Over $76 billion in funds have been stolen, taking stock of six major tools for securing cryptocurrency assets

Over $76 billion has been stolen from cryptocurrency assets, prompting the need to assess six main tools for their security.Author: Emperor Osmo, Crypto KOL

Translation: Felix, BlockingNews

The crypto field is often described as the “wild west”. It is an industry where you can make a hundred times your investment, but you can also lose all your funds due to smart contract vulnerabilities, project exits, or entering too late. In the past, the crypto field has caused losses of over $76 billion due to rug pulls and scams. This article will list 6 tools to safeguard funds and avoid these crypto scams.

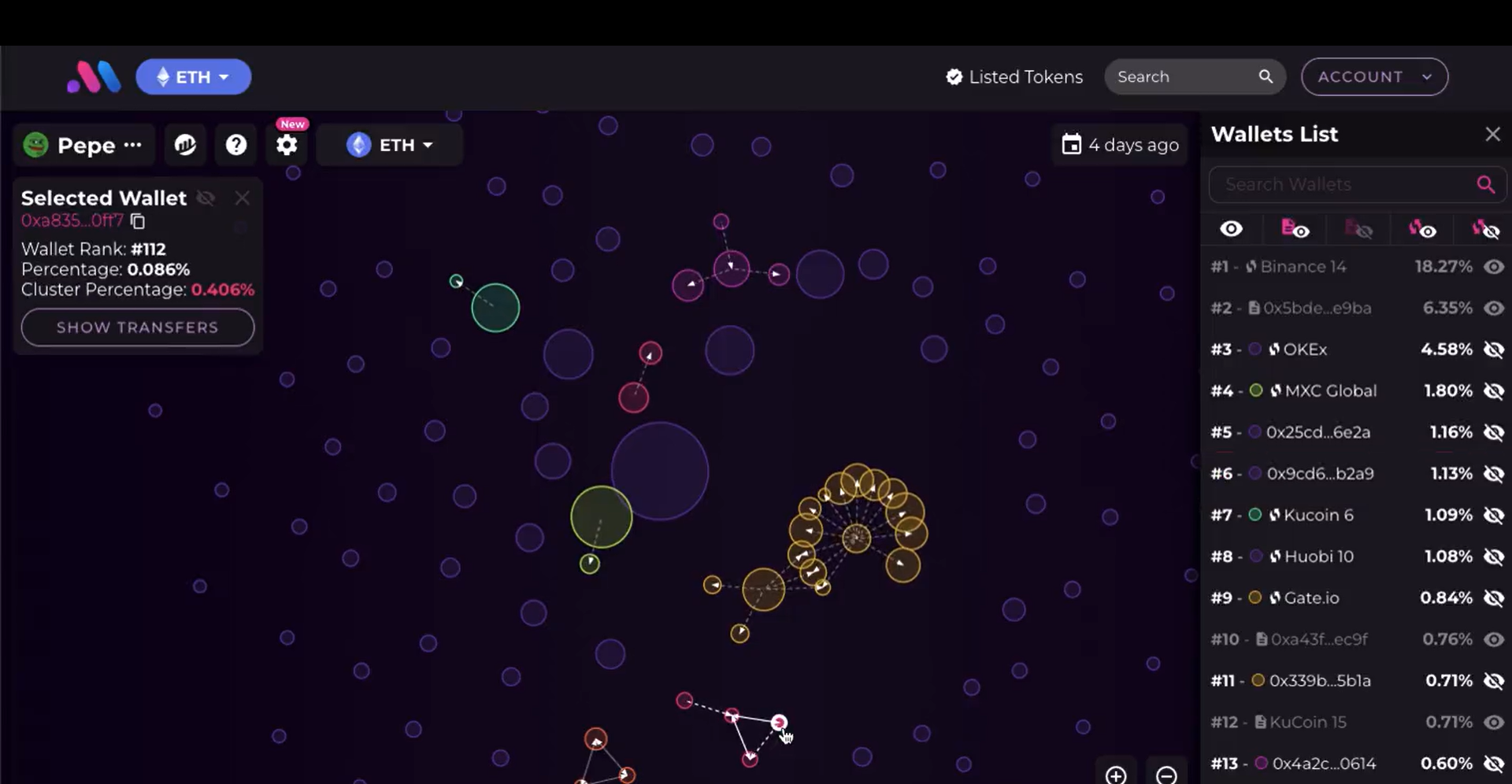

Bubblemaps

While there are blockchain explorers like Etherscan that can be used to view on-chain transactions, it is difficult to trace the flow of funds. Bubblemaps makes it easy to understand which wallets hold what funds and where they are going. During the season of Meme madness, rug pulls are everywhere. Bubblemaps plays an important role in discovering rugs and saving users thousands of dollars from scammers.

- “Rebellious Girl” and “Internet-addicted Youth”: 13-year-old DAO Founder Finds Self in Web3

- How to dissect ETH volatility? Breakdown of F(X) novel stable asset and leverage scheme

- Review of the Rise and Fall of Cryptocurrency Exchanges in the Last 13 Years: Dominance, Scandals, and Crashes

Related reading: Meme frenzy and then exit? 2 tools for token analysis

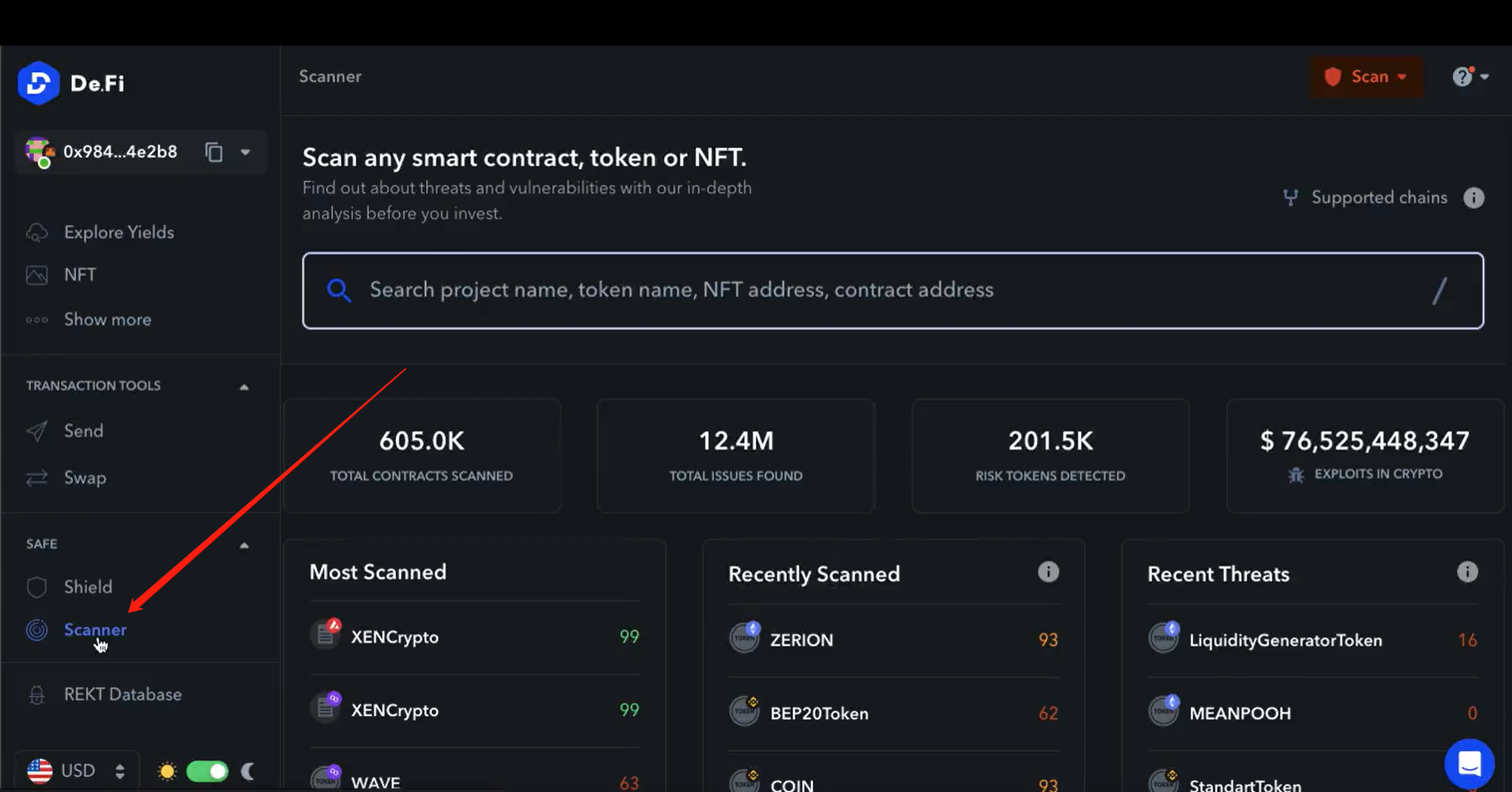

De.Fi

De.Fi offers a suite of products aimed at making the crypto experience safer. De.Fi platform’s wallet scanning and blocking features immediately identify any malicious contracts and prevent users’ liquidity from being drained. Defi_Mochi created a very simple and understandable tutorial on how to use these free tools.

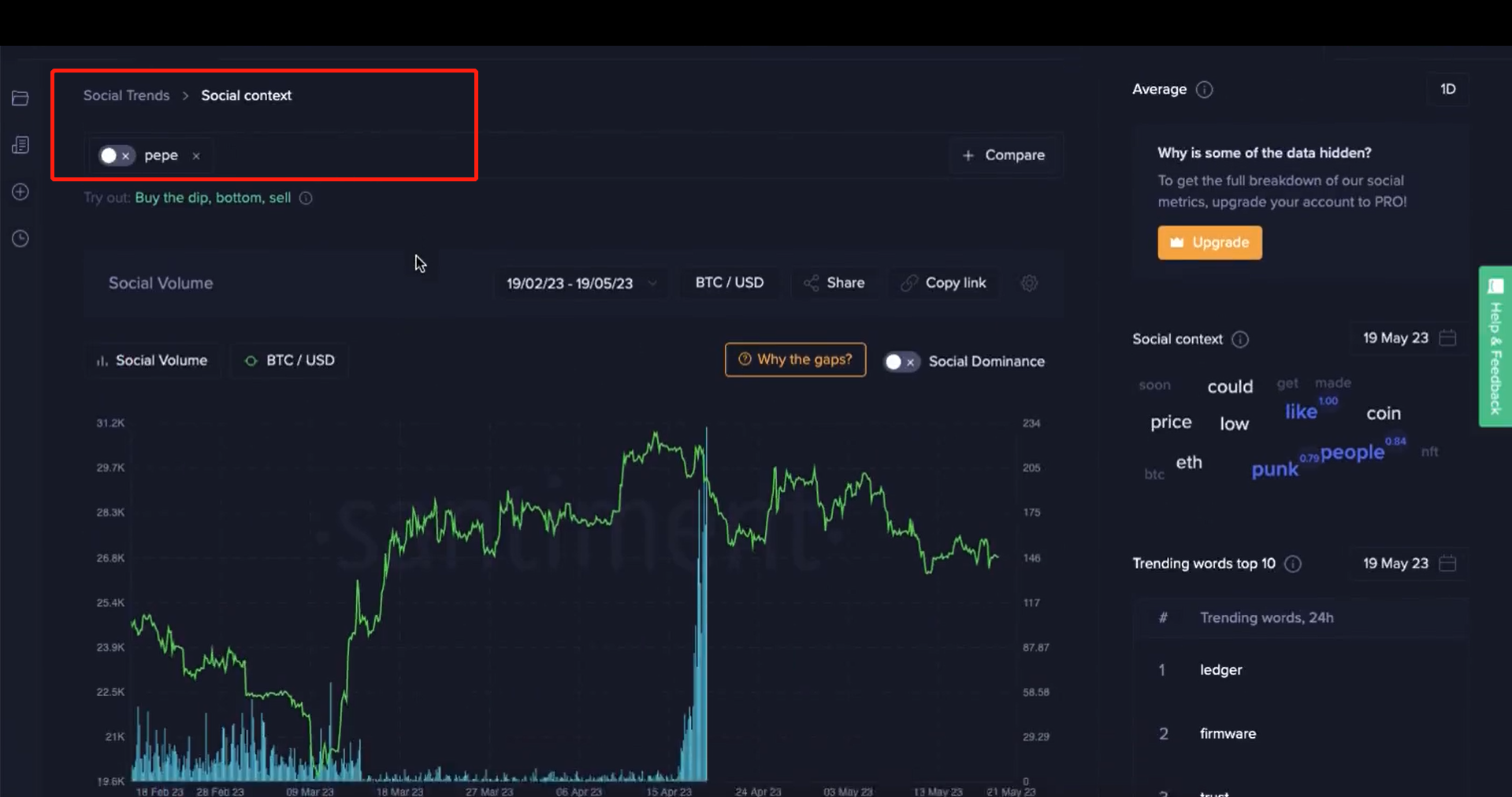

Santiment

Santiment allows investors to track market trends and understand market cycles. By tracking prices, NFTs, keywords, and cross-referencing, it can help avoid buying at the top.

In addition, Santiment can guide how to best allocate funds by analyzing the correlation between keywords and the market, while avoiding 90% of losses caused by delayed purchases.

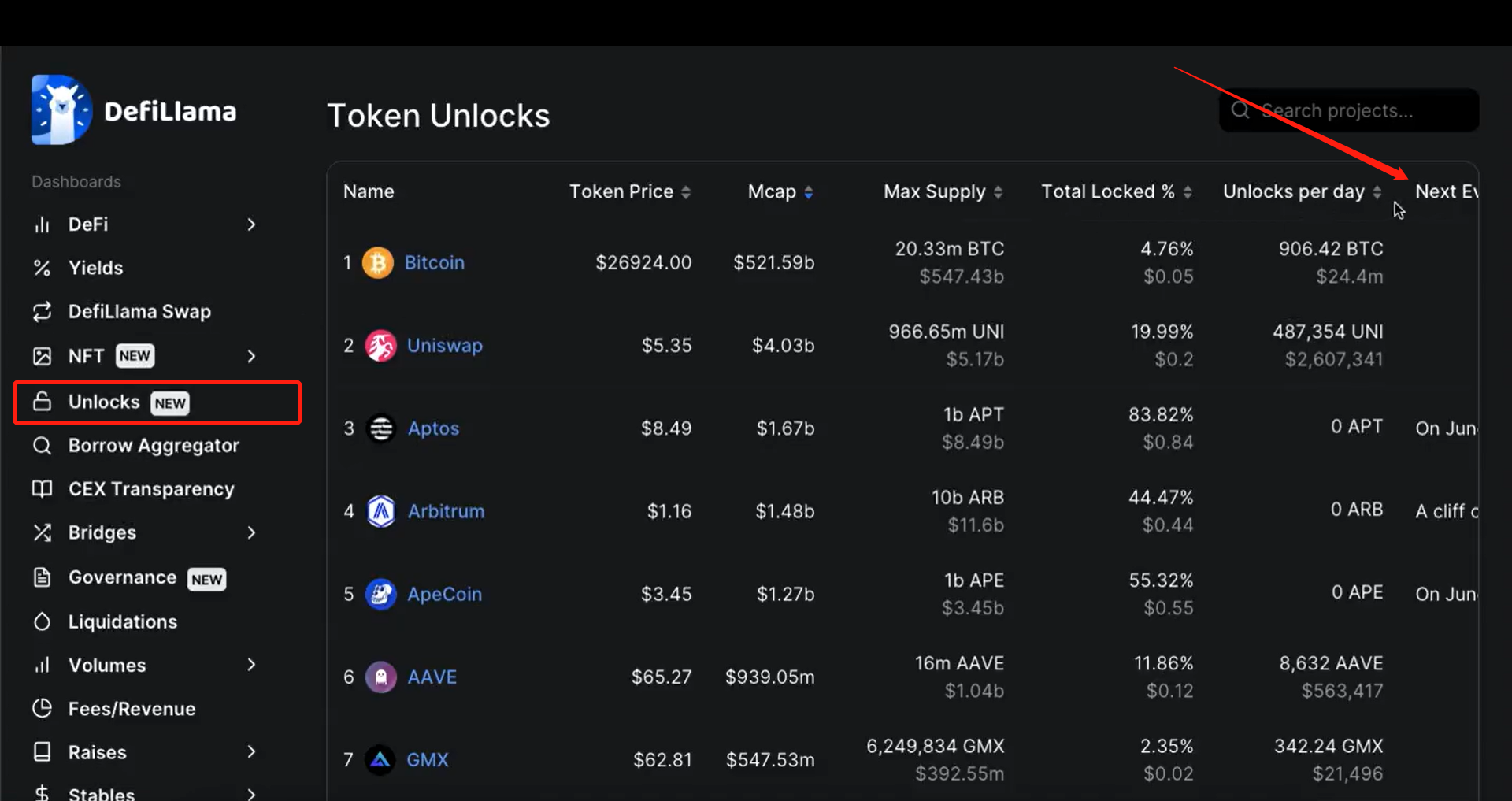

DefiLlama

DeFi Llama is a comprehensive platform that has everything you need to understand protocols from a basic level. For example, using DeFi Llama’s token unlocking feature, you can track which tokens will be unlocked and when.

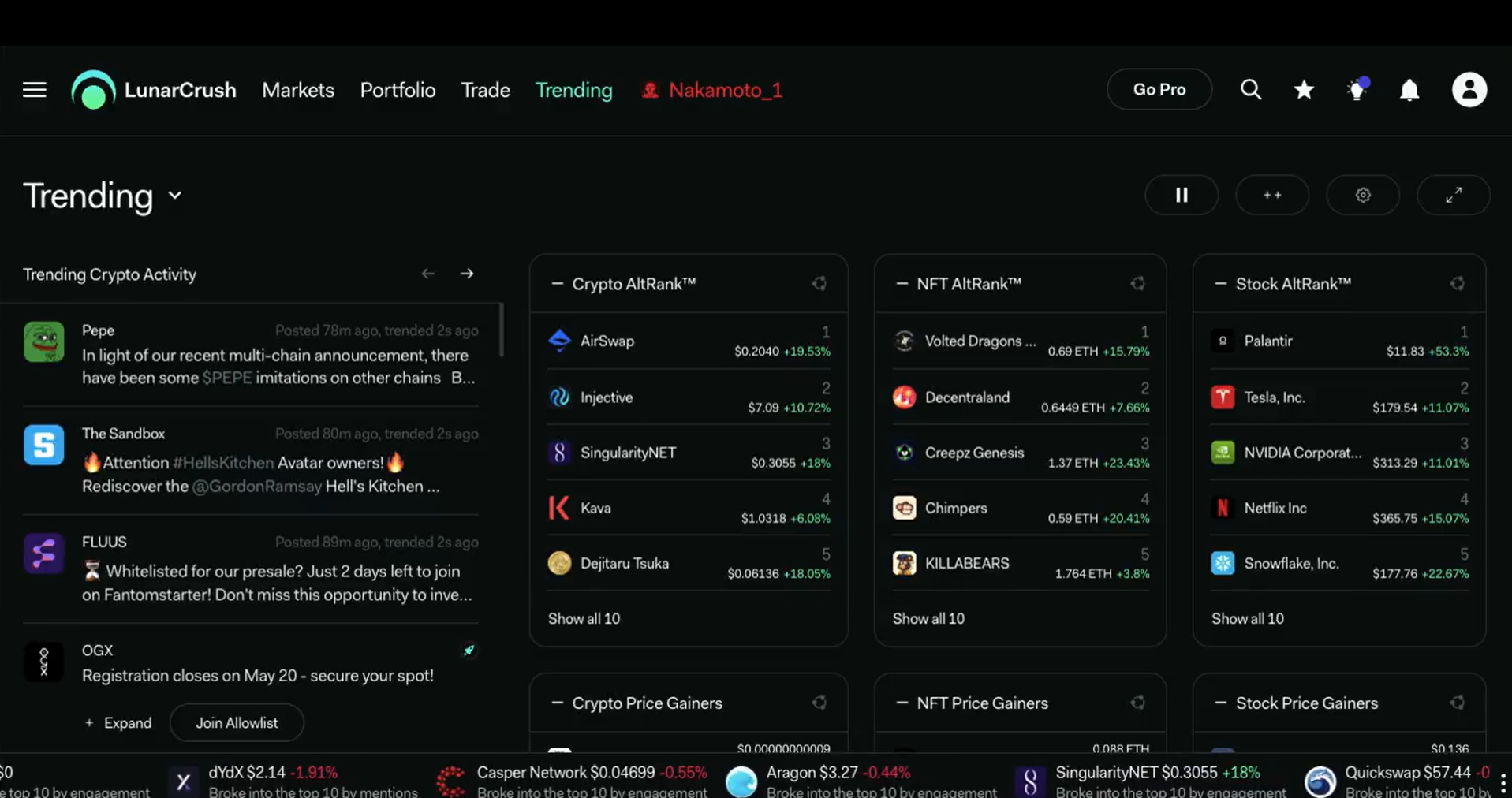

LunarCrush

Imagine a platform that can track trading trends and even help you successfully sell at the top before the trend changes. Lunar Crush can track social activity and understand market trends. Investors can buy into a token when it starts trending on social media and sell when the buzz is at its peak.

Blockpour

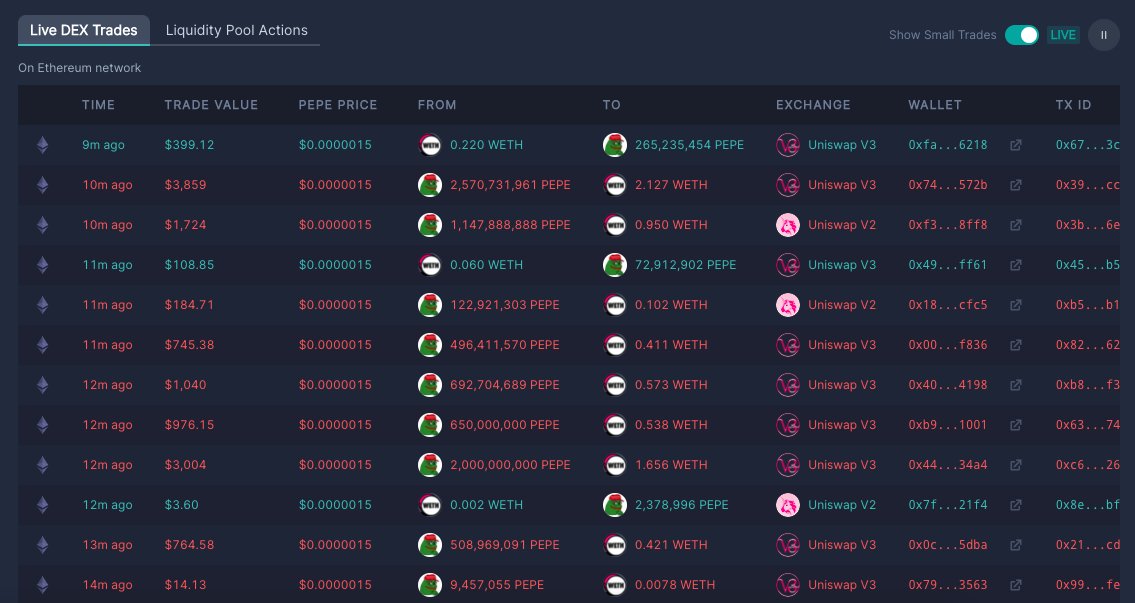

Blockpour is a multi-chain data aggregation and analysis platform that aggregates data from various ecosystems. By providing comprehensive depth data, it can prevent large losses due to differences in depth.

In addition, with the “real-time trading” function, investors can track every transaction in real-time, so they won’t miss any big moves by whales. Blockpour is a useful free tool whether you’re looking for potential coins or trying to get an in-depth understanding of a token.

In the cryptocurrency field, investors can earn 100 times their investment, but they can also lose their funds in bad trades, scams, or HoneyPot scams. Therefore, capital preservation is always the theme of the game, and the six free tools mentioned above will help investors achieve this goal.

Note: The navigation window on the BlockingNews official website summarizes commonly used analysis tools, including various block explorers, comprehensive data platforms, etc., and users are welcome to follow and visit.

Related reading: Inventory of on-chain data analysis platforms: Rich and detailed data, but not decentralized enough

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to use dynamic NFTs to provide liquidity products in the Sui public chain ecosystem?

- Decoding the new standard ERC-6551: A new way of playing NFTs in wallets

- Amid the encryption winter, what makes Worldcoin capable of securing a $100 million financing?

- 20 most active VCs and their largest investment in the 2023 bear market

- Future of Web3 Wallets: Innovation, Challenges, and Key Issues

- What should you pay attention to when playing MEME?

- Interpretation of investment trends from top 5 VC firms in the years after 2023