How to dissect ETH volatility? Breakdown of F(X) novel stable asset and leverage scheme

Analyzing ETH volatility with F(X) stable asset and leverage scheme breakdown.f(x) Protocol

Overview

Background

AladdinDAO

Stablecoins

- A stablecoin is a type of cryptocurrency whose value is pegged to another currency, commodity, or financial instrument in order to reduce price volatility compared to other more volatile cryptocurrencies such as Bitcoin.

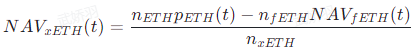

How the Protocol Works

Fractional ETH – Low Volatility Asset/”Floating” Stablecoin

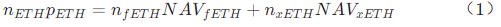

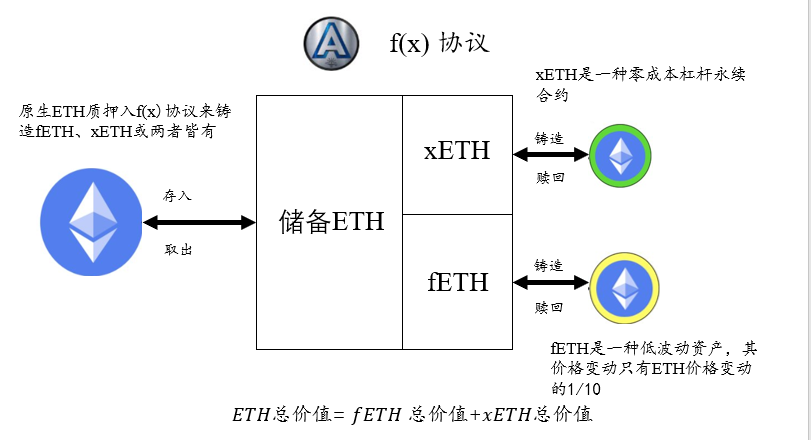

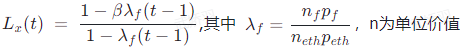

At the protocol’s inception, the price of fETH is set at $1. The protocol controls its volatility by adjusting the fETH NAV to only reflect 10% of the change in the ETH price (i.e., β_f = 0.1). When the ETH price changes, the fETH NAV updates according to the following formula:

where rETH is the return of ETH between times t and t-1.

- Review of the Rise and Fall of Cryptocurrency Exchanges in the Last 13 Years: Dominance, Scandals, and Crashes

- How to use dynamic NFTs to provide liquidity products in the Sui public chain ecosystem?

- Decoding the new standard ERC-6551: A new way of playing NFTs in wallets

The advantages of stablecoins are mainly reflected in low price volatility, low inherent risk, and high liquidity. fETH is a low-volatility asset with β=0.1, meaning that its price changes only one-tenth as much as the ETH price. In this way, fETH can avoid centralized risk while capturing some of the growth or decline of the ETH market.

Compared to traditional stablecoins, fETH issuance is based on market demand rather than CDP demand and is only limited by xETH (a token that can absorb fETH volatility and provide leveraged returns), making it more scalable and capital-efficient. fETH can be seen as a way of anchoring to ETH, but it does not maintain a fixed or near-fixed ratio like traditional anchoring methods, but adjusts based on β=0.1.

Overall, as a store of value and medium of exchange, fETH provides liquidity and stability in the cryptocurrency market while also retaining some potential market growth.

Leveraged ETH

Leveraged ETH, also known as xETH, is a decentralized, composable leveraged long ETH futures contract with low liquidation risk and zero capital cost (in extreme cases, xETH minters can even earn fees), designed as a companion asset to fETH. xETH holders generally bear the majority of fETH supply volatility, and traders can freely change positions by using the f(x) minting and redemption module or existing on-chain AMM liquidity pools.

fETH can be minted and redeemed based on direct demand as long as there is enough xETH supply to absorb fETH volatility. The leverage ratio of xETH is variable, so relatively little xETH can support a large amount of fETH.

Calculation of xETH’s leverage ratio

Determined according to the following formula:

- If the fETH mint amount is 0, then at this time $$\lambda_f=0,L_x=1$$, xETH becomes a perpetual contract for long ETH with a leverage of 1x.

The actual effective leverage ratio of the xETH token changes over time as xETH and fETH are minted and redeemed relative to each other’s supply. The higher the supply of xETH relative to fETH, the lower the effective leverage ratio of xETH, as excess volatility of fETH is spread across more tokens. Conversely, the larger the supply of fETH, the more the volatility is concentrated on fewer xETH tokens, resulting in a higher effective leverage ratio.

System Stability

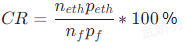

As xETH is an asset hedging fETH, the more xETH there is, the more stable the system is. If we consider the total ETH reserve as the collateral of the CDP, and the total fETH supply represents the borrowed amount, we can monitor the health factor of the system using a Collateral Ratio similar to the CDP system. For the f(x) protocol, we can define CR as follows

Whether minting fETH or xETH, or adjusting the net asset value of the two tokens, will affect the value of CR. If the system CR falls to 100%, it means that the value of xETH is zero, and at this time, the β value of fETH is 1, which means that it will be completely exposed to the price fluctuations of ETH and will no longer exist as a low-volatility asset. Therefore, f(x) has designed a four-level risk management module to conduct risk control.

Whether minting fETH or xETH, or adjusting the net asset value of the two tokens, will affect the value of CR. If the system CR falls to 100%, it means that the value of xETH is zero, and at this time, the β value of fETH is 1, which means that it will be completely exposed to the price fluctuations of ETH and will no longer exist as a low-volatility asset. Therefore, f(x) has designed a four-level risk management module to conduct risk control.

Risk Control

The risk control system of f(x) is a four-level module, which is used to take corresponding measures to maintain the low volatility of fETH and the positive net asset value of xETH when the collateral ratio (CR) of the system drops to a certain threshold, so as to increase CR. These measures include:

Stability mode: When the CR is below 130%, the minting of fETH is prohibited, the redemption fee of fETH is cancelled, the redemption fee of xETH is increased, and additional rewards are given to the xETH minter.

User Balance Mode: When CR is below 120%, users are encouraged to increase the system’s collateralization ratio by redeeming fETH, and are given additional rewards for doing so.

Protocol Balance Mode: When CR is below 114%, the protocol automatically uses ETH from reserves to market buy and burn fETH to increase the system’s collateralization ratio.

Recapitalization: In the most extreme case, the protocol has the ability to recapitalize by issuing governance tokens to raise ETH, either through minting xETH or buying and redeeming fETH.

Revenue

The revenue of the f(x) protocol is generated by charging fees for minting and redeeming fETH and xETH. These fees are an operational parameter that will be determined at launch. Additionally, when the risk management module is activated, fETH holders will also need to pay stability fees, which will be allocated to other users or the protocol itself that help balance the system.

β – Key parameters regulating volatility

Store of Value

Medium of Exchange

Cryptonative

Assumptions in extreme market conditions

Summary

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Amid the encryption winter, what makes Worldcoin capable of securing a $100 million financing?

- 20 most active VCs and their largest investment in the 2023 bear market

- Future of Web3 Wallets: Innovation, Challenges, and Key Issues

- What should you pay attention to when playing MEME?

- Interpretation of investment trends from top 5 VC firms in the years after 2023

- Key factors for the future large-scale adoption of DID and specific investment directions

- Is the father of ChatGPT’s ambition to solve AI threats with cryptocurrency by airdropping to one billion people grand or is he just trying to make a quick buck?