Future of Web3 Wallets: Innovation, Challenges, and Key Issues

Web3 Wallets: Innovation, Challenges, and Key IssuesAuthor: Shaun Heng

Translation: Kate, Marsbit

Introduction

This will not be another history of the Web3 wallet. There have been many articles on this topic in recent months, and you may have read some of them. The purpose of this article is not to simply narrate the development process, but to delve into the current innovations, challenges, and key questions that need to be raised. Let’s get started.

- What should you pay attention to when playing MEME?

- Interpretation of investment trends from top 5 VC firms in the years after 2023

- Key factors for the future large-scale adoption of DID and specific investment directions

This article will first look at the current state of Web3 wallets, called Wallet 1.0, and the progress of Account Abstraction (AA), particularly ERC 4337, which is driving the development of the next generation wallet, called Wallet 2.0. In addition, potential risks and limitations associated with Wallet 2.0 will be discussed.

Given the rapid development of the Web3 wallet field, this article aims to establish a framework to help builders and investors determine long-term value. The framework will promote their construction and investment in this field. The core of the framework should address five key questions:

1. Is this a great business?

2. Will building Wallet 2.0 unlock a new way to solve problems that is 10 times better than before?

3. How can companies establish sustainable competitive advantages, especially in situations where they heavily rely on first-mover advantages?

4. Can companies find a distribution angle to add smart contract functionality to existing products?

5. What assumptions do we have to believe in for it to succeed over existing wallet solutions?

We will delve into each of these questions in more detail. But first, let’s take a look at the current state of the Web3 wallet field to provide better context.

“Not your keys, not your coins.”

The emergence of cryptocurrencies has fundamentally changed our view of money and assets. However, the prevailing lack of trust in traditional financial institutions has made it necessary to develop reliable and secure storage solutions. Recent failures of financial intermediaries such as FTX, BlockFi, and SVB have highlighted the fact that the safety of client assets depends on the provider’s ability to pay. As a result, users are increasingly turning to crypto rather than intermediaries for higher security. The emergence of Web3 wallets addresses this problem by providing users with the ability to securely store and manage their crypto assets while maintaining complete control of their private keys. As the saying goes, “not your keys, not your coins.”

If you do not control the private keys to your cryptocurrency assets, then you do not truly own them. The emergence of Web3 wallets solves this problem, allowing users to securely store and manage their cryptocurrency assets while maintaining full control over their private keys.

Key Properties of Web3 Wallets

Web3 wallets are a type of digital wallet designed to seamlessly collaborate with decentralized applications (dApps) that use blockchain technology. Unlike traditional wallets, Web3 wallets allow users to retain full control over their assets without the need for third-party intermediaries such as banks and financial institutions. Some key properties of Web3 wallets include:

Decentralization: Web3 wallets are decentralized, running on a peer-to-peer network, and do not rely on centralized servers. This makes them more secure and able to withstand hacking attacks and other security threats.

Interoperability: Web3 wallets are designed to work with a variety of blockchain protocols and cryptocurrencies, allowing users to manage and store multiple assets in one place.

Security: Web3 wallets use advanced encryption technology to protect private keys and other sensitive information, protecting users from theft and fraud.

User-Friendly: Web3 wallets are designed to be user-friendly, with a simple and intuitive interface that makes them accessible to anyone.

Status of Wallets 1.0

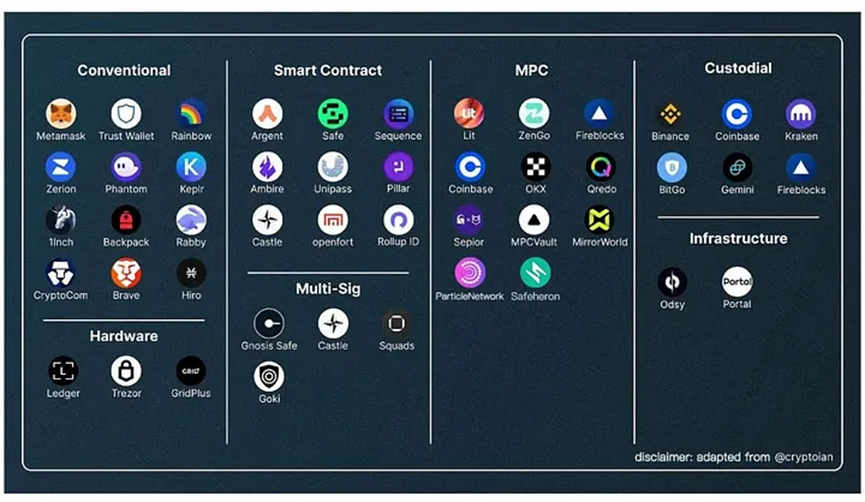

Currently, the landscape of digital wallets can be roughly divided into two types: custodial and non-custodial wallets.

Custodial wallets are services where a third party company (such as a centralized exchange) holds and manages a user’s private keys, essentially custodizing their cryptocurrency assets.

On the other hand, non-custodial wallets are wallet solutions where users can fully control their private keys, ensuring that they are the sole custodians of their cryptocurrency assets. Non-custodial wallets can be further divided into three categories: externally owned account (EOA) wallets, smart contract wallets, and multi-party computation (MPC) wallets.

1. EOA wallets are the most common type of digital wallet used for storing and managing cryptocurrency. These wallets require users to hold their private keys, typically provided by centralized exchanges or wallet providers. Examples of EOA wallets include Metamask, BackBlockingck, Phantom, Rabby, and Rainbow.

2. Smart contract wallets are decentralized wallets that use smart contracts to manage assets. These wallets are more secure and flexible than EOA wallets and support advanced features such as social recovery and multisignature support. Examples of smart contract wallets include Argent, Safe, and Sequence.

3. MPC wallets use a technique called threshold encryption to enhance security. The private key required for authorizing transactions is split into multiple parts and distributed to different parties, ensuring that no single party can independently access the key. This approach significantly reduces the risk of a single point of failure or attack, making it more difficult for hackers to steal funds. Examples of MPC wallets include Fireblocks, ZenGo, Coinbase MPC, and Blockstream Network.

Finally, it’s worth mentioning the emerging category of infrastructure where teams are developing solutions and primitives that allow other developers to create and customize wallets for end-users, simplifying the wallet creation process.

Challenges facing current Wallet 1.0

While cryptocurrency wallets have made significant strides in recent years, there are several challenges that need to be addressed to make them more accessible and user-friendly. Some of the key challenges currently facing cryptocurrency wallets include:

Inaccessibility to the general user: Cryptocurrency wallets are difficult for the average user to understand, making it difficult for them to take advantage of the benefits of blockchain technology.

Complex login: Setting up a cryptocurrency wallet can be a complex process, involving many steps. This may be a barrier for new users, especially those who are not tech-savvy.

Lost or stolen mnemonic phrases: Cryptocurrency wallets rely on mnemonic phrases, which are a series of words used to recover the wallet in case the device is lost or stolen. However, if the mnemonic phrase is lost or stolen, it can result in the loss of all funds stored in the wallet.

Fragmented chains: Different wallets for different chains add another layer of complexity, making it harder for users to seamlessly manage their assets across various blockchain networks.

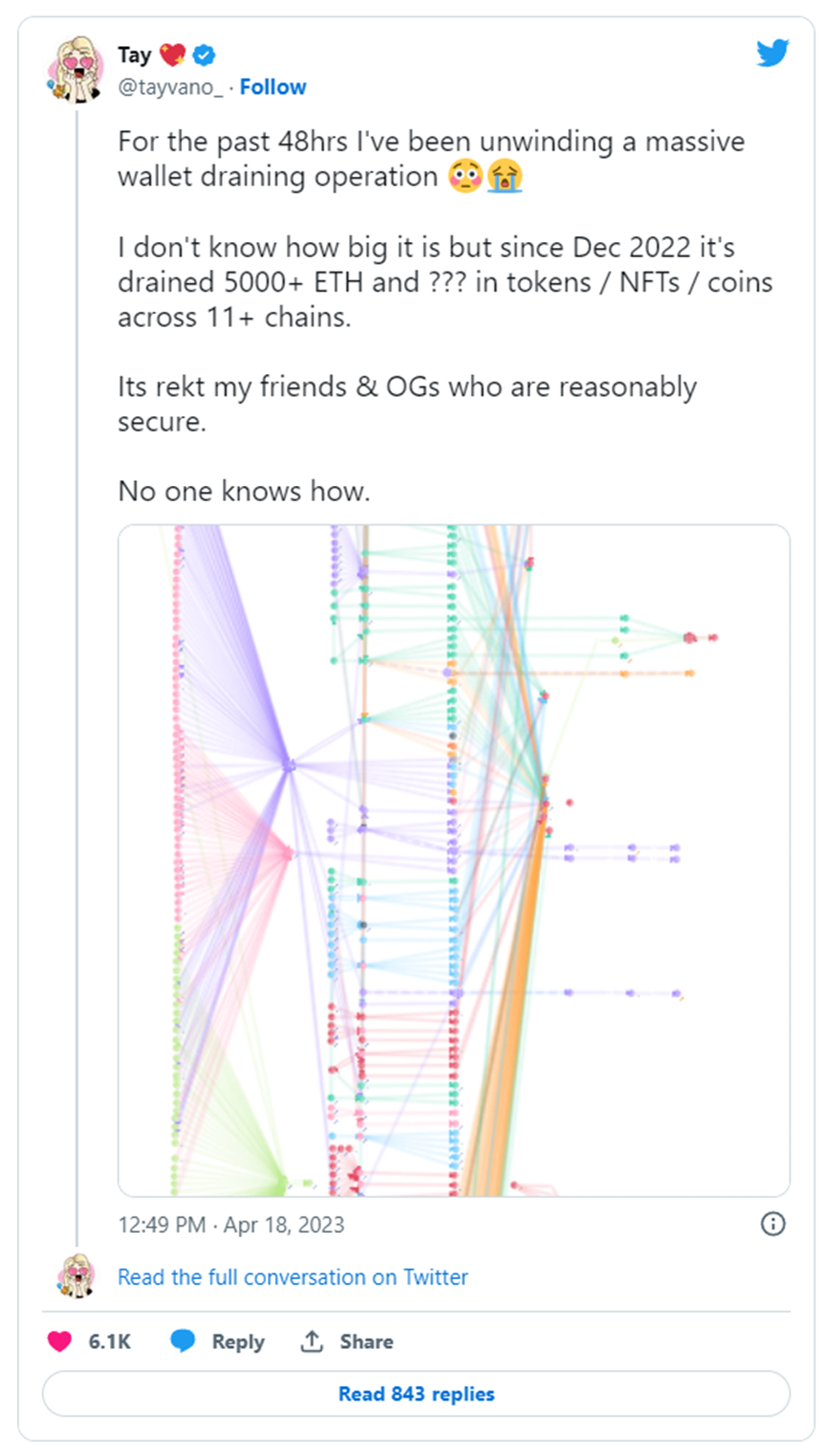

Even crypto OGs can lose funds due to vulnerabilities, as we recently saw with @tayvano_’s revealed wallet-draining operation.

https://twitter.com/tayvano_/status/1648187031468781568?s=20

To address these challenges, wallet builders are exploring new methods and technologies to create more user-friendly and secure digital wallets that are easier to adopt by mainstream audiences.

The Innovation of Abstract Accounts (“Why Now?”)

The emergence of account abstraction (AA) in the Ethereum network has brought significant progress to the development of Web3 wallets. AA introduces on-chain programmability through smart contracts, adding flexibility to Web3 wallets.

Key difference between EOA and Smart Contract Accounts

Traditionally, only EOA can control funds on the Ethereum network. This means that smart contracts must rely on EOA to execute transactions, which limits the range of operations that smart contracts can perform.

With AA, smart contracts can now directly control funds, making them more powerful and versatile.

Why ERC 4337 Matters Today

A special development that is significant today is ERC 4337. This Ethereum standard implements protocol AA without changing the consensus layer. ERC 4337 introduces several key features that enhance the user-friendliness and accessibility of Wallet 2.0.

Social Recovery: Wallet 2.0 can now have multiple owners, allowing for social recovery of lost private keys.

Atomic Multi-Operations: Smart contracts can execute multiple transactions as a single atomic operation, simplifying complex transactions and ensuring their integrity.

Paying Transaction Fees with ERC20 Tokens: Smart contracts can now pay transaction fees with ERC20 tokens, providing greater flexibility in payment options.

Blockingymaster: Wallet 2.0 allows third-party Blockingymaster to sponsor transaction fees on behalf of users, optimizing gas usage and improving efficiency.

These features make Wallet 2.0 more accessible and user-friendly, which is crucial for the adoption of Web3 wallets.

The Future Road of Wallet 2.0

The development of Web3 wallets is still in its early stages, with much work to be done before becoming mainstream. Wallet 2.0 is the next stage of development for Web3 wallets, and it requires the collective efforts of developers, entrepreneurs, and investors to make it a reality.

The development of ERC-4337 has led to the emergence of a new type of wallet that has the potential to completely change the way we store and manage digital assets.

While Wallet 1.0 provided a good starting point, it still has limitations in many aspects, particularly in terms of user accessibility and login complexity. The future of Wallet 2.0 lies in addressing these limitations while introducing new features to improve their functionality and security.

“What are some builders currently building?”

Some developers have begun working on the landscape of Wallet 2.0. The focus of building these wallets is on user accessibility, security, and interoperability. They leverage the power of smart contracts to provide features such as social recovery, atomic multi-operations, and gas fee sponsorship.

Some emerging wallets 2.0 that will focus on ERC-4337 include Castle, Soul Wallet, Candide, UniBlockingss, Biconomy, Banana Wallet SDK, Stackup and Etherspot.

5 key questions to ask when evaluating Wallet 2.0

As with any emerging technology, evaluating potential risks and returns related to Wallet 2.0 is important. Here are five key questions to consider when evaluating Wallet 2.0 solutions:

1. Is this a great business?

A successful Wallet 2.0 solution requires more than just a useful tool for users. It must also be a sustainable business model in and of itself. Builders must consider factors such as revenue streams, customer acquisition costs, and profitability. In addition, they must evaluate potential market size and competition to determine whether the business can scale and thrive long term.

Competition is fierce in the Wallet 2.0 space, and new solutions must offer compelling value propositions to succeed. The business model must be sustainable and have a clear path to profitability.

2. Will building Wallet 2.0 open up a new way of solving problems that is 10 times better than before?

The second question to ask is whether Wallet 2.0 will open up a new way of solving problems that is 10 times better than before. Wallet 2.0 has the potential to address many of the problems associated with traditional wallets. For example, social recovery and atomic multi-operation capabilities can provide significant improvements over existing solutions.

Social recovery provides a more secure and user-friendly way to recover lost private keys, while atomic multi-operations allow multiple transactions to be executed as a single transaction, saving users time and money. These features can provide advantages over traditional wallets, which do not offer these capabilities. However,

However, it is crucial to consider Peter Thiel’s principle – a successful product must be at least 10 times better than its competitors. When evaluating the potential of utilizing ERC-4337, enterprises should evaluate whether the technology brings substantial improvement in productivity, creativity, or quality. In addition, the economic feasibility of implementing smart contract functionality should be evaluated to ensure that the benefits outweigh the associated costs.

3. How can companies establish sustainable competitive advantage, especially in situations where first-mover advantage is critical?

The third question is how companies can establish sustainable competitive advantage, especially in situations where first-mover advantage is critical.

Social recovery and atomic multi-operation functionality may be key differentiators for Wallet 2.0, offering a first-mover advantage. However, competition is fierce in the Wallet 2.0 space, and builders must establish a sustainable competitive advantage to succeed in the long term. This advantage can be built on the basis of technology, network effects, or branding.

Wallet builders must identify a unique value proposition that sets them apart from competitors. That said, I do believe that there will be some defensive plays in certain specific areas. I’ll discuss two of them below, but this list is by no means exhaustive.

1. Unique and proprietary distribution channels: Having unique and proprietary distribution channels can help startups stand out from competitors. It provides a unique way to access customers that isn’t easily replicable, thereby offering a unique advantage. This distinctiveness can attract customers and differentiate the startup from similar products in the market. I’ll elaborate on this point in the next question.

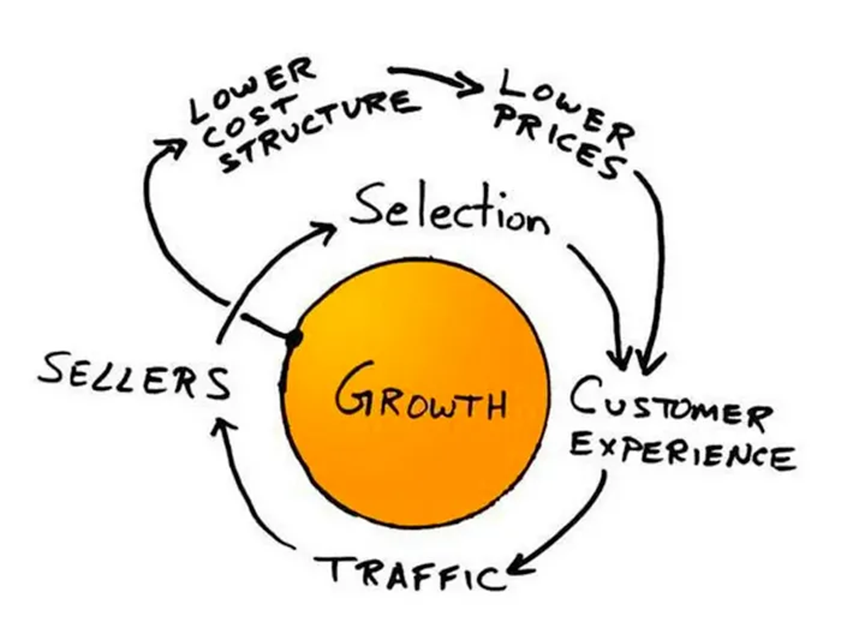

2. Viral spread embedded in the product: Embedding viral spread into a product isn’t a matter of luck. Viral spread is carefully designed. Many of the best companies have a growth cycle—a flywheel that turns faster over time. This is Amazon’s famous growth cycle. What’s yours?

4. Can companies find a distribution angle to add smart contract functionality to existing products?

Another important question to ask is whether companies can leverage their existing partnerships and relationships with existing businesses to distribute Wallet 2.0 to a wider audience. This is particularly important given the challenges faced by the current landscape in guiding users to Wallet 2.0.

One potential distribution angle for Wallet 2.0 is through partnerships with centralized exchanges, which currently hold the majority of user assets in the cryptocurrency ecosystem. By integrating Wallet 2.0 functionality into their platforms, exchanges can offer users enhanced security and self-custody options while still maintaining control over their funds. This also helps exchanges stand out in a crowded market and attract users who value self-regulation and security. The key question here is how do you convince an exchange to partner with you instead of building their own exchange? Learning from past successes may be meaningful. This is an article by the CEO of Sardine on the cost-effectiveness of buying versus building in the crypto fraud detection and anti-money laundering space.

Another potential distribution angle is through partnerships with DeFi protocols, which can integrate Wallet 2.0 into their platforms to offer users greater control and transparency over their funds. This also helps drive adoption of Wallet 2.0 among users who are already accustomed to the DeFi ecosystem and are looking for more advanced self-custody options.

5. What assumptions do we have to believe in order for it to be successful over existing wallet solutions?

Finally, builders must critically evaluate the assumptions and beliefs underlying their Wallet 2.0 solution. They must consider technical feasibility, user adoption, and market trends, which will determine whether their solution can be successful. Additionally, they must be prepared to adjust their approach as the landscape evolves and new challenges emerge.

A. Users value the security and transparency provided by Wallet 2.0 enough to justify the complexity of using them.

With the use of decentralized protocols and smart contract code, Wallet 2.0 provides a higher level of security and transparency than centralized wallets. However, this comes at the cost of increased complexity, which may make Wallet 2.0 inaccessible to the average user. In order for Wallet 2.0 to be successful, users must be willing to put in the effort to learn how to use them and must value the added security and transparency enough to justify the additional complexity.

B. Wallet 2.0 can provide at least as good of a user experience as existing wallet solutions, despite their more complex architecture.

Compared to existing wallet solutions, the architecture of Wallet 2.0 is more complex, which may make them more difficult to use and also have a worse user interface. However, Wallet 2.0 developers are working hard to improve the user experience by building more intuitive interfaces and utilizing the latest user experience design principles. If Wallet 2.0 can provide at least as good of a user experience as existing wallet solutions, despite their more complex architecture, they will have a good chance of being widely adopted.

C. Wallet 2.0 can effectively address the challenge of mnemonic backup and recovery, reducing the risk of users losing funds.

One of the biggest challenges facing existing wallet users is the risk of losing funds due to lost or stolen mnemonics. Wallet 2.0 offers potential solutions to this problem, such as social recovery mechanisms and other advanced key management technologies. If Wallet 2.0 can effectively address the challenge of mnemonic backup and recovery, they will be able to provide a more secure and user-friendly alternative to existing wallets.

D. Wallet 2.0 can achieve widespread adoption through collaboration and integration with existing participants in the cryptocurrency ecosystem.

Finally, in order for Wallet 2.0 to be widely adopted, they will need to establish partnerships and integrations with existing participants in the cryptocurrency ecosystem, such as exchanges, dApps, and other wallet providers. This will require Wallet 2.0 developers to build open and interoperable systems that can seamlessly integrate with existing infrastructure. If they are successful in doing so, they will be able to leverage existing user bases and expand the scope of their solutions.

Potential Risks and Limitations

While Wallet 2.0 brings great hope for the future of DeFi, builders and users must also be aware of potential risks and limitations. These include:

ERC-4337 does not solve the high gas problem

Using ERC-4337 to send simple transfers may be more expensive than using EOA since a contract call is required to use ERC-4337. However, in the aggregation aspect, ERC-4337 may be more cost-effective than EOA since it can aggregate signatures to minimize the amount of data on the mainnet.

Security risks associated with ERC-4337

Compared to traditional wallets, Wallet 2.0 introduces new security risks. Malicious actors may attempt to exploit vulnerabilities in smart contract code, potentially resulting in loss of funds. When considering ERC-4337, potential security risks may arise due to the introduction of new opcodes, including the possibility of unexpected errors or attack vectors. Builders must prioritize security in their design and development processes to minimize these risks. These potential security risks are why Safe is waiting until ERC-4337 is fully tested and audited before adding support for it.

ERC-4337 requires cross-chain interoperability

When it comes to implementing Wallet 2.0, chain compatibility may also be a limitation. These wallets are designed to interact with specific blockchain networks and their corresponding smart contract languages. However, they often lack compatibility with multiple chains, limiting their functionality and versatility. This means that if users want to switch between different blockchain networks or use smart contracts on different platforms, they need to create separate wallets for each chain. This limitation hinders the seamless and efficient management of digital assets and transactions across multiple blockchain ecosystems. To address this challenge, developers are actively exploring solutions such as cross-chain interoperability protocols to enable Wallet 2.0 to connect different blockchain networks and enhance its compatibility.

Legal and regulatory challenges

The legal and regulatory environment surrounding Wallet 2.0 is still evolving, with significant uncertainty in many jurisdictions. Builders must be aware of these risks and ensure that they comply with relevant laws and regulations.

Conclusion

In summary, the Wallet 2.0 space will fundamentally change the way we store and manage digital assets. As the web3 ecosystem continues to evolve, the need for secure and user-friendly wallet solutions will only become more pressing. Wallet 2.0 represents the next generation of wallet technology, offering a range of new features and advantages that were previously impossible to achieve.

In this report, we have explored the key properties of Web3 wallets, the current state of Wallet 1.0, AA innovations, and the future of Wallet 2.0. We have also outlined five key questions that creators in the wallet space should ask themselves when evaluating their business.

Future outlook for the Wallet 2.0 space

As the ecosystem continues to evolve, we can expect to see more advanced and user-friendly wallet designs, better key management solutions, and new use cases for Wallet 2.0. The integration of new technologies, such as second-layer scaling solutions and cross-chain interoperability, will further enhance the functionality of Wallet 2.0. As the blockchain industry matures, Wallet 2.0 will become an essential tool for managing digital assets and interacting with dApps.

Advice for builders in the wallet space

First, focus on building sustainable competitive advantages that can withstand heavy reliance on first-mover advantages. Second, prioritize user experience and accessibility to make Wallet 2.0 more easily accessible to ordinary users. Third, ensure that wallet design and key management solutions prioritize security and ease of use. Fourth, identify potential distribution angles for existing enterprises that can add smart contract functionality to existing products. Finally, keep up with the latest trends and technologies in the blockchain ecosystem, stay ahead of the curve, and provide innovative solutions that meet user needs.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is the father of ChatGPT’s ambition to solve AI threats with cryptocurrency by airdropping to one billion people grand or is he just trying to make a quick buck?

- Sui Explorer Browser User Manual: Quickly Understand the Development of the Network

- The Sustainable Path of Integrating Environment and Finance: Can ReFi Reshape Web3?

- What is the purpose of the world coin that features iris authentication, global airdrops, and the creator of ChatGPT?

- Can the combination of decentralized derivative exchanges and account abstraction open up the next incremental entry point?

- US House Stablecoin Hearing: State and Federal Regulatory Authority Dispute Focus of Both Parties

- Conversation with Sui Developer Relations Manager: How to start developing on Sui from scratch?