Bot is 0.8%. The fee is deducted directly from the transaction amount and processed through the contract. This means that users do not need to worry about paying fees separately or dealing with additional fees. Of the generated fees, 40% will be allocated to $HOOD holders, 30% of the fees will be allocated to referrers, and 30% of the fees will be used for the development and maintenance of the bot.

Revenue Sharing

Holders can earn 30-40% of the revenue from the taxes collected on $HOOD transactions, as well as the opportunity to earn 40% of the bot fees and referral fees. This means that users can earn passive income simply by holding $HOOD. This revenue-sharing program has two main purposes. First, it provides additional incentives for users to hold $HOOD, supporting the token’s value and stability. Second, it allows users to share in the success of RobinHood Bot. As the bot becomes more popular and usage increases, the collected fees will also increase, bringing greater returns for token holders.

Summary

RobinHood Bot provides advanced and comprehensive functionality for traders to help lower the barrier for the general public to engage in cryptocurrency trading and promote mainstream adoption. At the same time, RobinHood Bot protects users from malicious operations and timely identifies large-scale transactions at the early stage on the blockchain, while tracking social trends. As holders of $HOOD, users can access the robot itself, and the tokens held are not only sustainable, but also incentivized through a revenue-sharing model. Transparency and decentralization ensure that the team’s interests are aligned with the users’ own interests, ensuring that RobinHood Bot evolves based on user needs and constantly changing market trends.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of 10 Tips for Web3 Entrepreneurship The period of bonanza for bottom-up project development has passed, and marketing is becoming more important.

- Overview of the first six investment projects of the Base Ecosystem Fund

- One out of a hundred, taking stock of the first batch of investment projects by the Base Ecology Fund.

- Nima Capital sells tokens and sells luxury homes, previously invested in these 16 projects.

- With 8 years of experience and managing over 540 million dollars, how does CoinFund, a cryptocurrency fund, choose its track and invest in projects?

- Investment institution Rug? Nima Capital sells tokens to sell luxury homes, previously invested in these 16 projects

- APR Winter? A comprehensive analysis of high-yield DeFi projects in the market