Trend analysis: The transaction volume of the Bitcoin chain exceeds the on-chain, and the main application scenarios tend to be centralized

Author: Charles Edwards

Translation: First Class (First.VIP) _Tracy

Editor's note: The original title was "More and more transactions are being moved off-chain. Is this still what we expect from Bitcoin?" 》

In the past 3 years, Bitcoin has been concentrated in the hands of a few institutions, and the way Bitcoin conducts transaction settlement has also changed-Bitcoin transactions have gradually moved off-chain.

- Ripple has completed the final USD 20 million investment in MoneyGram, with a total investment of USD 50 million

- Are Bitcoin miners still mining in 2140?

- Opinion: Blockchain games are still an experiment until commercial success

Summary

· Today, Bitcoin's main application scenarios tend to be centralized.

· More and more Bitcoins are hoarded on centralized platforms, and in less than 3 years, this value has increased by 700%

· More and more transactions are completed off-chain (off-market), and the transaction volume of the exchange is 300% more than the daily transaction volume on the chain.

· As a currency, Bitcoin needs to combine third-party off-chain protocols, and assets become centralized … you can buy coffee with Bitcoin.

As an institutionalized or decentralized asset, the fate of Bitcoin may depend on a race between technological development and public acceptance

· Be careful about "committing to pay"!

Centralization of Bitcoin

In The Bitcoin Standard, Saipedean Ammous talks about the future scenario of Bitcoin for interbank settlements. The author points out that the reason why Bitcoin is suitable for this role is because the supply of Bitcoin is difficult, and no one can change the extremely low inflation rate of Bitcoin. Moreover, Bitcoin can complete the final settlement of international transactions at low cost within an hour, which is currently unattainable by any traditional settlement process. The author's argument is very convincing.

Maybe he is right.

Over the years, people have proposed a large number of Bitcoin application scenarios. This article explores two of the most popular scenarios today, and how current technology development and adoption is trending towards Bitcoin centralization. Both scenarios are:

Bitcoin as an asset

Bitcoin as a cash

The institutional era of Bitcoin has begun.

Bitcoin as an asset

Trend 1-Off-chain transaction volume has exceeded on-chain transaction volume

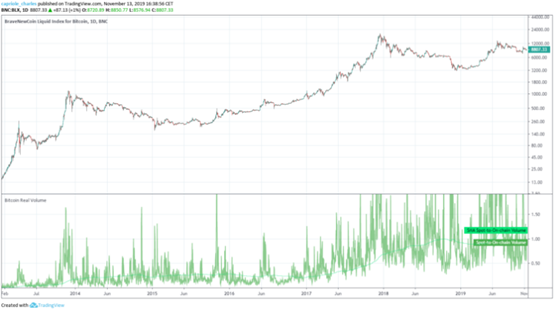

The sharp increase in the transaction volume of Bitcoin on the exchange highlights the continuous increase in the transaction volume of Bitcoin. Compared with the transaction volume on the Bitcoin blockchain, the exchange transaction volume has grown more significantly.

In 2017, Bitcoin's daily average spot market transaction volume only accounted for 1/4 of the on-chain transaction volume.

Fast forward to 2019.Bitcoin's daily average spot market transaction volume is 4 times the on-chain transaction volume. Today, the daily spot transaction volume is 10% higher than the daily on-chain transaction volume.

If derivatives are added, the total daily over-the-counter transaction of Bitcoin will be more than 300% higher than the total transfer amount on the blockchain.

The ratio of spot transactions to on-chain transactions is rising

[Source: TradingView "Real Bitcoin Trading Volume"]

Bitcoin's on-chain transaction volume has never fallen to levels before 2017. The high proportion of transactions on the exchange indicates that Bitcoin is entering the era of high-frequency trading. Traders buy and sell bitcoin positions multiple times a day.

For example, Alameda Research says its $ 100 million capital alone accounts for 5% of Bitcoin's daily global trading volume.

Today's OTC trading volume is much larger than the intra-market trading volume.

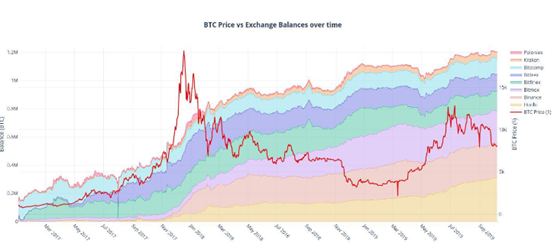

Trend 2-Bitcoin is increasingly concentrated on large exchanges

Due to the rapid growth of transaction volume, contrary to the biggest principle of Bitcoin "owning its own private key", Bitcoin is rapidly concentrating on large exchanges.

TokenAnalyst's research found that as of October 2019, the top 10 exchanges had stored 6.7% of Bitcoin. This is just data based on known bitcoin address ownership, many other addresses are difficult to link back to the central owner (exchange), so the real data may be much higher.

In less than 3 years, the amount of bitcoin stored on the exchange has increased by 700%. After the bull-bear conversion, more and more Bitcoins are concentrated on centralized platforms.

In less than 3 years, the total supply of Bitcoin in the top 10 spot exchanges has increased from 1% to 6.7%

(Source: TokenAnalyst.io)

Trend 3-Asset Operation

The vast majority of investors want additional returns from asset operations. For today's Bitcoin holders, there are already more than 12 loan platforms in the market that provide passive income services. For example, Nexo processed more than $ 1 billion in crypto-guaranteed loans in just 18 months.

Most of these loan platforms have an annual rate of return of about 8% in 2019, and the temptation for users to leave Bitcoin to an institution is huge.

Bitcoin as cash

The irreversible robustness of settlement on the Bitcoin chain is also the weakness of it (a fast payment platform). The Bitcoin blockchain can only process 5 transactions per second, while Visa processes 1700 transactions per second. However, the introduction of a new Bitcoin solution has made possible the future of fast Bitcoin trading.

At present, all new schemes involve the centralization of Bitcoin or the use of off-chain protocols.

Trend 4: Consume Bitcoin

Not all trading volume comes from pure investment and speculative demand.

Part of the transaction demand may come from the person sitting opposite you in the cafe—consumer demand.

It used to be that the cost of buying a cup of coffee with Bitcoin was higher than the cost of the coffee itself, but now it doesn't hold up. If you want to use bitcoin for everyday consumption, platforms such as TenX offer a viable approach-TenX's Visa card. The Visa card interacts with the spot exchange to quickly exchange bitcoin into fiat at the point of sale. The Visa card opens the door to the world of fiat currencies, allowing Bitcoin (and other currencies) to be used everywhere Visa is accepted.

Although Visa cards may not be the way to maximize Bitcoin consumption, it was very effective until most retailers accepted Bitcoin.

This is the second example of Bitcoin's institutionalization.

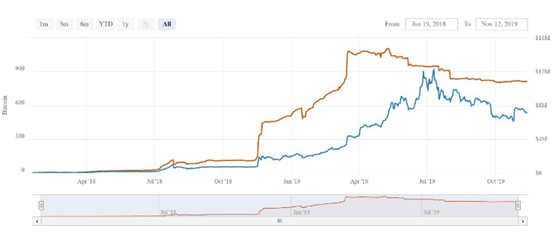

Trend 5-Lightning Network

The Lightning Network is a response to Bitcoin's spendingability. Lightning Network provides "lightning" speed and low cost. The payment is completed off-chain, and records need to be placed on the blockchain when final settlement is required.

After accumulating enough users, you can purchase goods anywhere through the Lightning Network.

The Lightning Network is still in its infancy, with network capacity of only about $ 10 million (see table below). Although the growth rate has slowed recently, the number of nodes, channels and network capacity have all increased by more than 100% year-on-year.

Lightning Network Capacity: Approximately $ 10 million configured on the network

(Source: Bitcoin Visuals)

Bitcoin must become a widely used everyday currency without the help of applications such as the Lightning Network, OpenNode, and other off-chain payment aggregators.

Bitcoin as currency will not be Bitcoin on the chain.

Trend 6-Convenience First

An interesting phenomenon has emerged. Although Bitcoin has historically faced the risk of hacking and theft of funds, Bitcoin owners increasingly favor the liquidity, return and ease of use of centralized platforms.

Users love the simple user interface of the exchange, just as we like Uber Eats. Regardless of the inherent risks, logging in to a sophisticated website is better than guarding the key or connecting to a Ledger cold wallet. But who knows what Uber riders are doing with your food?

The current institutionalization of Bitcoin may be a repeat of history.

Gold has a similar history. Due to limited supply, low inflation, and easy destruction, gold has become another huge value store. But gold has the disadvantages of being bulky, cumbersome, safe and expensive to transport. Just like Bitcoin's private key, holding a gold bar in your hand may make it clear that you own it. Historically, there has been some significance in concentrating gold in banks and issuing receipts and bills to “commit to paying holders”.

Note: All commitments to convert asset securitization into cash have been broken

If bitcoin is accepted by the mainstream as a means of value storage, it is not difficult to imagine that many people would choose a "trusted" and insured institution to manage their positions under the premise of security and promise to provide the required Someone pays for their Bitcoin.

Institutions that endorse Bitcoins, such as Wrapped BTC, should issue a warning. If these stablecoins are more and more popular in the market due to the 1: 1 exchange with Bitcoin, "greater utility", perhaps instantaneous exchanges and 0 commissions, please think twice. Especially if these stablecoins are backed by companies, regulators or central banks, you need to be more careful.

Contrarian view-Decentralized Finance (DeFi)

More and more decentralized financial applications supporting blockchain have emerged. A whole new world of decentralized finance (DeFi) was born.

The role of DeFi is to complete core business interactions without trust and transparent protocols without intermediaries. An important scenario of it is that it allows you to retain the private key, and therefore allows you to retain clearer decentralized ownership among users.

Today the largest application scenario of DeFi is the decentralized exchange (DEX). Although the trading volume of decentralized exchanges is growing, it is still dwarfed compared to centralized exchanges.

An argument against DeFi today is that no chain is truly decentralized except the Bitcoin blockchain. The centralized team has the ultimate power to change the blockchain, change the circulation, and reverse the bad events.

Although personally managing bitcoin private keys today has more explicit ownership, over time, personally managing private keys may incur greater risks. In a world where Bitcoin is used on a large scale and everyone has a private key, there will be their own problems. Imagine what would happen if everyone hid money under the mattress today?

The obvious solution is personal insurance for Bitcoin private key management.

However, in the short term, the risks of individuals managing bitcoin, and the cost of an insurance company managing the distributed network of a bitcoin holder, may be greater than the risks and costs of a centralized custodian. This will also cause most people to favor Bitcoin institutionalization.

In the future, DeFi may solve the above problems. For example, a DAO (Decentralized Autonomous Organization) insurance fund without a centralized organization. This will be a more advanced and trustless version of NexusMutual, but it may take some time.

Although the trend of Bitcoin's centralization today may only be a short-term trend, it will take some time for true decentralized platforms to compete with centralized platforms.

Bitcoin usage impact today

What do all the popular bitcoin usage scenarios today have in common? What do these six trends have in common?

Tokens are increasingly concentrated in the hands of a few organizations, and OTC transactions are increasingly used for settlement.

Bitcoin's centralized investment and transactions are showing increasing momentum. At present, the only solution for using Bitcoin as a currency is through third-party settlement or escrow.

The fate of Bitcoin

Today, only about 1% of the world's population is using Bitcoin, and the jury is still open about the centralization of Bitcoin. Until November 2019, the main trend is centralization.

The fate of Bitcoin as a centralized asset may eventually turn into a race against time. A rampant competition between technology development and large-scale applications.

Chicken or egg first? Automated DeFi solution (and broad trust) to privately manage Bitcoin? Or is it more convenient to adopt bitcoin on a large scale and centralize bitcoin in existing institutions before the technology catches up?

If Saifedean's guess is correct, Bitcoin will become an interbank settlement asset in the 21st century, and Bitcoin will continue to move towards institutionalization and eventually become the 21st century gold standard-the Bitcoin standard.

As recently as 1933, more than 80 years ago, President Roosevelt declared private possession of gold illegal. Gold was forced to exchange gold-backed notes with the Federal Reserve for $ 20.67 per ounce. However, when gold ownership was re-legalized in 1974, the price per ounce of gold rose to $ 154, and all banknotes issued in 1933 are now gone.

American investors who wanted to hold gold for a long time since 1933 received "gold guarantee bills" over the next 40 years, and their wealth actually shrank by 87%-all thanks to the US government.

If bitcoin does become an inter-bank settlement asset one day, I expect this situation will change.

Reprinted please retain copyright information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Vitalik 4D Long Text: What will happen to the hard core puzzles that plague cryptocurrencies in five years?

- Opinion | Why it is inevitable that the stablecoin introduces the KYC program

- Babbitt Original 丨 Two blockchain listed companies were born this week. Why did Hangzhou grab the nation?

- USDT Alchemy: Concealment, Additional Issues, and Manipulation

- One article to read Singapore's central bank digital currency plan, Ubin

- Overview: What are the DAOs on Ethereum?

- QKL123 market analysis | Blockchain organization innovation, crypto assets are indispensable (1126)