How to use dynamic NFTs to provide liquidity products in the Sui public chain ecosystem?

Using dynamic NFTs for liquidity products on the Sui public chain ecosystem.After the hustle and bustle of the past two years, the NFT market seems to have entered a “cold winter,” with various blue chips falling in price. At its root, the first phase of static NFTs dominated by PFPs has reached a growth bottleneck, and the second phase requires a new narrative to open up incremental markets, with dynamic NFTs becoming a new hot spot in the market.

However, dynamic NFTs have more stringent requirements for underlying infrastructure, and the emergence of the new public chain Sui has successfully broken the bottleneck. Sui uses the Move virtual machine (MoveVM) and Move programming language to implement smart contracts, reducing the barriers to innovation for creators through dynamic NFTs, unlocking more types of use cases and more fascinating applications and experiences. Developers can implement dynamic NFTs, upgrade, bundle, and group them, and generate real-time feedback on NFT behavior on the chain.

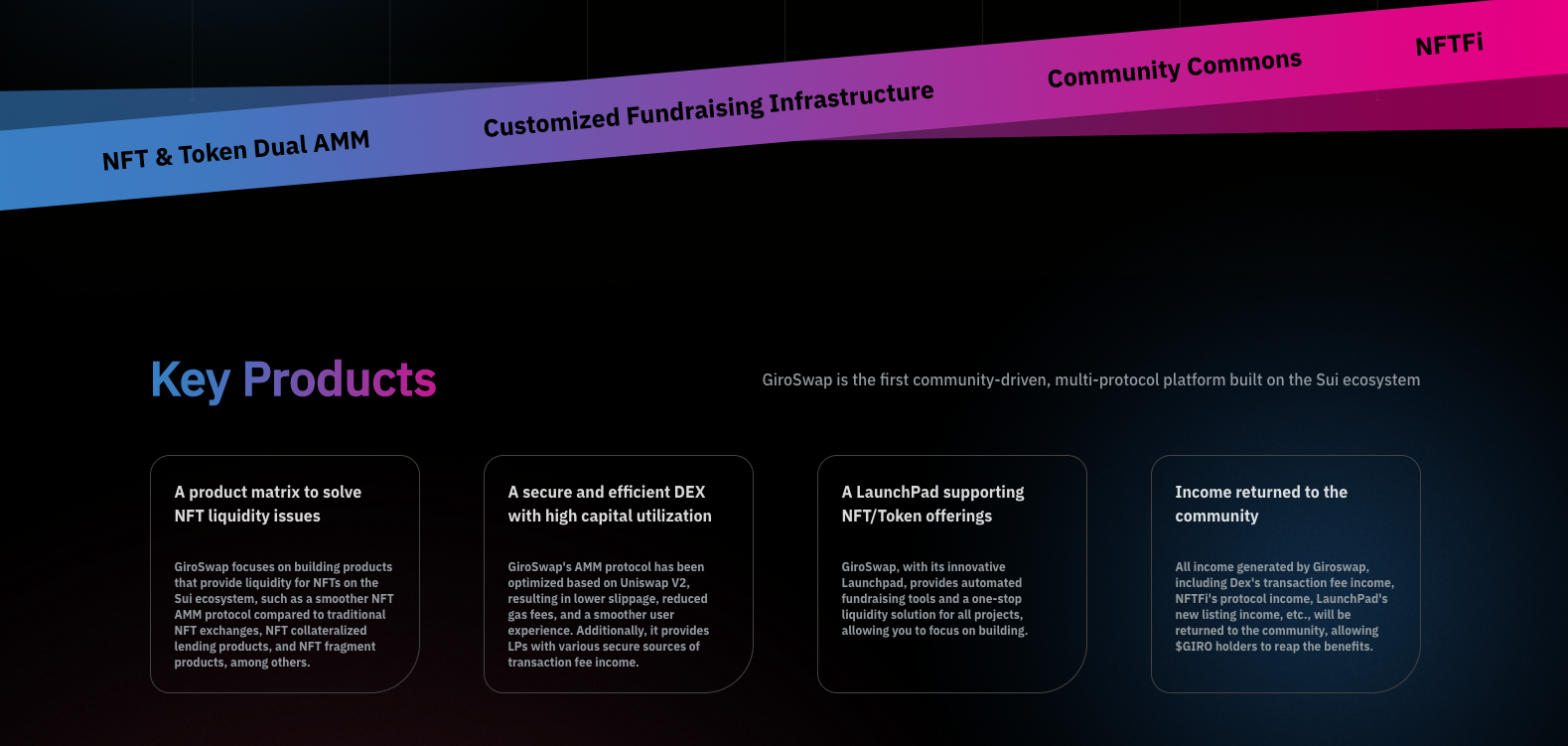

Like static NFTs, dynamic NFTs also face liquidity difficulties in the initial stage. GiroSwap focuses on building products that provide liquidity for NFTs on the Sui ecosystem. Its product matrix is diverse, including NFT AMM protocol, NFT lending, NFT fragmentation and NFT installment payments, as well as NFT/Token LaunchBlockingd.

As the first one-stop scalable dynamic NFT liquidity application protocol based on Sui, GiroSwap is committed to exploring and leading the innovation direction of the crypto market. Through GiroSwap, users and developers can jointly explore the infinite potential of dynamic NFTs and enjoy the dividends of liquidity.

- Decoding the new standard ERC-6551: A new way of playing NFTs in wallets

- Amid the encryption winter, what makes Worldcoin capable of securing a $100 million financing?

- 20 most active VCs and their largest investment in the 2023 bear market

1. NFT2.0: Dynamic NFTs become the next market trend

In the 2023 NFT market, it seems to have entered a deep bear market, with many blue-chip projects such as BAYC, Azuki, and Moonbirds constantly falling to the floor, and overall buying sentiment is low. Even the Bitcoin Ordinals inscription in March and Yuga Labs’ hard sell failed to make a bigger splash and save the sluggish NFT market.

At its root, NFTs lack new narrative logic. After the various JPEG or PFPs in the first phase of the market (2021-2023) were crazily hyped to the ceiling, their value gradually returned, and consumers (players) became more rational. It is difficult to pay for NFTs without practical value. Therefore, in the second phase of NFTs, if they want to expand the increment, they must enhance their practical value, such as NFTs as tickets, members, identities, game props, investment targets, and so on-the static NFTs of the first phase are obviously unable to meet the needs, and the emerging dynamic NFTs have recently received much attention and become a hot spot in the market.

What is a dynamic NFT? Dynamic NFT, or dNFT for short, is in contrast to static NFT. In fact, most of the NFTs we come into contact with are “static NFTs”. Static NFTs cannot be changed once they are minted and cannot be changed on the chain once they are formed. This is because when the code is written, their metadata (core attributes) is fixed and permanently immutable. This feature is also very suitable for digital art works such as videos, images, GIFs, 3D models, etc. Currently, static NFTs are mostly used in art projects, music photography, sports events and other fields.

However, because of the fixed metadata, static NFTs cannot be dynamically upgraded, so they also have some bottlenecks. Some tokenized assets in the real world, constantly updated electronic games, etc. need to access data to continue updating, and static NFTs cannot meet the needs. At this time, dynamic NFTs can solve this contradiction well.

Dynamic NFTs can change based on external conditions-the smart contract will trigger a change in dynamic NFT metadata. In addition to changing metadata, dynamic elements can also be realized. Dynamic NFTs can be minted based on certain specific conditions, such as when a hidden location is discovered in an AR application. Dynamic NFTs can also trigger “hidden attributes” through user interaction, which do not exist in the metadata originally.

Specifically, dynamic NFTs can be applied in the following areas:

• On-chain NFT passports. Dynamic NFTs can automatically update digital identities without replacing digital identity documents, including details such as residence, marital status, and contact information.

• Games. Players use NFTs to participate in P2E games. Achievement data obtained in the game (such as online time, winning percentage, MVP, etc.) will affect the state of the held NFT in real time. The game developers in the background can also upgrade the player’s NFT based on this data, or group it with other high-level players to improve the player’s gaming experience. In addition, real-time feedback can be generated on the chain based on changes in NFT behavior to achieve an open game ending (optional game ending).

• Virtual real estate. Although real estate NFTs have been available before, static NFTs cannot reflect the constantly changing factors such as real estate prices, years, and ownership; dynamic NFTs can capture real estate details and have the flexibility required for specific information updates. For example, if you hold a real estate NFT in a certain area of Beijing, the NFT will change with changes in market prices, market supply and demand, and the price will vary greatly.

• Brand dynamic marketing. In the past, brand NFT projects were mostly built from scratch, and most brands worked alone, which was very time-consuming and laborious. Now, based on dynamic NFT, data resources can be gathered on and off the chain to design dynamic marketing plans that maximize the interests of the brand and ultimately broaden the commercial chain and enhance product value.

Compared with static NFT, dynamic NFT is more intelligent and can adapt to and reflect the external world in real time. It can also set restrictions and rules, further enriching the application scenarios of NFT, and more use cases are worth exploring. The new round of development of NFT has just begun, and dynamic NFT is expected to inject fresh blood into the NFT market and introduce more increments to continuously expand the market size.

II. Sui provides an innovative cornerstone for dynamic NFTs

Static NFTs do not have inherent operational logic, and all the empowerment with NFT subjects is separate. Its application is detached from the story and culture of NFT itself. However, dynamic NFTs have inherent operational logic, and the empowerment they provide is endogenous and can be directly displayed. The development prospects of dynamic NFTs are beyond doubt, but they face great technical difficulties in landing and practice.

First of all, dynamic NFTs need to continuously modify or update metadata in smart contracts based on the signal source, which requires higher basic hardware requirements such as storage and transaction processing speed. At present, static NFTs develop best on Ethereum mainly because the requirements for these are relatively low; the high gas fees of tens of dollars and inefficient processing and matching (TPS is only 15) have greatly reduced the possibility of Ethereum developing dynamic NFTs, and other public chains also lack development conditions. Sui’s emergence has made up for the shortcomings of the development of dynamic NFTs.

Sui’s smart contract is written in Move language. Move language is a smart contract language that can be compiled and runs in a blockchain environment that implements MoveVM. At the beginning of its birth, it considered many security issues of blockchain and smart contracts and referred to some security designs of RUST language.

Unlike many existing programming languages, Move language is designed to support programs that can both write and interact safely with untrusted code and support static verification. Move language has such security features because it abandons all non-linear logic based on flexibility considerations, does not support dynamic dispatch, and does not support recursive external calls. Instead, it uses concepts such as generics, global storage, and resources to implement some alternative programming patterns. For example, Move omits dynamic scheduling and recursive call features, which in other smart contract languages have led to costly re-entry vulnerabilities.

Compared to other public chains, Sui runs at an unimaginable speed and scale – with a peak throughput of up to 297,000 TPS, its performance is key to transaction parallelization. In most blockchains, transactions must be sorted and executed in order in the block; serial execution unnecessarily limits the throughput of these chains, as most transactions are independent of each other. Because Sui requires an explicit description of the dependency relationship of transactions, it can process them in parallel. In the few cases where transactions are intertwined, Sui can still sort them and execute them in sequence. Because independent transactions can be verified in parallel, Sui can linearly increase throughput by adding more devices to each verification node, thereby increasing scale.

Not only does Sui have high throughput, it also has low latency. Its consensus algorithm is designed to minimize the communication required between validation nodes to process transactions; unlike the traditional blockchain’s broadcast-and-drop approach, Sui ensures bidirectional handshake between requester and approving validator, which leads to simple transactions being verified almost immediately, and complex transactions can be executed within 2-3 seconds.

High throughput and low latency make it easy to integrate transactions on Sui into dynamic NFTs and other settings that need to be completed in real time, such as games.

In addition, most blockchain storage is account-centric, while Sui’s storage is designed around objects. Each object is owned by an address, which can be mutable by default, made immutable, or shared among multiple addresses. Sui’s Move smart contract can receive these objects as input, operate on them, and return them as output. This is a completely different smart contract programming paradigm from Solidity or Rust, and is more expressive and simpler for digital object expressions of dynamic NFTs and encrypted games.

Moreover, by studying the code of MoveVM, we can see clearly that the storage of data and the storage of the call stack (process logic) of MoveVM are separated, which is the biggest difference from EVM. For example, to implement an ERC20 Token on EVM, one needs to write the logic and record the status of each user in a contract, while in MoveVM the user status (resource under the account address) is stored independently and program calls must comply with mandatory rules on permissions and resources. Although some flexibility is sacrificed, security and execution efficiency (which helps achieve concurrent execution) are greatly improved.

III. GiroSwap: an Extensible Dynamic NFT Liquidity Application Protocol Based on Sui

With the official launch of Sui mainnet on May 3, dynamic NFTs are about to see explosive growth and become the most eye-catching new trend in the crypto market. Of course, dynamic NFTs are just the first step, and various financial products (i.e., NFTFi) around dNFTs are indispensable. Especially for dNFTs, liquidity is the first problem to be solved.

Traditional static NFT markets such as Opensea basically use an order book matching system, where sellers place orders or buyers bid prices. One problem here is that sometimes buyers and sellers do not agree on the price, which may result in NFTs being either overpriced or underpriced; and sometimes multiple buy orders need to be purchased in batches, consuming expensive gas fees.

GiroSwap, the first extensible dynamic NFT liquidity application protocol in the Sui ecosystem, was created to solve the problem of dynamic NFT liquidity. GiroSwap is the winning project of the Sui hackathon in Vietnam and is currently live on the mainnet, focusing on one-stop aggregation trading of NFTs/tokens.

Specifically, GiroSwap has launched multiple flagship products to meet market demand, including NFT AMM protocol, NFT lending, NFT fragmentation, NFT installment payment, and NFT/token LaunchBlockingd. With GiroSwap, users do not need to navigate multiple applications in the Sui ecosystem. One Dapp can solve all their needs, making GiroSwap = Uniswap + BenDAO + Opensea + Blur+ LaunchBlockingd.

GiroSwap’s decentralized NFT exchange uses an automated market maker (AMM) model. Liquidity providers (LPs) can provide liquidity for their favorite NFTs by depositing assets into a single-sided or double-sided trading pool, and can choose to charge transaction fees based on the difference in buy/sell prices. GiroSwap does not distinguish between different NFT IDs, which means that each NFT in the liquidity pool is bound to the current price coefficient. Users who want to buy or sell NFTs can obtain the same price from the NFT pool during the transaction, regardless of whether the NFT ID is rare or not. In addition, GiroSwap supports one-click purchase and batch purchase, which can effectively save gas fees.

GiroSwap’s decentralized NFT exchange uses an automated market maker (AMM) model. Liquidity providers (LPs) can provide liquidity for their favorite NFTs by depositing assets into a single-sided or double-sided trading pool, and can choose to charge transaction fees based on the difference in buy/sell prices. GiroSwap does not distinguish between different NFT IDs, which means that each NFT in the liquidity pool is bound to the current price coefficient. Users who want to buy or sell NFTs can obtain the same price from the NFT pool during the transaction, regardless of whether the NFT ID is rare or not. In addition, GiroSwap supports one-click purchase and batch purchase, which can effectively save gas fees.

In addition to supporting NFT trading, GiroSwap also supports trading of Sui’s native tokens and all tokens bridged into the Sui ecosystem through AMM. Compared to Uniswap V2, GiroSwap has lower slippage, lower gas fees, and a smoother user experience.

It should be noted that compared to traditional NFT markets, GiroSwap has solved many problems by adopting the NFT AMM model. In traditional markets, the filtering functions of each NFT collection are not the same, but GiroSwap achieves more flexible filtering by calling the tags of each collection contract, allowing users to more easily find NFTs that meet their needs.

In addition, GiroSwap has launched an NFT lending market to unlock the value of dynamic NFT assets. If NFT holders do not want to sell their assets, they can also mortgage their NFTs to obtain stablecoins or Sui tokens to ease cash flow pressure. The peer-to-pool matching lending system connects borrowers and lenders through liquidity pools, and GiroSwap also implements a powerful liquidation system to ensure the safety of lent NFTs and protect the interests of lenders.

Furthermore, GiroSwap also offers NFT installment payments through its peer-to-pool trading system. This feature allows users to purchase the NFTs they want in installments, making NFTs more accessible to a wider range of users. Users can buy the NFTs they are interested in without paying the full price in advance, thereby promoting further growth and adoption of NFTs in the market.

In addition, considering that NFTs may become blue-chip projects with high prices, making it difficult for ordinary retail investors to access them, GiroSwap has introduced NFT fractionalization, allowing users to convert their favorite NFTs into MemeTokens that represent partial ownership of the underlying NFT. These MemeTokens can be freely traded on the platform, allowing users to access a variety of NFTs without owning the entire asset. This feature increases the liquidity of the entire NFT market and democratizes access to valuable NFTs.

Finally, GiroSwap has launched the innovative LaunchBlockingd, which provides automated fundraising tools and a one-stop liquidity solution for all projects (NFTs, tokens). GiroSwap allows developers to customize token/NFT issuance, claiming, and other rules before fundraising activities, and developers only need to set fundraising terms, which can effectively reduce development and market-making costs.

Overall, GiroSwap is the first community-driven multi-protocol platform built on the Sui ecosystem, aiming to create broader network effects by interweaving various decentralized markets and tools, and injecting more liquidity into the market.

GiroSwap dynamic NFT BlockingSS display:

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Future of Web3 Wallets: Innovation, Challenges, and Key Issues

- What should you pay attention to when playing MEME?

- Interpretation of investment trends from top 5 VC firms in the years after 2023

- Key factors for the future large-scale adoption of DID and specific investment directions

- Is the father of ChatGPT’s ambition to solve AI threats with cryptocurrency by airdropping to one billion people grand or is he just trying to make a quick buck?

- Sui Explorer Browser User Manual: Quickly Understand the Development of the Network

- The Sustainable Path of Integrating Environment and Finance: Can ReFi Reshape Web3?