Amid the encryption winter, what makes Worldcoin capable of securing a $100 million financing?

Despite the encryption winter, how can Worldcoin secure $100 million financing?Author: LeftOfCenter

According to sources, Sam Altman, the founder of OpenAI, is seeking $100 million in new funding for his other crypto project, Worldcoin, and is currently in advanced negotiations. “Financial Times” cited an insider as saying that the new round of financing has the support of existing and new investors. As early as 2022, Worldcoin received investments from institutions such as Andreessen Horowitz (a16z) and Khosla Ventures, with a valuation of up to $3 billion, which means that the valuation of the project tripled in just one year. It was reported that in October 2021, Worldcoin completed a $25 million Series A financing led by a16z, with a valuation of $1 billion. Other investors include Digital Currency Group, Coinbase Ventures, and Multicoin, as well as angel investors such as FTX founder Sam Bankman-Fried and LinkedIn co-founder Reid Hoffman.

Financing in the crypto winter is not an easy task, and it is even more difficult to get such a large amount of money. Why did Worldcoin, which was still unknown two years ago, receive capital attention and still be able to obtain huge investments with a valuation of $3 billion in the crypto winter? What investment potential do investors see in Worldcoin? What does Worldcoin mean for the wallet track and the crypto industry?

- 20 most active VCs and their largest investment in the 2023 bear market

- Future of Web3 Wallets: Innovation, Challenges, and Key Issues

- What should you pay attention to when playing MEME?

Introduction to Worldcoin

Worldcoin was proposed by Altman in 2019 and was inspired by the economist’s theory of “universal basic income (UBI)”. It hopes to achieve fair distribution of wealth by sending free cryptocurrency Worldcoin, which is simply understood as “sending money” in the form of universal basic income (UBI) to redistribute the wealth created in the AI era.

Since it is free to send money, a method is needed to determine the user’s identity and prevent the same person from receiving tokens multiple times with different identities. Therefore, World ID was created as the underlying identity protocol of Worldcoin, which can ensure that each person can only register one account with their iris.

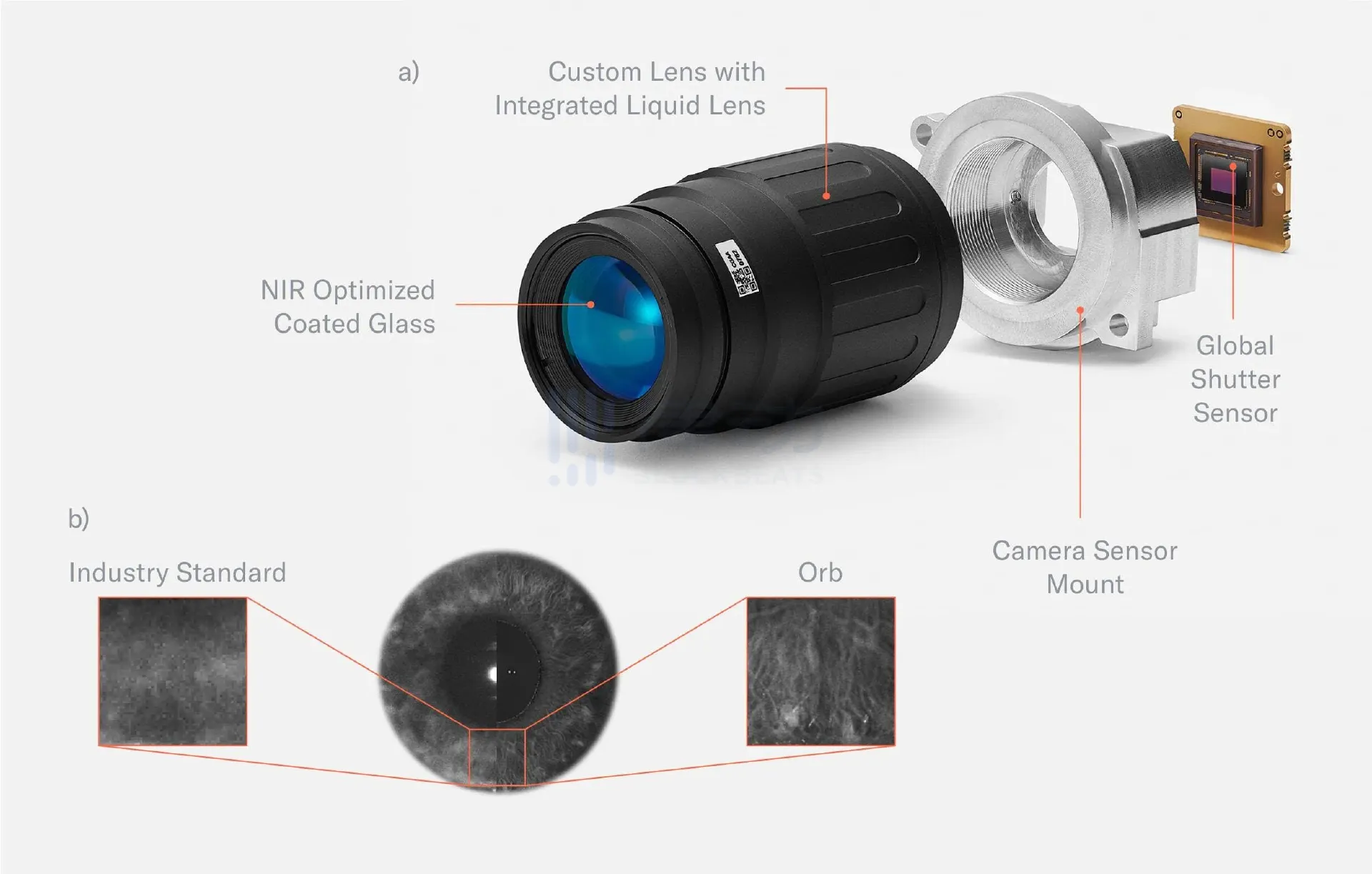

In addition, the team has developed a set of biometric devices that verify a person’s uniqueness by scanning their irises, while ensuring the privacy of the verified person through zero-knowledge proof. This scanner, called Orb, is currently in beta testing and uses open-source design, with two lenses, wide-angle and long-focus, working in conjunction with neural networks to capture high-definition images of the iris. Due to compliance restrictions, the hardware device is currently only available for trial in some regions, including Argentina, Chile, India, Kenya, Portugal, and Spain.

Orb’s function is simple: to scan the human iris and convert the biological feature image into an uncrackable hash code consisting of letters and numbers. Worldcoin calls it “IrisCode”. If it is verified as a new registered user by comparing it with the data in the database, a new WorldID will be added to the Worldcoin database, and an encrypted wallet with a QR code will be generated. Users can obtain free Worldcoin tokens through this wallet.

In summary, Worldcoin is a product ecosystem built around UBI, which includes three products: WLD Token, which will be distributed free of charge to 1 billion people worldwide, World ID, which is used to verify real identity, and World App, which is used to store tokens.

From the Narrative of a Grand Vision to the Form of a Product and User Data

Worldcoin, which originated from the UBI theory, had a grand ideal from the beginning-to distribute digital currency free of charge to the world’s 7.9 billion people and achieve fair distribution of wealth.

“Through UBI, let billions of people around the world get rid of poverty and achieve the goal that cryptocurrency and its financial system cannot achieve due to being too expensive and the transaction speed being too slow-like expanding cryptocurrency and its financial system to hundreds of millions of people,” This is a bold plan and a utopian vision. Although the vision is beautiful, it is also easy to become a pure narrative. With a small number of cryptocurrency users, Worldcoin’s ambition was once questioned, comparable to the “moon landing plan”.

However, after two years of silent development, Worldcoin has taken shape in terms of product form and user growth, and its business logic has also become clear beyond the ideal narrative logic.

First of all, sending Free coin to users around the world is both a narrative technique and a very clever customer acquisition strategy. Every time a new account receives a cryptocurrency, it brings a new wallet user to Worldcoin, which will help Worldcoin seize the wallet entrance. In the cryptocurrency industry, mastering wallets is equivalent to seizing traffic entrances.

Data shows that the ecological wallet “World App”, which was launched a few days ago, has already conducted small-scale tests, and the number of registered users has reached nearly 1.7 million, and is growing rapidly at a rate of a new user every 14 seconds, making it the fastest-growing wallet in the world. Users completed website, mobile application and encrypted DApp login authentication over 6.3 million times through World ID, and the total number of sent and received transactions exceeded 690,000, with a daily transaction volume of 60,000.

At first glance, 1.7 million may not seem like an impressive figure, but for the cryptocurrency industry, it is still a considerable number.

Worldcoin’s breakout is not unfounded. At least from the product design of the “World App” recently released by the ecosystem and the economic model of Worldcoin, we can see some traceable fundamentals.

In terms of product design, the team “accurately targets the target users and optimizes the usability of the product.”

Due to objective compliance issues, most of the currently open countries are in third world countries and regions. This means that from the beginning, Worldcoin has taken the route of surrounding cities from the countryside, which also coincides with Worldcoin’s main goal-universal finance. Of course, inclusive finance should cover those underdeveloped countries with weak financial infrastructure, which is the vast majority of Asia, Africa, and Latin America where Worldcoin currently covers.

Since it is the route of inclusive finance, the first consideration should be the residents of those regions and countries where the financial infrastructure and hardware equipment are generally inadequate.

In response to the current situation where most of the third world’s financial infrastructure and hardware equipment are not yet perfect, Worldcoin has made the maximum inclusive and friendly improvements to the product design. On May 8th, Worldcoin announced the launch of the ecological wallet “World App”. This exclusive wallet supports transactions without gas fees, is compatible with OS and Android versions, and currently supports downloads in more than 80 countries/regions around the world, supporting multiple localization languages. The product size is only 18MB, and it can even support mobile phones with a service life of 10 years.

At the product level, the team designs the product based on the lowest software and hardware standards, so that the usage threshold of current users is minimized. Only in this way can the original vision-including most of the world’s humans-be realized and reach people in various regions of the world, including those who cannot touch the new digital economy.

Photo: "National Geographic"/John Stanmeyer photographed African immigrants holding their phones to receive cheap signals from Somalia to contact their overseas relatives on the coast of Djibouti on the evening of February 26, 2013.

Regarding the token mechanism, Worldcoin adopts a deflationary reward model and incentivizes activity through task completion.

According to the plan, Worldcoin is expected to issue WLD tokens by the end of June, with a total supply of 10 billion, and distribute more than 80% of the token supply to the community and contributors through free distribution.

To incentivize early contributors, rewards are obtained through a deflationary mechanism, which means that as more people join, the amount obtained by later participants will decrease. This will not only stimulate early participation enthusiasm and motivation, improve user growth rate, but also, especially for those cryptocurrency veterans who cannot participate in certain regions due to compliance requirements, create FOMO effect, generate market buying pressure, and generate momentum for price discovery.

In addition, WLD tokens are not distributed in a one-time manner, but are obtained through task completion. In the early stages, 1 token can be received per week, and the time interval for token acquisition will increase over time, possibly 1 token per month, which is beneficial for maintaining user activity. From the data, it also achieved good results, with a total of 1.7 million users and a daily transaction volume of 60,000.

World ID: The Antidote To The Proliferation of False Content in the AI Era

With the widespread use of artificial intelligence, the proliferation of false and anonymous accounts on the Internet will intensify. Artificial intelligence is good at imitating human behavior by generating text, deep fakes, or bypassing common verification methods, making it increasingly difficult to distinguish between human accounts and bots/false accounts, and identity verification has become an urgent problem to be solved.

As an open and permissionless identity protocol, World ID can not only serve as a globally universal digital passport, but also anonymously prove a person’s uniqueness, that is, “you are you” without revealing privacy.

World ID uses proof of personhood to address two issues caused by AI: prevent Sybil attacks and minimize the spread of incorrect information generated by AI.

Since we acknowledge that AI will bring about a level of change in human society that is comparable to the industrial revolution, finding solutions to the problems it creates will also be a real need.

If the so-called universal finance and UBI in the early stages of entrepreneurship still remain at a certain level of idealistic narrative logic, then today, two years later, Worldcoin not only has real products and real user growth, but also enables us to see its reasonable business logic, and from a higher level, has real needs in terms of social significance.

It can be said that in addition to its own reasonable business logic, Worldcoin can also solve real social problems at a higher level, which is why Worldcoin, which was still unknown two years ago, is now favored by top capital and still has a high valuation in the cold winter.

Interestingly, Worldcoin’s founder Sam Altman is also the founder of OpenAI. OpenAI’s leadership in the AI race has contributed to a new round of hot trends, and it can be said that OpenAI’s and ChatGPT’s success has given Worldcoin new opportunities. This is not only because Sam Altman’s aura has led investors to “dig up” his other project, Worldcoin, but also because the potential threat of artificial intelligence led by OpenAI to create and disseminate inaccurate information on a large scale can be solved by the latter, providing real usage scenarios and use cases for the latter’s business logic. To some extent, these two projects have achieved a perfect self-contained loop.

What does this mean for the cryptocurrency industry?

The “World App”, which is growing rapidly at a rate of one new user every 14 seconds, can be said to be the fastest growing wallet in the world. Looking at the logic that “mastering the wallet is mastering the traffic entrance of the cryptocurrency industry”, the importance of Worldcoin for the wallet track is beyond doubt. Considering that transaction fees may be introduced in the future (according to Tiago Sada, product, engineering and design director of Tools For Humanity, World App charges a few basis points per transaction), mastering the traffic entrance of the wallet will bring huge commercial success to World App.

If Worldcoin can continue to expand steadily and achieve its target expectations, it may bring tens of millions of incremental users, which may accelerate the adoption of cryptocurrencies on a large scale. This will benefit the entire industry and is the most important value for the entire cryptocurrency industry.

Due to the restrictions of current compliance issues, Worldcoin is forced to prioritize opening to underdeveloped third world regions and countries. For people in these areas lacking financial infrastructure, they will likely have their first wallet after scanning their eye and completing a series of follow-up operations, and WLD will be their first cryptocurrency in life.

So, each new user who receives WLD tokens is equivalent to successfully converting one “World App” wallet user, which not only allows WorldCoin to successfully occupy the key entry point of the cryptocurrency industry – wallets, but also brings incremental users to the cryptocurrency industry, because each new World ID has the potential to flow from the WorldCoin ecosystem to other corners of the cryptocurrency industry, which will benefit the entire cryptocurrency industry.

The Worldcoin ecosystem wallet World App, which carries new users, will use its extensive cryptocurrency channel to deliver these cryptocurrency novices to other cryptocurrency ecosystems.

In fact, from the very beginning, Worldcoin, which emphasizes openness and equality, has had a close relationship with the cryptocurrency industry, which is reflected not only in the founding team and VC background, the cryptocurrency-native project genes, but also in the ecological development, integration, and expansion, the Worldcoin team is actively connecting and cooperating with various cryptocurrency ecosystems.

Let’s take a look at where Worldcoin’s tentacles are reaching:

The native token WLD of Worldcoin will be issued on Ethereum, the underlying protocol of World ID has run on Polygon, and it is planned to migrate to Optimism OP mainnet together with World App. In addition, Worldcoin is actively developing and building around cross-chain.

The native wallet World App, built specifically for Worldcoin, not only supports Beta WLD payment, purchase and transfer functions, but also supports corresponding functions of various other tokens, including WETH, WBTC, DAI, USDC (more tokens will be supported in the future);

World App also supports CEX and DEX applications, currently supporting applications including Uniswap, ENS, Circle, Safe, MoonBlockingy, RampNetwork.

The Worldcoin team once partnered with Optimism, Coinbase and Prysm development teams to test, implement and release the EIP-4844 proposal, which aims to reduce L2 costs by a factor of 10, making it more affordable for more users to use DApps.

It can be said that Worldcoin is not only a wallet entry, but also an entry from the real world to the cryptocurrency industry. Entering the world of Worldcoin is equivalent to entering the cryptocurrency ecosystems of Ethereum, Bitcoin, and so on.

Imagine a scenario where World App is constantly supplying fresh blood to the crypto world through Worldcoin. These new users, who have their own wallets and digital identities for the first time, will have their first experience of buying and trading cryptocurrency. They will also start to try out more different crypto operations, not just passively receiving airdropped WLD tokens, but also using Ethereum and stablecoins for more on-chain operations such as trading, wealth management, and even publishing and collecting NFTs.

This will be followed by a series of cross-chain, bridging, and application technology developments around World App, which are like highways laid out around this wallet, connecting the places leading to Ethereum, Layer 2 chains, decentralized applications, and platforms to expand richer scenarios for new users.

As the entry point for connecting the real world to crypto, World App will connect to other blockchains and ecosystems such as Ethereum, bringing new users to the industry. From this perspective, it is not impossible for Worldcoin to leverage this to achieve widespread adoption of crypto.

Moving Forward Amidst Doubts

Of course, there has been constant doubt about WorldCoin during its development, with the main arguments focusing on privacy and security, unrealistic goals, and exploitation of vulnerable groups.

Doubt #1: Can iris scanning really ensure users’ real identities?

Although the team claims that the personality proof solution combining the identity protocol World ID and the biometric device Orb can perfectly solve the problem of fake accounts, can iris scanning really ensure users’ real identities?

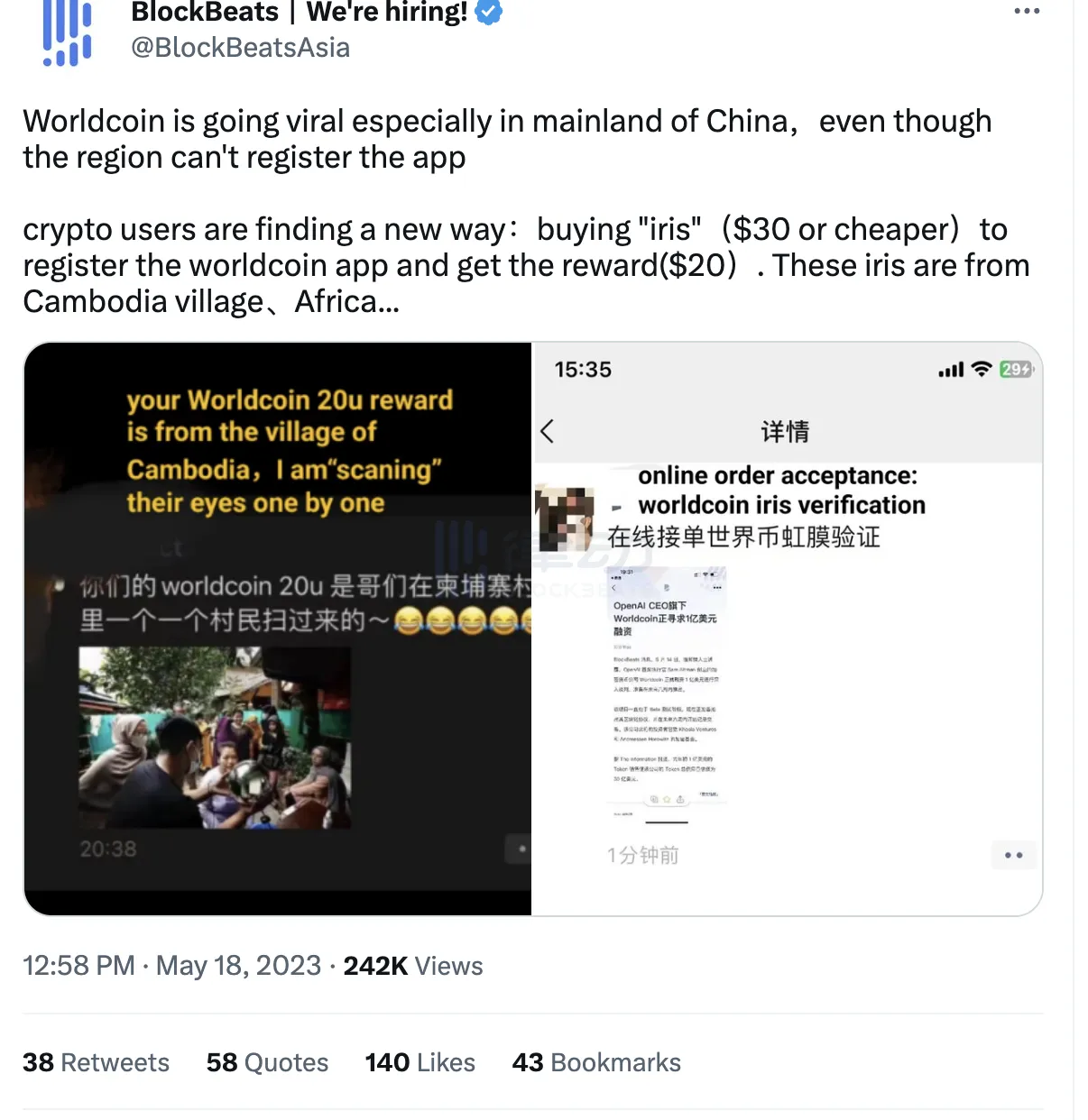

According to a tweet by BlockBeats, because WorldCoin has not yet opened in mainland China due to compliance issues, users cannot currently register. As a result, a business that replaces iris scans has quietly emerged on the market, where you can buy an iris verification for up to $30 and then receive a $20 reward. According to these intermediaries, most of the human iris scans used for this service come from rural areas of Africa and Cambodia. With such low-cost replacement iris scans, we can’t help but wonder how many of the so-called 1.7 million users are fake?

Worldcoin’s official response acknowledged the existence of a black market, but emphasized that there were only a few hundred such cases. In response to the iris black market, Worldcoin has launched new measures to combat it, including adjusting the initial face-to-face registration process and implementing dynamic and static QR codes.

Question 2: Privacy and Security

One common question about Worldcoin is that the human iris scan used by Worldcoin may raise privacy and security concerns.

The team explained that Worldcoin’s “underlying identity protocol” World ID uses zero-knowledge proof technology to verify a user’s identity without sacrificing their privacy, which can protect the privacy of users’ iris data. Unlike typical digital identity systems that use biometrics, iris scans are only used for identity verification, and iris images themselves are not retained (unless the user chooses to do so). The IrisHash generated by Orb processing is the only value passed into the database, which is generated locally and is unidirectional and irreversible.

However, today we have higher requirements for data privacy transparency, such as where data is stored, whether there is a possibility of sharing data with third parties, and with whom this data is shared.

Question 3: Former Ethereum Foundation members criticize WorldCoin’s economic model and regional issues

Former Ethereum Foundation member Hudson Jameson tweeted questioning the possibility of WorldCoin’s claim to create a fair global currency, and questioned WorldCoin’s economic model, saying “WorldCoin’s token economic model is flawed. WorldCoin’s goal is to make people around the world control and use the same currency, but only 80% of tokens are distributed to users, 10% are held by the team, and the remaining 10% are given to investors.”

In addition, Hudson believes that WorldCoin’s issuance may cause huge socio-economic problems locally, which vary by region, but so far there is no public information indicating the team’s handling of these issues and no working group of relevant experts has been formed.

Therefore, Hudson believes that WorldCoin is impractical and doubts whether it can bring tens of millions of new users by 2025.

Question 4: Snowden has questioned WorldCoin, and MIT Technology Review has called it “cryptocolonialism”

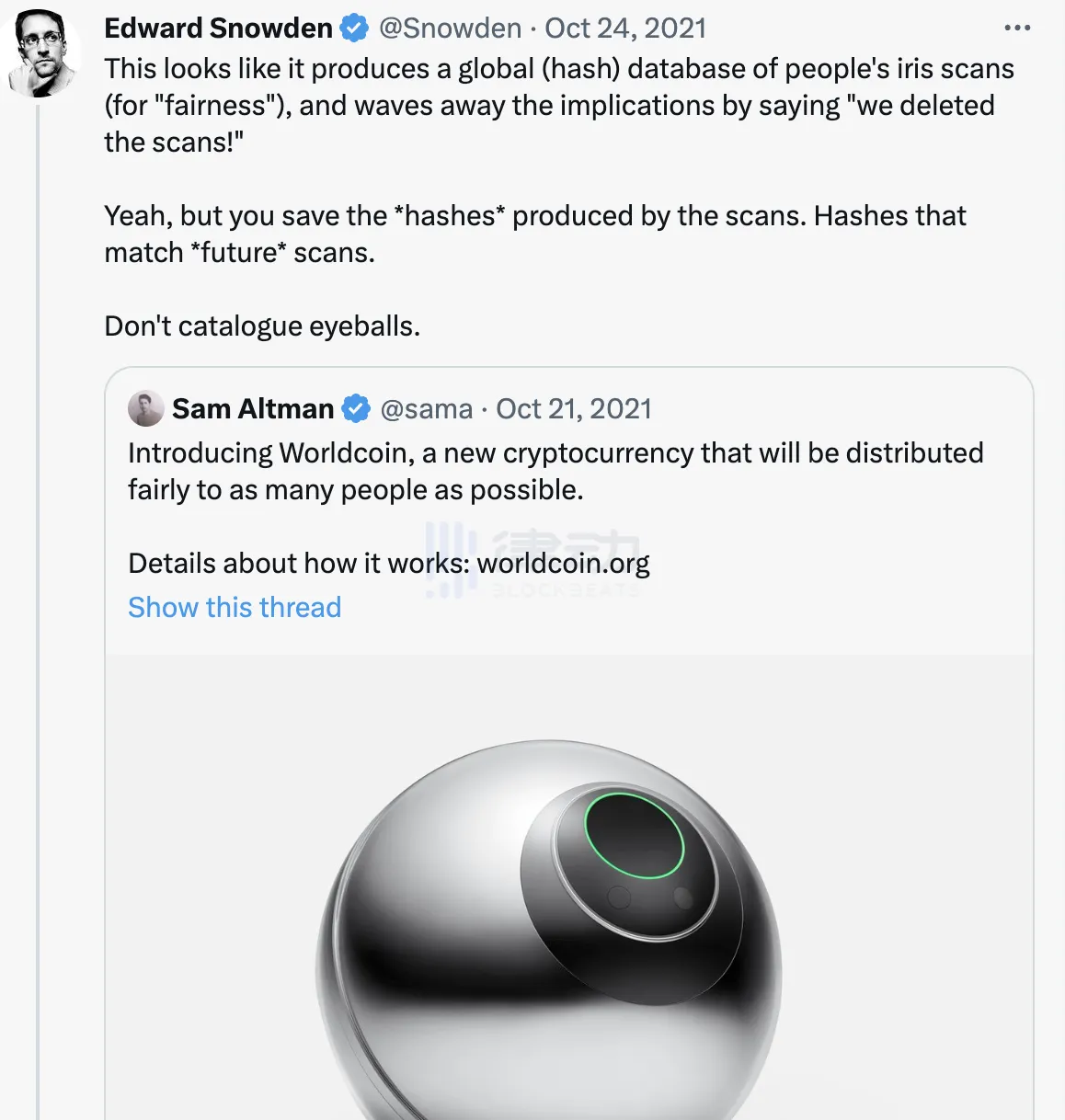

Back in October 2021, Snowden had questioned Worldcoin’s ID plan, fearing that Worldcoin would build a global iris database. Snowden said that it seemed like a global human iris scanning (hash) database generated under the banner of “fairness,” and that “we deleted these scans!” to eliminate the impact. Snowden also warned, “Don’t use biometric technology for anti-fraud. In fact, don’t use biometric technology for anything.”

Recently, the US technology magazine MIT Technology Review also wrote that Worldcoin was first tested in low-income communities, and was called crypto-colonialism because the cost of data collection was lower and more convenient due to the lack of legal protection for residents in these areas. According to technologyreview, as of March this year, Worldcoin’s iris scans have been opened to 24 countries/regions around the world, 14 of which are developing countries and 8 are in Africa.

Worldcoin may not be the perfect product, and it faces many problems, challenges, and even crises in the short term, but undoubtedly, it is the most potential cryptocurrency application so far. If Worldcoin can succeed, its tokens will appreciate, which may be why, apart from founder Altman, Worldcoin attracts top Silicon Valley venture capital.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpretation of investment trends from top 5 VC firms in the years after 2023

- Key factors for the future large-scale adoption of DID and specific investment directions

- Is the father of ChatGPT’s ambition to solve AI threats with cryptocurrency by airdropping to one billion people grand or is he just trying to make a quick buck?

- Sui Explorer Browser User Manual: Quickly Understand the Development of the Network

- The Sustainable Path of Integrating Environment and Finance: Can ReFi Reshape Web3?

- What is the purpose of the world coin that features iris authentication, global airdrops, and the creator of ChatGPT?

- Can the combination of decentralized derivative exchanges and account abstraction open up the next incremental entry point?