Taking speculation to the extreme? While everyone is obsessed with ‘personal stocks,’ friend.tech options contracts quietly go live.

Extreme speculation? While everyone focuses on 'personal stocks,' friend.tech options contracts are quietly launched.Speculation is always a feast, there are always ways to participate, but it’s difficult to make stable profits.

In the past week, the crypto market has been dominated by friend.tech.

The media is analyzing and interpreting, KOLs are showing invitation codes, scientists are listening for the joining of new big accounts to quickly buy shares… and the latecomers are considering whether to enter the market.

But don’t forget, there are more ways to enter friend.tech than just buying and selling shares.

- Enhancing user experience, reducing interaction steps, how can ‘intent-based transactions’ support the next wave of Web3 narrative?

- Wreck League Research Report Bored Apes Teams Up with Animoca to Create a 3A-Level PVP Fighting Blockchain Game

- Analyzing Friend.Tech from First Principles

The crypto market is a market dominated by high volatility. Around speculation itself, wherever there are hotspots, there are products that offer services by taking advantage of the volatility.

Now, you can even go long or short friend.tech on the chain without directly participating in the downloading and use of the product.

Two days ago, the on-chain options DEX Aevo announced the addition of the FRIEND-USD trading pair in their product.

Most players may have more open contracts but fewer options. In fact, the rules of options are simpler: holding options means having the right to buy or sell a certain quantity of underlying assets at a predetermined price within a specified time.

In other words, you can buy a call option on friend.tech today, and if it really goes up tomorrow, you can get a return based on factors such as leverage, price movement, and fees.

friend.tech itself has a speculative meaning, and options on friend.tech have a “speculation on speculation” meaning.

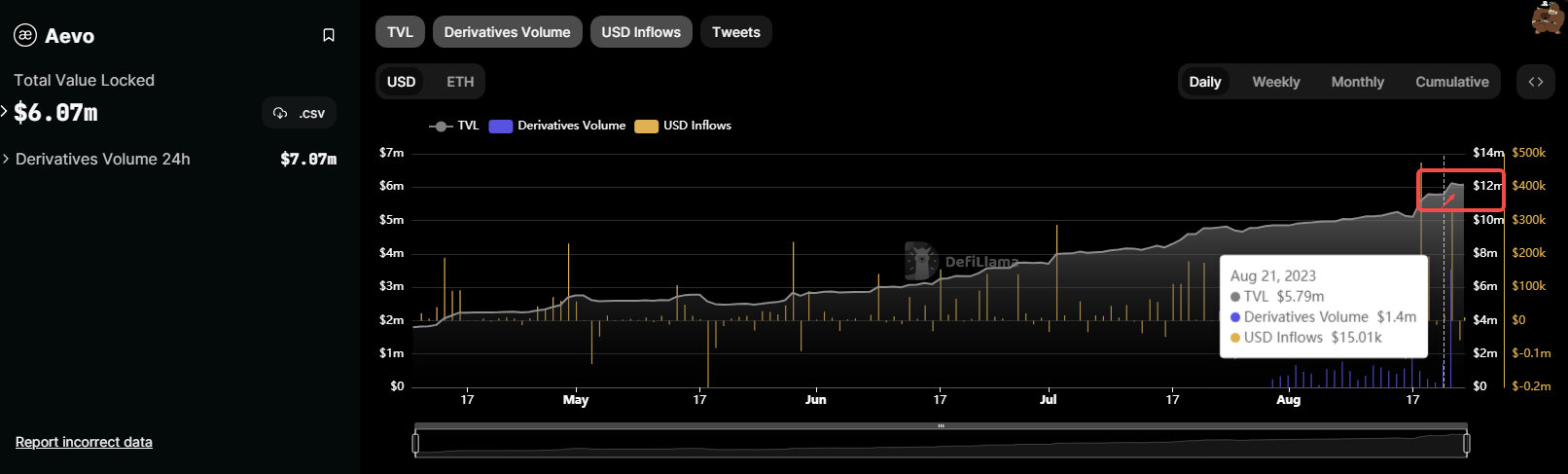

But market data is honest. DefiLlma shows that after Aevo launched this options trading pair, its TVL and capital inflows have seen a nice little increase. Where there is speculation, there is naturally heat.

If someone is not optimistic about friend.tech, they can also buy a put option and seek returns in leverage. But before that, it is necessary to understand the implementation and operation experience of Aevo’s friend options product.

Friend Index and Product Experience

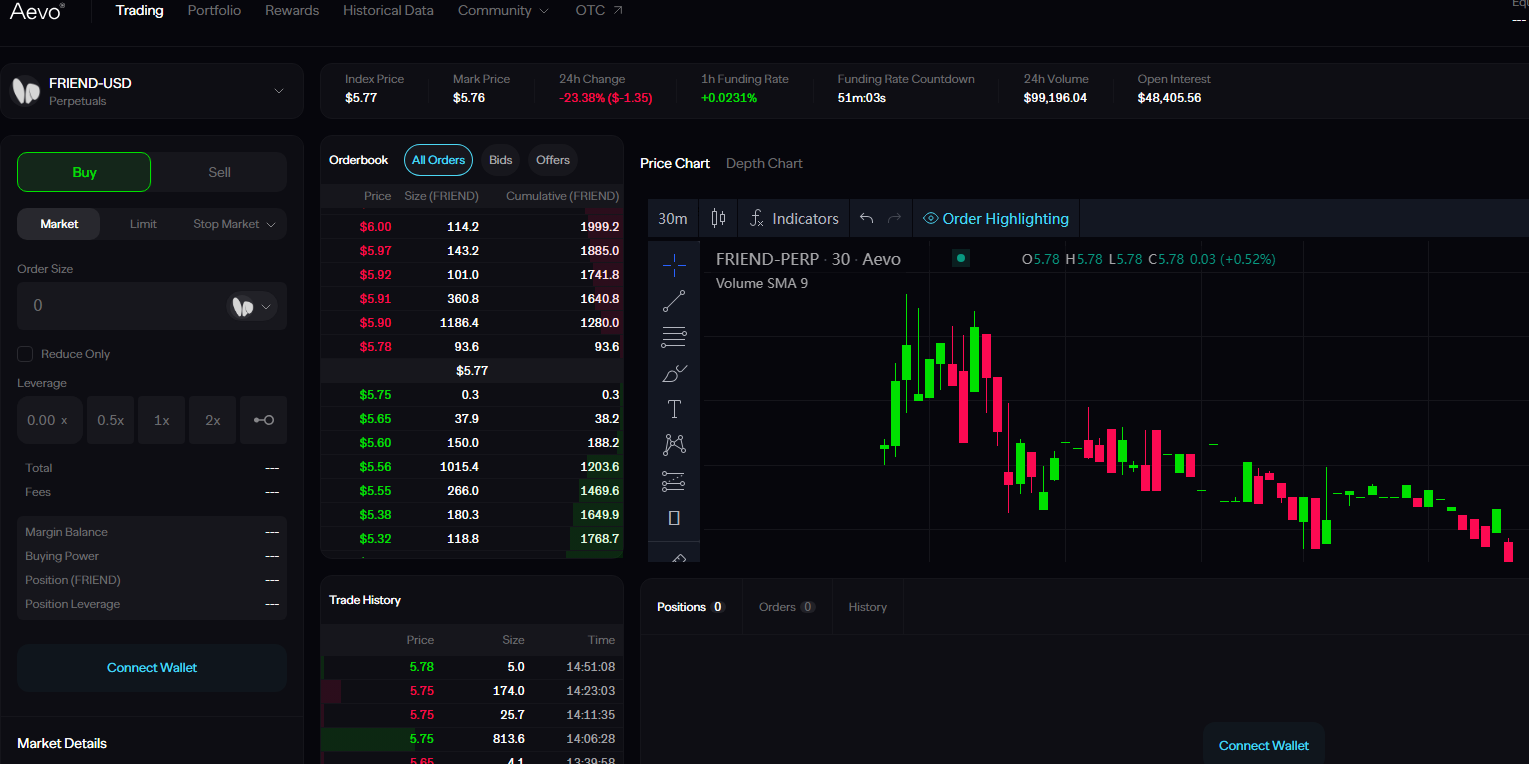

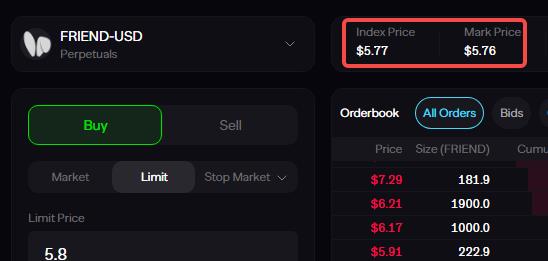

First, visit https://app.aevo.xyz/perpetual/friend and directly find the FRIEND-USD trading pair.

On the left side of the interface, you can see the trading options, namely Buy and Sell. The former is a call option, and the latter is a put option.

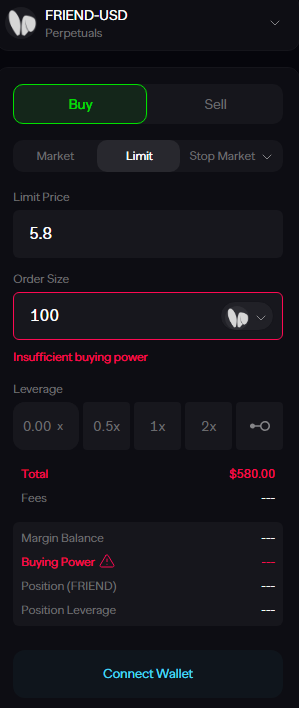

You can choose to trade at market price or set a limit price according to your desired price. Taking limit price trading as an example in the following figure, after setting the price, the number of purchases, and adjusting the leverage, the system will automatically calculate the transaction fees. After clicking confirm, the transaction will be completed.

It is important to note that everything is executed on the chain, so a wallet connection is required for actual operations. At the same time, leverage can only be opened up to 2x.

You may wonder, friend.tech is only able to bid on shares of different users, and the prices are different. So where does the unified price of the FRIEND-USD trading pair come from?

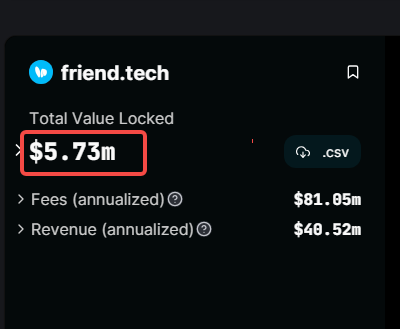

In fact, the price of this option fluctuates and has no connection with the buying and selling of friend.tech shares itself. The only relevant factor is the current total TVL of friend.tech.

Based on the changes in the total TVL, this options contract has designed a “FRIEND Index”.

The specific calculation method is to convert the current TVL value of friend.tech by dividing it by one million. For example, if the current TVL is $5.7M, then the FRIEND Index would be $5.7, and it will change synchronously with the increase or decrease of TVL.

Essentially, this is a way to leverage and predict the rise and fall of friend.tech.

If it becomes more popular, the TVL will naturally increase, and the corresponding price of the FRIEND Index will also rise, and vice versa.

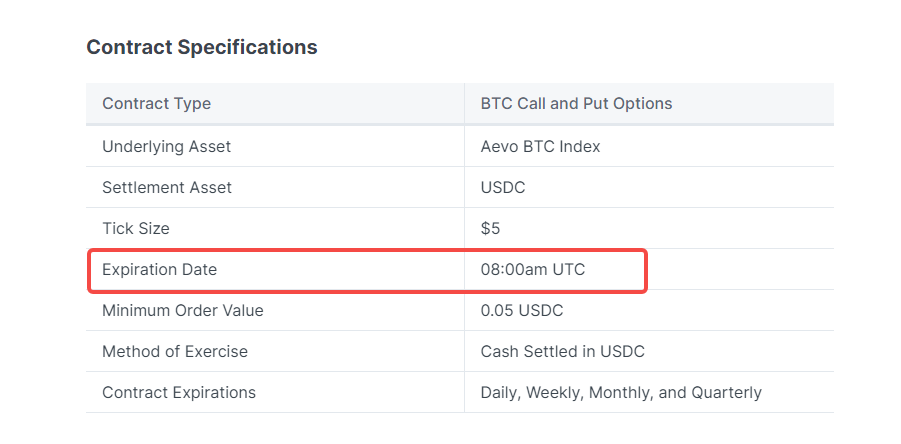

So when will the order take effect and calculate the profit and loss after placing the order?

According to Aevo’s design document, the settlement time for different options is at 8:00 AM UTC. Therefore, if you buy a call option today and the TVL of FRIEND increases at 8:00 AM tomorrow morning, you will make a profit, otherwise, you will incur losses.

Option Data Analysis

From the current relevant data about friend.tech options on Aevo, we can also see some market sentiment.

First of all, the hourly funding rate presents a negative premium, which means that the bears need to pay funding costs to the bulls. It also means that at the time of publication, there are more people who are bearish on friend.tech.

However, at the same time, the open interest of the contract is only close to $50,000, which to some extent indicates that the amount of funds participating in friend options is not large. Therefore, the bearish sentiment mentioned above only represents the sentiment of the people within the scope of trading options and does not necessarily represent the views of the entire market.

It is also worth noting that the current 24-hour trading volume of options is only around $80,000. Yesterday, this number was $540,000, even surpassing the trading volume of Ethereum options on the Aevo platform.

This also indicates to some extent that the popularity of options for friend.tech may not be able to sustain. Launching related options products during a trend can indeed bring some traffic, but how to attract users to continue trading options is a more difficult problem.

In addition, from the perspective of price trends, the FRIEND index price even showed scattered breakpoints, which means that there was little change in TVL of friend.tech during certain time intervals. Moreover, you may not be able to accurately predict when TVL will suddenly change, which also increases the difficulty for participants to judge whether to be bullish or bearish. The decrease in trading volume is also reasonable.

Therefore, overall, it is not so easy to profit from options for friend.tech. It seems that you cannot always participate in bearish options just because you feel it is a short-term speculation. This idea of killing two birds with one stone does not work well in the current product.

However, the emergence of options like this also demonstrates the essence of the cryptocurrency market – speculation is always a feast, there are always methods to participate, but it is difficult to find a stable way to make money.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Attracting 100,000 users in a month and ranking third in terms of protocol income, how much longer can the decentralized social application Friend.tech stay popular?

- OPNX Development History Tokens soar by a hundredfold, becoming a leading bankruptcy concept?

- Weekly Announcement | OKX platform upgrades KYC process and recommends users to complete advanced authentication; Avalanche (AVAX) will unlock tokens worth approximately $100 million.

- LianGuai Daily | The SEC files a motion for intermediate appeal regarding the Ripple case; friend.tech completes seed round investment, with LianGuairadigm participating.

- Content Marketing Methodology A Required Course for Web3 Startups

- Regulatory crackdown, slowed growth, Binance suffers two major setbacks.

- DeBank plans to launch Layer2, and the wool party has already taken action?